Market News and Charts for July 02, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

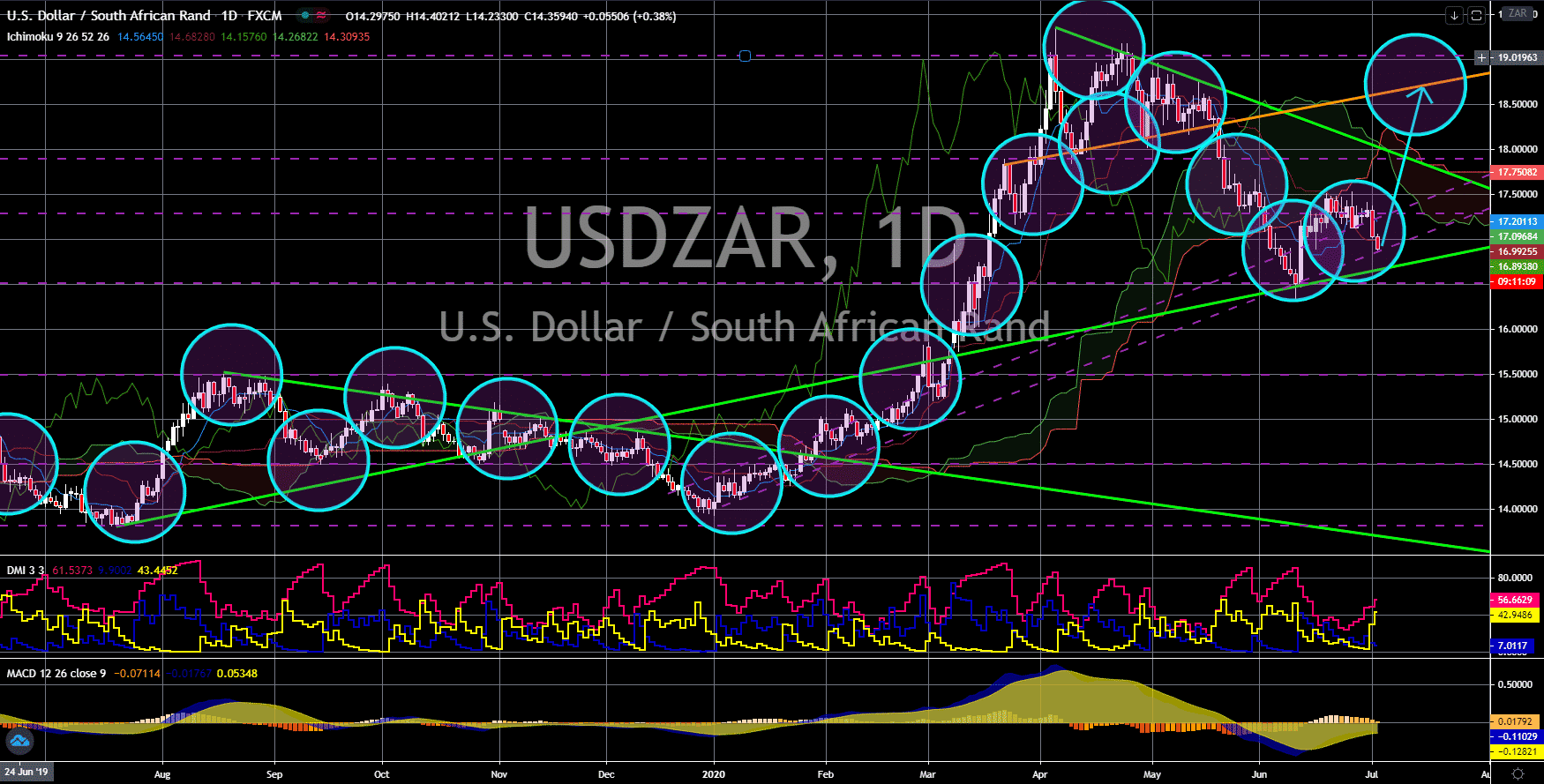

USD/PLN

The pair will continue to move higher in the following days towards a major resistance line. Employment in the United States is now picking up. Initial jobless claims report is expected to rise by 1,355K for last week compared to a rise of 1,480K in the week prior. Moreover, the unemployment rate will drop down to 12.3% for June from 13.3% in May. Meanwhile, the country’s Non-Farm Payrolls (NFP) report will be released today and analysts are expecting a positive result of 300K jobs creation. The United States was earlier expected to experience a grimmer outlook with the rising number of COVID-19 cases. On the other hand, the EU was supposed to be recovering from the virus. However, this might not be the case for Poland. The country will experience recession for the whole year. Expectations for Q2, Q3, and Q4 were -5.6%, -5.0%, and -3.3%, respectively. The ongoing election might further send these figures down.

