Market News and Charts for January 13, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

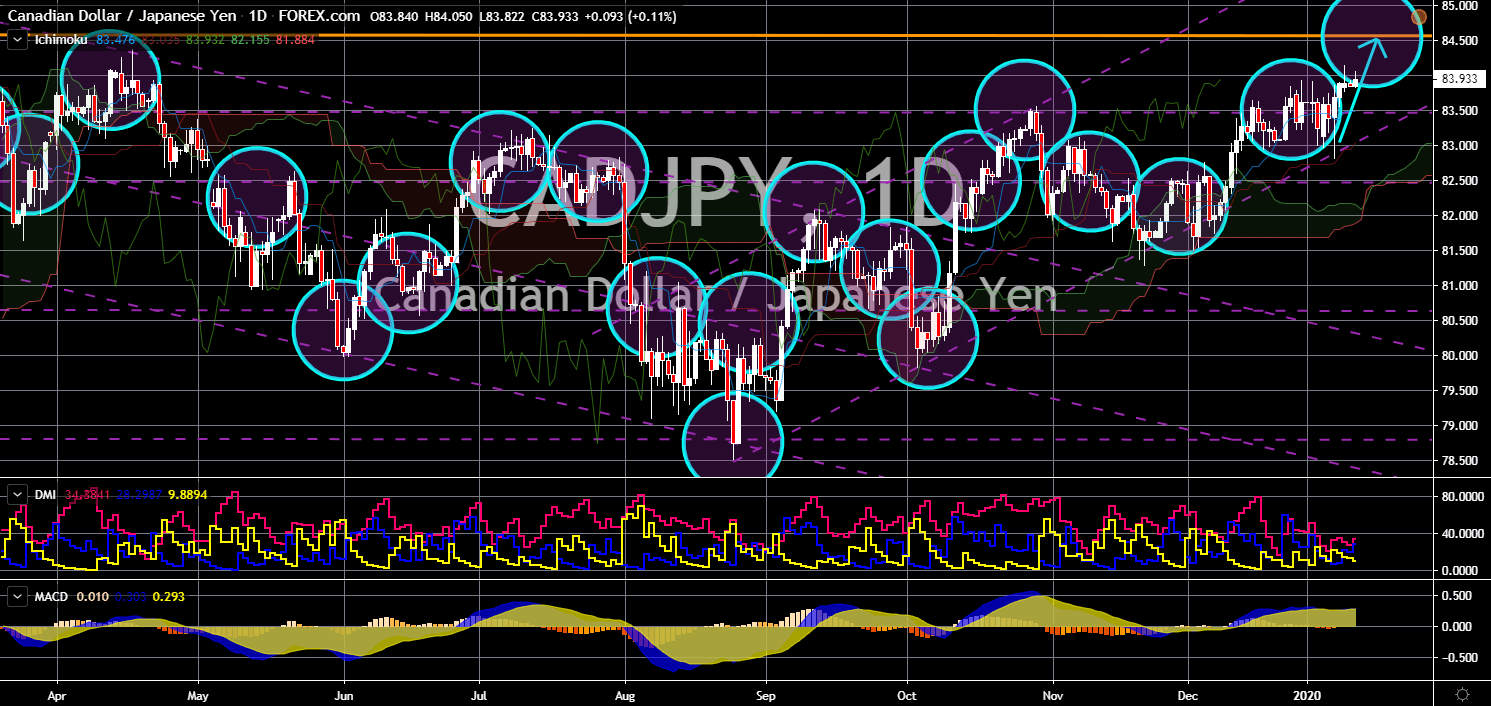

CAD/JPY

The pair will continue moving higher in the following days after it bounced back from an uptrend channel support line. Japan’s economy is expected to gain from the $121 billion stimulus package introduced by the government to stir the economy. In December, PM Abe’s cabinet approved a quantitative easing (QE) policy as fears of recession creeps industrialized and emerging economies. Japan is one (1) of the only four (4) countries with a negative interest rate. The numbers are expected to shrink as Sweden announces its plan to leave the negative territory. Pushing Japan’s interest rate lower will hurt the economy in the future. This leaves the country with QE as the remaining tool to prevent recession. On the other hand, Canada will regain its former glory and become the eighth largest economy in the world. This was according to Cebr’s World Economic League Table 2020, which predicted Canada to reach the spot this decade.

