Market News and Charts for June 03, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

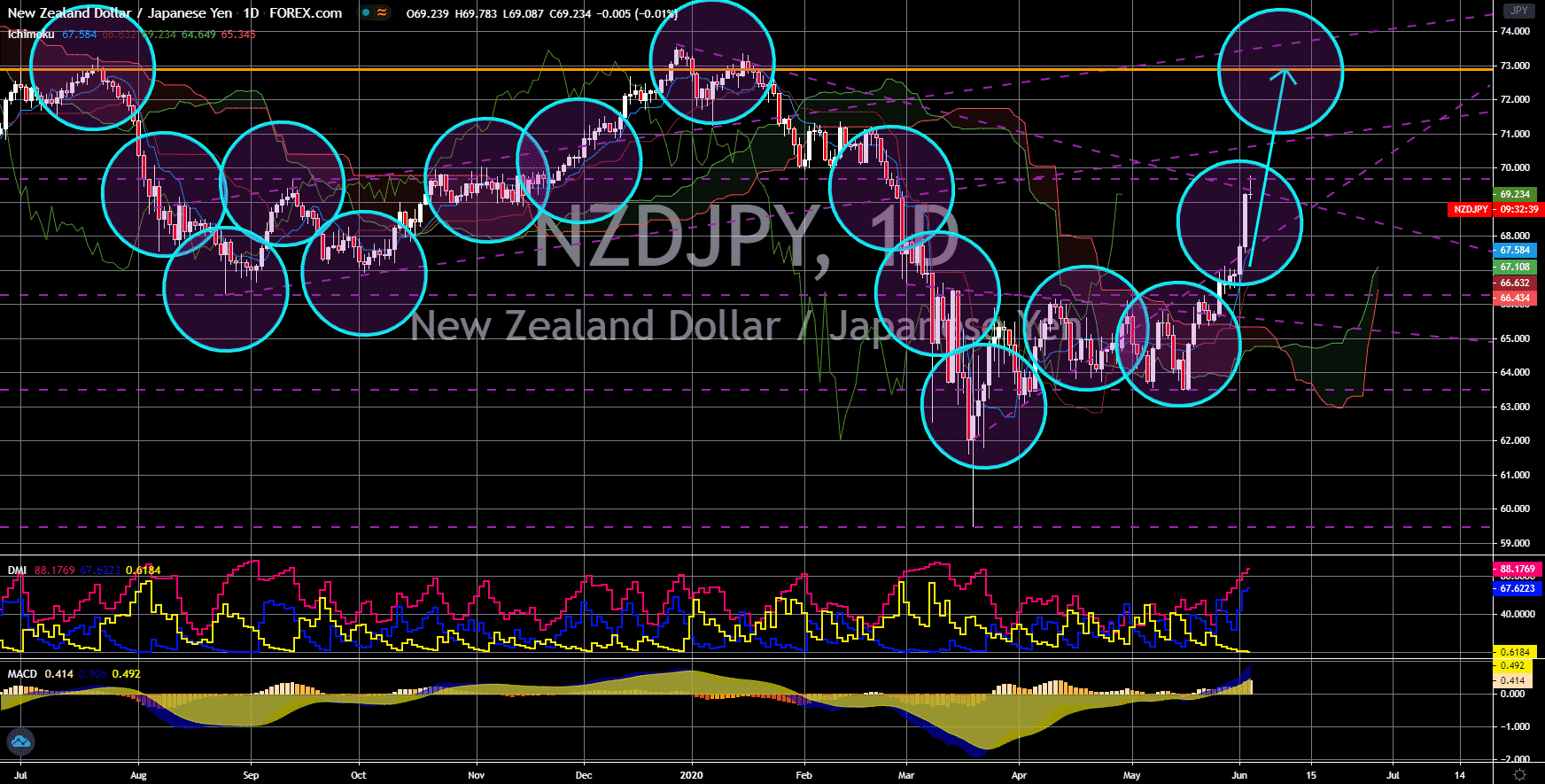

NZD/CAD

The pair will continue its rally to retest a major resistance line in the following days. New Zealand Prime Minister Jacinda Ardern is set to announce her plans for Alert Level 1 in the country today, June 03. This was after she went down a notch 2 weeks ago when she began lifting several restrictions and reopened the NZ economy. Analysts are expecting a total easing on all restrictions as the country successfully contains the coronavirus pandemic. In addition to this, the NZ government already prepared $401.3 million for economic recovery. The success of Ardern is expected to give her an advantage in the upcoming election in September. A recent report showed his Labour Party earning 56.5% support compared to its rival in politics, the National Party, which only earned 26.5% support. On the other hand, the Labor Productivity report in Canada is expected to recover. However, this will not be enough to challenge the NZD in coming sessions.

