Market News and Charts for January 31, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

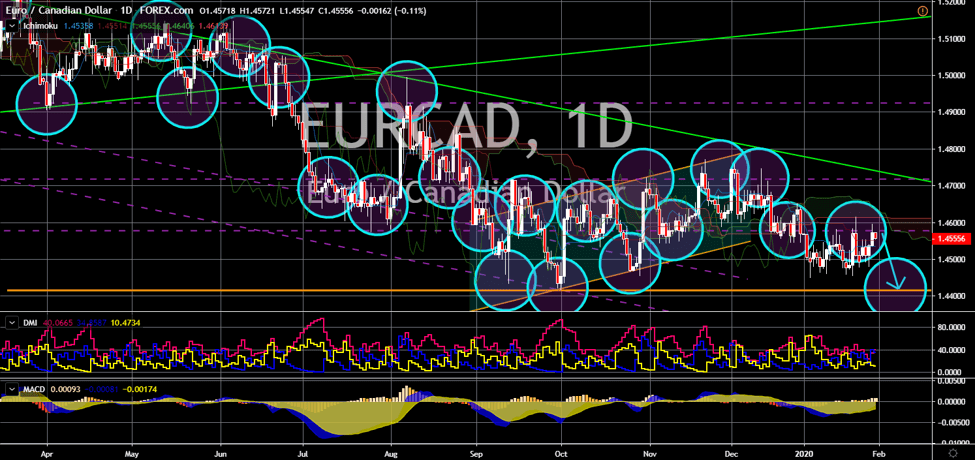

NZD/CAD

The pair will continue its upward movement and retest a key resistance line. New Zealand will reap the benefits of the Brexit as the UK is set to leave the bloc today, January 31. On a discussion between the two (2) countries’ trade ministers, Britain assured Wellington that it will be its priority in a post-Brexit trade agreement. This was after New Zealand became the first country to open UK embassy after the 2016 Brexit Referendum. New Zealand, on the other hand, is pioneering a new way to measure growth – personal happiness. NZ Prime Minister Jacinda Ardern proposed a well-being budget known as the “happiness deal”, the first in the world. She also negotiated a digital economy trading pact with Singapore and Chile. The country also strengthened its relationship with other Asian nations like China. Meanwhile, Canada saw a narrowing relationship with China after it detained Chinese telecom giant Huawei’s heiress.

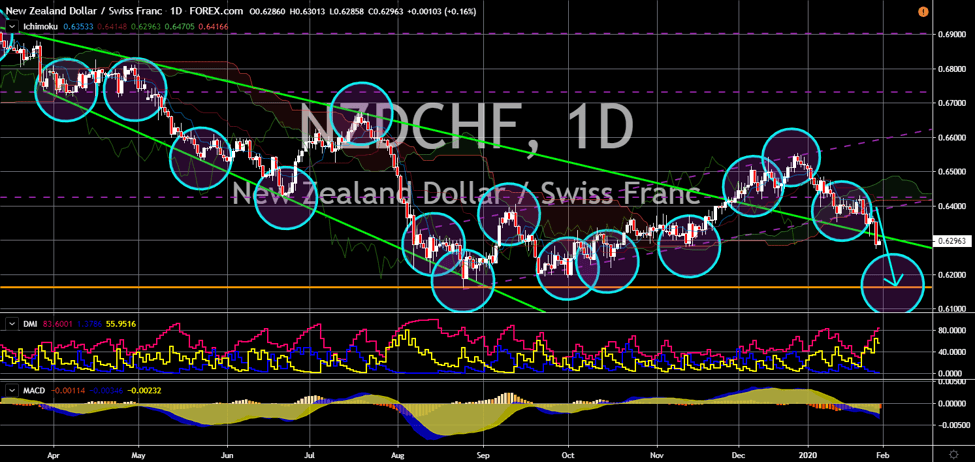

EUR/CAD

EUR/CAD

The pair will fail to breakout from a key resistance line, sending the pair lower toward its previous low. The single currency is under pressure amid the withdrawal of the United Kingdom from the European Union today, January 31. Germany released positive results for its Unemployment Change and Unemployment Rate report today. The change in the number of unemployed people dropped by 2,000 while the rate remains at 5.0%. The Brexit, however, will put a vacuum hole in the German employment record. Furthermore, business climate and consumer confidence in the European Union still sits at negative. Analysts didn’t see any improvement with these reports anytime sooner. In other news, Canadians are revolting against the European Union. The country accused the EU of not respecting the terms agreed on the $65.50 billion trade deal agreement. In line with this, the two (2) parties have not yet ratified CETA (Canada-EU Trade Agreement).

