Market News and Charts for June 01, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

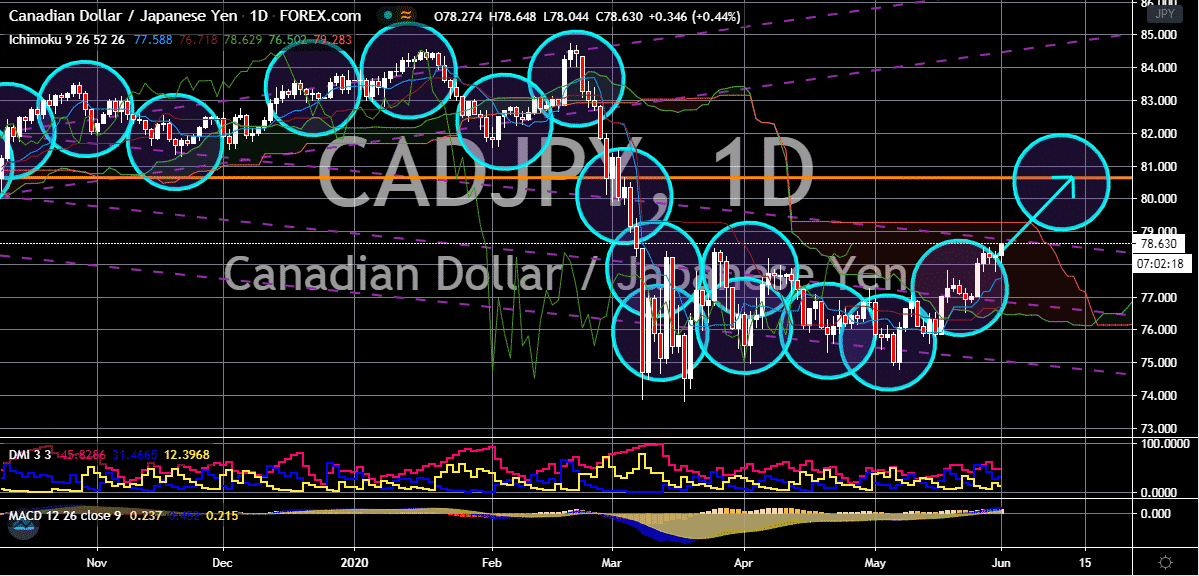

AUD/CAD

The Canadian dollar remains on the defensive against the Australian dollar in the sessions. See, the Canadian dollar is closely related to the US dollar and considering the broader weakness of the greenback in the current sessions, the loonie is also having difficult time. Meanwhile, the risk appetite in the global market is giving strength to the Australian dollar. It’s going to be a busy week for investors as both the Reserve Bank of Australia and the Bank of Canada are expected to give news or guidance regarding the economy. Later this week, the Bank of Canada is expected to release its official interest rate decision. Economists believe that the Bank of Canada will most likely leave its interest rates unchanged for June as it should first wait and see the effects of the previous rate cuts unleashed. Aside from that, the Canadian employment change report is expected to come out this Friday showing slight improvement from the month of May.