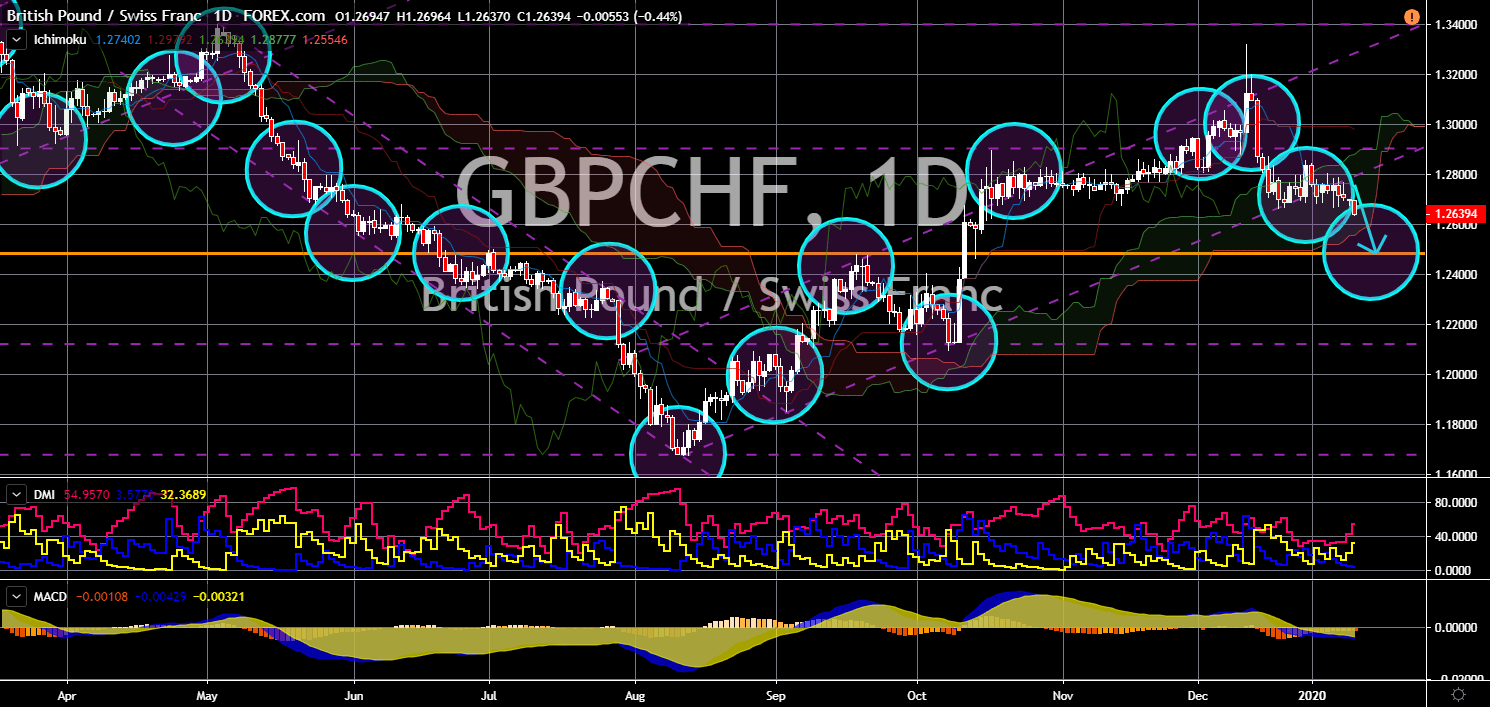

GBP/CHF

GBP/CHF

The pair will experience some weakness in the following days after it broke down from an uptrend support line. Following PM Boris Johnson’s win during the UK election, analysts are now anticipating a Brexit by January 31. However, many are still uncertain as to whether the United Kingdom and the European Union can reach a Brexit deal. Furthermore, uncertainties surrounding the deal and post-Brexit agreement, in case of a no-Brexit deal, might hurt the pound in the short-term. Meanwhile, demand for the Swiss Franc is increasing amid the Brexit and US-Iran tension. The franc is considered as a safe-haven currency, including the Japanese Yen. This was amid these countries’ neutrality on global issues. The UK is set to report its monthly and yearly gross domestic product (GDP) today, January 13. Analysts are anticipating a small boost on these reports following the win of the Conservative Party during the December 12 election.