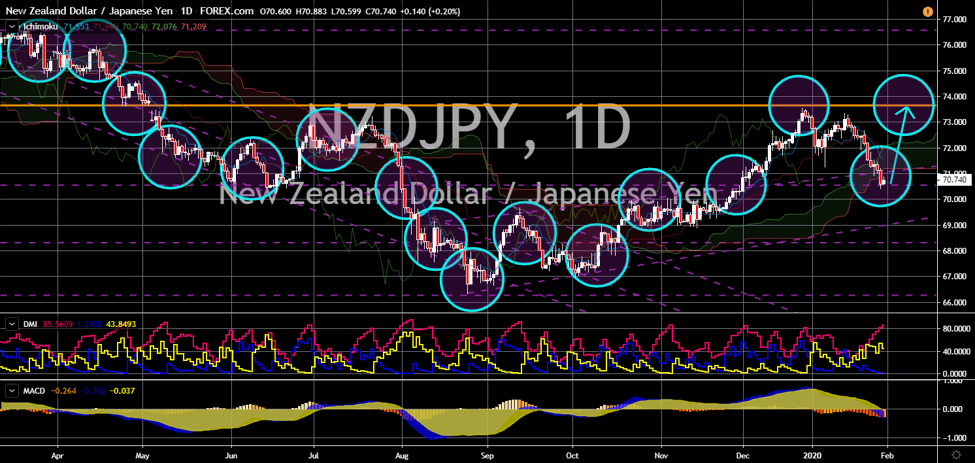

NZD/CHF

The pair will continue to move lower in the following days after it goes back to the “Widening Wedge” pattern resistance line. The withdrawal of the United Kingdom from the European Union will increase volatility in the financial market in the short-term. This will increase the appeal for safe-haven currencies like the Swiss Franc. Today’s deadline date was the result of two (2) delayed withdrawal dates arising from the disagreement on the Brexit deal. The New Zealand dollar is also set to benefit from the Brexit but in long-term. The likelihood of the UK creating a free trade agreement (FTA) with Britain is also a major factor for investors to invest in the franc in the long-term. As for which country will benefit first from the Brexit, it will be New Zealand. Wellington was the first to reconnect with the United Kingdom after it reopened its UK embassy. Trade ministers from the two (2) countries also agreed to prioritize NZ in a post-Brexit UK.

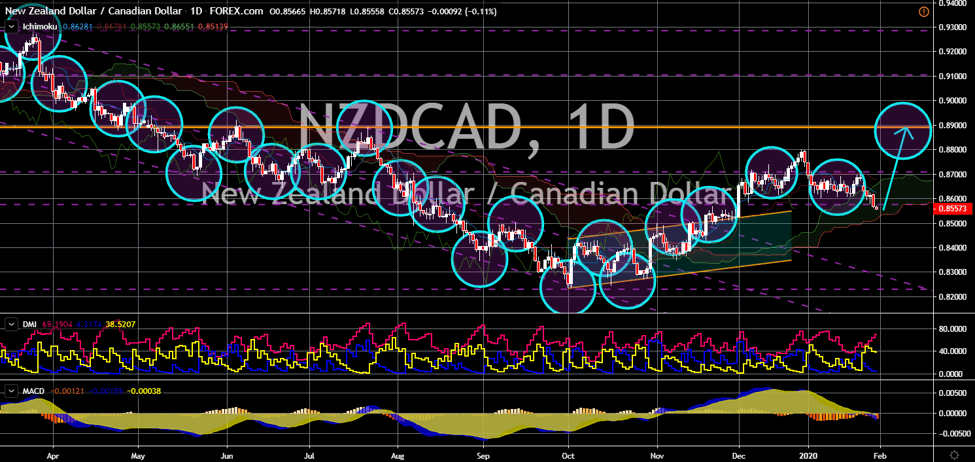

NZD/JPY

The pair will bounce back from a key support line, sending the pair higher to retest its previous high. Japan’s industrial production for the month of January is picking up after it recorded a growth of 1.3%. This was comparatively higher from December result of -1.0% and from the 0.7% forecast. Despite this, the country’s Unemployment Rate, Retail Sales, and Consumer Price Index still showed disappointing figures. The unemployment rate retains 2.2% figure from December. Retail sales, on the other hand, plunges to its third consecutive month of decline at -2.6%. The disappointing sales dragged the Core CPI. In other news, New Zealand Prime Minister Jacinda Ardern calls for an election of September. The election will test whether her popularity abroad is the same support she is receiving at home. PM Ardern rose to fame after she gave birth while in office. She also received praises for her handling of Christchurch attack.