Market News and Charts for January 23, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

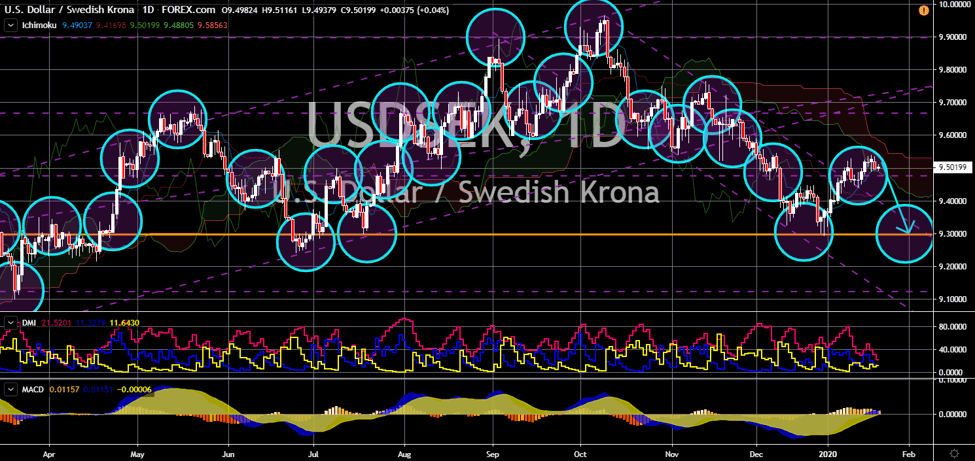

USD/SEK

The pair will reverse back in the following days after being whipsawed, sending the pair lower toward its previous low. Sweden leaves the negative territory of interest rate in the last month of 2019. This has fueled the Swedish Krona against the US dollar. However, the greenback managed to fight the krona following the signing of the US-China trade deal. Despite this, investors are worried about the future of the US dollar as impeachment in the House of Senate begins. Under the Trump Administration, US indices hit record levels and unemployment reached 50-years low. Another concern from investors was the diminishing leadership of America in the global arena. As Europe introduces a greener economy, the US is moving away and pumping oil as much as possible. America even reached records of daily oil production as demand for the black gold continues to surge. A street in Stockholm became the first location in Sweden to ban old diesel cars.

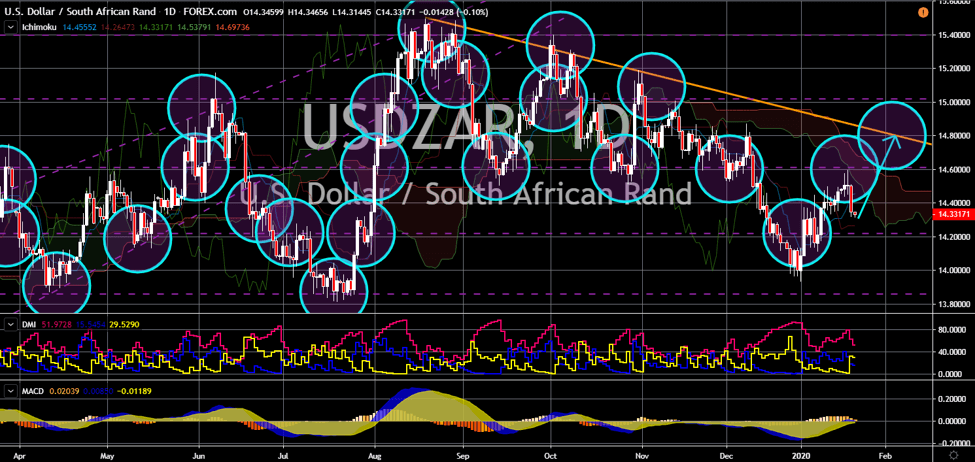

USD/ZAR

USD/ZAR

The pair will continue to move higher and reach an uptrend resistance line. The International Monetary Fund (IMF) is one of the leading global finance groups to cut South Africa’s GDP expectations. The IMF now only sees the largest economy in Africa to grow 0.8%. The reason for a lower outlook was amid the declining business confidence in the country. This was after South Africa experienced a massive power cuts disrupting businesses and government offices. The lower expectation was in contrary to the higher outlook by the IMF in the global economy. The global finance group now expect world GDP to rise 3.3% in 2020. The signing of the US-China phase one trade deal, the passing of the Brexit deal in the British Parliament, and the de-escalating tension between the United States and Iran is helping the industrialized and emerging countries to heal their economies. The US has also been reaching record highs for its indices and individual stocks

