Market News and Charts for January 07, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

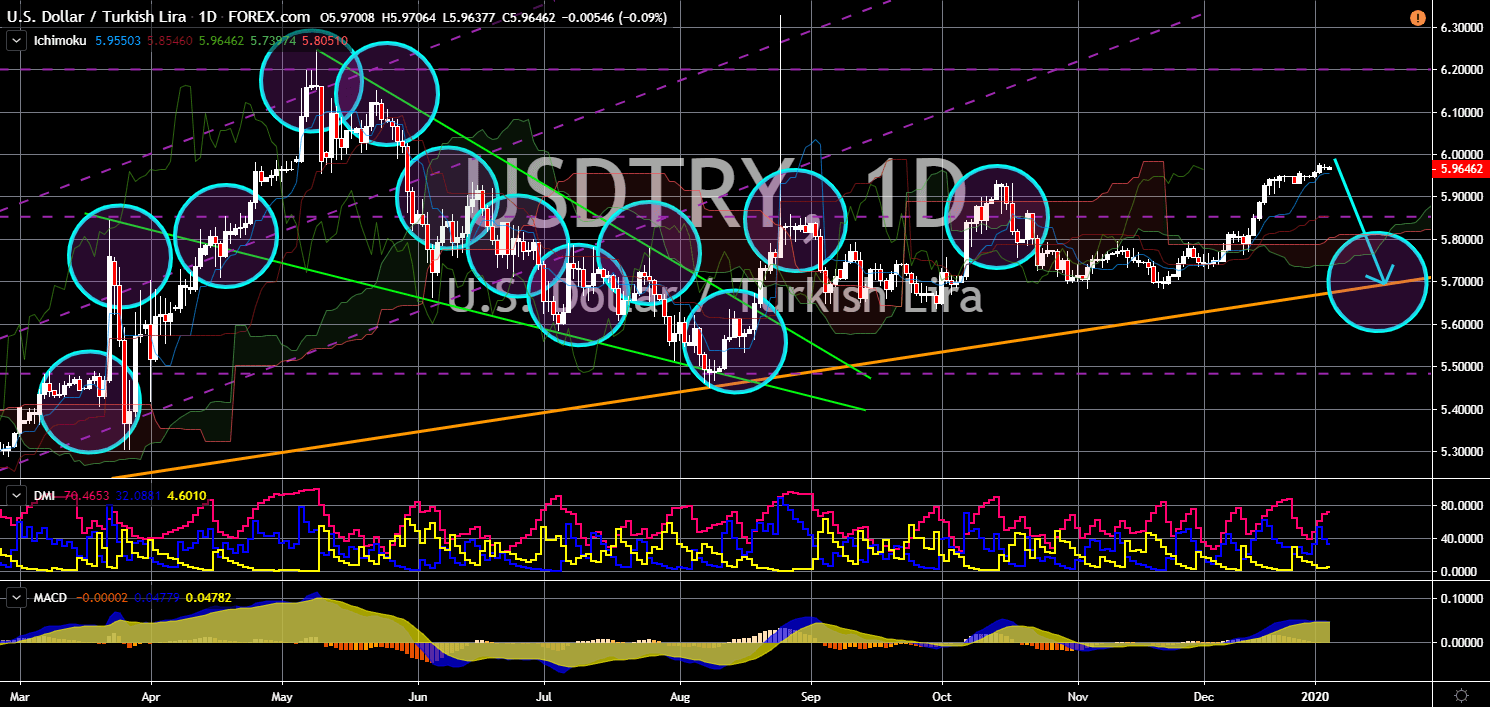

USD/TRY

The pair is expected to reverse back and head towards a major support line. Turkey has been increasing its influence in the Middle East amid the on-going US-Iran tension. 2020 has been a challenging year for Iran after two (2) of its top military men were killed by the United States. Analysts and investors were anticipating a retaliation by Iran, which could impact the global market. As for Turkey, the widening gap between its relations with the United States and the European Union could give the country an advantage to improve ties with Iran. Recently, America and China signed a phase one trade deal, which analysts hope could end the trade war between the two (2) largest economies in the world. However, tensions with Iran could force the United States to impose sanctions and cut trading deals with countries supporting Iran. The US is set to report its Imports, Exports, and Trade Balance reports today, January 07.

