Market News and Charts for July 29, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

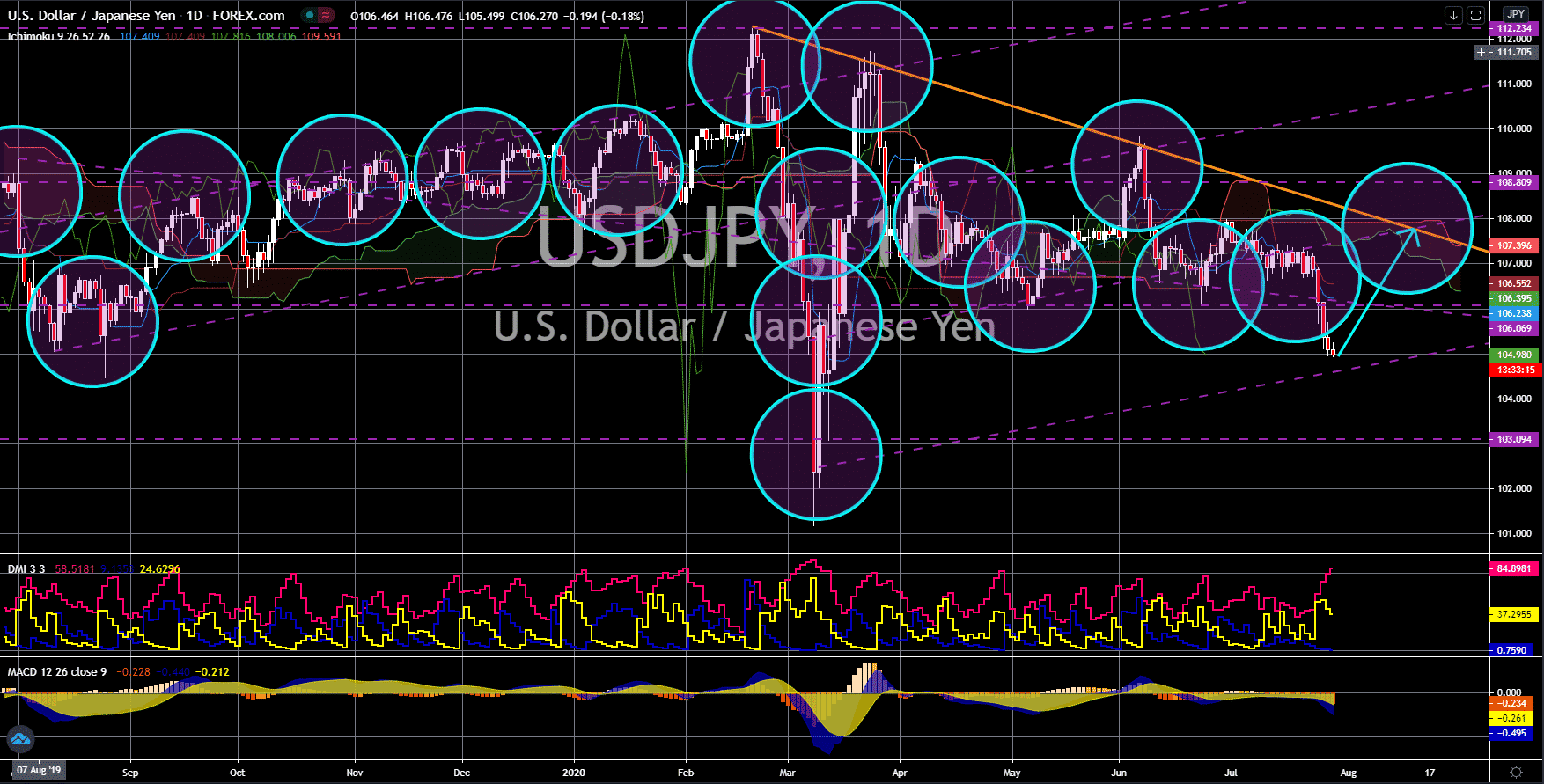

USD/JPY

The pair will bounce back from a major support line, sending the pair higher towards a major resistance line. The expectations for the Fed to retain its interest rate is expected to help the greenback to move higher against the Japanese yen. The current US interest rate was 0.25%, 150 basis points lower prior to the coronavirus pandemic. With the negative reports surrounding the US dollar, the interest rate decision report today, July 29, will bring hope among the USD bulls. Just like the US, Japan is also struggling with its current economic situation. Despite lifting the national emergency back in May, the country was still not able to recover from its recent slump. The expectations for Japan’s retail sales report today was an evidence to this. Analysts are expecting the report to decline by another 6.5% following its decline of 12.3% in May. Meanwhile, April’s 13.7% was the second-highest decline in retail sales in the country’s history.

