Market News and Charts for July 21, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

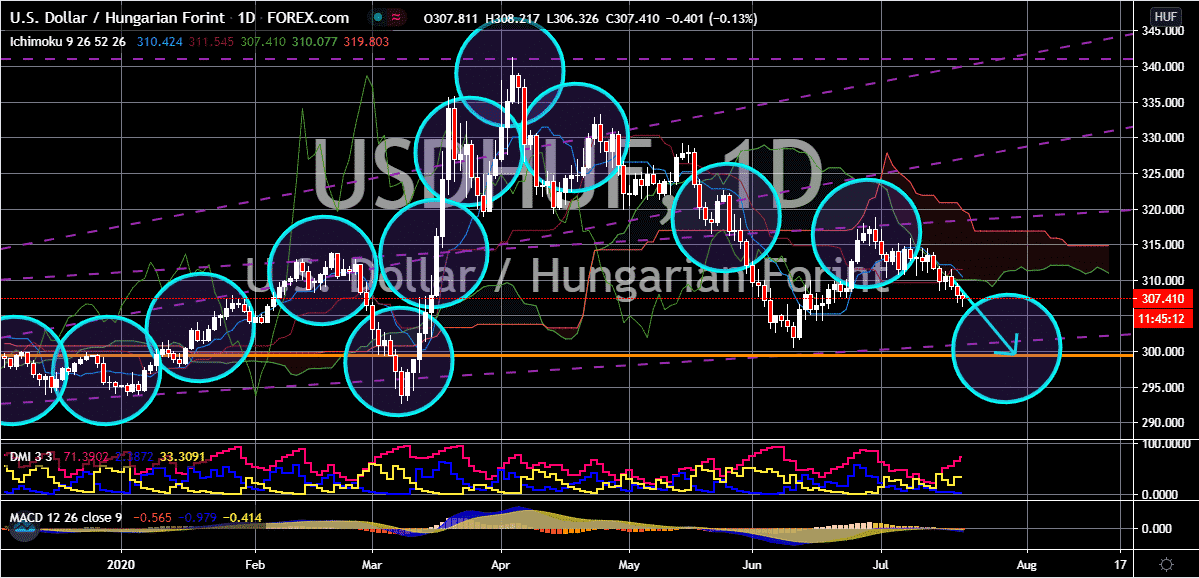

USD/HUF

The safe-haven appeal of the US dollar continuously falters against the Hungarian forint. And the recent news of a recently agreed upon stimulus package for the eurozone regions has sealed the fate of the USDHUF trading pair. Prices are widely projected to turn out very bearish as the greenback struggles to gain footing against the Hungarian forint. Bears are hoping to force prices to ranges last seen back in early March. However, looking at the fundamentals, it appears that the buck still has a huge chance to make a solid comeback against the forint. Just recently, it was reported that most experts in the region believe that the Hungarian National Bank will probably unleash another rate cut that would be detrimental to the forint’s strength but useful for the economy’s recovery. Reports say that Hungary might continue to reverse its course following a change in the internal team that oversees the country’s monetary policy.

