Market News and Charts for January 08, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

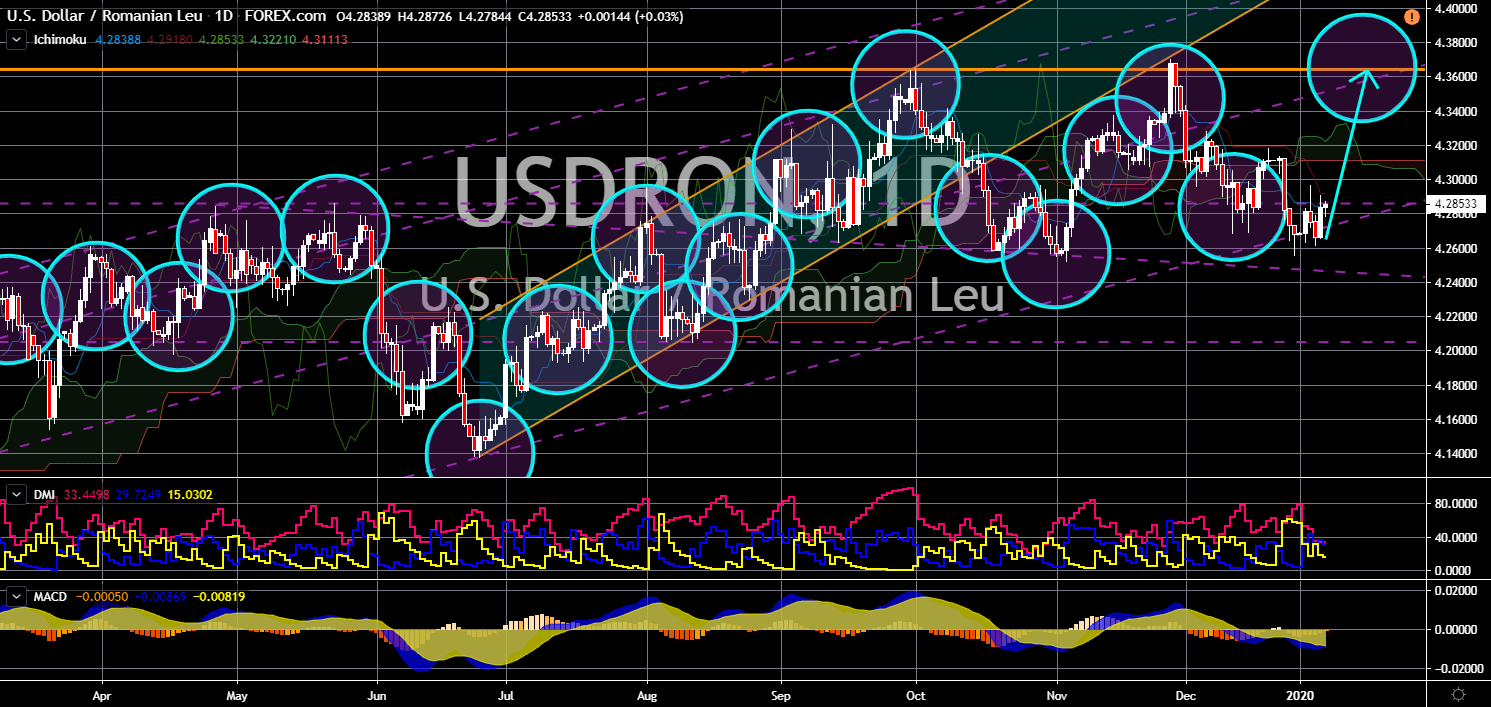

USD/BRL

The pair is expected to reverse back and move toward its previous low. Brazil came under pressure following its statement showing signs of support for the United States and the NATO (North Atlantic Treaty Organization) allies against Iran. President Jair Bolsonaro’s foreign policy was to move Brazil closer to the United States. However, as US President Donald Trump directly hit rivals, like China and Iran, with sanctions, Brazil was seen distancing itself from the US. In a statement released yesterday, January 07, Bolsonaro assured his country that it will maintain its trading relations with Iran. Also, China remained Brazil’s largest trading partner in 2019. The country also overtook the United States as the largest soybean producer in the world. The phase one trade deal between the United States and China will take effect on Friday, January 10. However, analysts believe that the Brazil-China relationship will not be affected by this.

