Market News and Charts for June 07, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

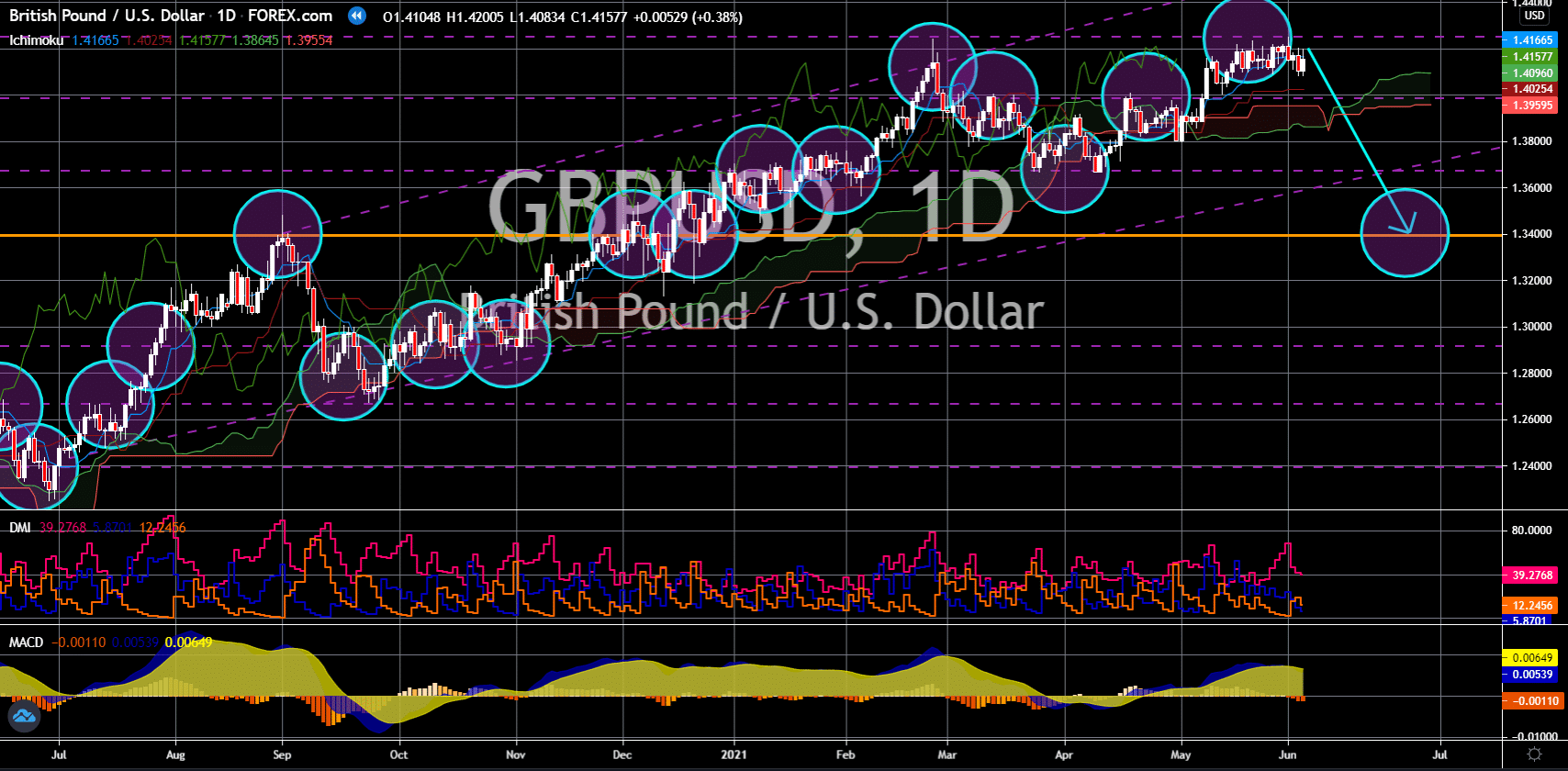

GBP/USD

The pair will fail to break out of its current resistance, which will send the GBPUSD pair lower in sessions. Demand for the British pound will start to fade amid the improving economic data from the United Kingdom. All PMI figures from the past three (3) trading days came in higher than the consensus estimate. On Thursday, June 03, the Composite and Services PMIs both recorded 62.9 points for the month of May. The numbers were 0.9 and 1.1 points higher compared to their previous record. The upbeat PMI on June 03 was followed by a 2.6 points jump in the Construction PMI, which posted an actual data of 64.2 points for the same month. As for Monday’s report, June 07, the Halifax House Price Index slowed down to 1.3% from a revised result of 1.5% in April. Meanwhile, the end of government support for local businesses in September could reverse the short-term projection of a decline towards 1.34000 and sent the unemployment rate higher to 5.5%.

