Market News and Charts for July 10, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

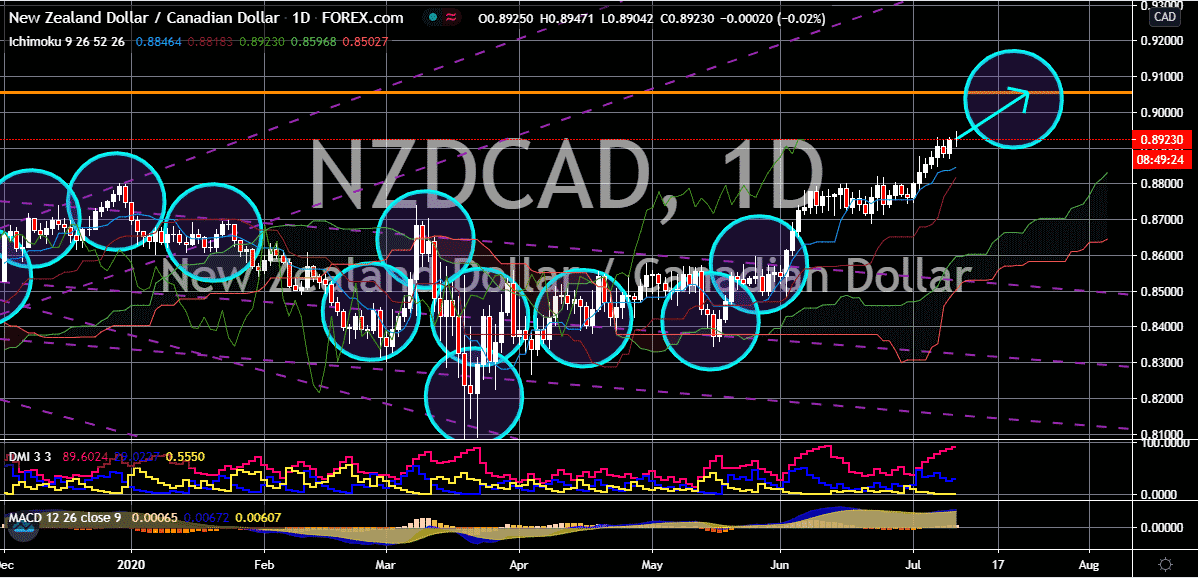

EUR/USD

Prices take a dip this Friday. Although the pair is still expected to continue climbing higher in the coming sessions as the US dollar faces more upcoming hurdles compared to the euro. The exchange rate has seen an aggressive tug of war between bulls and bears in recent trading sessions, however, as of press time, prices appear neutral. The renewed risk aversion has been the main cause of the euro’s weakness today. While this should have initially given a wide opening for the US dollar, the rising number of cases in the US limits the mobility of bearish investors. Moreover, a recent report says Wells Fargo, an American financial services company, sees the eurozone’s economic prospects to be more encouraging. This news has helped the euro prevent the US dollar from running away with gains. Economists from the American firm say that the bloc’s economy is seeing continuous stabilization and improvement in terms of activities and confidence.

