Market News and Charts for July 11, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

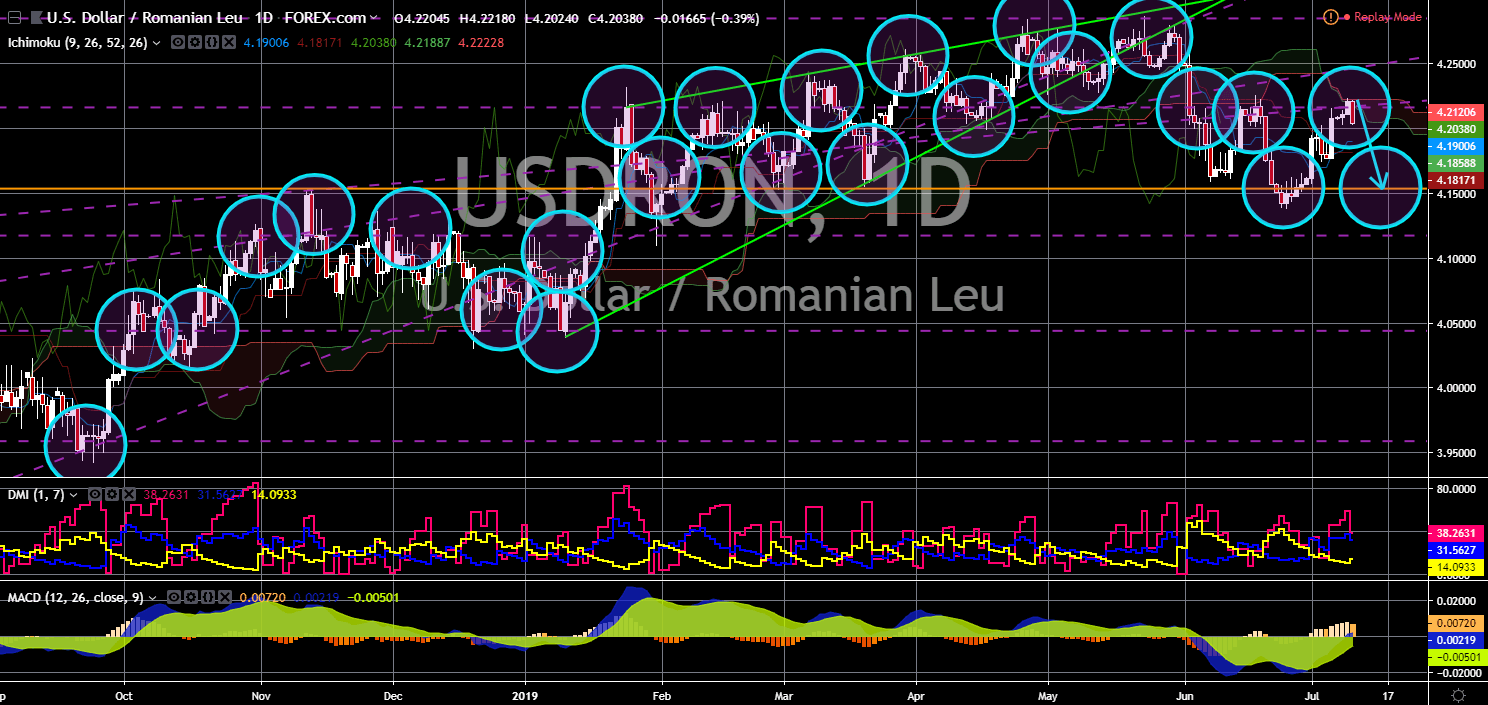

USD/RON

The pair was seen to fail to break out from a major resistance line, sending the pair lower towards a key support line. Romania had been benefiting from the fallout of the relationship between the United States and Turkey. Turkey announced its purchase of Russia’s S-400 missile defense system, which compromise the defense sharing agreement of the NATO (North Atlantic Treaty Organization) alliance. The U.S. had already halted its delivery of F-35 fighter jets and encouraged Poland and Romania to purchase the jets. This was a big move for the U.S. who was seen increasing its influence in the Eastern bloc and increasing its military activity in the region. This will also build a big wall between Russia and Europe, especially after the Russian annexation of Crimea, a Ukrainian territory. Ukraine was applying to become a member of the European Union and the NATO alliance.