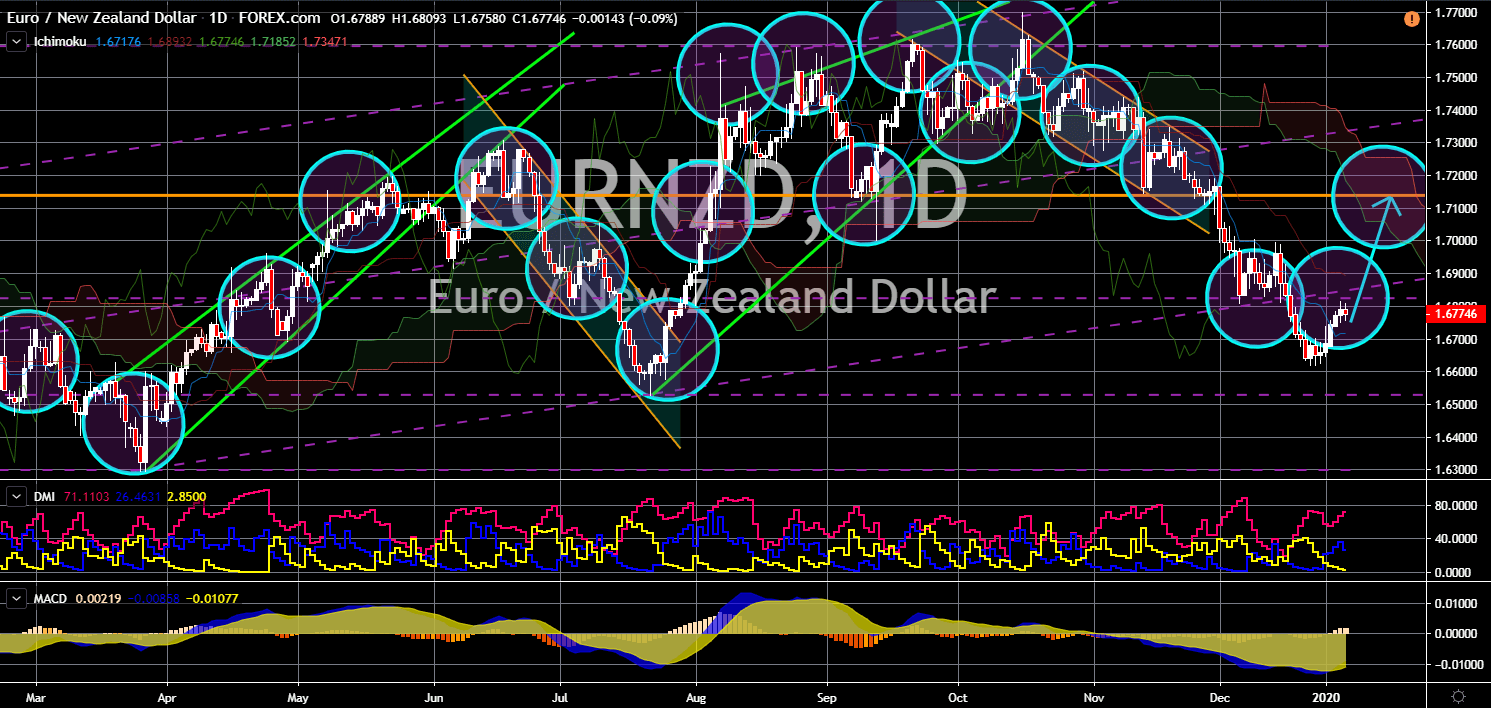

EUR/NZD

EUR/NZD

The pair will break out from a key resistance line, which will send the pair higher in the following days. The European Union’s economy has been weighing down economic uncertainties. For 2019, the country was able to ratify the EU-Japan Free Trade Deal, which became the largest trading zone in the world. However, EU-member states are having a hard time to stir their economy amid interest rate cuts. Figures showed that inflation were still below the target of most member countries. A slowdown in Germany, the EU’s economic powerhouse, could trigger a Eurowide recession. New Zealand, on the other hand, has become a favorite for traders, specifically that the United Kingdom is set to leave the European Union. Once withdrawn from the largest trading bloc in the world, the post-Brexit trade agreement will take effect. New Zealand is the first country to sign a post-Brexit trade agreement with the United Kingdom.