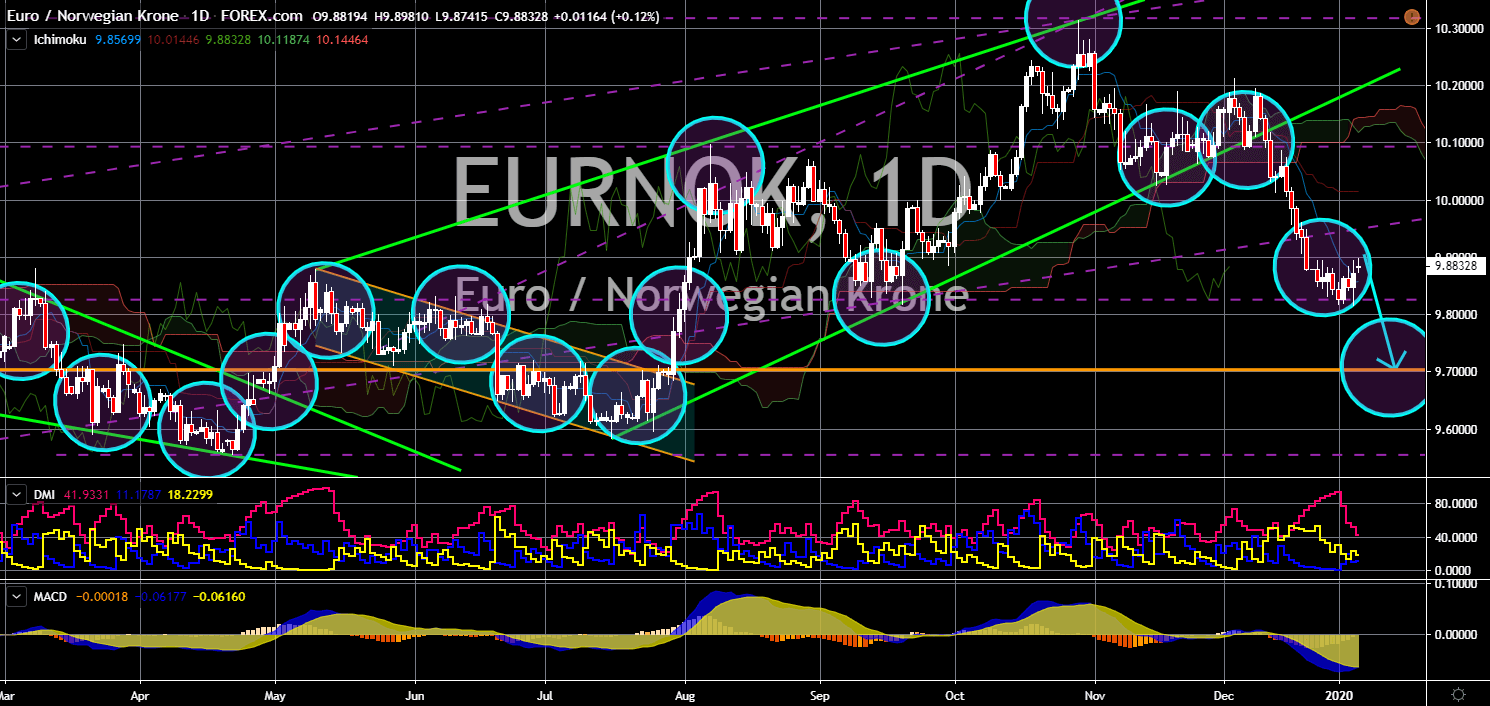

USD/RON

USD/RON

The pair is expected to bounce back from an uptrend support line, sending the pair higher towards a major resistance line. The United States is due to publish its Crude Oil Inventories report today, January 08. Analysts and investors are anticipating a huge movement in crude oil prices following tensions between the United States and Iran. Companies producing military equipment were also soaring in the US stock exchanges. In line with this, Romania said its Aegis Ashore defense site is now online and ready to shoot down missiles from enemies. Following the fallout of the US-Turkey relations, America has increased its efforts to militarize the eastern bloc. Aside from Romania, the United States has also stalled Ground-Based Midcourse Defense System in Alaska, Guam, South Korea, and Israel. In other news, Romania’s defense ministry said it has 14 soldiers participating in the NATO mission in Iraq.