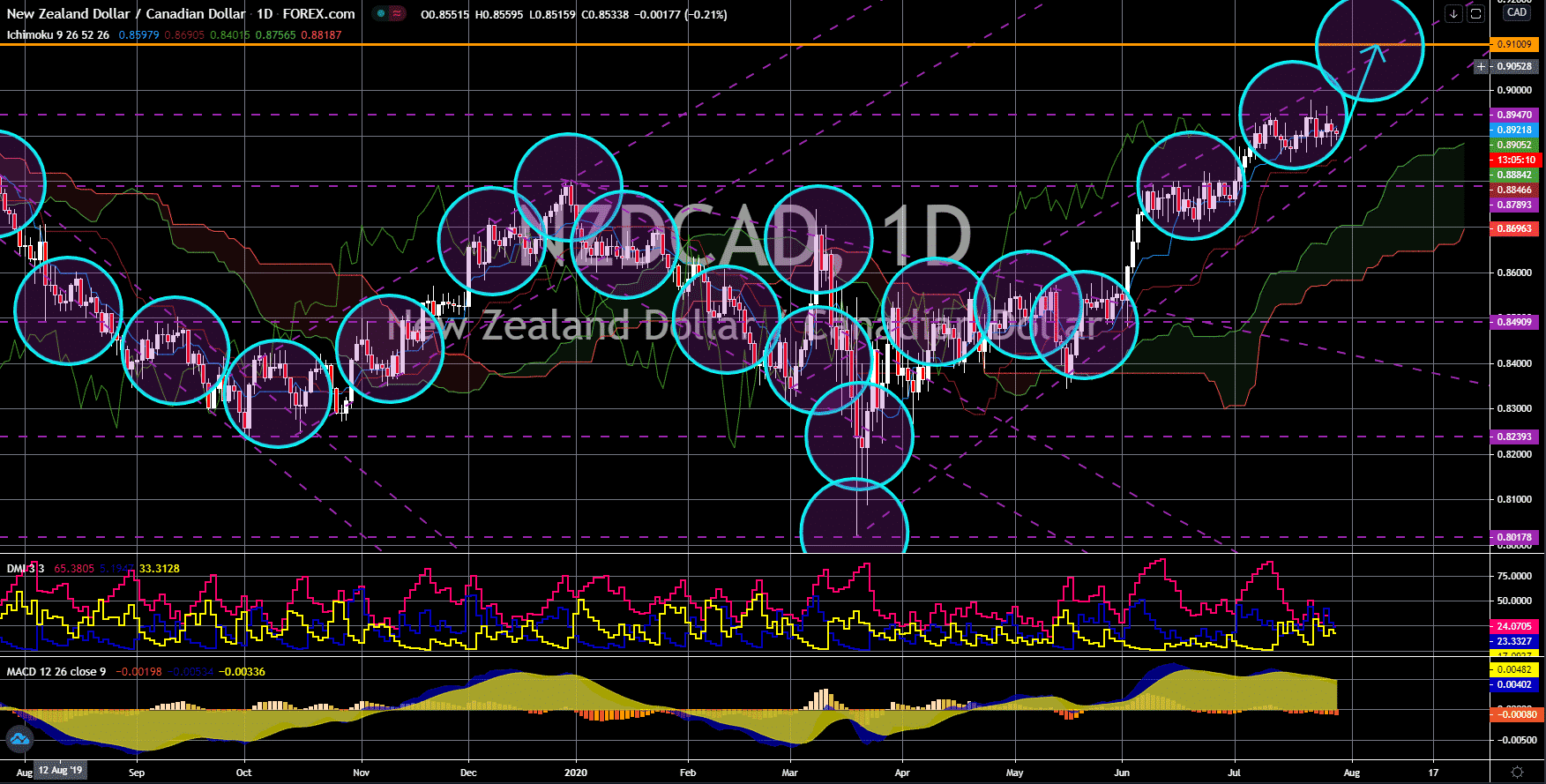

NZD/CAD

The pair will continue to move higher in the following days towards its April 2019 high. Job postings in Canada went up by 17.0% on this week’s report compared to the prior week. This was due to the recent actions taken by the Canadian government to restart its economy. Aside from this, a recent report from Conference Board of Canada suggests the growth in liquified natural gas (LNG) businesses in British Columbia. On the report, the non-profit think tank said the boom in LNG will add 96,550 new jobs, increase the total wages in Canada by over $6 billion, and increase the country’s gross domestic product (GDP) by $11 billion annually. However, analysts are still pessimistic with the country’s recovery and growth prospect. Canada’s strength was its immigrants and with most of the world still banning immigration due to COVID-19, the country’s growth is limited. Meanwhile, New Zealand was among the countries who might open its borders soon.

