Market News and Charts for January 29, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

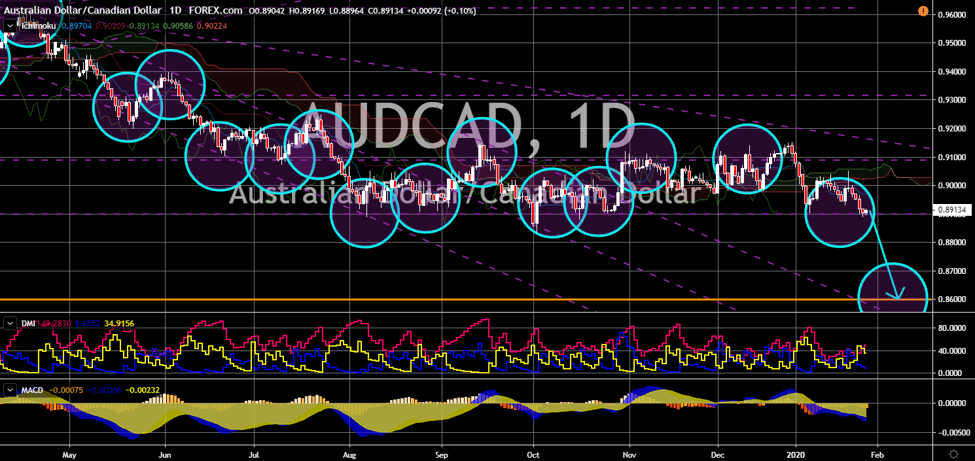

AUD/CAD

The pair will breakdown from a major support line, sending the pair lower toward its 10-year low. Australia’s already weak economy will continue to decline amid the ongoing wildfires and coronavirus scare in the country. The country is under fire since September and has so far burned eight million hectares of land. The 5-month long wildfires left 25 people dead and thousands homeless. This put the tourism industry under threat. In 2018, tourism accounts for 3% of the country’s gross domestic product (GDP) and figures are rising. From 2017 to 2018, tourism rise by 7%. Another threat to the country’s tourism industry was new virus from China. On the other hand, Canada has been resilient despite global economic uncertainties. Analysts have forecasted Canada to reclaim the eight spot on the largest economies in the world. The Bank of Canada haven’t made any rate cuts despite emerging economies racing to the bottom.

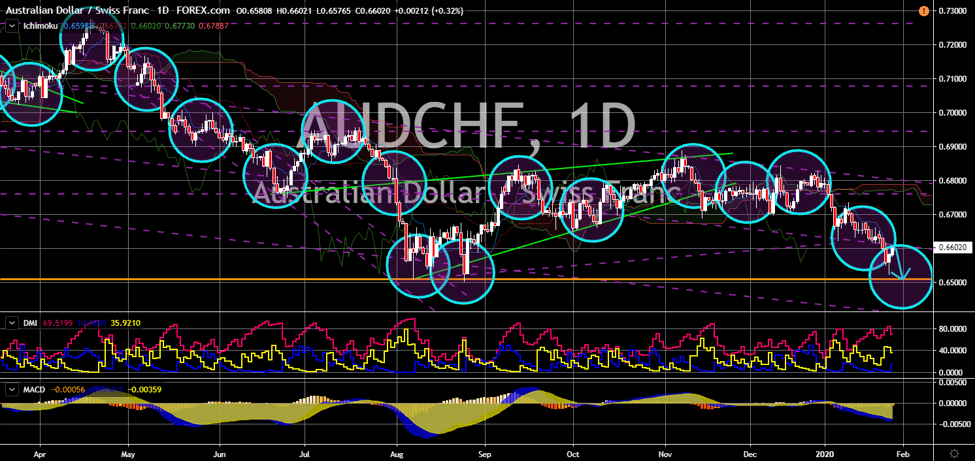

AUD/CHF

AUD/CHF

The pair will fail to breakout from a key resistance line and reverse back to retest its previous low. The economic expectations for the Swiss economy in the next six (6) months will enter a new high. This was amid the global scare on the newly found virus in Wuhan, China. Experts in the field of science and medicine warned that Coronavirus is more dangerous compared to SARS in 2003. The fear translates to opportunities for safe-haven economies like Switzerland to outperform the broader market. This, in turn, will be beneficial to the Swiss Franc. In the last month of 2019, the Swiss Economic Expectation Index had its first positive result since the second half of 2018. This was due to the global economic uncertainty brought by the US-China trade war. The Australian dollar, on the other hand, will take collateral damage. Australia is heavily exposed to the Chinese economy and has been facing decline in its tourism industry amid wildfires in the country.