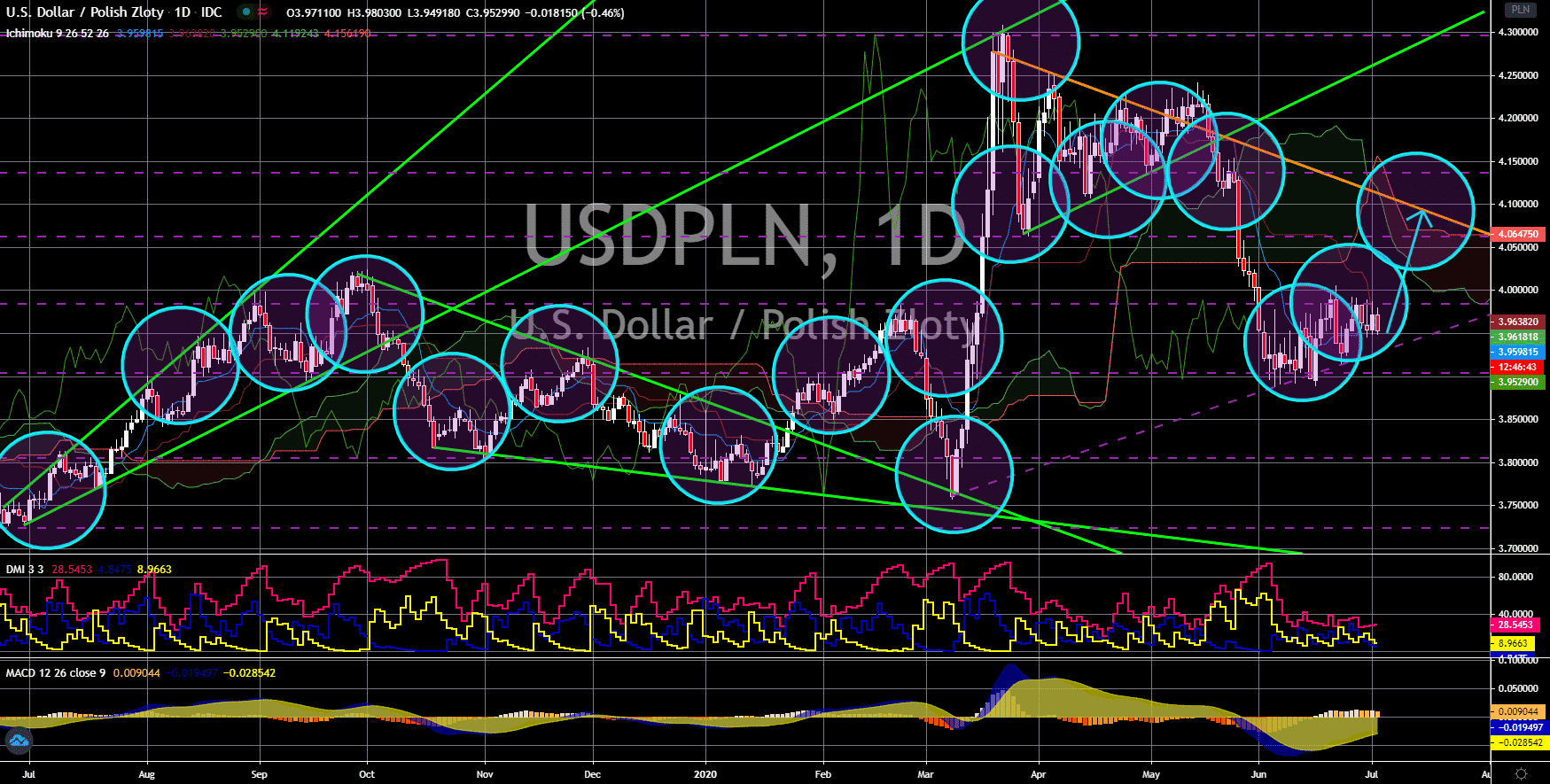

USD/ILS

The pair will bounce back from a major support line, sending the pair higher towards its previous high. Israel is facing a challenge with the increasing number of unemployed individuals due to the lockdown. Prior to the lockdown, Israel’s unemployment rate was 3.4%. Now, it has risen to 21% and is expected to further increase as the global second wave of the coronavirus has just started. Aside from this, the report shows that employees below 34 years old were the most affected by the layoffs. 61% of those were women below 24 years old. As rising claimants for unemployment benefits rose, Israel’s finance minister considered cutting the public sector’s budget. This, in turn, will further drag the Israeli economy. Aside from this, the term sharing agreement between Prime Minister Benjamin Netanyahu and Benny Gantz could derail the US-Israeli relationship. The US has provided Israel a lot of support economically and politically under Netanyahu’s leadership.