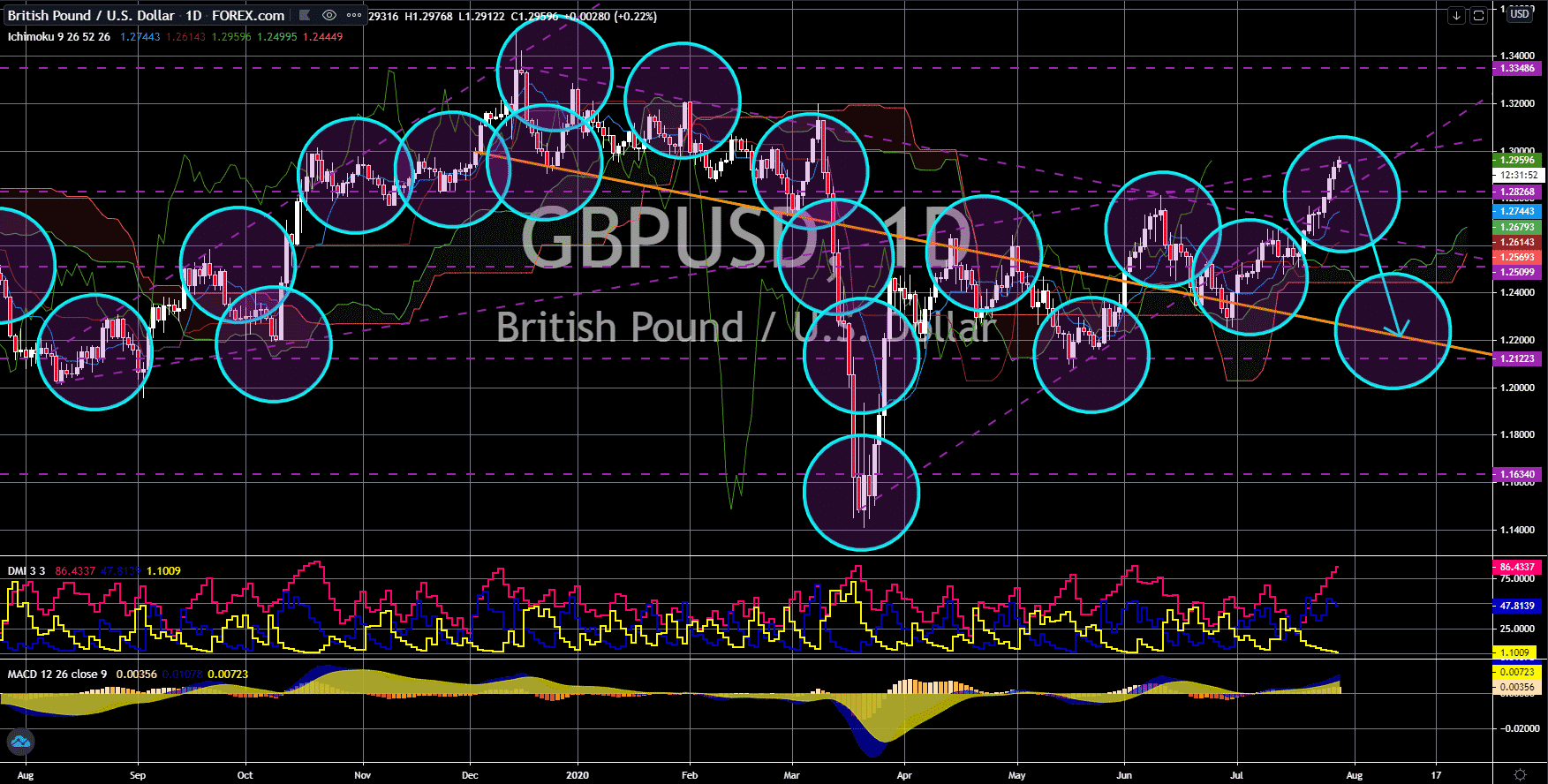

GBP/USD

The pair will fail to break out from a major resistance line, sending the pair lower. The credit consumption in the United Kingdom is still weak as the country’s restrictions are yet to be lifted. The coronavirus cases in Britain continues to soar with the confirmed cases now totaling to 301,000 with 45,878 deaths recorded. Unemployment was also high and this scenario forces UK citizens to save money, which, in turn, is affecting the country’s economic activity. Consumer credit for the month of June is expected to drop by another $2 billion. On the other hand, mortgage approval and lending are expected to pick up in today’s report. However, expectations were still low compared to the pre-coronavirus data. The same is true for the United States whose initial jobless claims last week broke the downward trend. However, the expectations for the Fed to retain its current benchmark interest rate of 0.25% will cause the USD to surge in the short-term.