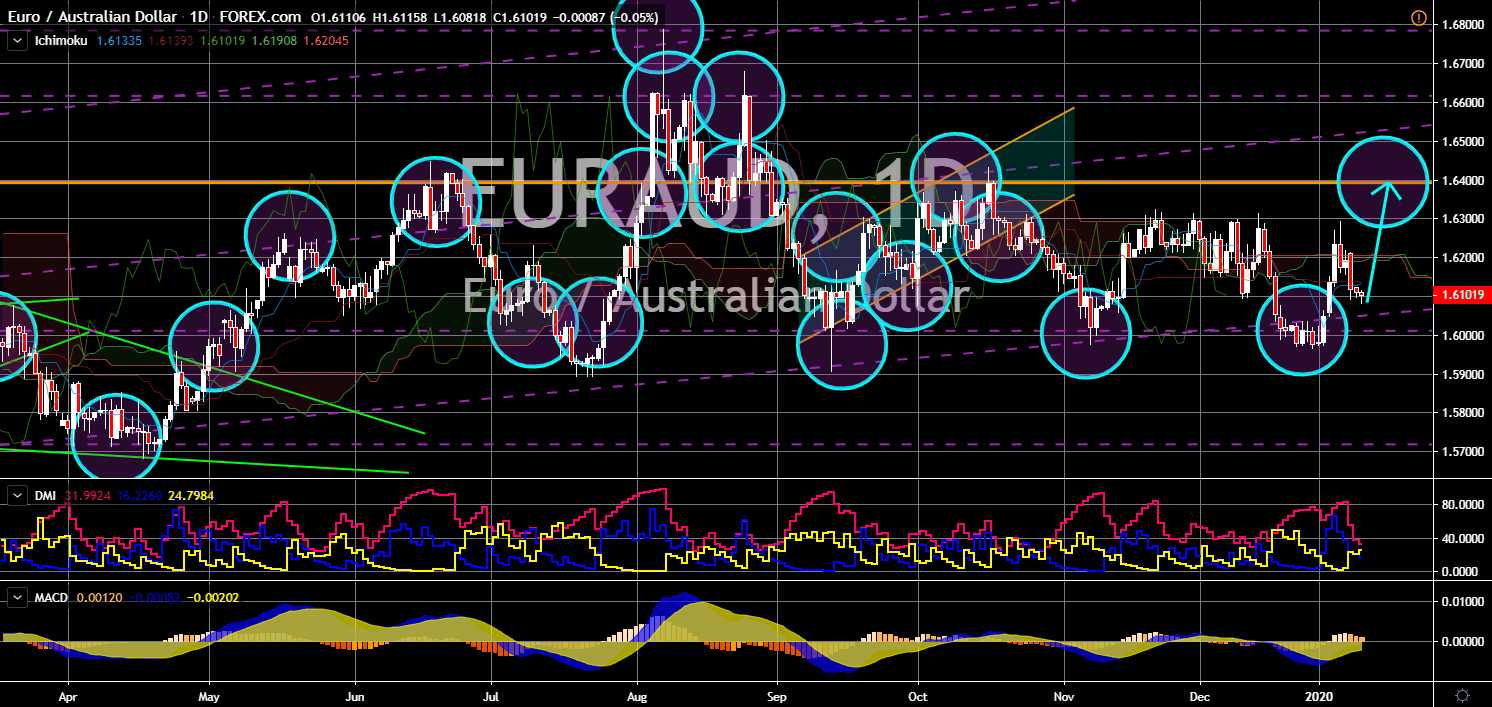

EUR/AUD

The pair is expected to continue its upward movement in the following days. Australia waged war against the European Union. This was after the government-funded $100,000 research investigating the legality of EU’s claim to the word “Prosecco”. Prosecco was used to describe wine produced from a certain type of grape until the European Union challenged it. According to the bloc, Prosecco is used to describe a type of wine made in Northern Italy. This challenge by the EU includes banning Australia’s prosecco wines. Currently, Australia’s exports relating to prosecco wines was at $60 million. Analysts, however, expect exports to rise to $500 million in the next decade. In other news, Australian Prime Minister Scott Morrison’s rating dropped by 8% to 37%. The score was lower than the rating by opposition and Labour Party leader Anthony Albanese. This was after his government was accused of improper handling of Australia wildfires.