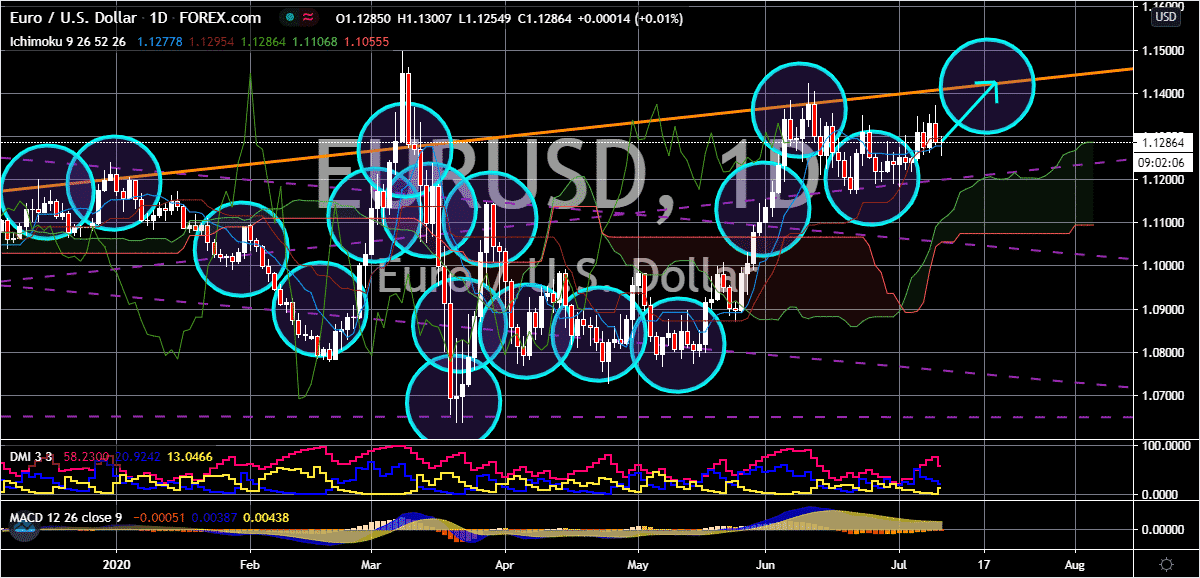

GBP/USD

Brexit related news helps to fuel the British pound against the US dollar. Bullish investors continue to power higher in the trading sessions, going against the current risk aversion mood felt by the global market. The pair is projected to rally towards its resistance this July, reaching its monthly highs in sessions. The demand for safety currencies or assets may have increased this Friday, but unfortunately for the greenback, it’s not enough to save it against the sterling’s strength. Investors are closely eyeing the news related to the Brexit. And just recently, it was reported that British Prime Minister Boris Johnson crashed the Brexit dinner to warn European Union official Michel Barnier that the divorce deal must be done this summer. According to local reports, the BPM interrupted the talks between United Kingdom’s negotiator David Frost and his EU counterpart earlier this week. However, EU officials said that negotiations are not easy.

