Market News and Charts for July 01, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

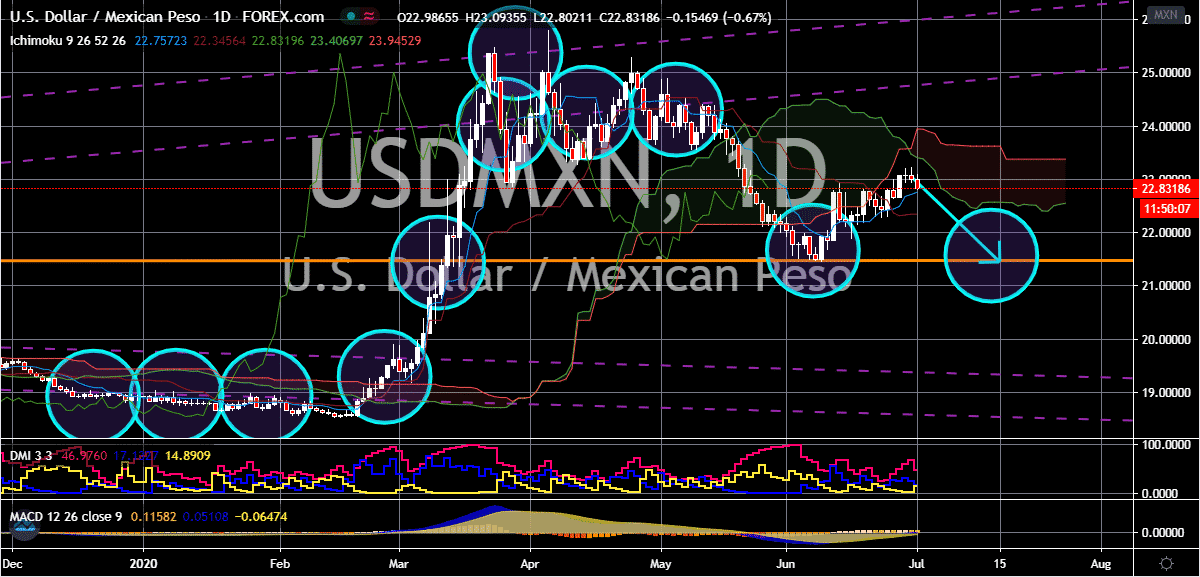

USD/MXN

The Mexican peso finally regains its footing against the US dollar. The pair is widely predicted to take a downward trajectory as Mexico exerts more effort to stop the spread of the coronavirus pandemic. Well, compared to the United States, which currently has the greatest number of COVID-19 cases in the globe, Mexico’s readings for the coronavirus is significantly lower. This could help bearish investors to trade through despite the safe-haven appeal of the US dollar. The Latin powerhouse recently implemented a new “traffic light” system to help the struggling economy by easing the lockdown restrictions in the region. During the daily briefing, the Mexican Health Minister said the system will help show the transmissions levels from each state in Mexico and the current availability of hospital beds. The four colors in the system represents which has the lowest to the highest capacity and transmission levels as of a traffic light.