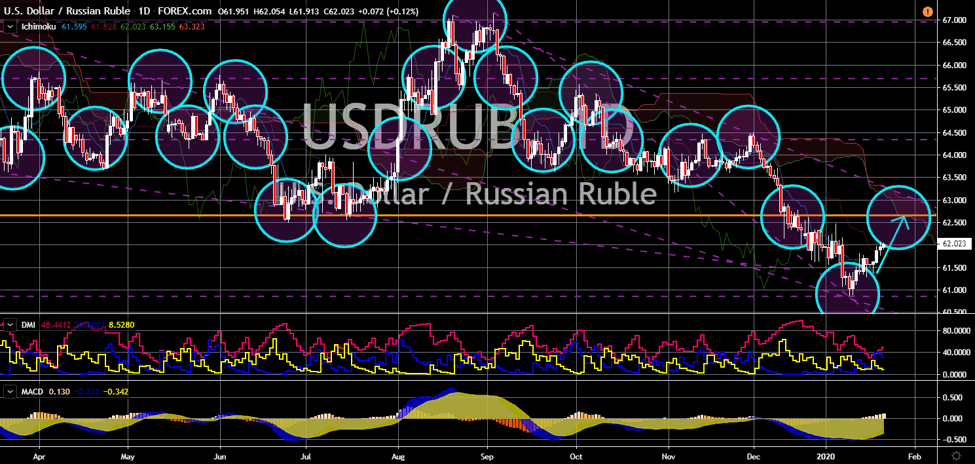

USD/RUB

The pair will continue to move higher in the following days to test a major resistance line. Russia Industrial Production year-over-year (YoY) is expected to continue to disappoint investors. This was after the report posted a 0.3% growth in December from 2.6% in the month prior. On the other hand, the Russian Central Bank Reserve continues to increase. In last week’s report, reserves climbed by $1.5 billion to $557.5 billion. This was compared to the $11.5 billion 20 years ago when Russian President Vladimir Putin first came to power. Just recently, the Russian president made a bold move. He forced the Russian Prime Minister Dmitry Medvedev and his government to resign. Analysts see the move as a response to the diminishing popularity of Putin in Moscow. In the US, Trump is also facing an impeachment procedure. Despite this, the US stock and indices are reaching their record levels and unemployment is hitting 50-years low.

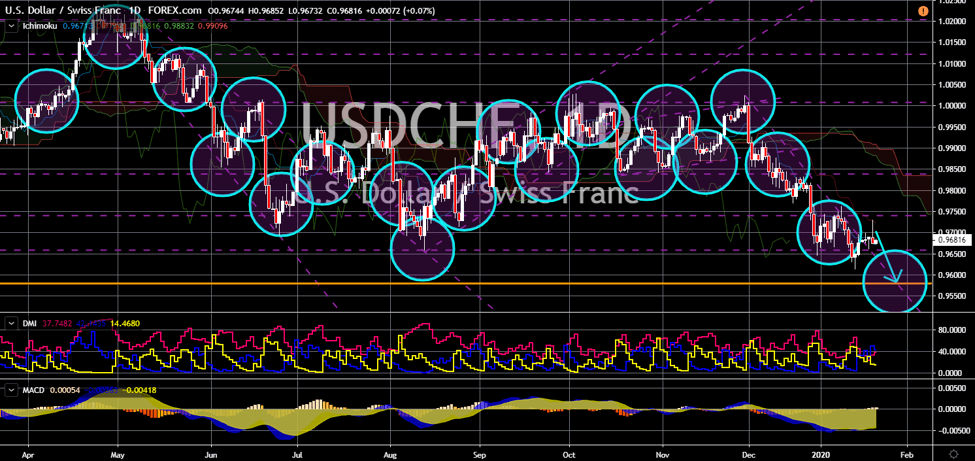

USD/CHF

The pair will continue to move lower in the following days toward its 16-month low. Together, the US and Switzerland are in the spotlight once again. The World Economic Forum (WEF) is currently being held in Davos Switzerland. The summit is attended by world leaders around the globe, including the most influential people that have a connection with the global economy. During US President Donald Trump’s speech, he highlighted his accomplishments in the US economy, shrugging off the ongoing impeachment hearing against him in the US senate. Trump argued that the US growth domestic product (GDP) growth should be at 4% and the Dow Jones Industrial Average (DJIA) must have been 10,000 points higher if it weren’t for the Federal Reserves. However, many analysts debunked this claim. In other news, as climate change became a hot topic in 2019, Trump and Thunberg clashes on climate change at Davos once again.