Market News and Charts for July 14, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

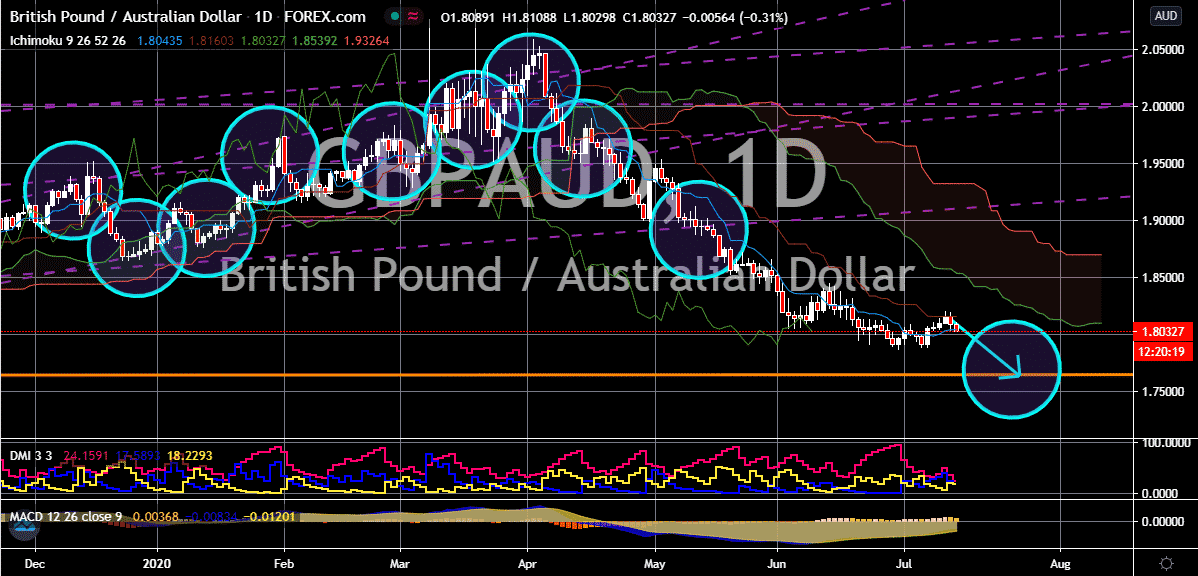

GBP/AUD

Despite the pressure felt by the Australian dollar from the increasing number of new COVID-19 infections, the sterling still stands no chance against the antipodean currency. The British pound to Australian dollar exchange rate is on track to gradually go down towards its support level by the latter part of the month. Looking at the performance of the two currencies against other assets, the pound is strong while the Aussie is weak. Unfortunately for bullish investors of the pair, the sterling’s success against the US dollar isn’t working against the Aussie. And on the other hand, bears are fortunate because the broader weakness of the antipodean currency isn’t reflecting on the pair’s performance. Political uncertainties around the Brexit is causing the sterling to fall to its knees. Just recently, Britain launched a campaign to inspire businesses to seek a new “relationship” with the EU, following the controversial “Get ready for Brexit” activities last year.

