Market News and Charts for June 08, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

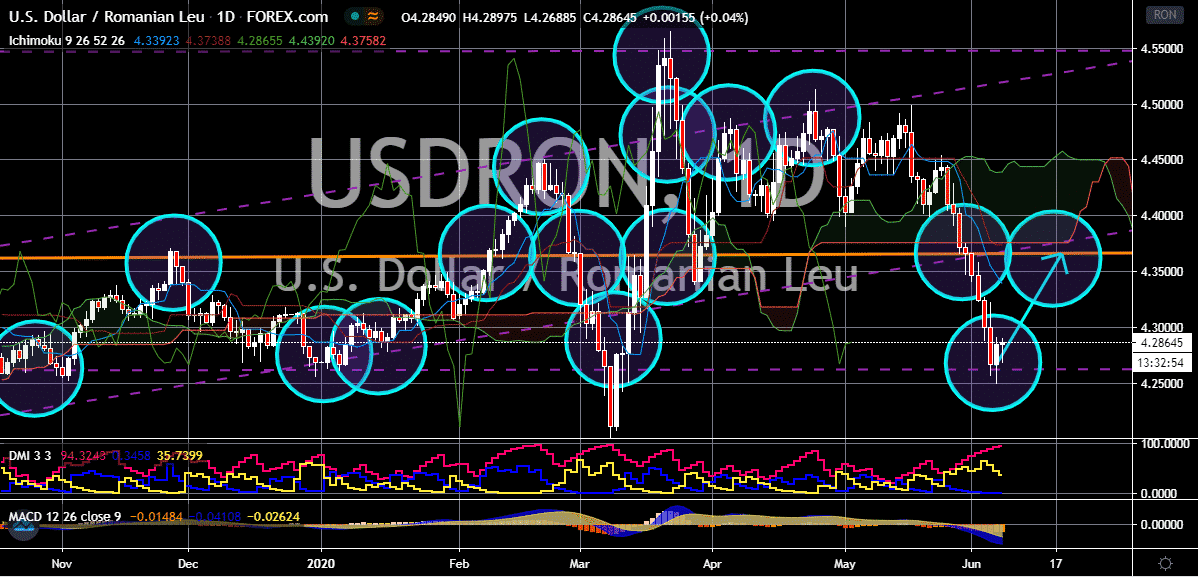

USD/BRL

Thanks to the efforts of the Brazilian central bank, the Brazilian real makes a comeback against the US dollar. The broader strength of the greenback in the global market is no match for the determination of bearish investors to recover. Considering the US dollar to Brazilian real trading pair’s sharp decline, the pair should reach its support levels by the second half of the month. The Brazilian real is gaining strong momentum after struggling thanks to the previous interest rate cut of the Latin American country’s central bank earlier this year. The currency is feeling the pressure from both political and economic factors; the looming recession in the heavyweight country and the intense controversies regarding the Brazilian president and anti-lockdown protesters. As for the US dollar, it’s reign is about to end as other currencies thrive and the risk sentiment continues to prosper along with the hopes for a speedy recovery of the global economy.

