Market News and Charts for July 09, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

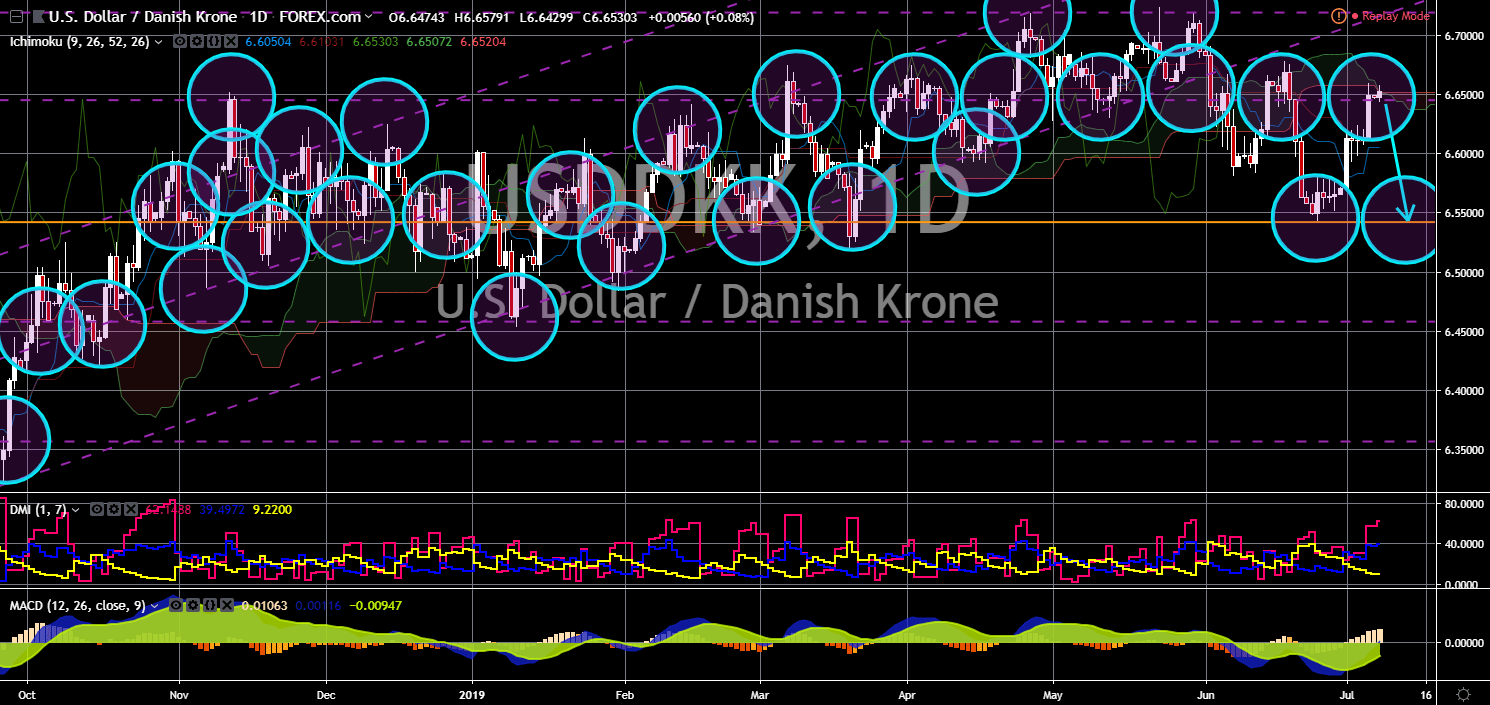

USD/DKK

The pair was expected to reverse back after hitting a major resistance line, sending the pair lower towards a major support line. The United States is facing enemies on the east (Russia) and on the west (China). Following the trade war between the two (2) largest economies in the world, the U.S. and China, the former was now seen to be taking head to Russia, with the two (2) nuclear-armed countries withdrawing from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces). Now, the United States was seen increasing its influence in Europe, particularly in the Scandinavian region, to counter China’s aggression. Denmark was U.S.’ closest ally inside the European Union. However, this could change following the election of Denmark’s new Prime Minster Mette Frederiksen, which had recently met with German Chancellor Angela Merkel, one of the de facto leaders of the European Union.