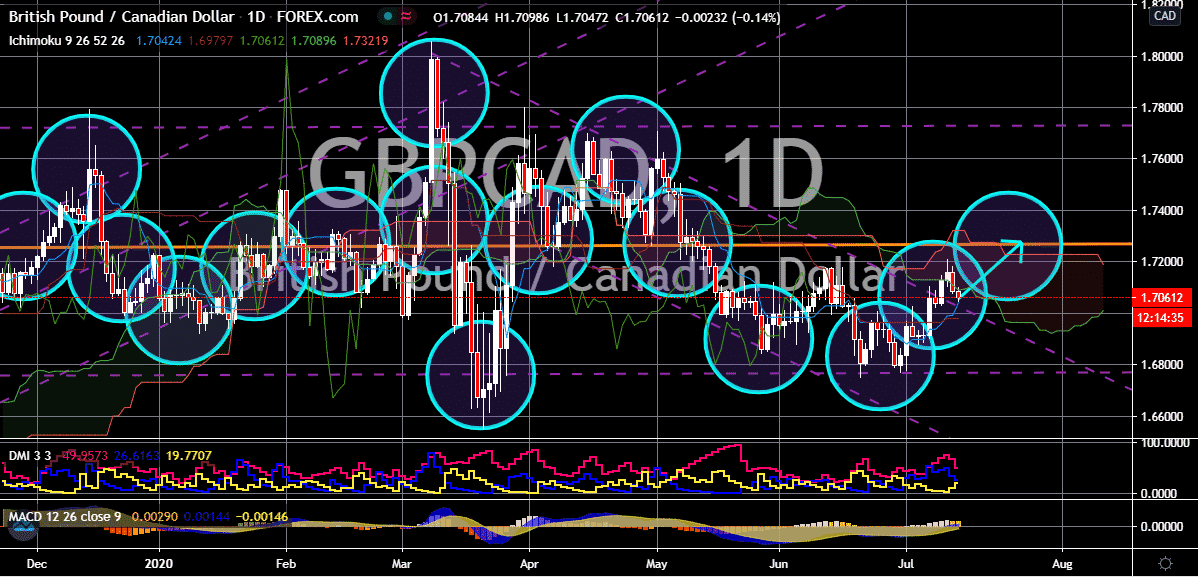

GBP/CAD

It appears that the British pound is losing its touch against the Canadian dollar. However, the trading pair isn’t expected to go on a bearish path and prices remain on track to eventually hit its resistance later this month. The Canadian dollar is expected to get weaker and weaker against the British pound because of the rising number of coronavirus infections. Moreover, the current recent why the pair is going down is the recent news from the International Energy Agency which came in bullish for crude prices and commodity-linked assets such as the Canadian dollar. According to reports, the IEA updated its forecast just yesterday, predicting that oil demand would pick up by 400,000 barrels per day this 2020. The forecast is a mixed signal because the travelling industry is recovering while lockdowns are gradually being ease. And on the flip side, the number of confirmed cases is still rising, and the globe is still far from a commercialized coronavirus vaccine.

