Market News and Charts for July 26, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

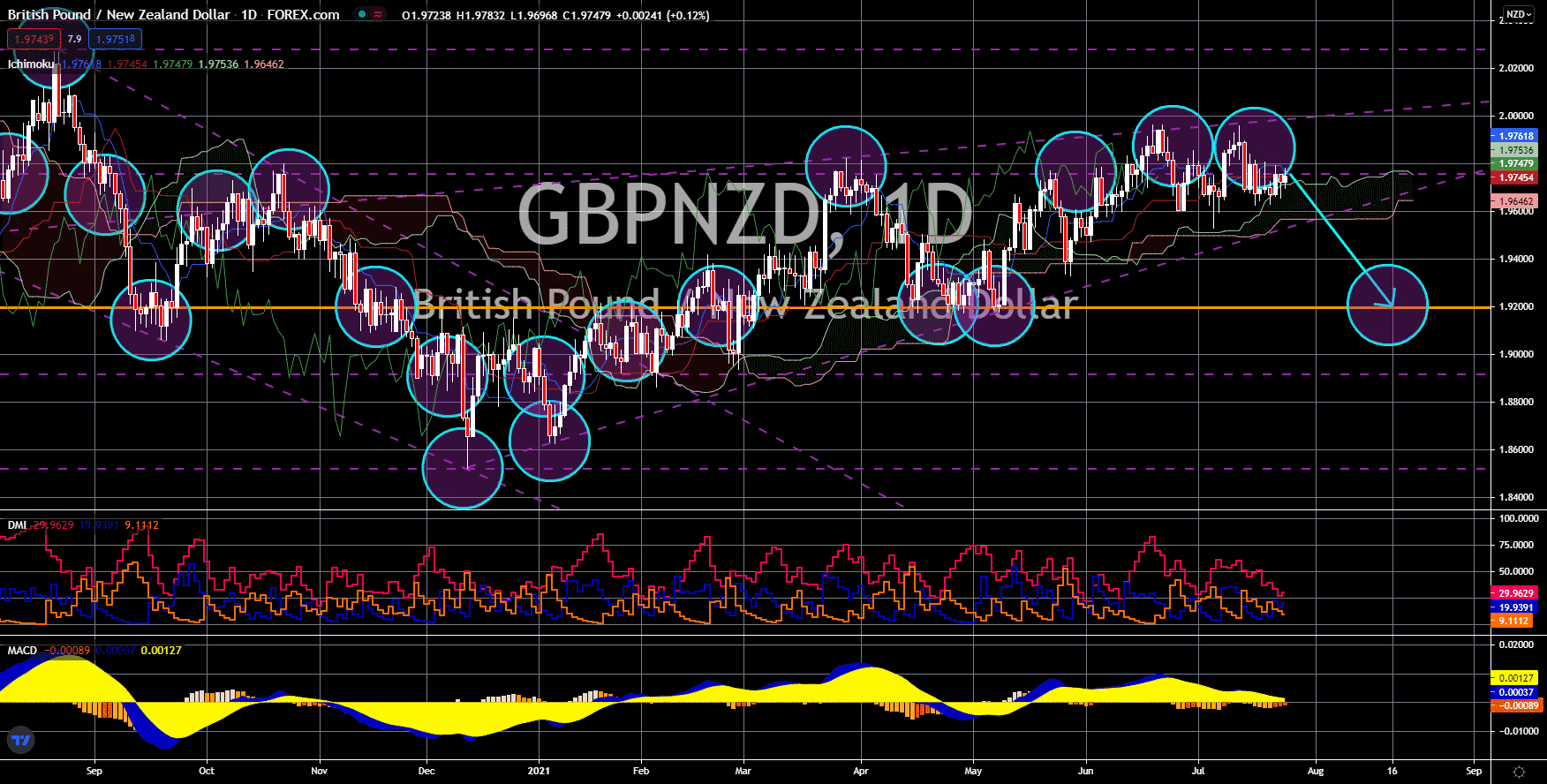

GBP/NZD

The British pound will underperform against its New Zealand counterpart in the coming sessions. The UK is experiencing a fourth wave of the pandemic which started in late May. As a result, the preliminary data for the Purchasing Managers Index report fell from the prior month’s results. The Services sector led the decline by 4.6 points to 57.8 points. Analysts were expecting a minimal impact with a 62.0 points projection from the previous 62.4 points. Meanwhile, the PMI data of the manufacturing sector dropped to 60.4 points, a 3.5 points net difference from June’s final result of 63.9 points. This led to a Composite PMI of 57.2 points. If the actual figure came near the preliminary figure, this would represent a 6-month low for the report. As Britain suffers from the rise in covid cases, the BOE doubled down on its commitment to keep the current monetary policy in place. Gertjan Vlieghe said that a rate hike would be premature given the current situation.