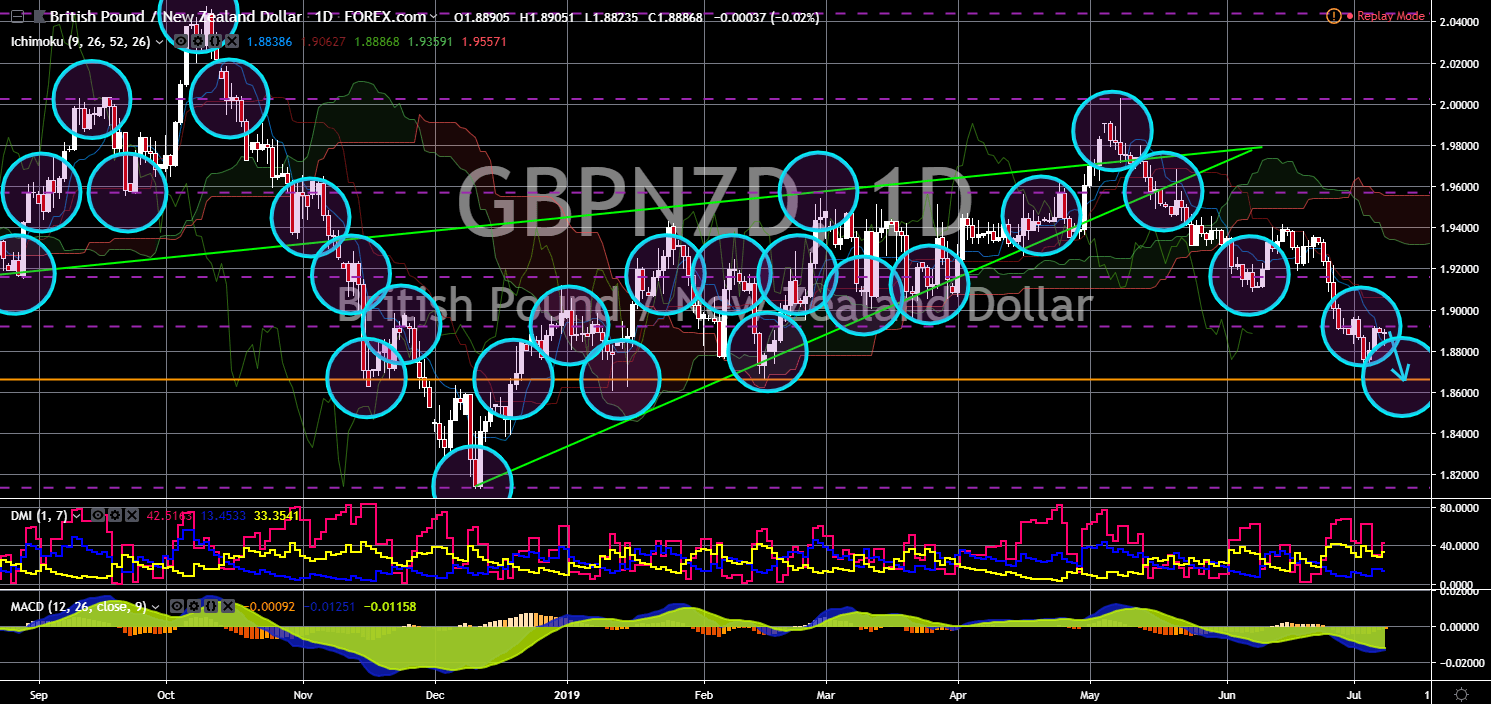

GBP/NZD

GBP/NZD

The pair failed to recover after it was sold down heavily in the past few days followed by a quick reversal. Following the withdrawal of the United Kingdom from the European Union, the integration of the former British Commonwealth, known as the CANZUK (Canada-Australia-New Zealand-United Kingdom), was seen to be the best option for the UK to prevent its economy from totally collapsing, specifically in the event of a “No-Deal Brexit”. However, with the changing political landscape, the former colonies were forced to side where it will benefit the most. New Zealand signed a post-Brexit trade agreement with the United Kingdom, while maintaining its existing trade relationship with the European Union. Australia did the same thing, however, it received retaliation from the EU. Canada received a green light to conduct a bilateral trade agreement with the bloc but is waiting for the unofficial tariff rates from the UK.