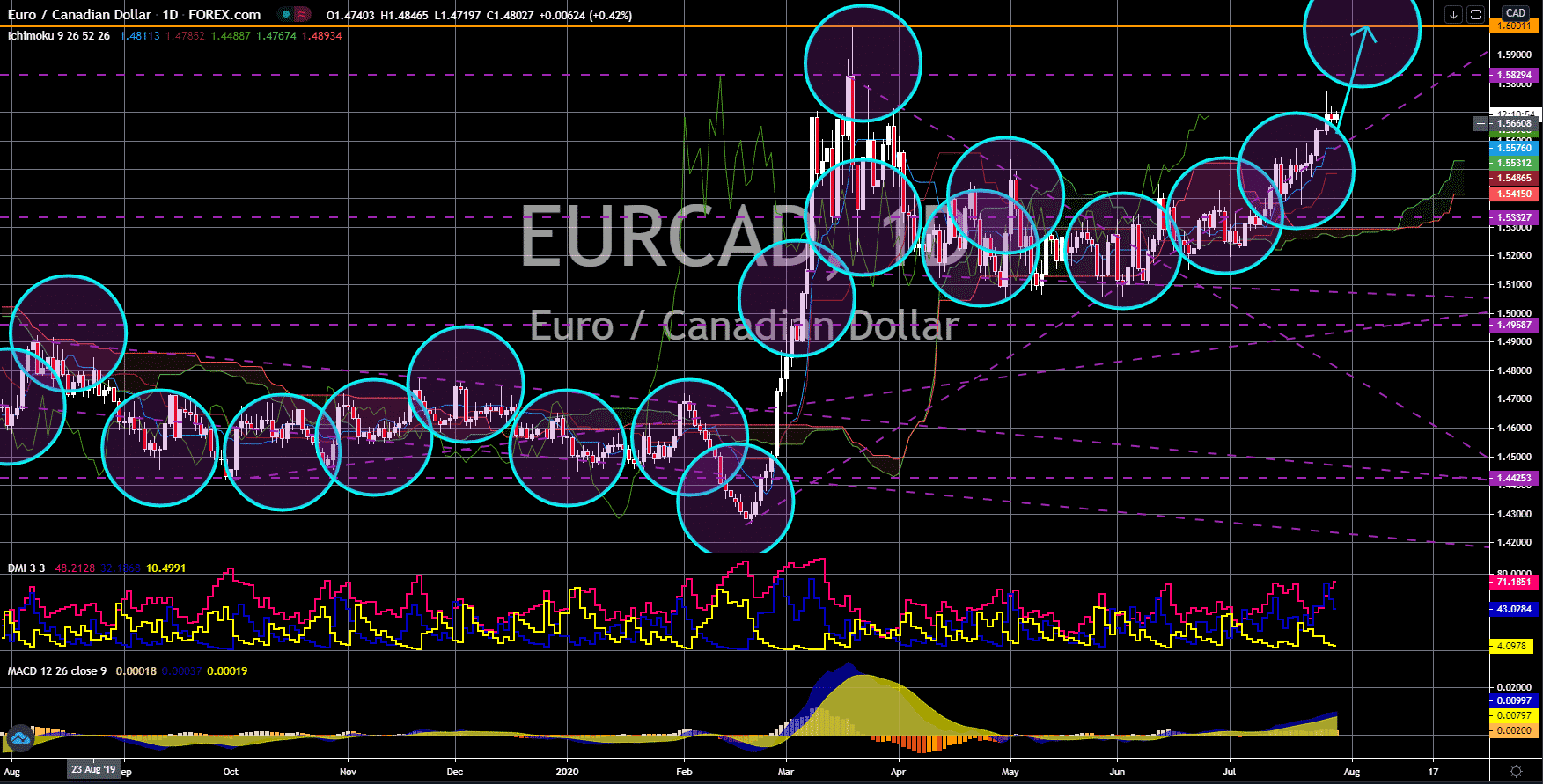

EUR/CAD

The pair will continue to move higher in the following days towards its previous high. The positive improvement in the Spanish data will push the single currency higher against the Canadian dollar. In its recent retail sales report YoY, Spain posted -4.7% decline compared to previous record of -19.0% and expectations of -17.8%. On the other hand, its unemployment rate climbed to 15.33%. This figure is way lower than expectations of 16.70% for the second quarter of the fiscal year. Meanwhile, job seekers in the second-largest economy in the European Union, France, dropped down for the second consecutive time. This suggests that companies in France are rehiring following the reopening of its economy. Recovery in Canada is also evident with the recent reports in the country. However, the future growth prospect might be lower as the number of people migrating in the country dropped down due to several restrictions brough by COVID-19.