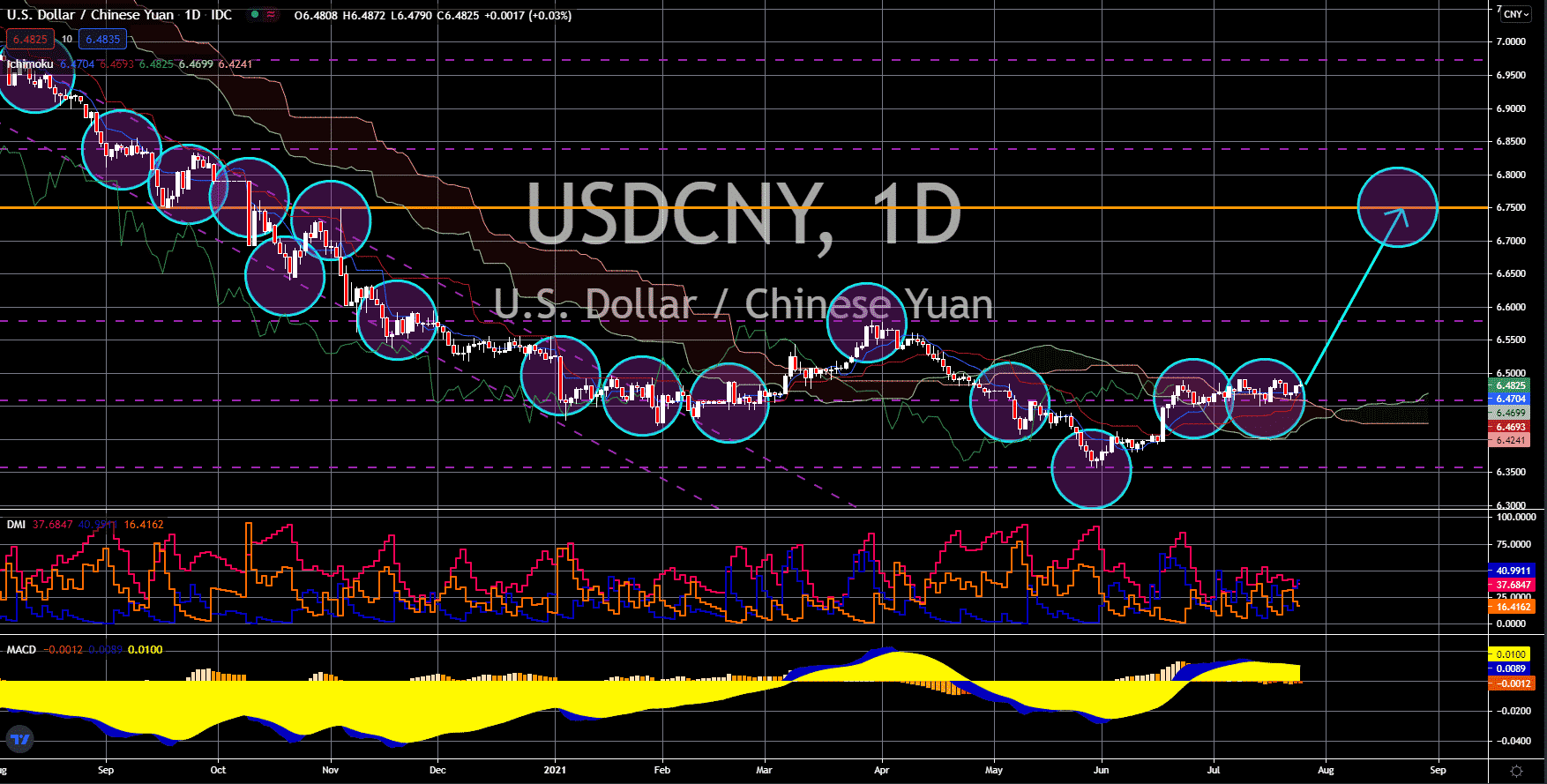

USD/CNY

The USDCNY pair will continue to recover and is now headed towards 6.7500 in the short to near term. Investors and traders shrugged off the disappointing US economic data last week on news that the government has pre-ordered 200,000 bolster shots. The third vaccine dose from Pfizer is said to be potent against the Delta variant. If approved for emergency use authorization (EUA) in the third quarter, the US will be the first to be immunized against Variants of Concerns (VOC). As for the recent reports, the initial jobless claims hit 419,000 last week which was the biggest weekly jump in the past nine (8) weeks. Meanwhile, the housing market printed bleak numbers on July 26 having recorded a -6.6% decline in new home sales for June. This represents 676,000 listings from May’s 724,000 record. The consensus estimate is an increase to 800,000 or a 3.5% jump month-on-month. The US leading index has also slowed down with a 0.7% growth MoM from 1.2% prior.