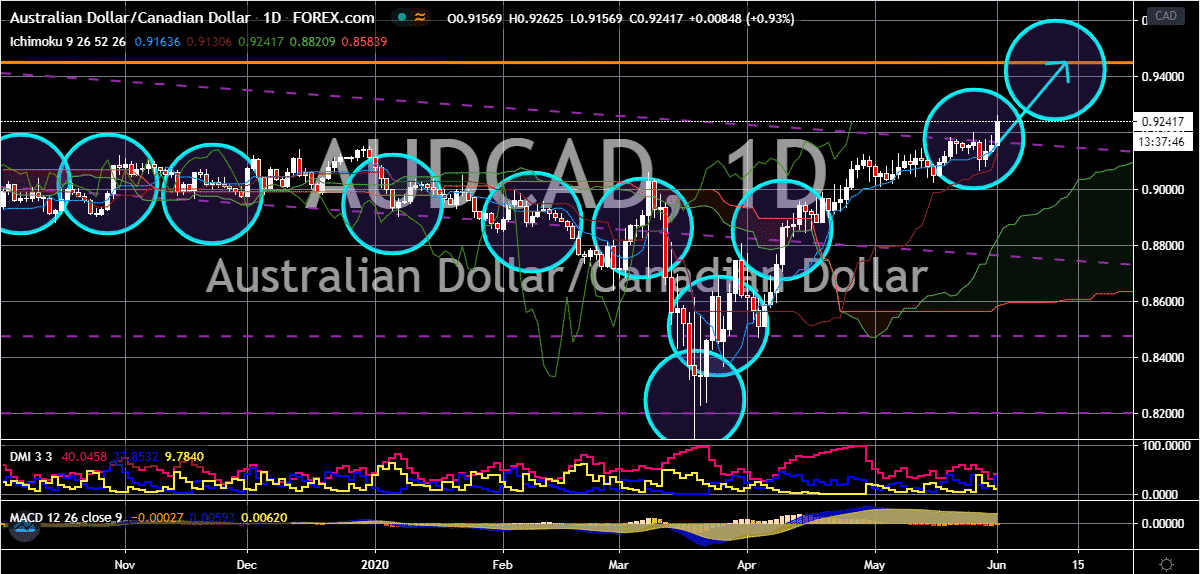

AUD/CHF

The renewing hope and risk appetite in the global market has significantly fortified the Australian dollar against most currencies including the beloved Swiss franc. The pair is currently approaching its initial resistance and bulls want to break past it and reach the higher one. The faltering safe-haven appeal of the Swiss franc has also helped in the rally of bulls, but it could actually be its eventual downfall. Seem the trade tensions and the ongoing political turmoil from various countries could turn the direction of the pair upside down. And bulls are hoping to force a reversal once the pair hits its resistance. But investors of the Australian dollar remain determined and are waiting for further guidance on the widely anticipated RBA interest rate decision. Tomorrow, the Reserve Bank of Australia is set to announce its interest rate decision for June and economists believed that it will leave its interest rates unmoved at 0.25%.