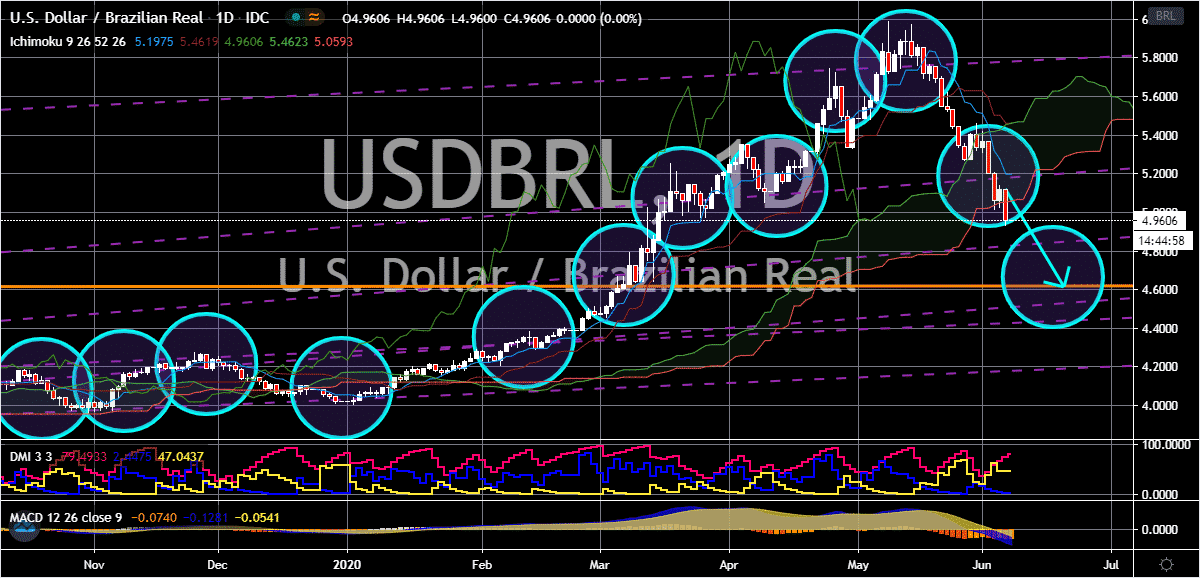

EUR/BRL

The exchange rate slightly steadies this Monday, but bears are widely expected to come out triumphant in the coming sessions. The pair should go down to its support level this month as the Brazilian real makes an astonishing come back. The news about the European Central Bank’s decision to expand its stimulus program even more than expected failed to support the euro last week. The ECB opted to widen its stimulus program to support the badly injured economies in the region which is currently facing its worst recession since the Second World War. The decision of the ECB also supported the risk sentiment in the market which ultimately boosted the Brazilian real as well. According to reports, the central bank ramped up its emergency bond-buying scheme by about €600 billion to €1.35 trillion. Aside from that, ECB head Christine Lagarde is set to testify later today, to update the bloc about the stimulus programs which delighted bulls.