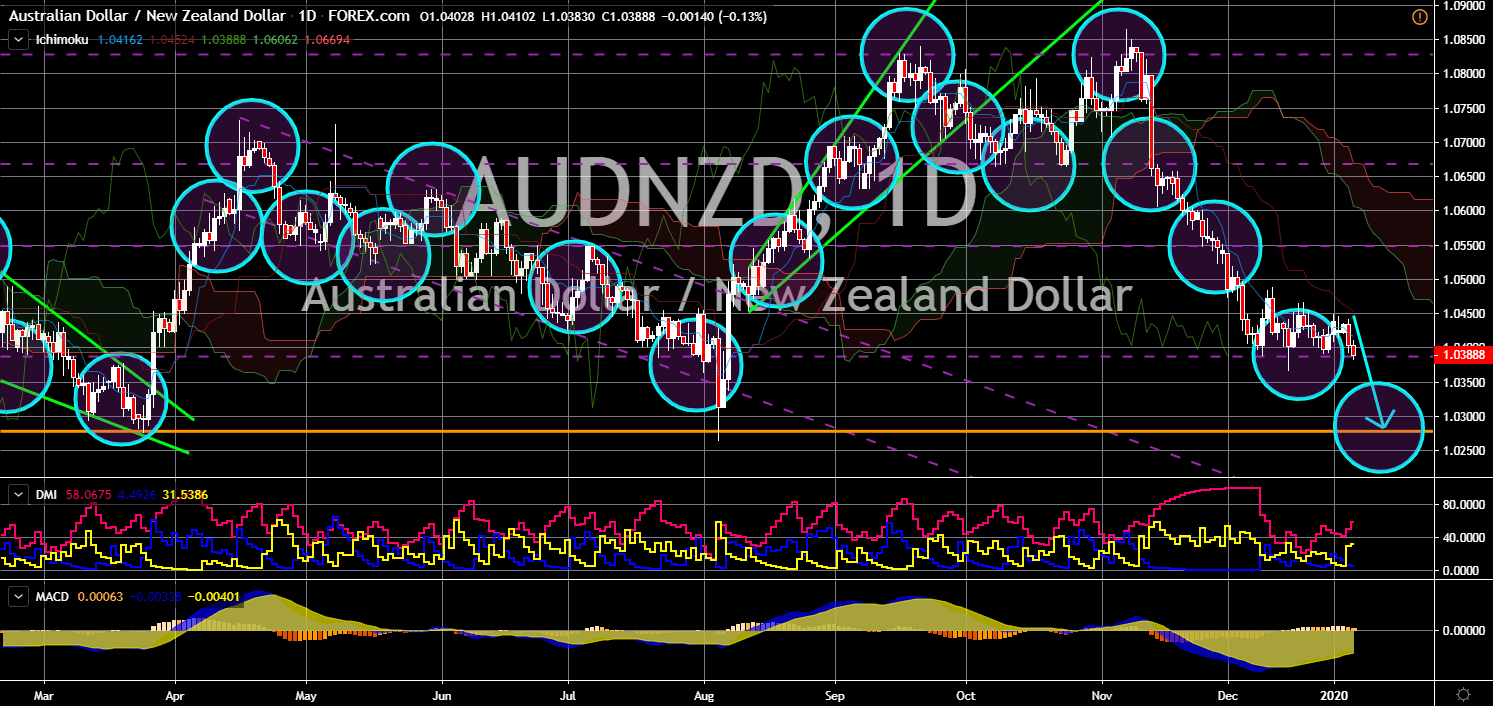

AUD/NZD

The pair will break down from a major support line, sending the pair lower toward its 10-month low. Major wildfires welcomed Australia this 2019. Half a billion animals have already died with the fire, which analysts see could impact the Australian economy. In December, the country’s advertisement plummet, which could affect the productivity of the country and therefore affect its economy. Australian Prime Minister Scott Morrison already pledged $1.39 billion for the fire reconstruction. This event could further add to the recent announcement by the Prime Minister wherein he said he will not approve a free movement with the United Kingdom. Australia has also a free movement agreement with New Zealand but reiterated that it will no longer be extended. This is expected to hit Australia’s relationship with its allies. The European Union could also threaten Australia to have a green economy once it ratified the Australia-EU free trade agreement.