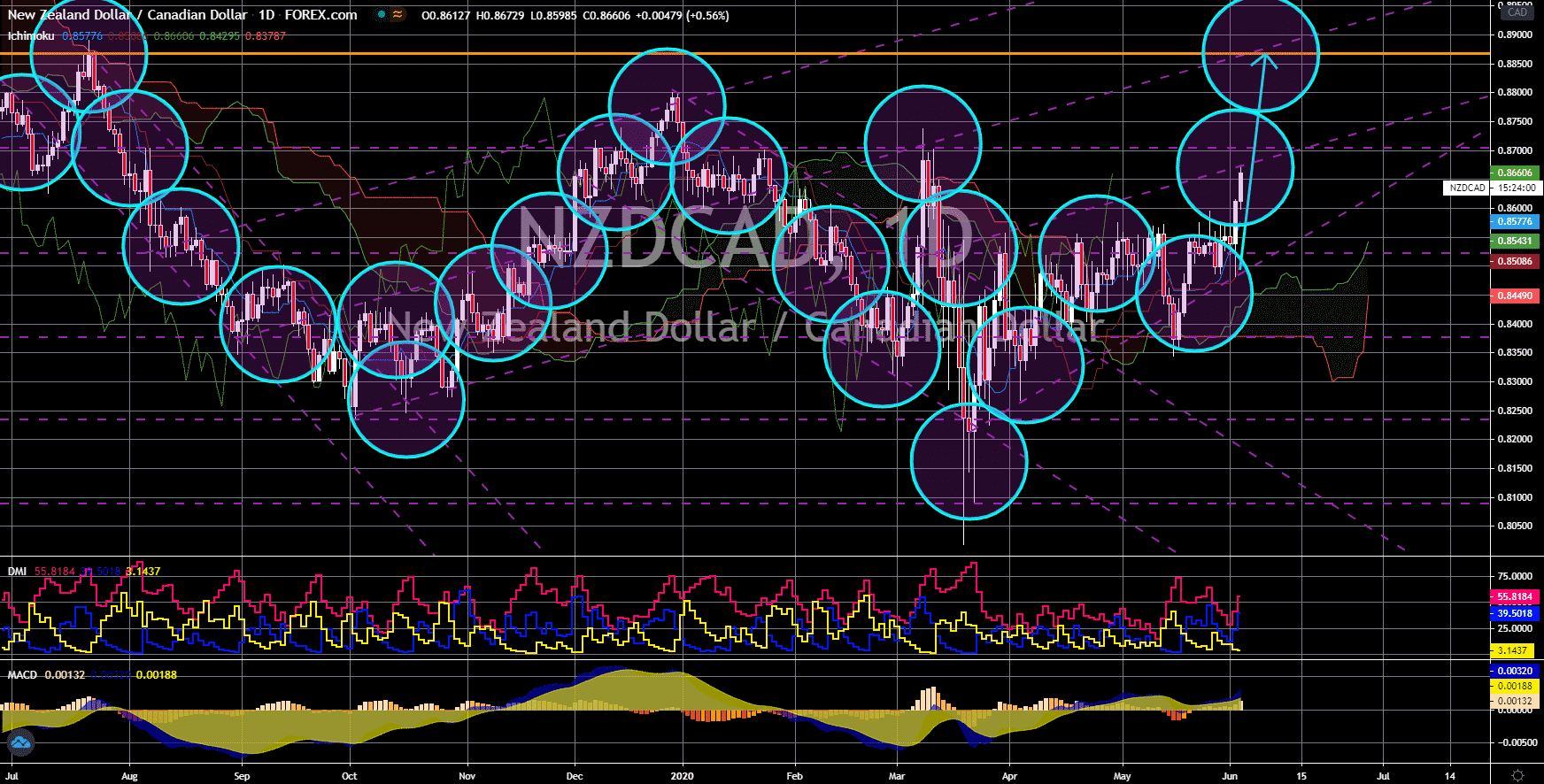

GBP/USD

The pair broke out from a downtrend channel resistance line, sending the pair higher towards a key resistance line. The United Kingdom and the United States are facing challenges with the coronavirus pandemic and with China. The UK has the largest coronavirus cases in Europe and the fourth in the world while the US still takes the lead at 1.87 million confirmed cases. The two (2) economies are also being brought together with the issue of Hong Kong’s sovereignty. While the world continues to contain the coronavirus pandemic, China is sweeping its political influence in Hong Kong. Recently, it introduced a law which will end the status of Hong Kong as a special administrative region (SAR). However, the US will be the biggest loser in this scenario as many US companies operate in one of the world’s financial centers. New York is the biggest financial center followed by London and Hong Kong. Shanghai is at the fifth spot next to Singapore.