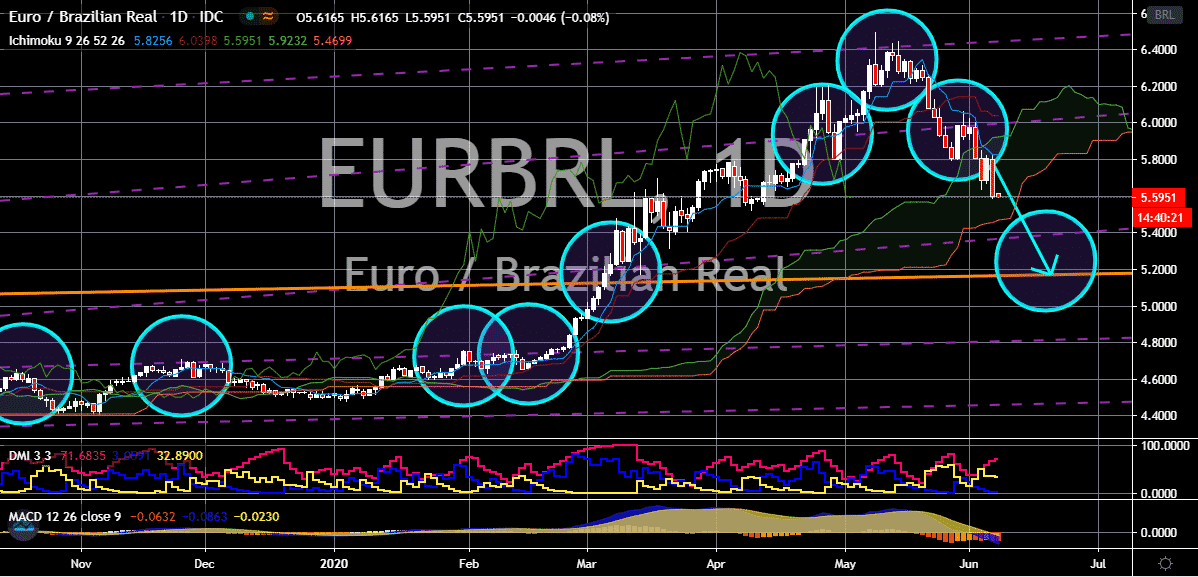

GBP/BRL

The recovery of the Brazilian real plus the ongoing Brexit deal concerns have pushed the pair lower today. Bears remain dominant as they seek redemption after the pair rallied to its highest levels. The British pound to Brazilian real exchange rate should reach its support in no time as the Brexit deal deadline is fast approaching. The pound sterling, just like other currencies that are matched up against the Brazilian real is doing fairly well in the forex market but terrible against the Latin American currency. The Brexit talks scheduled last week ended on an unfortunate stalemate, which are fueling the concerns of investors that the negotiation this month will fail as the European Council holds its summit later this month wherein the divorce should be discussed. Meanwhile, Brazil’s economic status is far from great. The country’s economy is heavily damaged by the pandemic and it is currently one of the countries with the greatest number of cases.

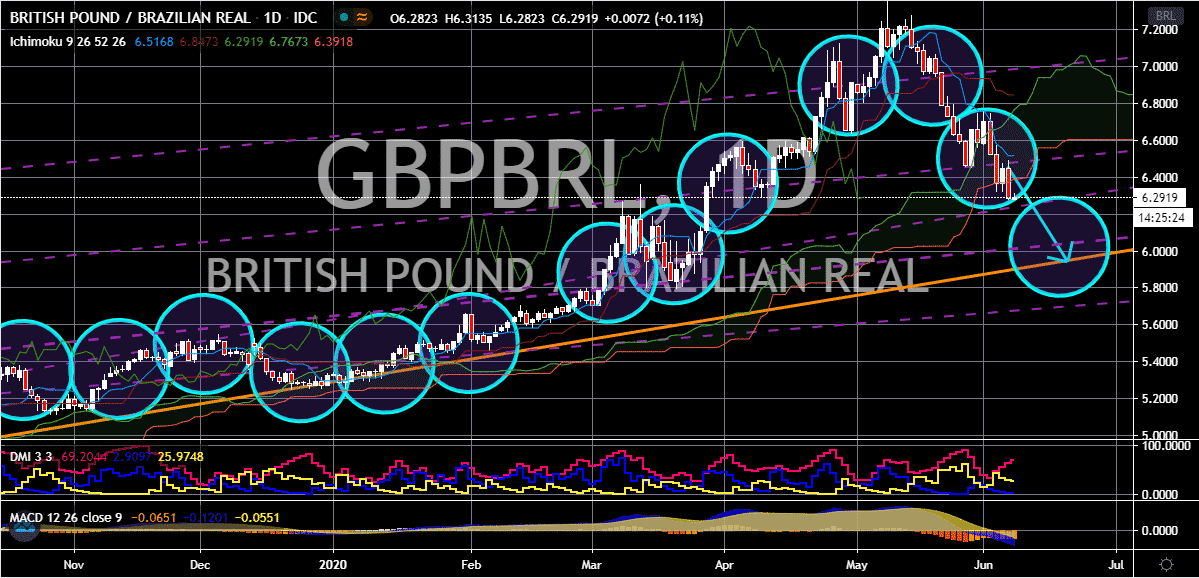

USD/RON

Dismal economic data from the region has caused European currencies such as the Romania leu to ease this Monday against the greenback. This leaves an opening for the greenback to regain some of its major losses against the leu after the sharp fall of the USDRON exchange rate. The greenback should continue to thrive and force the pair higher towards its resistance by the halfway point of the month. The US dollar is dented as is now bolstered by the positive economic data but considering the ongoing political turmoil between Beijing and Washing and the unrest that could slow down the recovery of the economy. Although there are also projections that its recovery might end sooner than expected because of the rising risk appetite for other currencies especially those linked to commodities. Moreover, Romania’s 2024 to 2028 government bonds recorded this biggest daily surge this Monday. The European country’s bonds rose between 1 to 1.3-euro cents.