Market News and Charts for July 15, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

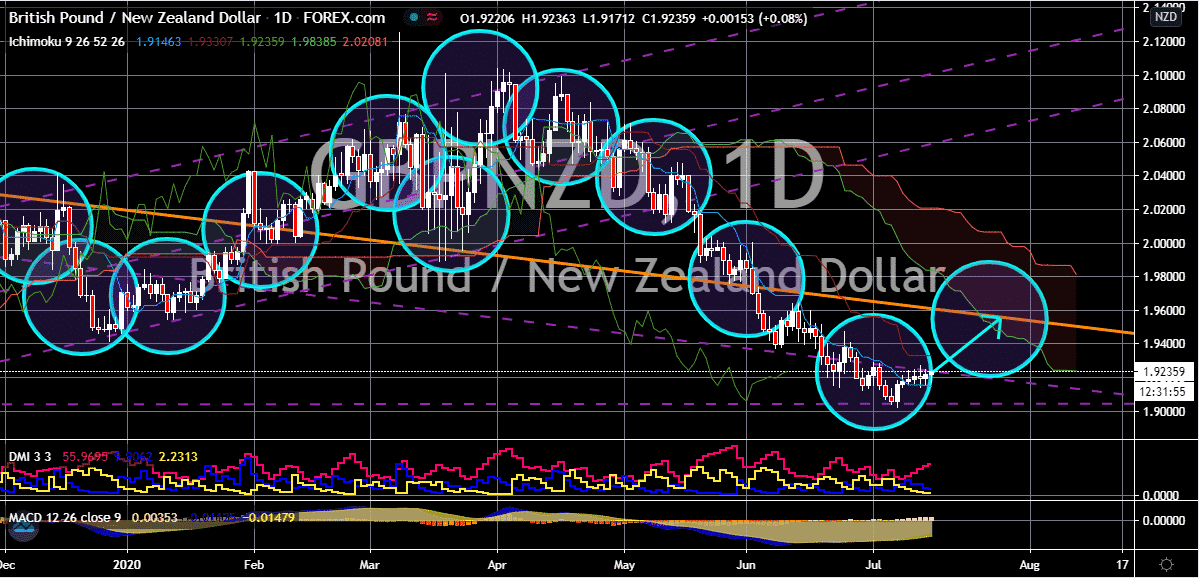

GBP/NZD

Looking at both assets separately, it appears that the New Zealand dollar is strong, and the British pound is weak. But in their match up, it seems like bullish investors have the upper hand. The trading pair is widely projected to climb up as its seen flirting with a critical resistance level. Once bulls conquer this area, prices may see an uptrend towards the higher resistance level this July. The market is very much influenced by the Brexit mood and the heightened tension between Washington and Beijing. Investors are waiting for China’s response to the latest comment of US State Secretary Mike Pompeo regarding the situation in the South China Sea. If the tension continues to escalate, the dominant run of the New Zealand dollar could potentially end, leaving a wide opening for the British pound to take control. However, the sterling is also pressured by Brexit woes, and the recent warning of the German Chancellor isn’t helping its cause.