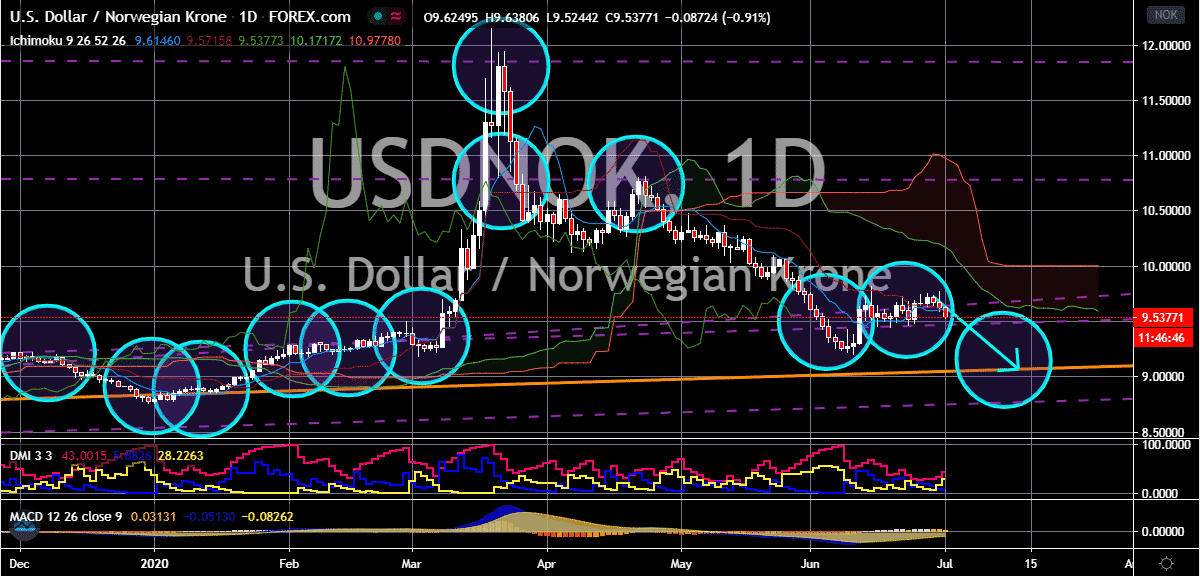

USD/NOK

The Norwegian krone is strengthening and pulling the US dollar near to the pair’s support. Bearish investors are hoping to reach the support level by the first half of the month, reaching levels last seen in early January. Looking at it, the main factor that continues to drive the Norwegian krone is the rather stable run of oil prices. In fact, the prices of oil are steadily trading near the $40-mark, a big improvement from its levels back in April, especially during the unprecedented crude crash. So ever since oil prices started stabilizing, the Norwegian krone, along with other commodity-linked currencies, have strengthened significantly against the US dollar. See, Norway is one of the largest producers and exporters of crude in the globe, and the direction of the krone is highly affected by the conditions in the commodity market. Every day, the country produces more than a whopping 2 million barrels and exports most of that volume.