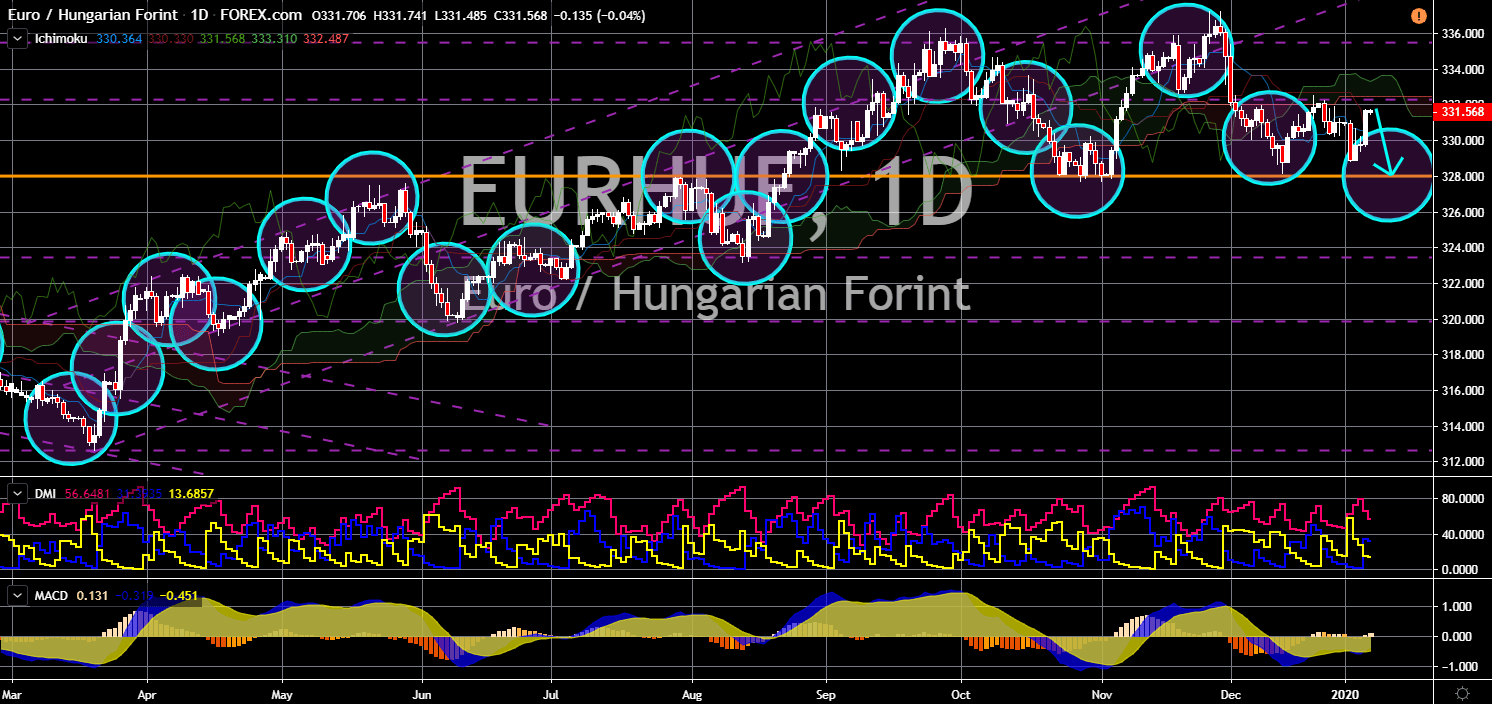

EUR/NOK

The pair will breakdown from a major support line, sending the pair lower towards another major support line. Analysts are expecting today’s report for the euro currency to continue to disappoint investors and traders. For the month of November, France incurred a trade deficit of $3.7 billion. France reserve assets are also plunging, which is bad for the single currency. In addition to this, business climate in the European Union is expected to further plunge for the fourth straight quarter. The same thing is expected for European Consumer Confidence report. Analysts are also expecting for inflation to remain below the target. This is expected to continue to drag the euro currency and weigh down any positive data from EU-member states. Germany, the EU’s economic powerhouse, is expected to continue the negative figures from November, which could further send Germany into recession. Norway’s $1 trillion sovereign wealth fund is expected to break records this 2019.