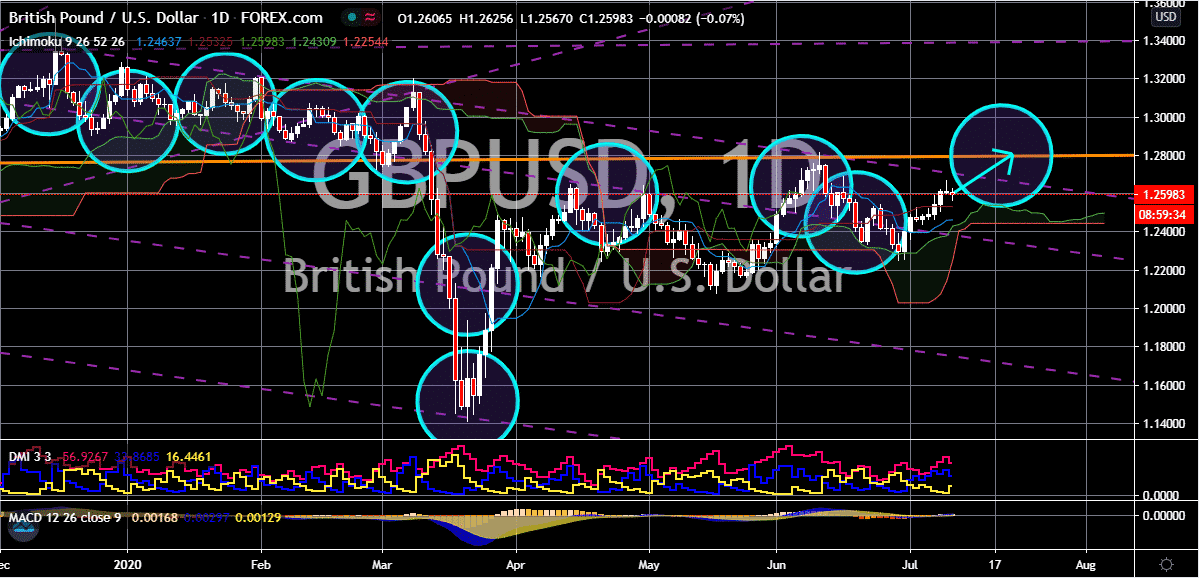

USD/JPY

The US dollar to Japanese yen exchange rate head downwards as bears become more and more powerful. In the matchup between the two safe-haven currencies, it’s evident that the Japanese yen has more steam this time. Today, it was reported that the risk aversion sentiment in the market is once again rising, placing the spotlight on safety currencies like the two. However, the main cause of the risk aversion is coming from the increasingly alarming new coronavirus cases in the United States. Just yesterday, it was reported that the United States has surpassed the 3 million mark, recording the biggest daily jump since the pandemic reached the country. The total number of COVID-19 cases includes the nearly 1 million people that have already succumbed to the deadly and unforgiving virus. In fact, the death rate is far greater than any other country in the world and more states in the country are struggling to contain the rapidly spreading virus.

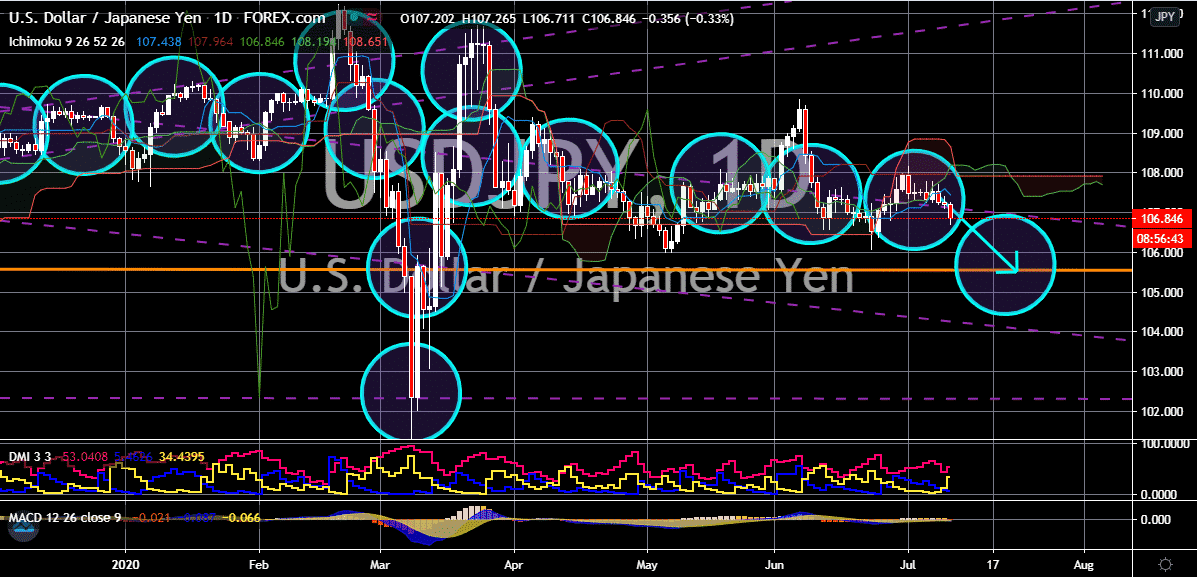

NZD/CAD

The New Zealand dollar to Canadian dollar exchange rate is seen trading neutrally this Friday as both currencies face headwinds. See, the global market is facing a severe loss of appetite for anti-risk assets such as the Canadian dollar and the Australian dollar. As of writing, bulls are seen holding levels last seen in April 2019. The main fundamental that should support the Canadian dollar is the jobs report from the country. However, some economists believe that the report will fail to support the loonie as the momentum for new job openings has significantly softened. This will allow bullish investors to continue dominating the New Zealand dollar to Canadian dollar trading pair. As for the New Zealand dollar, the main factor that’s slowing it down this Friday is the risk aversion that is topped off by the stalled performance of the equity market. The antipodean currency’s momentum against others may shift, but it remains solid against the loonie.