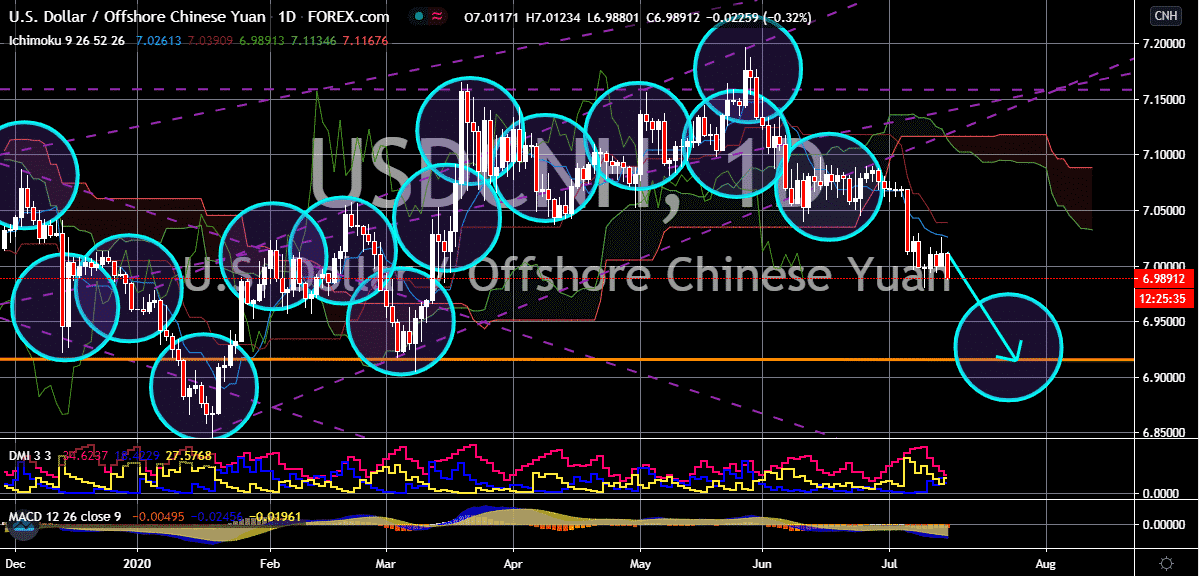

USD/CNH

The Chinese yuan continues to see gains against the US dollar this Wednesday. Although yesterday the buck appeared like it’s forcing a recovery, there are more fundamental factors supporting the Chinese yuan’s case. The pair will likely reach its support levels this July thanks to the positive sentiment sparked by American investment banking company, Goldman Sachs. Just recently, it was reported that the bank sees the Chinese yuan strengthening further against the beloved US dollar in the next twelve months. According to the bank’s strategists, the Chinese yuan will primarily rally thanks to the recovery of the Chinese economy’s health. It’s no new news that China, where the outbreak started, has very few existing cases as of writing. That comes in contrast to the number of cases seen in the United States. Aside from that, the economic recovery of some of China’s biggest trading partners is helping the yuan power through.