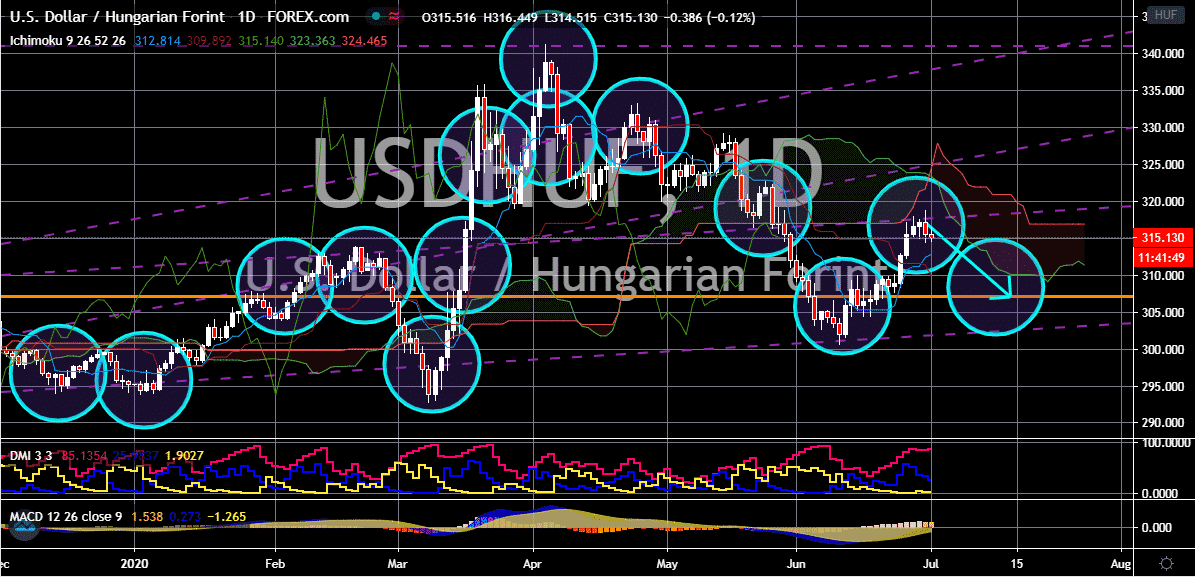

USD/HUF

Last week, the National Bank of Hungary unleashed an unexpected rate cut which caught investors by surprise. The said rate cut opened the door for bullish investors to regain their footing and force the pair’s prices to climb once again. However, the US dollar is immediately showing signs of exhaustion and had immediately lost steam in yesterday’s sessions. It appears that bulls and bears are struggling to decide a direction as of writing because the pair is rather neutral. But in the end, the tides are widely expected to turn into the favor of bearish investors. But it’s also doubted whether the pair would go down past its support because of the aforementioned rate cut that would definitely affect the strength of the Hungarian forint. The main factor that should help the forint is the slowdown in the economic contractions in the region. Most emerging European currencies are seen trading firmly this Wednesday in the foreign exchange sessions.

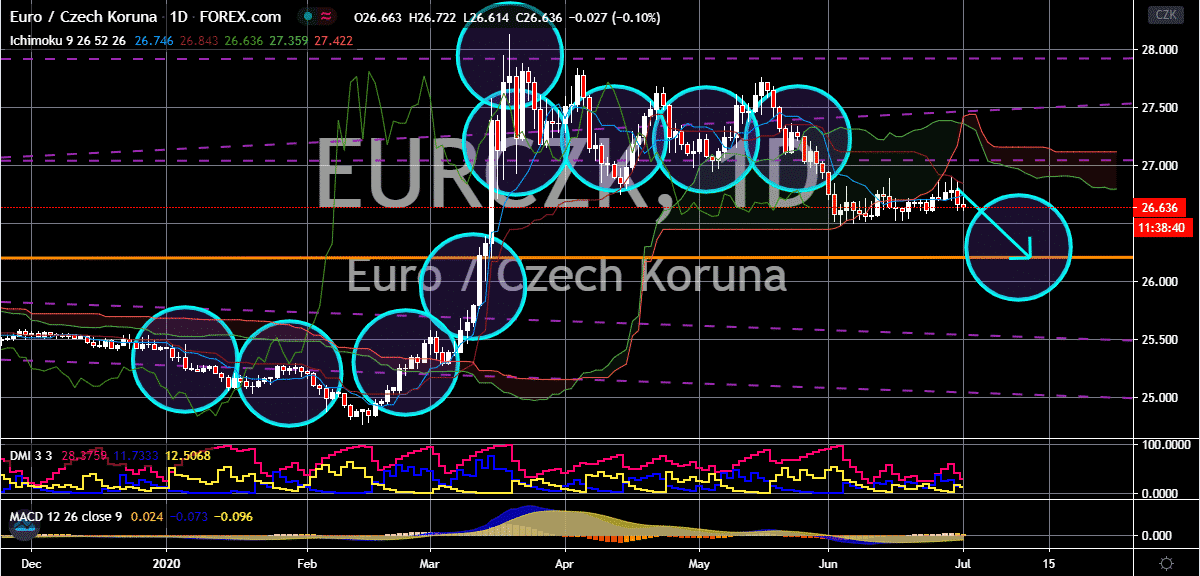

EUR/CZK

The euro is seen riding the positivity and confidence of European traders about the economic recovery of the bloc. Meanwhile, other European currencies such as the Czech koruna are also strengthening which suggests that bulls and bears will have a tough task in pushing the tides in their favor. But ultimately, the direction is predicted to go down as the koruna will benefit greatly from the end of its coronavirus lockdown in the country. On the other hand, the euro is hoping to extend its best rally in more than two years as the confidence in the region gets better. The euro is seen holding tight on its gains from earlier this year. Bulls are praying that the coronavirus vaccines that are being developed by a number of biopharmaceutical companies will show interesting results which would in turn fortify their run in the sessions. But that still has a long way to go, so as of now, the Czech koruna will work hard to continue recovering.