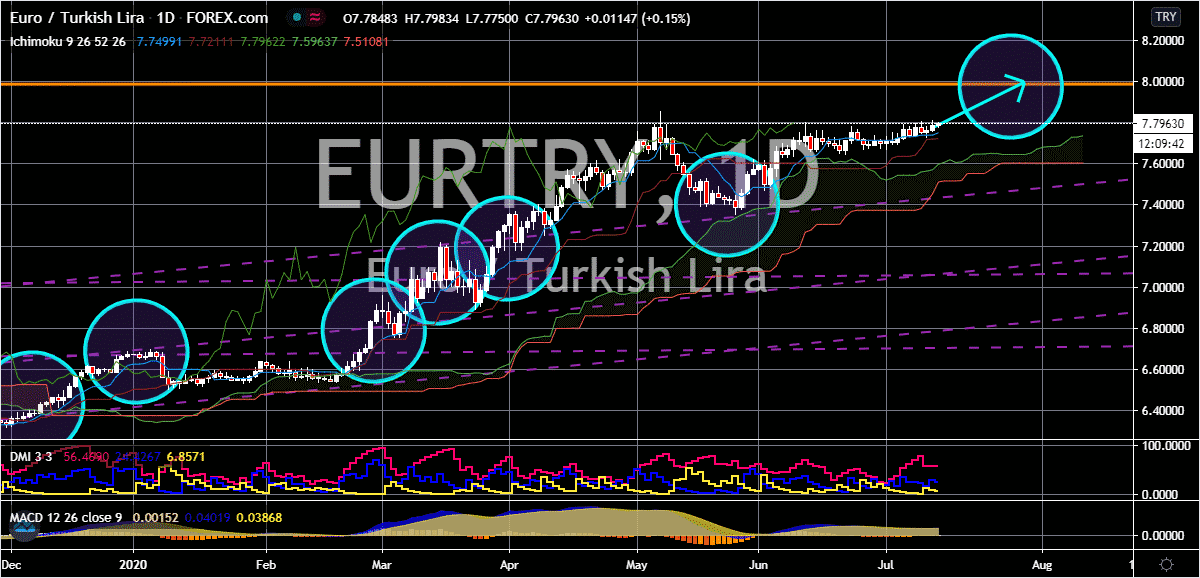

EUR/TRY

The value of the Turkish lira continues to disintegrate against the euro. The pair is so bullish, it’s widely on track to record levels from the Turkish financial crisis period. The euro to Turkish lira exchange rate is projected to inch its way towards the resistance level and it’s clear that bears are having difficulties trying to redeem their losses. In fact, experts believe that the country is on the verge of another devastating currency crisis because of the alarmingly weak performance of the lira against major currencies in the market. Most experts believe that the euro won’t easily crumble against the Turkish lira despite the weakness faced by the currency against other currencies in the market. This is because the lira is significantly weaker than it. Investors are waiting for further guidance from the scheduled meeting of EU policymakers. Reports say that on Friday and Saturday, the leaders will discuss the €750 billion recovery plan for the bloc.

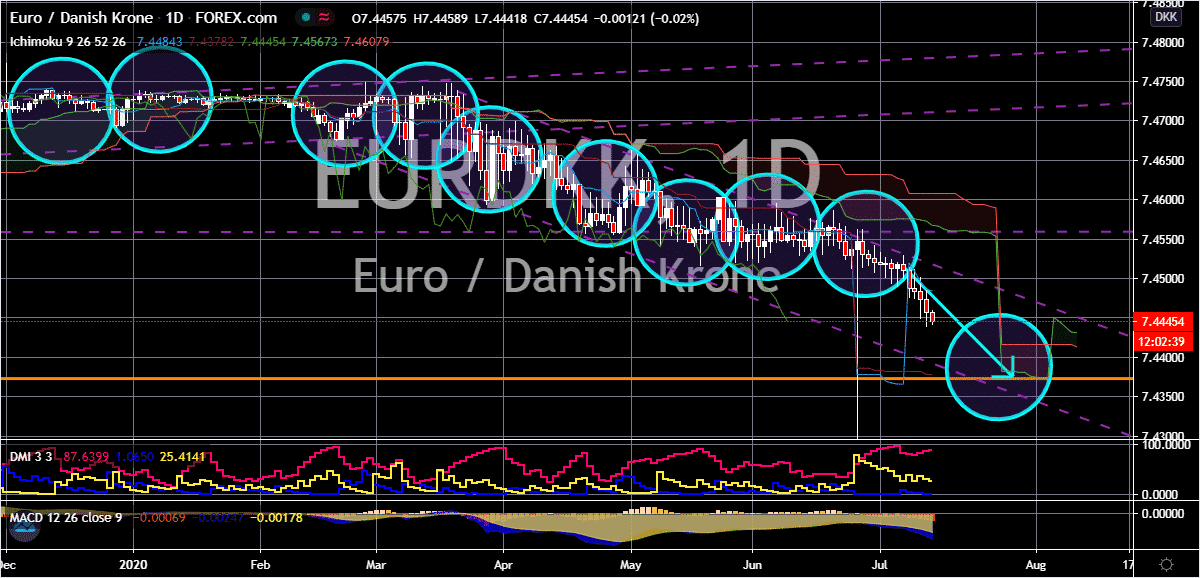

EUR/DKK

The Danish krone appears fortified and aggressive against the euro. The single currency is on the defensive as bearish investors continue to power through and force the pair lower. The euro is weighed on by the concerns of investors about the Brexit, which if there were no deals, it would hurt both the UK and the eurozone. On the other hand, bears are taking advantage of those concerns to bring the pair to levels last seen in mid-September 2017. In the recent sessions, the krone mainly relied on economic data such as Denmark’s trade balance report. Moreover, good news for the Danish economy and its people came when a beneficiary receiving aid was reported. According to reports, the European Commission recently approved two schemes for Denmark to support self-employed and freelancers affected by the COVID-19 pandemic. The plans were approved under the government aid Temporary Framework. The rescue plan will cost around €93.3 million.