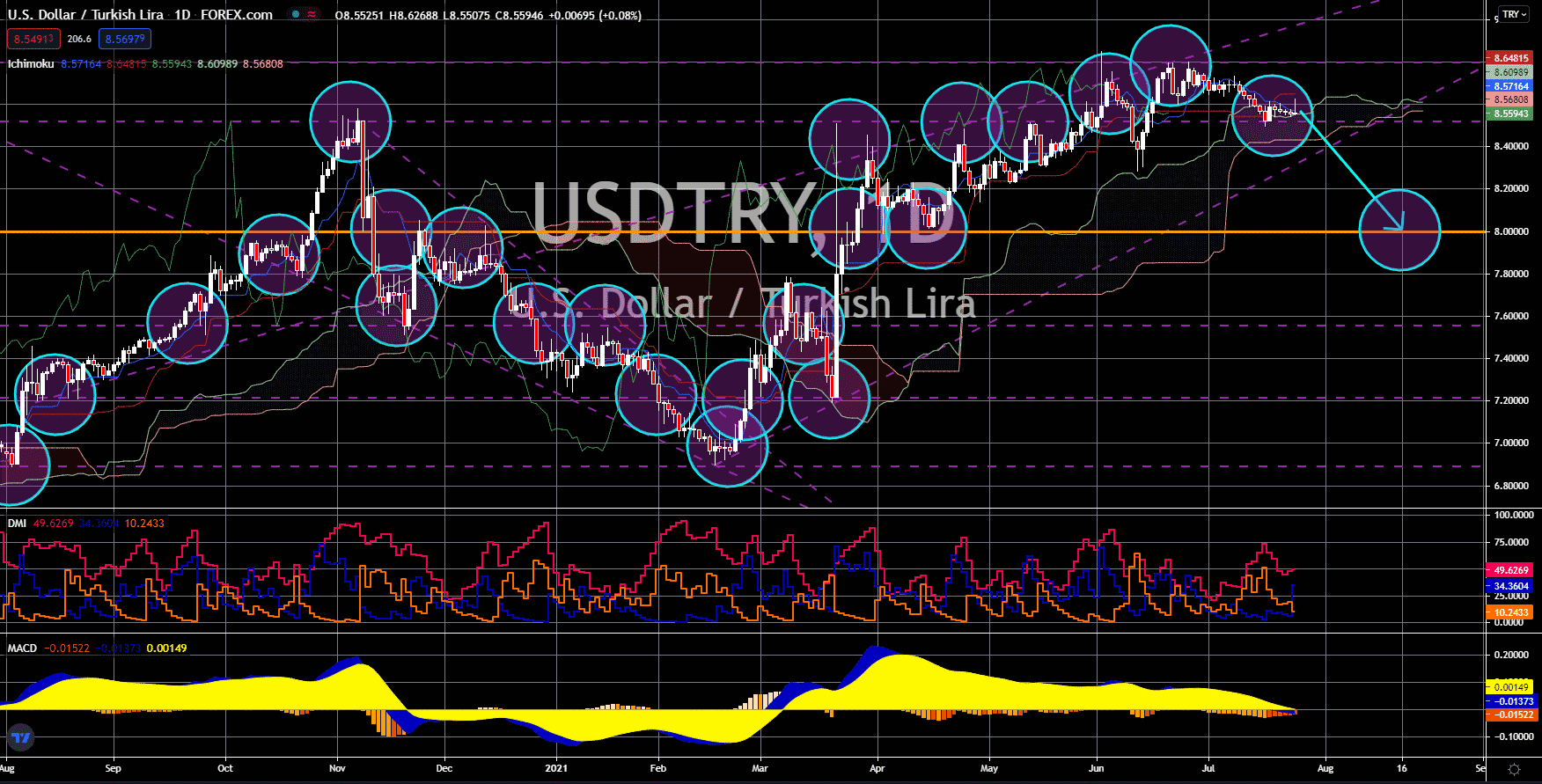

USD/TRY

The US dollar will continue to retreat against the lira towards the psychological 8.00000 level. Ankara’s vaccination rate saw a massive increase in mid-June. The tally as of July 25 shows half of the population has received at least one (1) vaccine shot. As a result, the Real Sector Confidence Index jumped to a 9-year high in July to 116.6 points as most restrictions were eased in the month. The services sector led the gains with confidence of 114.8 points, a month-on-month growth of 5.8%. This was followed by the construction sector with a 4.7% jump to 86.3 points. The reopening also resulted in the retail trade confidence index soaring 3.7% to 109.6 points. Turkey’s vaccination campaign is expected to improve in the coming weeks. Businesses demand visitors’ proof of vaccination before allowing them to enter the premises. In other news, the UN Security Council condemned Turkey’s support for an independent Turkish Republic of Northern Cyprus.