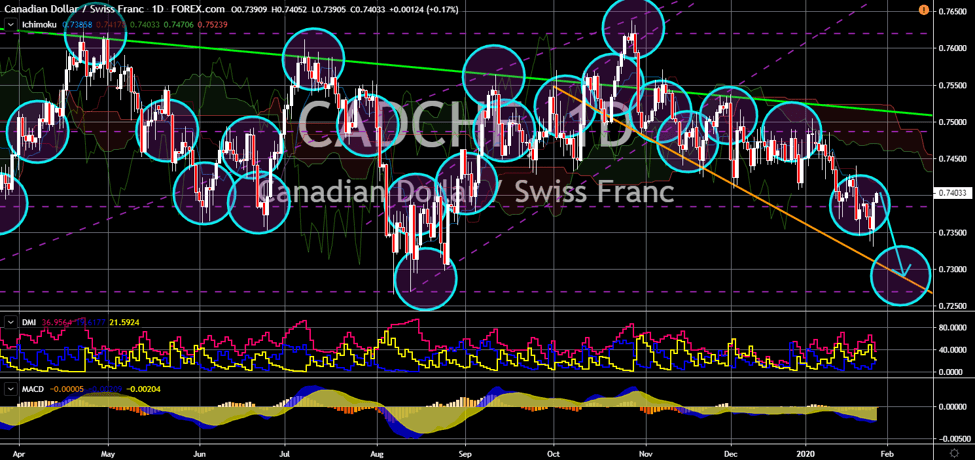

CAD/CHF

The pair will breakout from a major support line, sending the pair lower towards another major support line. The appeal of the Swiss Franc as a safe-haven currency is outshining the resilient Canadian economy. Bank of Canada was one (1) of the few countries that didn’t bend to pressure to cut its benchmark interest rate. Canada’s 1.75% interest rate haven’t changed since 2015 and will continue to do so in the coming months. However, the country’s economy is under pressure from the Brexit and from the ratification of NAFTA. The NAFTA (North American Free Trade Agreement) is the largest multilateral trade agreement in the world. Following US President Donald Trump’s election in 2016, he proposed the ratification of the trading pact. However, economies are worried that the ratified deal is only pro-US. The Brexit, on the other hand, will pressure Canada to choose between the EU and its former colonial master, the United Kingdom.

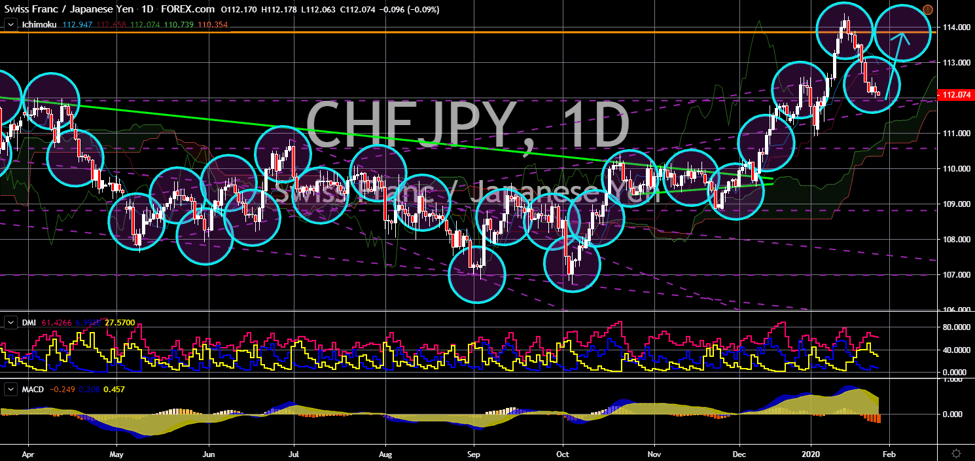

CHF/JPY

The pair will bounce back from a major support line, sending the pair higher to retest its previous high. Japan’ Foreign Bonds Buying report spike to record last seen on September 2018. The report suggests that short-term economic performance of Japan is not looking good. This was amid worries by analysts that Japan has no more tools to counter new economic uncertainty. In December, the Japanese government introduced $121 billion economic stimulus to stir economic activity. Japan will need to further cut its already negative interest rate if it wishes to make more room for economic expansion. Japan is one (1) of the only three (3) remaining countries with negative interest rates in the world, together with Denmark and Switzerland. In December, Sweden ended its five (5)-year negative rates experiment. The global economic uncertainty, on the other hand, is helping the Swiss franc to outshine major currencies.