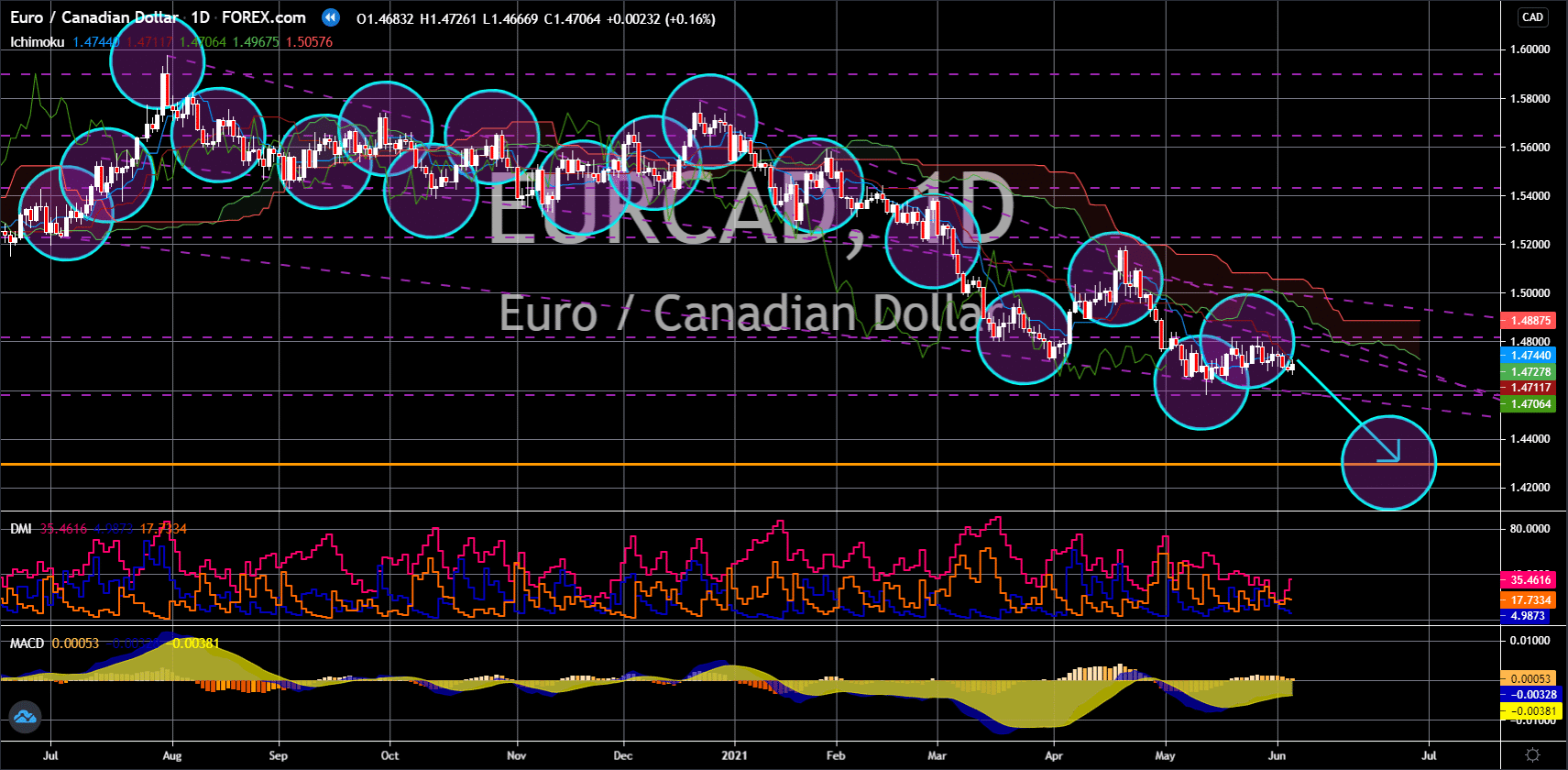

EUR/CAD

The euro will continue to underperform against its Canadian counterpart in the coming days. The recent reports from the 27-member state bloc continue to publish better-than-expected results. The investor confidence index in the Eurozone for the next six (6) months advanced to its highest level in three (3) years. Figure for the month of June came in at 28.1 points, a 7.1 points improvement from the prior month. Meanwhile, the May PMIs from the EU and the bloc’s Big Three (Germany, France, Italy) were either in line with the estimates or higher than the forecasts. The average Markit Composite of the member states was 57.1 points with Spain leading the advance in the PMI at 59.4 points. On the Services PMI, most of the growth for the Eurozone data came from the bloc’s second-largest economy. The recorded number for the services sector was 55.2 points for the European Union while France came in higher at 56.6 points while Germany posted 52.8 points.