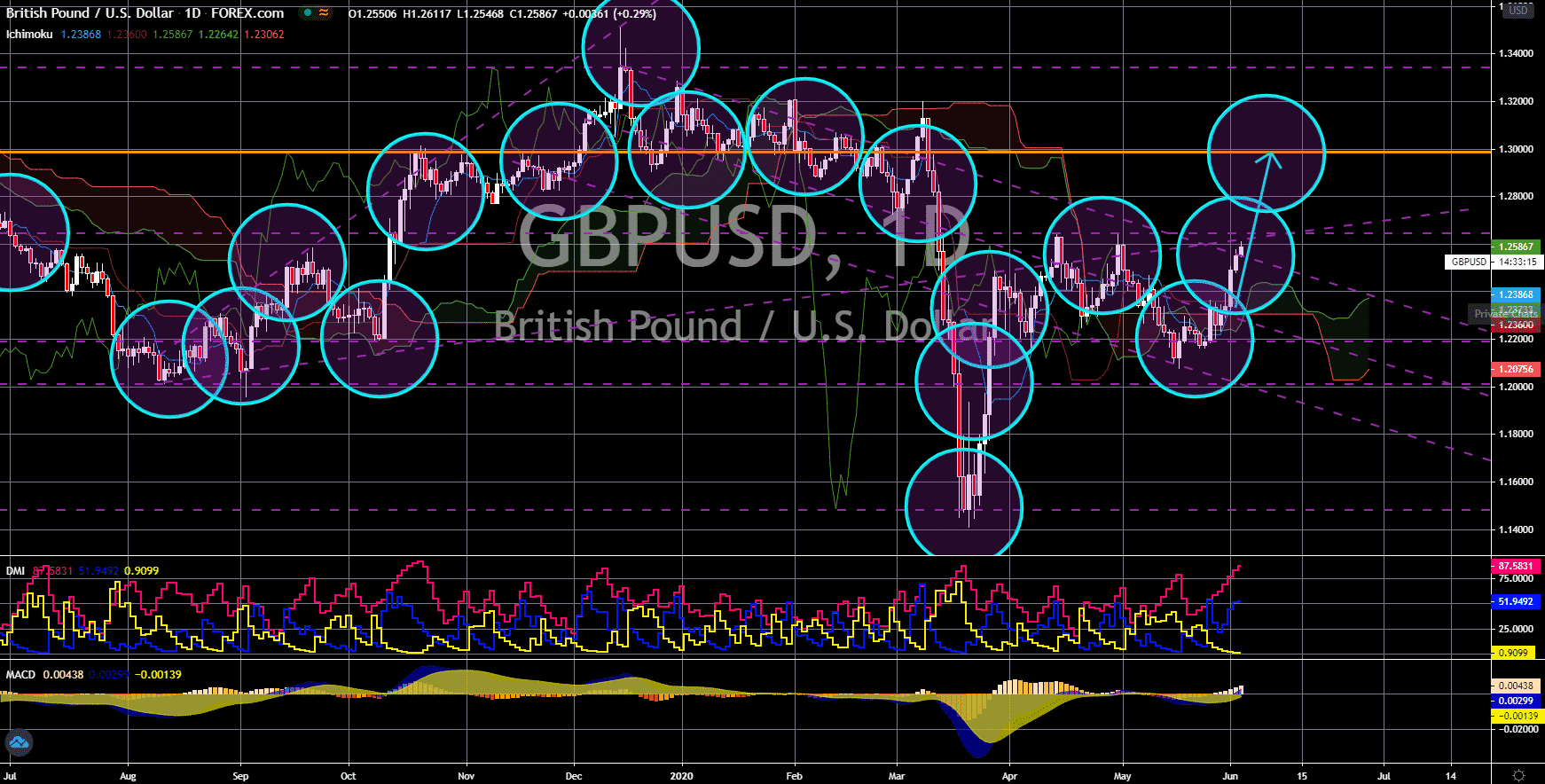

EUR/CAD

The pair will bounce back from a major support line, sending the pair higher towards its previous high. Canada’s plan of economic recovery might be derailed as the number of new immigrants are expected to only reach 170,000 this year. Canada is among the Group of 7 (G7) biggest economies in the world and its strength greatly relies from immigrants. The immigrants drive consumption and housing in Canada, which in turn, drive its economy. The fewer number of new immigrants was due to the global lockdown caused by the coronavirus pandemic. Meanwhile, the European Union is on its path to regain losses it incurred during the lockdown. Aside from the stimulus plan introduced by the European Union, each member state has also their own fiscal and monetary policies to keep their economy afloat. Among the countries with the largest fiscal stimulus injected to their economy was the EU’s economic powerhouse, Germany.