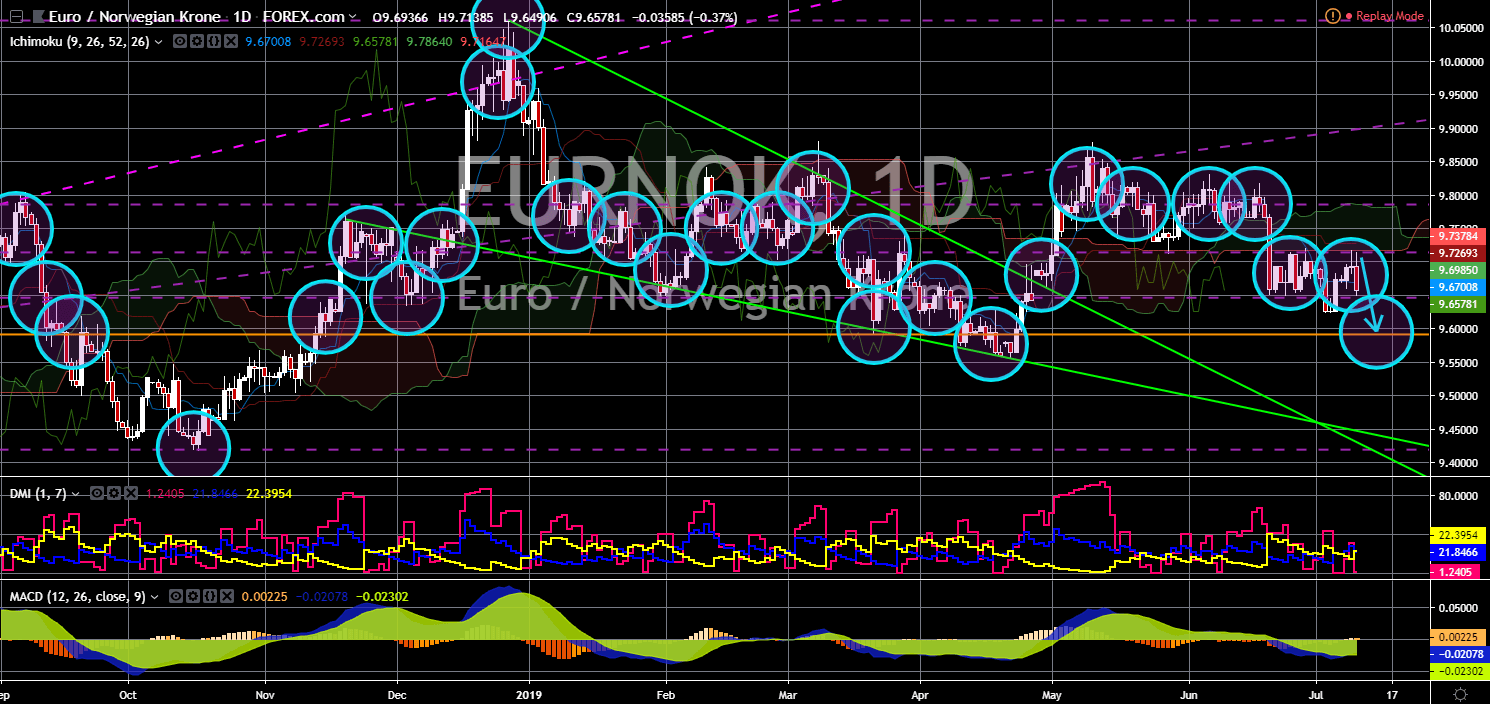

EUR/NOK

EUR/NOK

The pair was seen trading inside a channel, with the pair currently heading towards the channel’s support line. The resignation of UK Prime Minister Theresa May gives rise to a more hard-Brexit proponent candidates, the former and current Foreign Affairs Secretary, Boris Johnson and Jeremy Hunt. The two (2) candidates increased the likeliness of a “No-Deal” Brexit as no one wants to compromise the negotiation agreement with the European Union. However, an aggressive British prime minister can also be a threat to the 27-member states bloc as the European Free Trade Agreement (EFTA) was planning to add the United Kingdom on its members, meaning the UK will have a bigger voice against the EU and all its negotiations for the bilateral trade agreements between the two (2) parties. The EFTA was comprised of Norway, Switzerland, Iceland, and Liechtenstein.