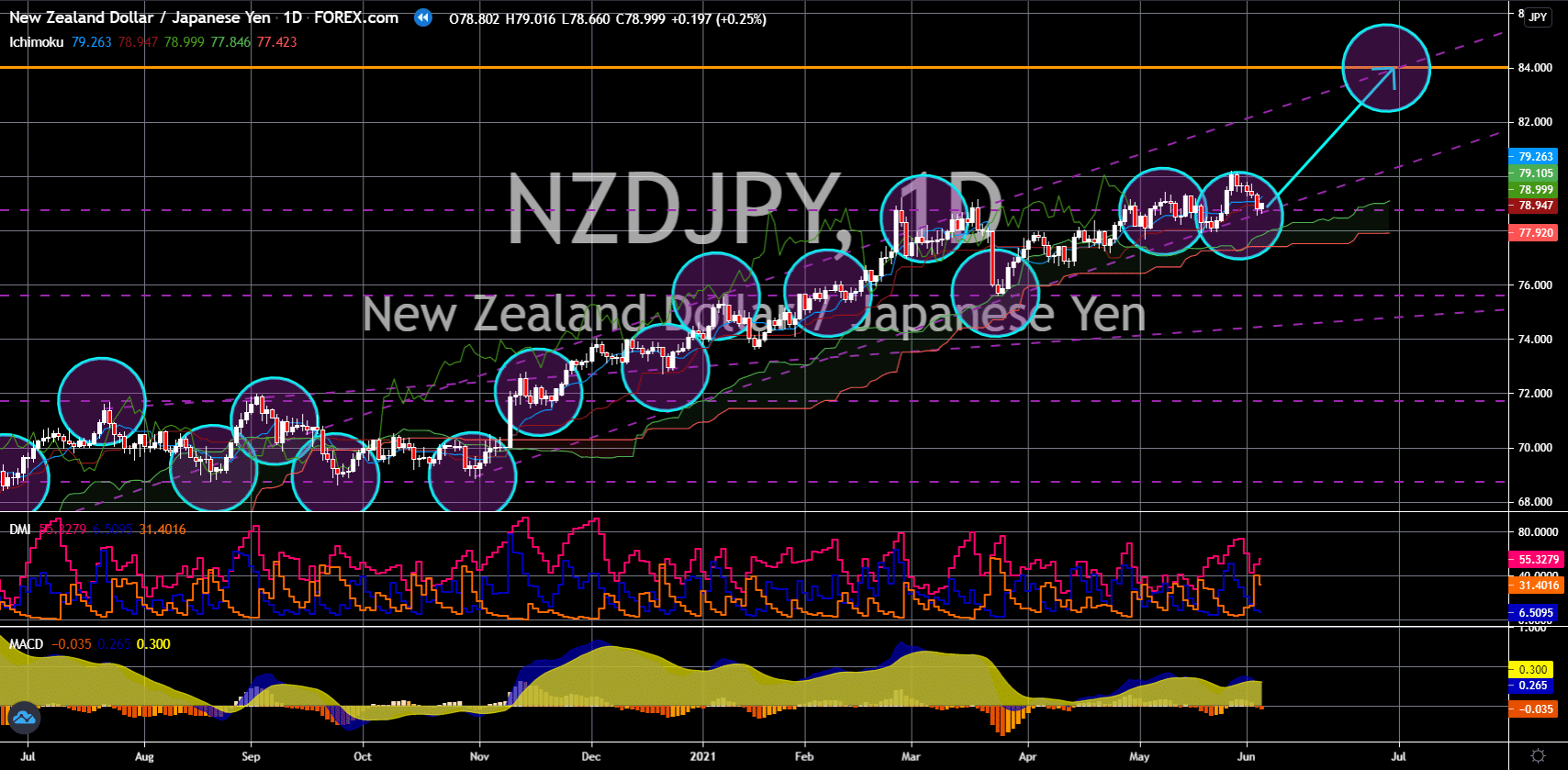

NZD/JPY

The NZDJPY pair will bounce back from the uptrend channel support line to reach the 84.000 resistance area. Japan risks going back to recession after it recorded a -1.0% contraction in the first three (3) months of fiscal 2021. The decline followed two (2) consecutive growth in the GDP. On a year-over-year basis, the Q1 economic status of Japan puts it -3.9% of the pre-pandemic level. Analysts expect further challenges in the second quarter of the year as Tokyo was put under a national emergency. Q1 saw the peak of the third wave while May recorded the highest single day increase in COVID-19 infections at 7,914. As a result, banks tightened their lending activities with only 2.9% recorded in May from 4.8% in the month prior. The household spending in April confirmed the bank’s decision to keep its asset liquid with a growth of only 0.1%. Meanwhile, Coincident Indicator and Leading Index slowed down with 2.6% and 0.6% results, respectively.