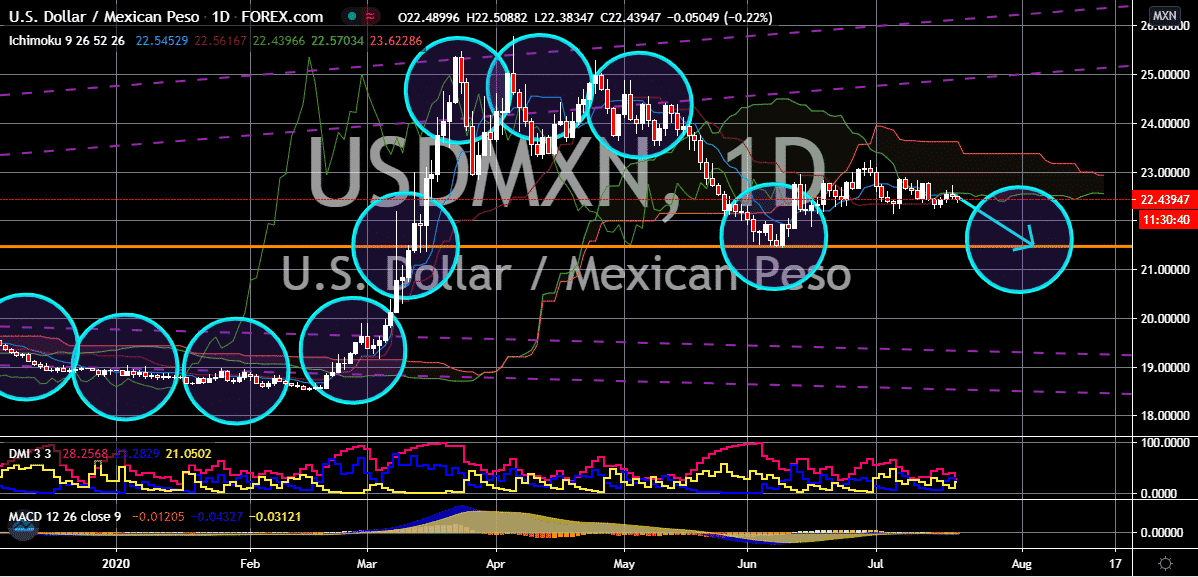

USD/MXN

Experts have been warning about the sustainability of the Mexican peso’s strength. Although prices are widely expected to go down as the safe-haven appeal of the US dollar continues to fade due to the good news from coronavirus vaccine news. The Mexican peso is also gathering strength from the positivity in the global equity market and is harnessing strength from the renewed positivity. However, there are headwinds ahead for the Mexican peso after Mexican finance minister Arturo Herrera said that the country might need to have adjustments of changes in its fiscal plans. This is all due to the disruptions brought by the coronavirus pandemic to the economy. According to Herrera, how the Mexican economy will recover will very much depend on how the pandemic evolves and if a vaccine finally arrives in the market. Of course, a vaccine isn’t expected to be produced anytime within this month of next month, it still pressured the peso.