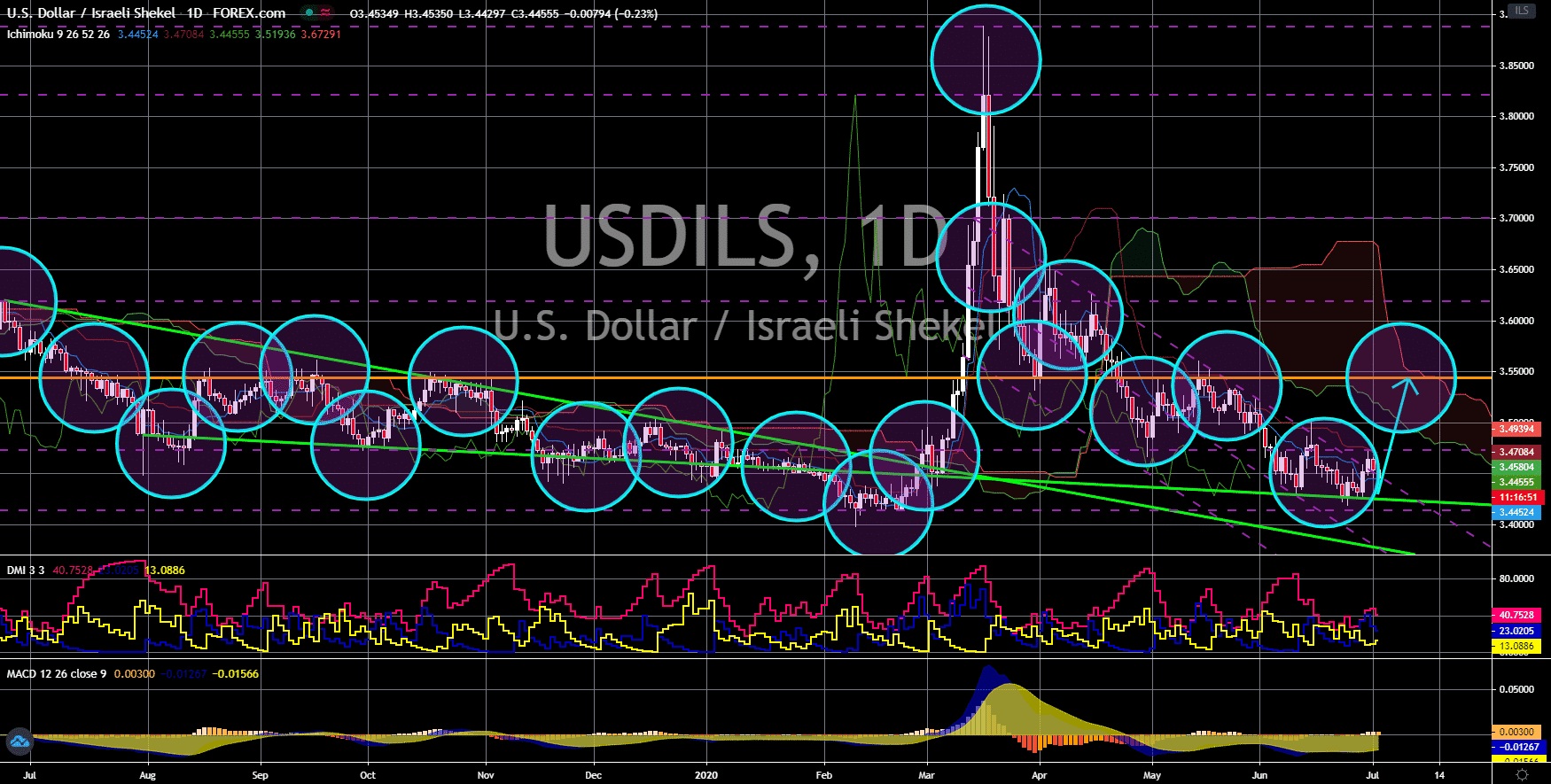

USD/SEK

The pair will bounce back from an uptrend support line, sending the pair higher towards its previous high. Sweden’s central bank is ramping up its quantitative easing (QE) policies to support the economy. Sweden became controversial at the start of the pandemic for its refusal to lock down. Instead, it relies on herd immunity to beat the coronavirus. Despite refusing to lock down, however, the country’s economy still experienced a slowdown. Now, the country will need to face the economic effect of COVID-19 while still refusing to close businesses. Meanwhile, despite the unwillingness of US President Donald Trump to lock down, state governors still impose a lockdown to their respective states. America’s economy briefly experienced a slowdown, but it is now back on track with some states already allowing several companies to resume their operations. Investors were optimistic that the largest economy in the world will thrive against the pandemic.