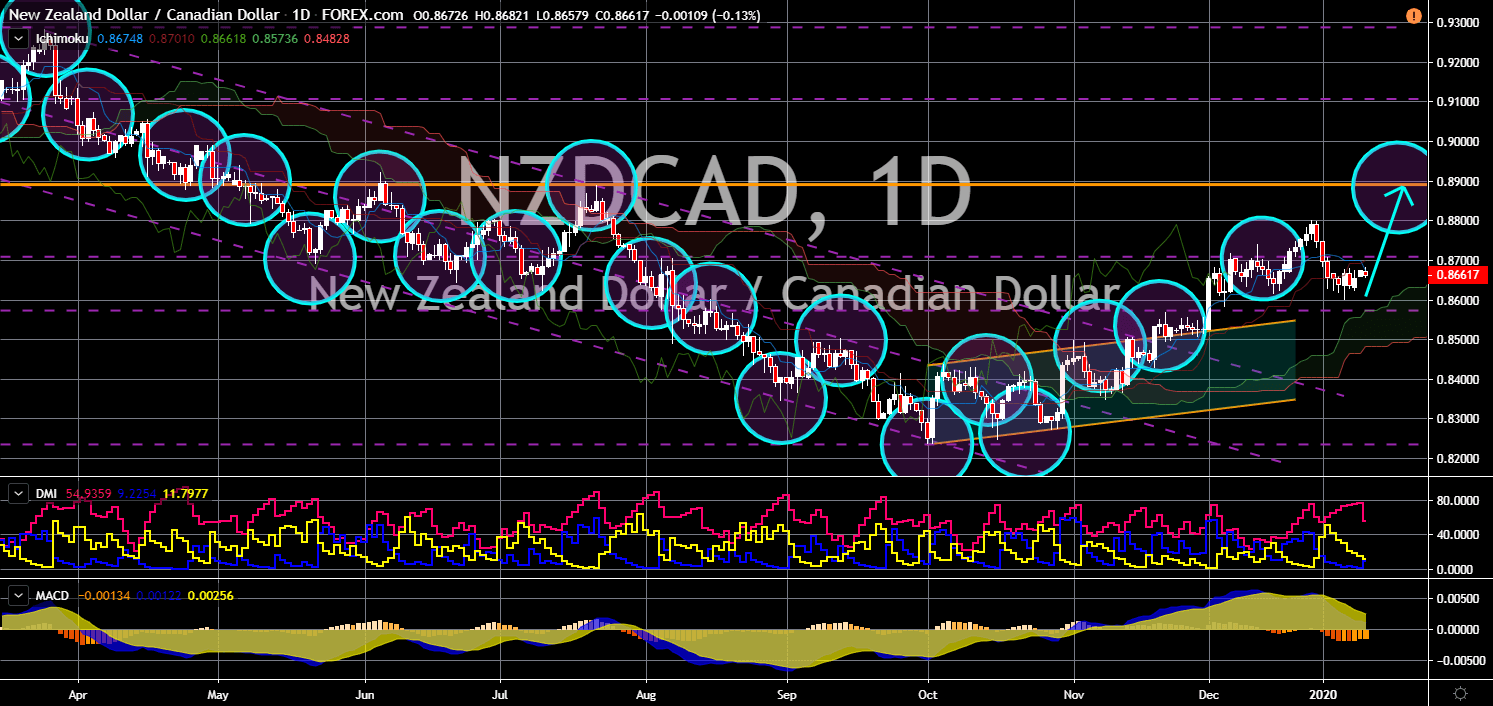

NZD/CAD

The pair bounced back from a key support line, sending the pair higher. The Duke and Duchess of Sussex was reportedly looking at Canada to become their new home. This was after the two (2) royals said that they are stepping down as “senior” members of the Royal Family. The news was a good one for Canada. The United Kingdom is expected to negotiate the terms of Prince Harry and Meghan Markel’s stay in the country. Moreover, Canada is expected to reclaim the eight spot in the list of the largest economies in the world. Among middle economies, Canada was one (1) of the few who hold onto its current benchmark interest rate. This was amid other countries slashing their rates to weigh down the possibility of a recession. On the other hand, New Zealand is set to publish its Business Confidence report today, January 13. Figures show confidence plunging for the past eight (8) consecutive quarters, with the lowest recorded in September at -40%.