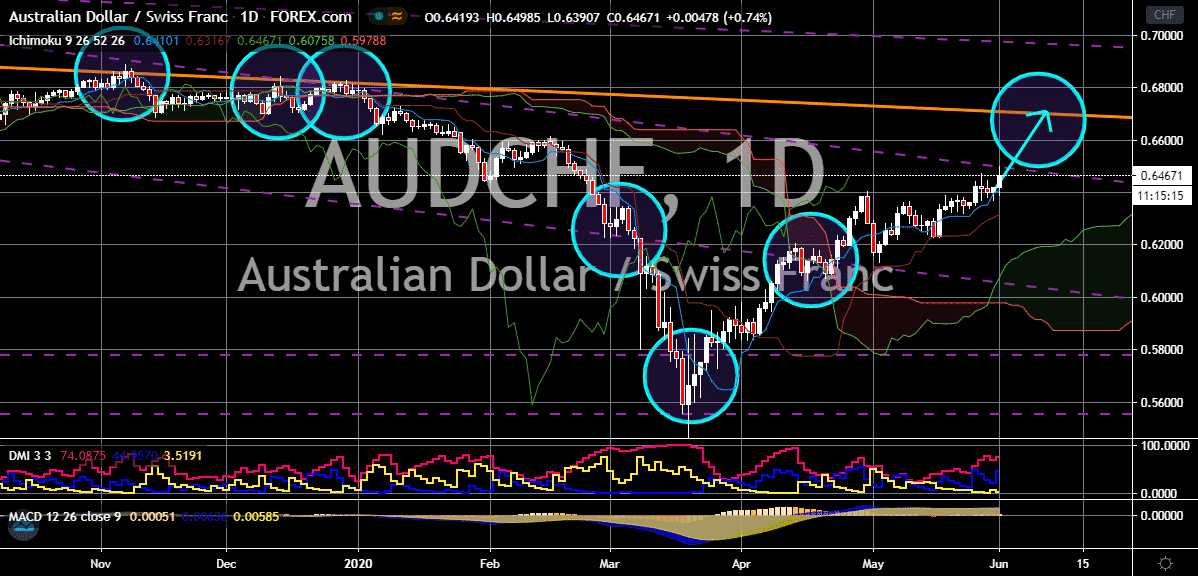

GBP/JPY

Despite the unfavorable conditions faced by the Japanese yen, the British pound is seen having a tough time rallying against it. Compared to the rally of other currencies, it appears that the sterling has not successfully taken advantage of the situation. See, the Japanese economy is currently at a recession, thus pressuring the Japanese yen. At first glance, it would seem that it should have supported the yen’s safe haven appeal. However, that’s not the case, the recession is causing the safe-haven value of the yen to disappear and as long as the economy remains in trouble, it’s sparkle won’t come back. Meanwhile, the British pound is heavily pressured by Brexit concerns, so despite the lackluster appearance of the Japanese yen, bulls have only managed to secure limited gains. As the deal deadline approaches, the more intense the pressure gets for the sterling, and considering that the British government doesn’t want an extension, it will cause a hard time for bulls.

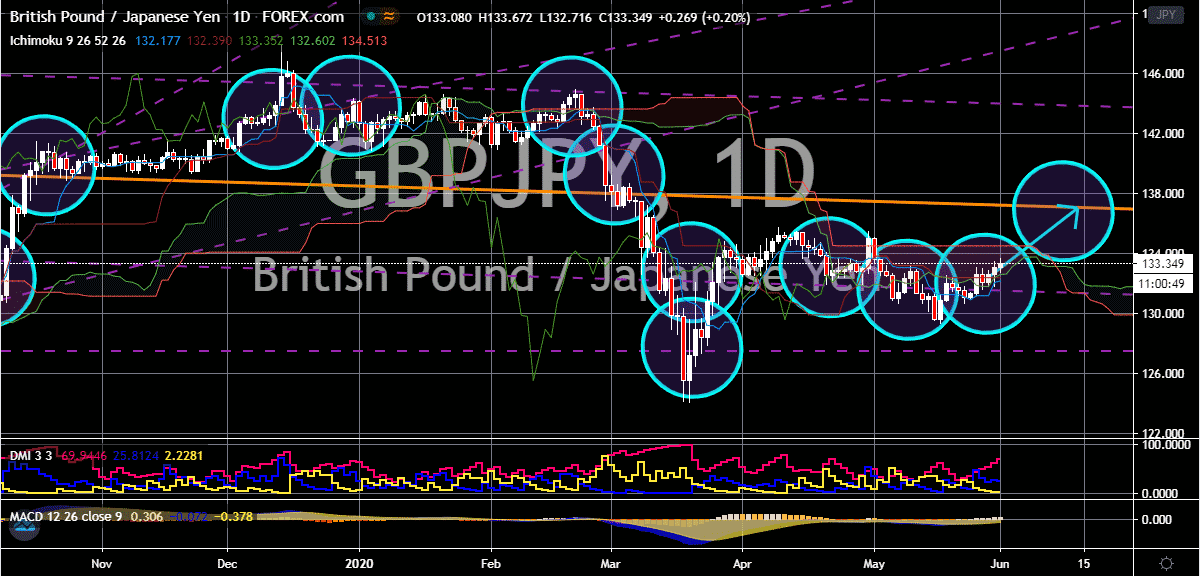

CAD/JPY

Following the announcement of a recession by the Japanese government earlier last month, it appears that the tides have turned in favor of bullish investors. Thanks to the gradually yet fragile rebound of crude prices, bullish investors are fueled with determination to propel the pair higher towards its resistance level. It’s widely expected that the Canadian dollar to Japanese yen exchange rate will climb to its resistance before the halfway mark of the June. Japan is doing its best to counter the negative impact of the recession by unprecedented amount of stimulus and post coronavirus plans for the economy mainly in its tourism. The beautiful Asian country is easing its travel restrictions on other countries that have already contained their coronavirus outbreaks such as Thailand and Vietnam in Asia and the two antipodeans, Australia and New Zealand. But as of the moment, the fundamentals are still working for Bullish investors.