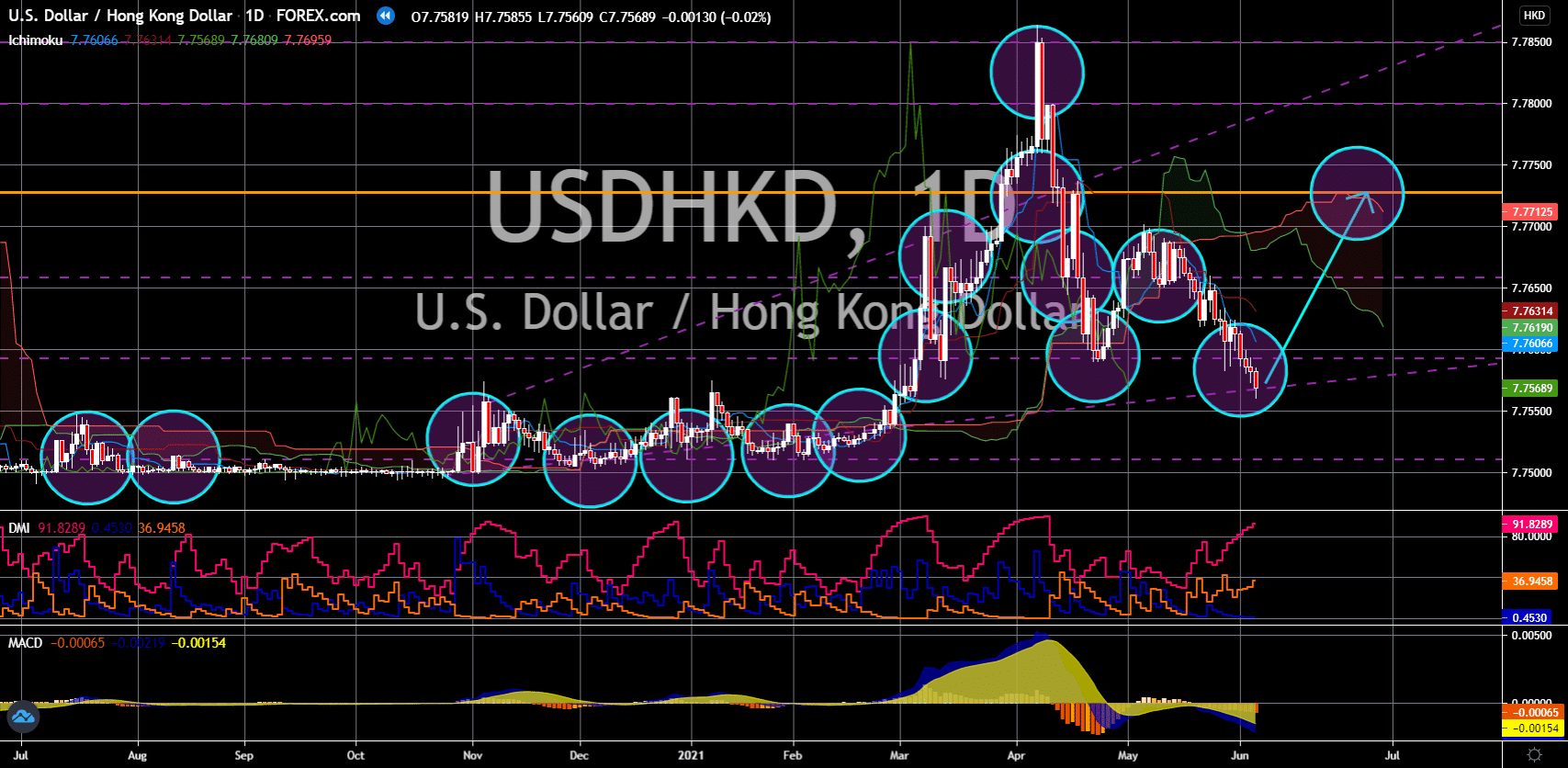

USD/HKD

The USDHKD pair will reverse back from the recent sell-off with a target price set at 7.77265. Last week was filled with reports from the US labor market. On Thursday, June 03, the number of unemployment benefit claimants fell to a pandemic record low of 385,000. This figure marks the first time that the report dropped below the 500,000 thresholds since April 2020. The monthly non-farm payrolls (NFP) report followed on June 04. In May, the US economy added 559,000 jobs, which was almost double the 278,000 roles filled in April. This sent the unemployment rate to 5.8%, which represents a 12-month low. In addition to this, the negative figure in crude inventories of -5.080 million barrels suggest a growing demand for the black gold as the US economy starts to reopen. The reported data came in better-than-expected against consensus estimates of a decline by -2.443 million barrels and a previous record of -1.662 million barrels in the previous week.