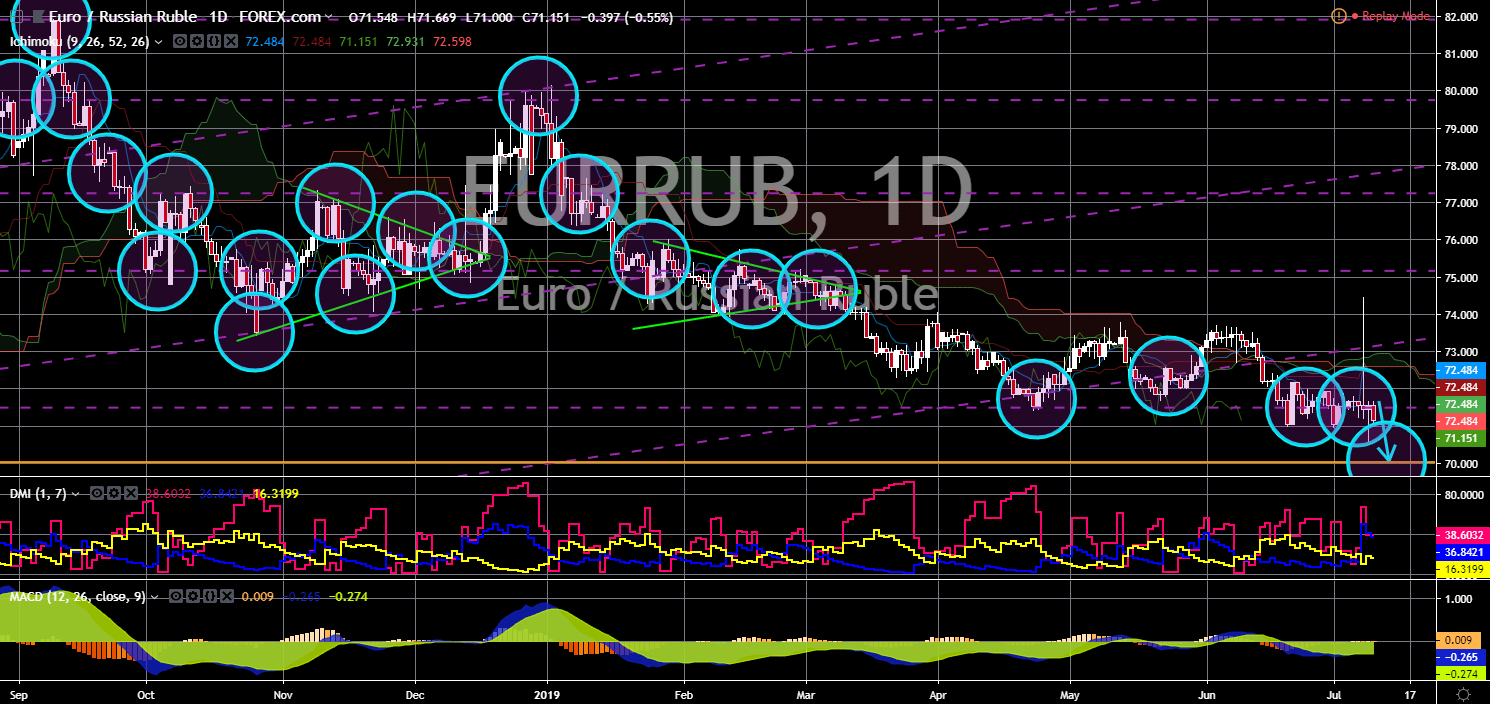

EUR/RUB

The pair was expected to break down from a major support line, sending the pair lower towards its 17-month low. Following the withdrawal of the second largest economy in the bloc and second largest arm manufacturing country in the world from the European Union, the bloc was now seen struggling economically and politically. Aside from this, the United States and Russia withdraw from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces), which prohibits these two (2) nuclear-armed countries from building nuclear weapons that can reach Europe. The withdrawal was seen to start a new era of cold war between the West and the East. The European Union was trying to create a super-state with the Germano-Franco leadership. The proponent of Single Currency, German Chancellor Angela Merkel, envisioned a “United States of Europe”. However, following Merkel’s resignation, that vision might never be materialized.