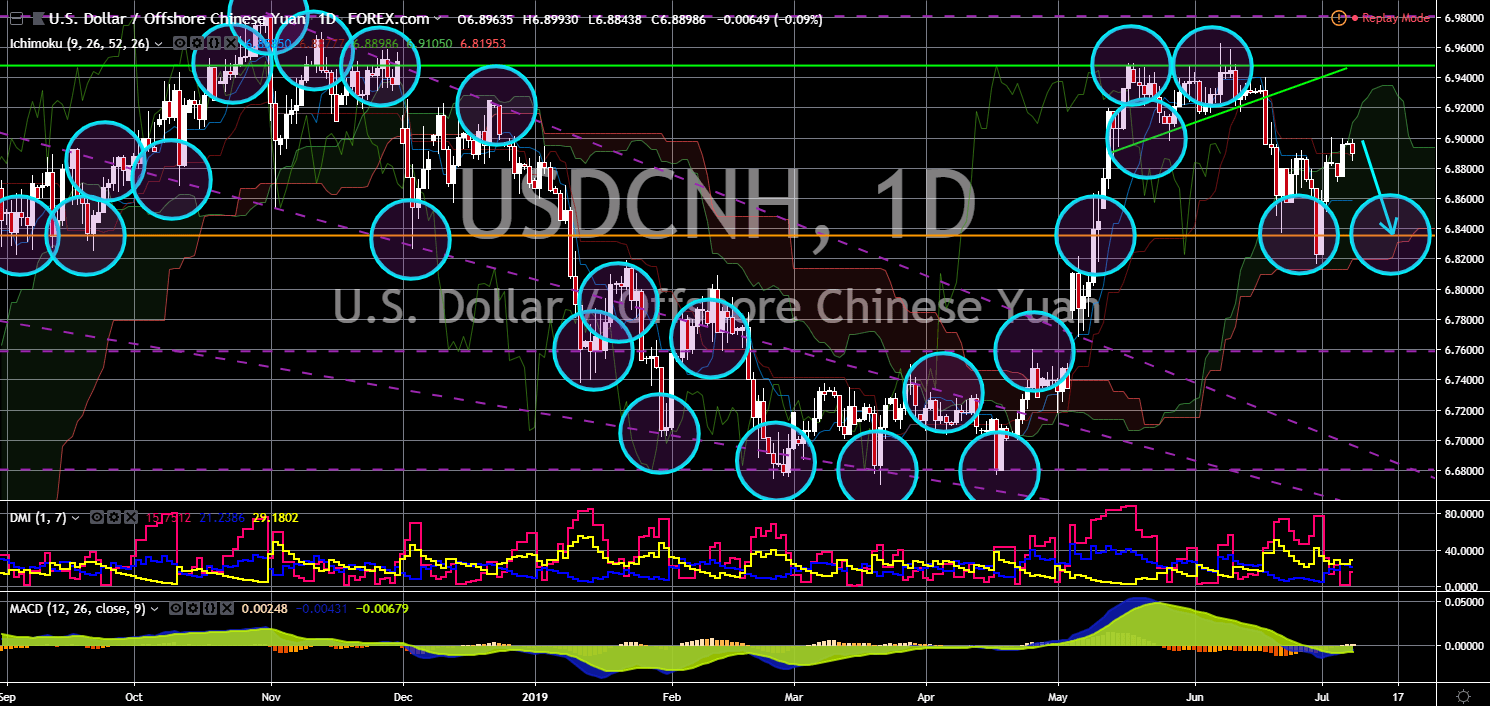

USD/CNH

The pair was expected to reverse back as in enters a downtrend movement, following the recent rally and consolidation on the pair. After U.S. President Donald Trump and Chinese President Xi Jinping agreed to a trade truce during their meeting in the G20 Leaders Summit in Japan, the two (2) economic and military superpower was facing another obstacle in Taiwan. Taiwan, officially the Republic of China (ROC), was considered as a wayward province by China. The Chinese civil war has separated people who wants democracy and communism, with The People’s Republic of China (PRC) holding the mainland China, while the Republic of China (ROC) was forced to flee in the nearby island. Now, China has demanded that the United States “immediately cancel” a potential $2.2 billion arms sale to Taiwan, including battle tanks and anti-aircraft missiles. The United States is bound by law to support democratic countries.