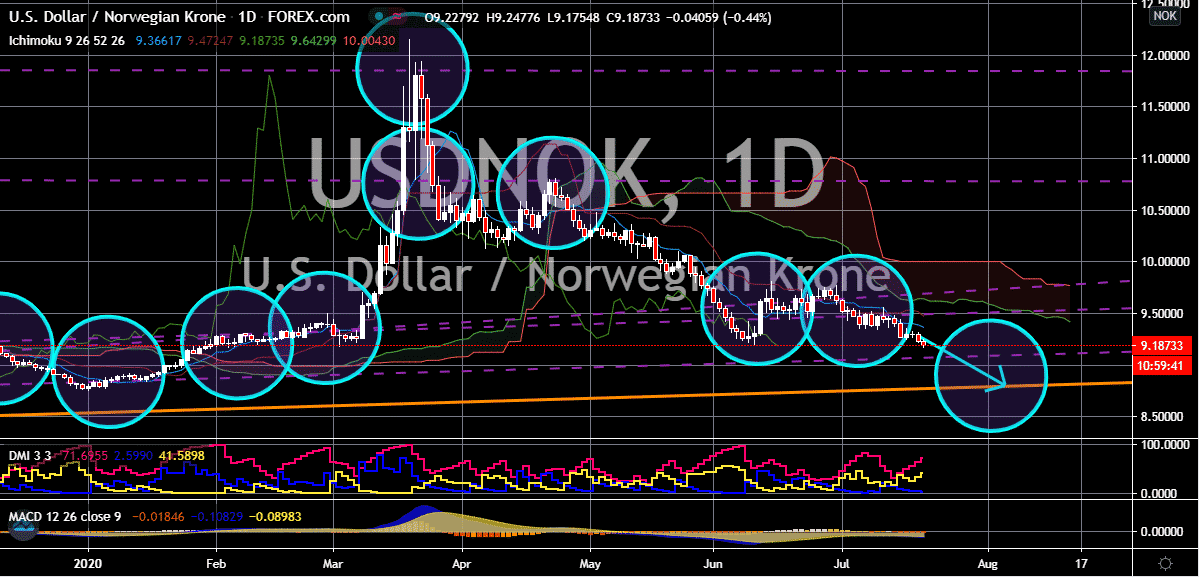

USD/NOK

The Norwegian krone hangs on to its winning momentum against the US dollar and the trading pair is projected to fall down to its support by the first week of August. The Norwegian krone is running on several factors. First, the strong performance of crude prices in the market as OPEC holds on to its production cuts. The news that the EU leader finally agreed on a stimulus package to help the bloc has also strengthened the Norwegian krone and the commodity market. These odds have made it perfect for bearish investors to have a firm grip on the direction of the trading pair. And considering that coronavirus vaccine-related news has also slashed the safe-haven appeal of the buck, prices should stay in bearish waters for now. The hopes brought by the coronavirus vaccine have outshined the headlines of rising number of cases around the world. However, as crude demand remains an issue, there is still hope for bulls to recover in the near-term sessions.

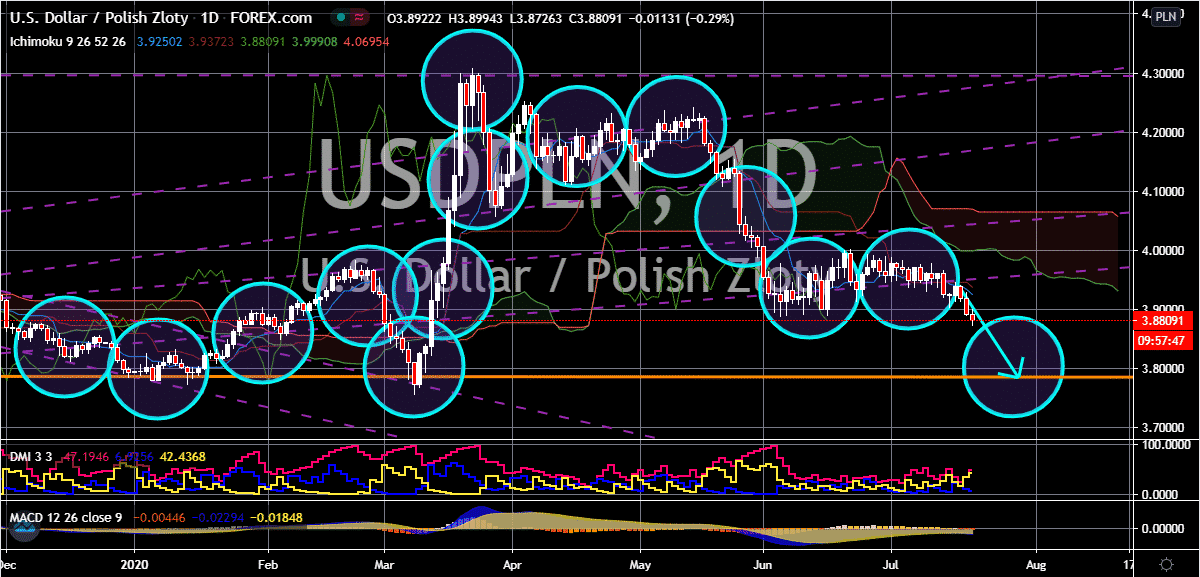

USD/PLN

The Polish zloty is trading strong against the beloved greenback, forcing it in its backfoot in the sessions. The pair is expected to hit its support levels before the month ends as prices steeply drop. The news from the joint European Union stimulus has helped the Polish zloty extend its gains against the greenback. Earlier this Tuesday, it was reported that EU leaders finally struck a highly anticipated deal that is worth 750 billion euros to help save the eurozone economies. Moreover, it was recently reported that Polish central banker Lukasz Hardt told the press that the country’s inflation may exceed the bank’s most recent forecasts. This could then prompt an interest rate hike for the Polish central bank and thus further strengthening the zloty against other assets such as the buck. Bears are hoping that it would be the case since Polish central bank has already unleashed three rate cuts this 2020, and now, interest rates are almost near zero.