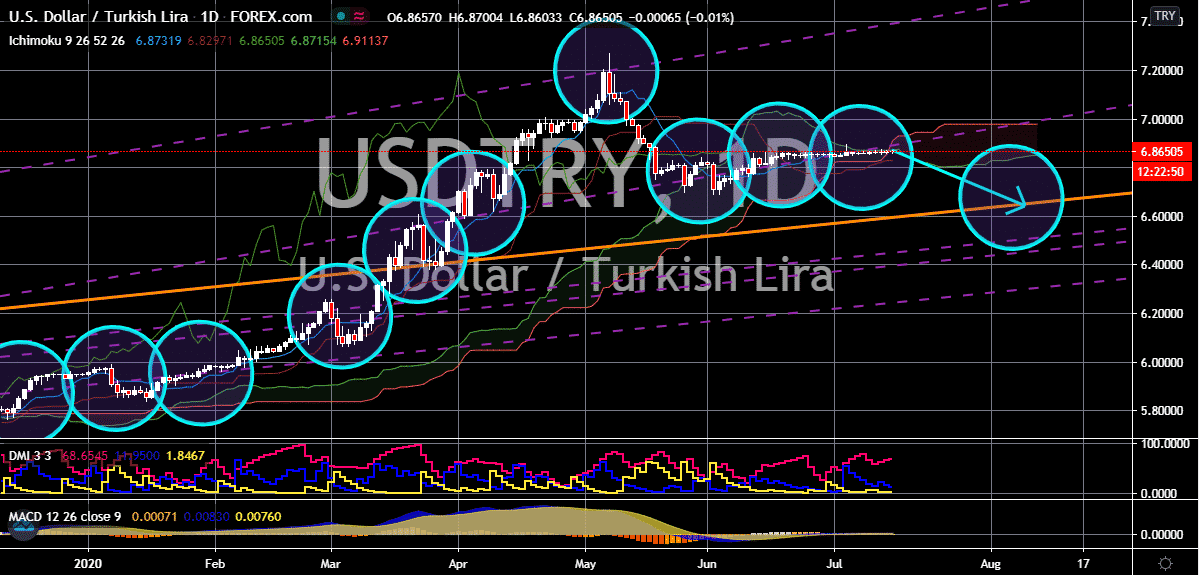

USD/TRY

Despite the strong sentiment felt by economists for the Turkish economy, the Turkish lira still lacks the power to overpower the US dollar. The pair has been struggling to pick up any significant momentum both ways as prices trade slightly neutrally in the past few weeks. However, it’s believed that the Turkish lira will eventually pick up strength to bring the US dollar to Turkish lira exchange rate lower by the beginning of the next month. Perhaps the main cause of the lira’s weakness is the massive funds injected by the government to the Turkish economy. Just recently, it was reported that the $6.3 trillion to the economy and focus on low-performing students in the country. According to Andreas Schleicher, founder of the state’s Program for Internal Student Assessment, the country has seen god progress over the last decade. The injected funds will add more liras in the circulation; hence, the currency will remain pressured.

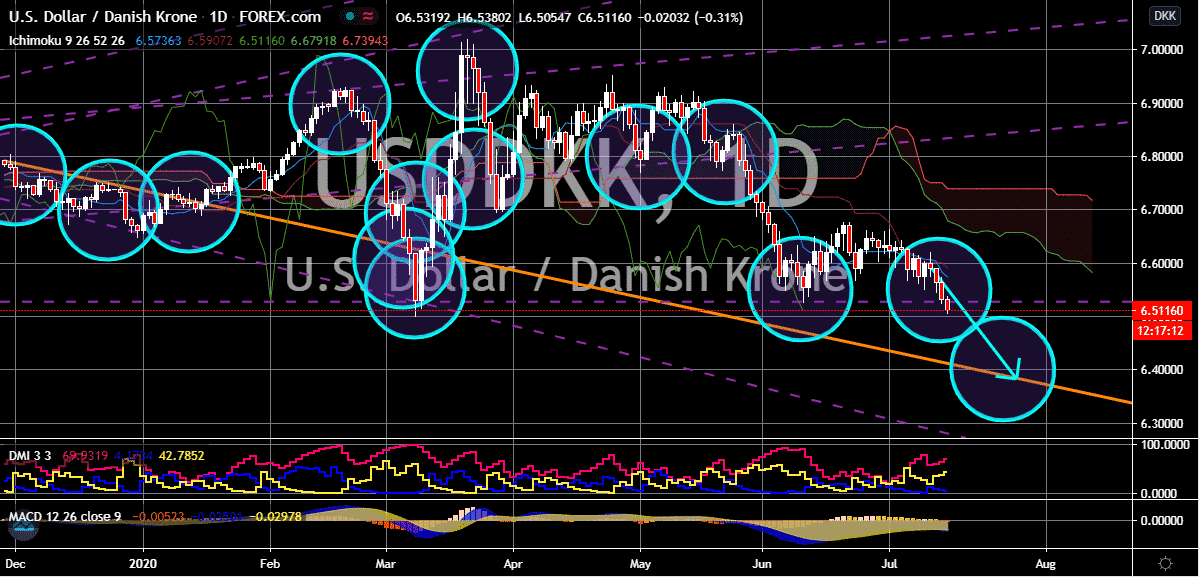

USD/DKK

The Danish krone receives some weight from the recently approved scheme for the Danish economy’s recovery. However, even that won’t help the greenback’s fate against the European currency. The trading pair is widely expected to continue plummeting towards its support levels in the coming sessions, hitting its lowest levels since September 2018. Just recently, it was reported that the European Commission approved 1.1 billion Danish krone aid to help companies struck by the pandemic and were affected by the restrictive measures enforced by the government. The aid comes as Denmark gradually re-opens its economy, strengthening the appeal of the Danish krone even further. The aforementioned scheme will be open for companies that are still prohibited from opening due to the pandemic. Firms are able to apply for the aid until the end of August and will be granted full or partial compensation of the fixed costs that they continue to bear.