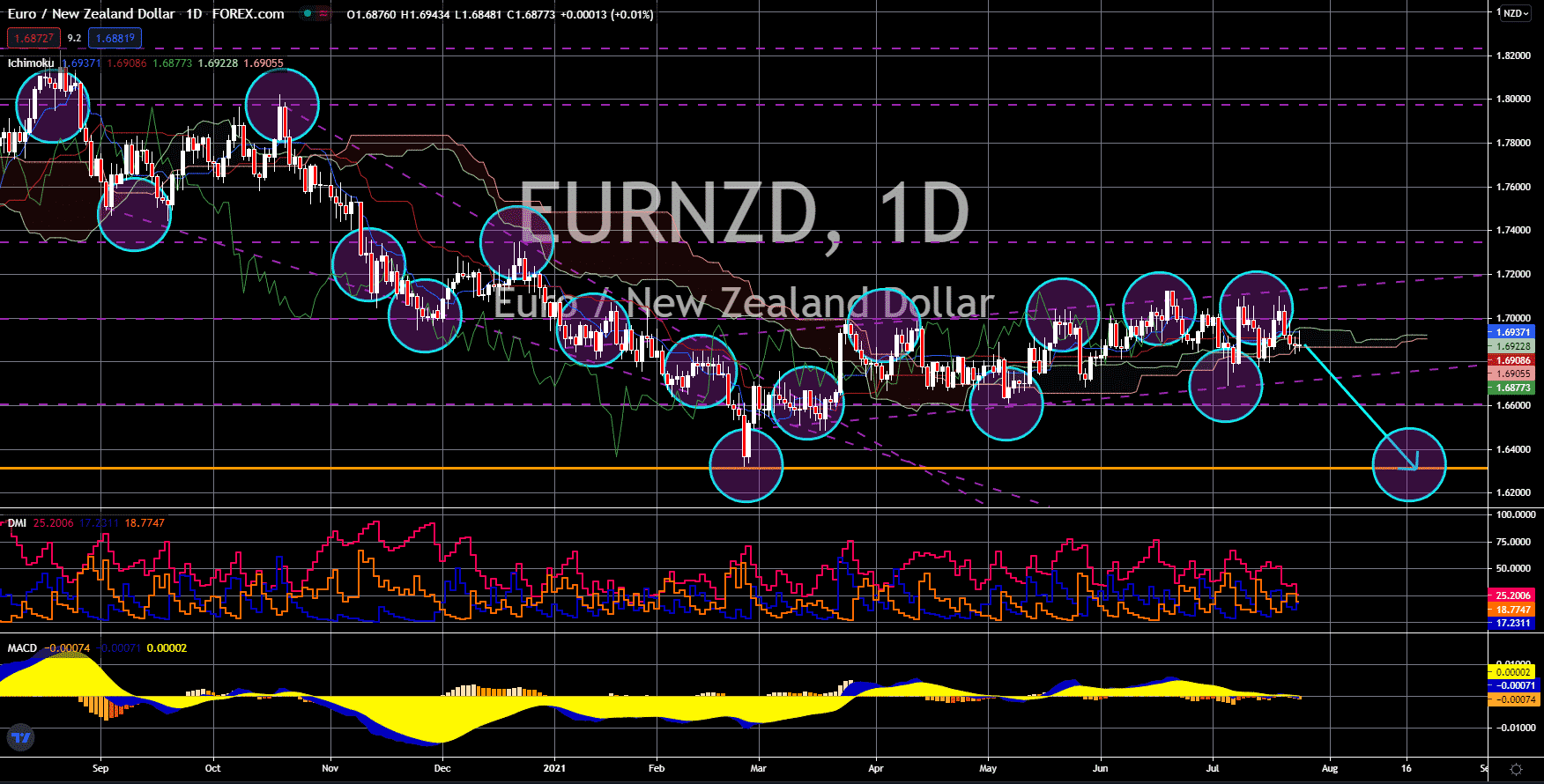

EUR/NZD

The pair will reverse back to revisit its previous low at 1.63230 in the short to medium term. The European Central Bank tweaked its monetary policy from a 2.0% annual inflation target to below, but close to, 2.0%. This will allow the ECB to have flexibility with the rise in prices of basic goods. The central bank’s move was the first revision of its 2003 adoption of a fixed 2.0% target. It expects inflation to pick up in the near term, sharing the temporary spike expectations by the Federal Reserve, before easing to 1.4% by 2023. In addition, President Christine Lagarde has committed to spending the 2.21 trillion Pandemic Emergency Purchase Programme (PEPP). Last week, the European Central Bank retained the interest rate at zero percent while deposit and lending rates came in at -0.50% and 0.25%. In other news, the ECB lifted some of its credit requirements for banks. Starting September, the banks are allowed to distribute dividends to their stockholders.