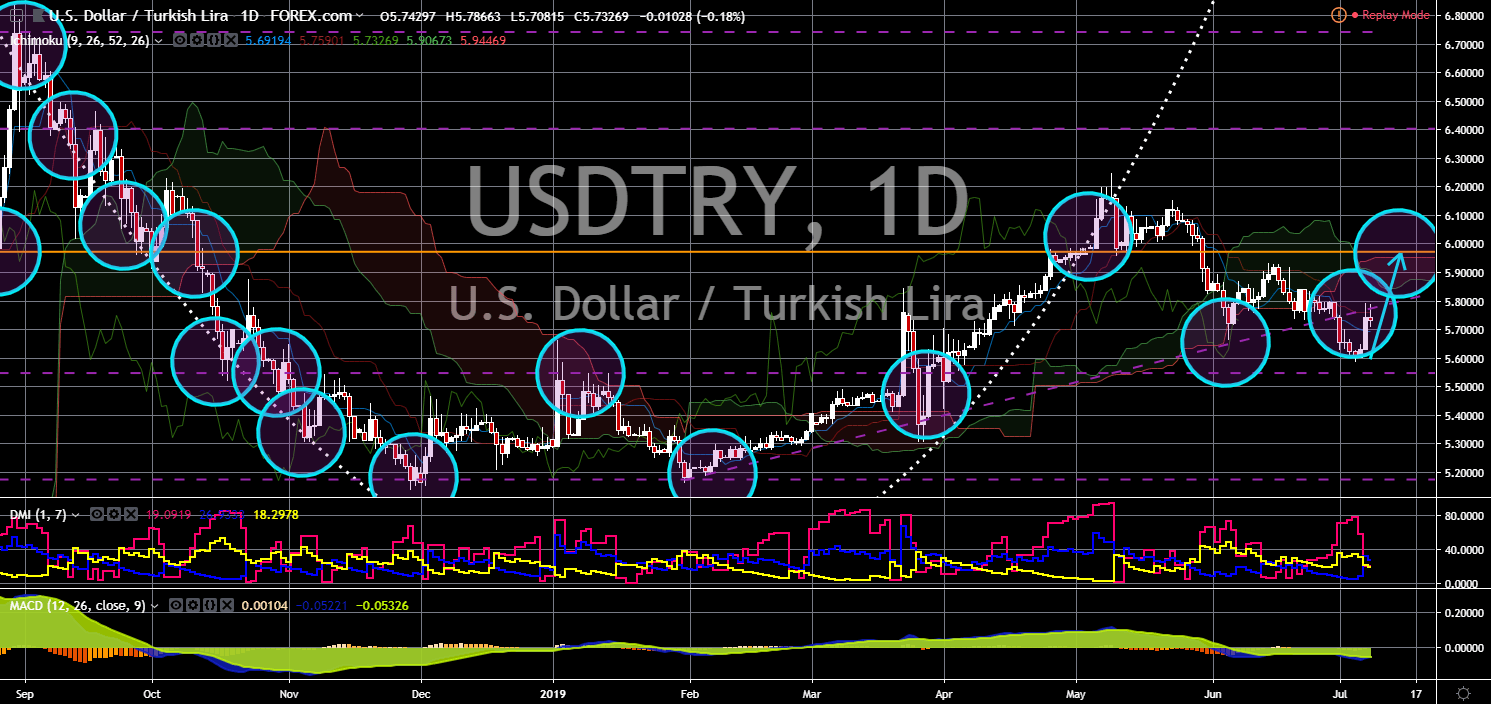

USD/TRY

The pair was expected to breakout from an uptrend resistance line after it broke down and found a strong support line, which sends the pair higher. A messy multibillion-dollar deal between Turkey and the United States took another turn over as Russia announced it was in the process of delivering a much-anticipated missile system to Turkey. Turkey is a member of the NATO (North Atlantic Treaty Organization) alliance and its defense sharing agreement. Turkey’s purchase of Russia’s S-400 missile defense system will compromise the NATO defense. The U.S. F-35 fighter jet is the most advanced weapon that the U.S. had against its enemies and Russia obtaining any information about F-35 will put them ahead of the U.S. Despite this, a growing number of people are turning away from Turkish President Recep Tayyip Erdogan as seen on the recent election and before the commemoration of the failed Turkish coup.

-

Support

-

Platform

-

Spread

-

Trading Instrument