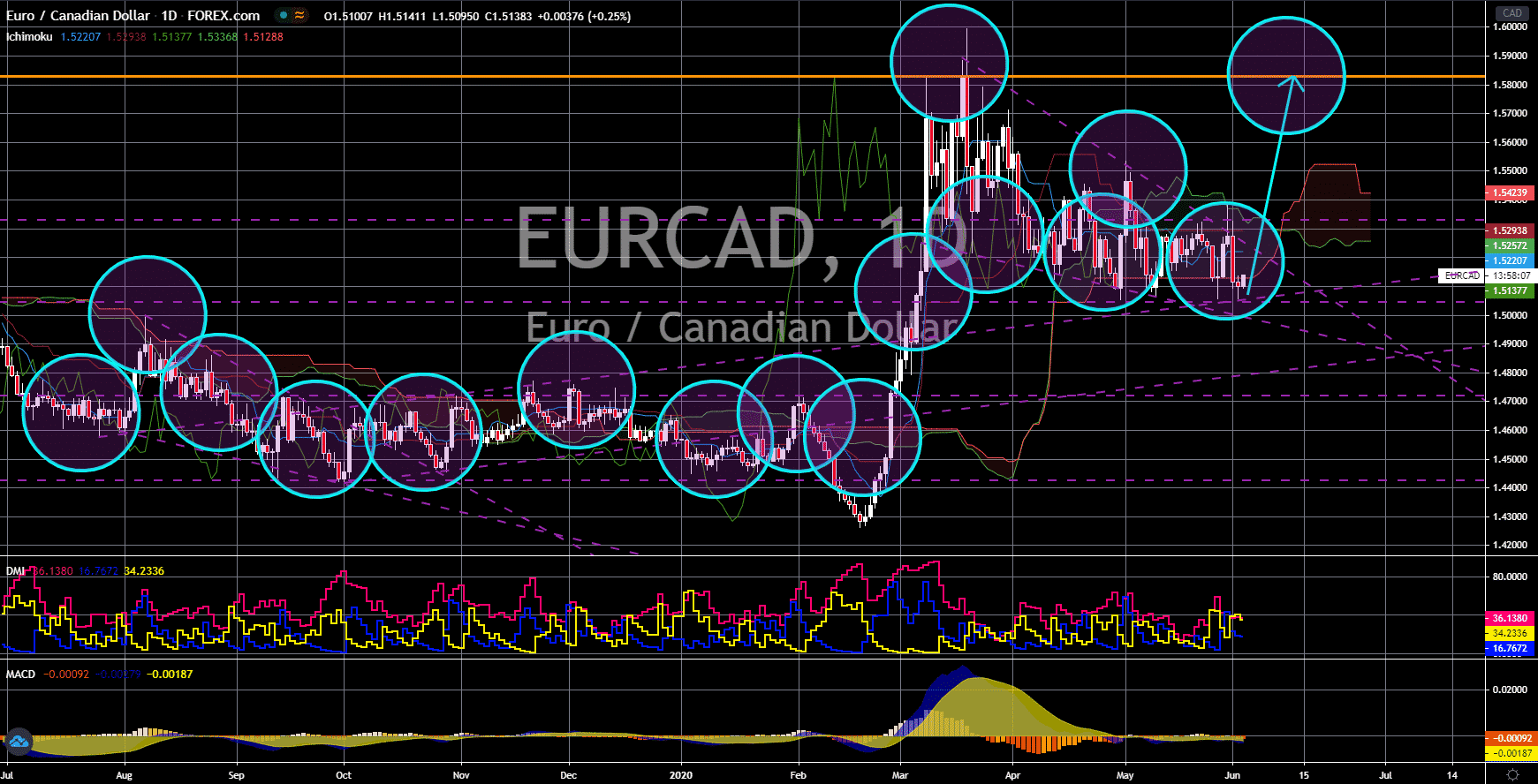

NZD/JPY

The pair will continue its rally towards a major resistance line in the coming days. Japan and New Zealand were both among the countries who successfully contained the deadly coronavirus. Japan lifted its national emergency status while New Zealand went down to Alert Level 2. Furthermore, NZ Prime Minister Jacinda Ardern is expected to move another notch lower at Alert Level 1 next week. This means that the country will lift all restrictions imposed during the lockdown. Between the two (2), however, the New Zealand dollar will thrive in sessions. New Zealand has injected lower stimulus in Japan as the impact of COVID-19 was lesser in the country. Despite this, Japan still enters recession, which will put a strain on the safe-haven appeal of the Japanese yen. Recently, Prime Minister Shinzo Abe unveiled the country’s largest fiscal stimulus in history at $1.1 trillion. This was in addition to the $500 billion stimulus injected in the economy in May.