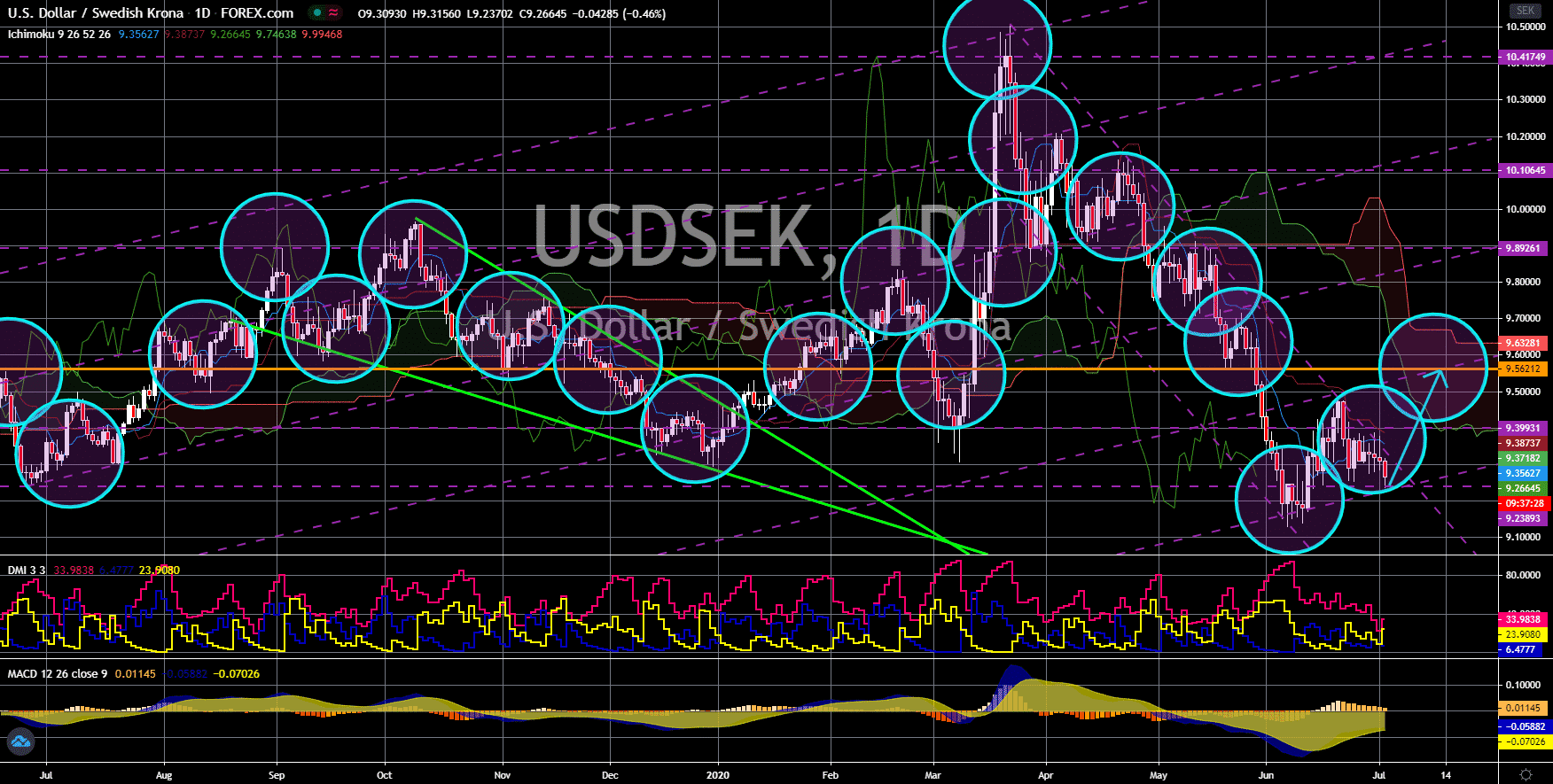

USD/ZAR

The pair will continue to move higher in the following days and bounce back from a major support line. The coronavirus pandemic broke economies around the world. However, South Africa seems to be getting the biggest share in the global GDP decline. South Africa is expected to shrink by 32.6% in the second quarter of 2020. This, by far, is the largest quarterly decline around the world due to COVID-19. This decline was attributed to the 5-week lockdown where SA citizens were not allowed to go out to buy even food and other necessities. Meanwhile, annual contraction is projected to reach 7.0%, the biggest decline in the country’s history. During The Great Depression in the 1930s, South Africa’s annual economic decline only reached 6.2%. Investors are worried on how Africa’s largest economy might recover from this decline. The increasing tension between the United States and China could further drag the country’s growth in the coming months.