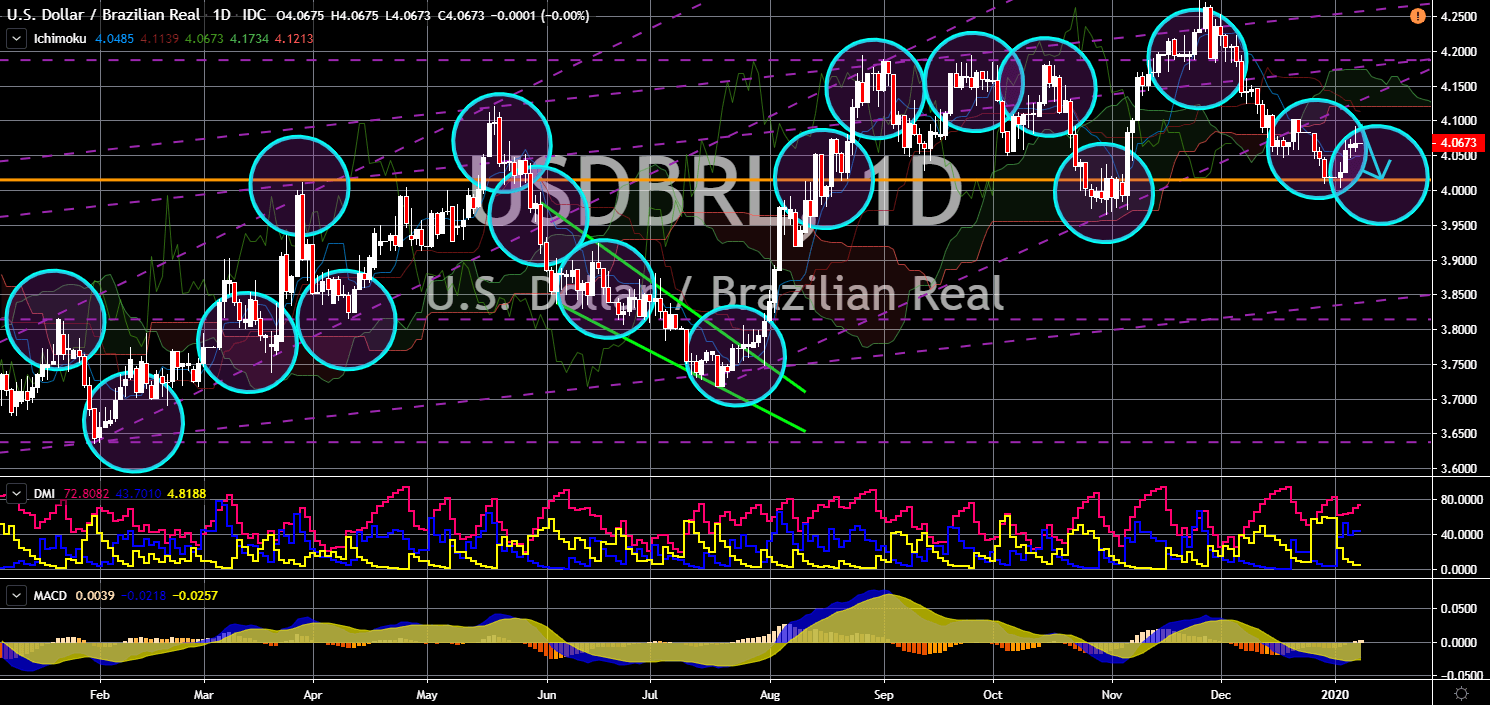

EUR/HUF

The pair is seen to fail to break out from a sideways channel’s resistance line. Despite controversies surrounding Hungary and its prime minister, Viktor Orban, the country managed to outperform other EU-member states. For the third quarter, Hungary reached a 5% GDP growth. Despite concerns of slowdown in the European Union, the escalating trade war between the United States and China, and Brexit uncertainty in the fourth quarter, analysts project Hungary to deliver a 5% growth for the whole fiscal year of 2020. Furthermore, economists see that the thriving eastern European nation will shrug off the slowdown expected this 2020. Moreover, a senior aide of UK Prime Minister Boris Johnson said the country will forge a special relationship with the far-right Hungarian regime in a post-Brexit trade agreement. The UK is set to leave the bloc on January 31, adding uncertainty in Europe, but will form new trading relations with other EU-member states.