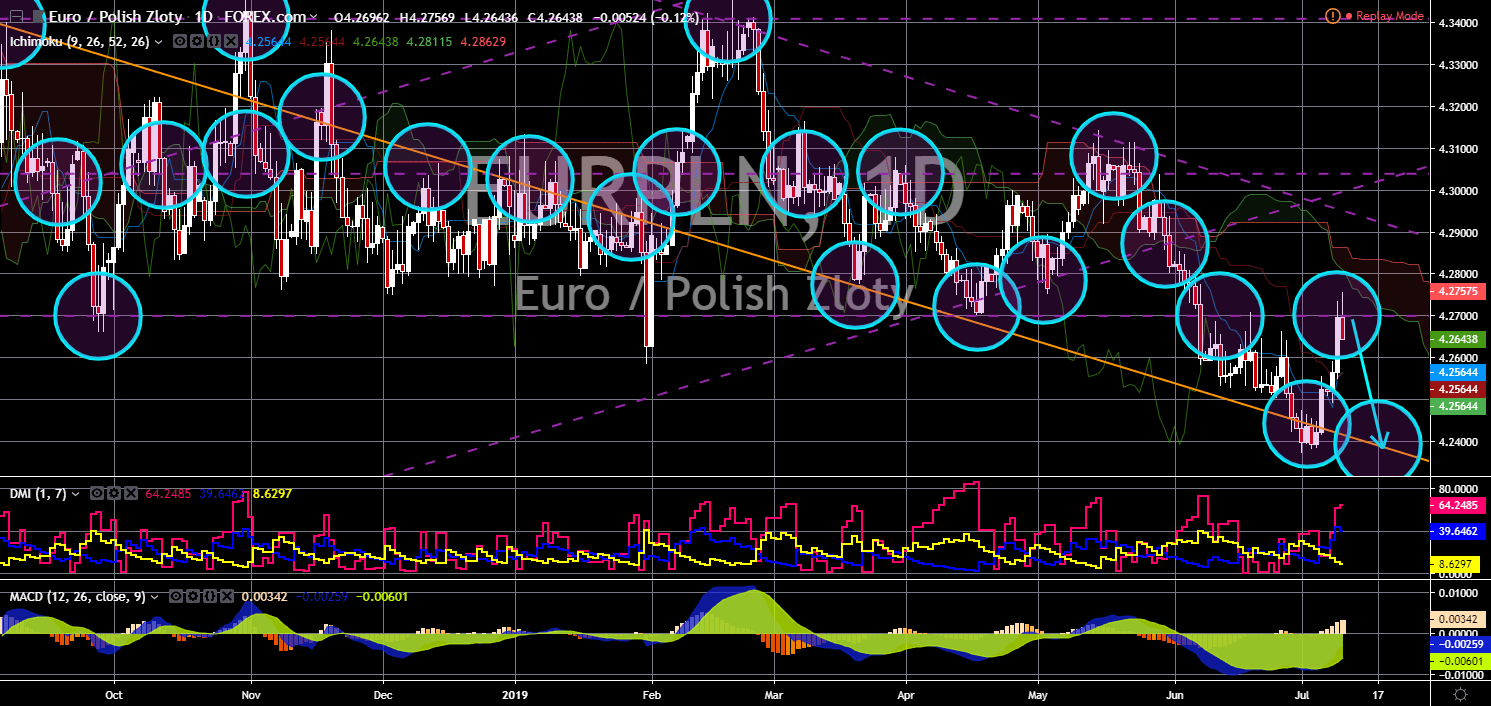

EUR/PLN

The pair failed to break out from a major resistance line, sending the pair lower towards the downtrend channel support line. The division within the European Union is growing as countries are pushing their group towards having a bigger voice inside the bloc. The Easter and Nationalist bloc, the Visegrad Group, was the first group to challenge the Germano-Franco alliance leadership as threats of rising military aggression from Russia threatens the group. Now, the Balkans are pressuring the Germano-Franco alliance to step up the progress of accession talks between the Western Balkans and the European Union. The Balkans are located between Turkey and the Visegrad Group. The integration of the Western Balkan to the European Union will create a powerful group, which together with the Visegrad Group could oust the current leadership of the Germano-Franco Alliance.