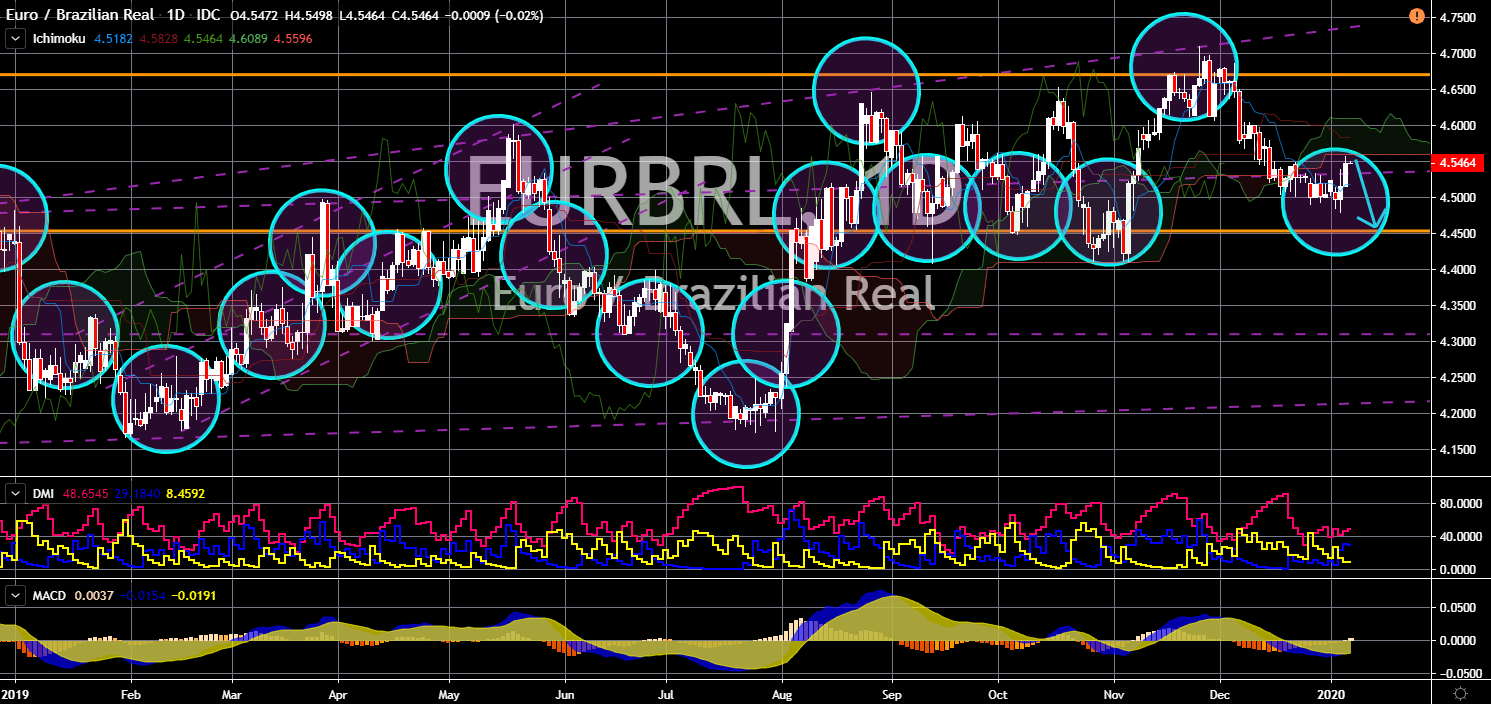

EUR/BRL

The pair is expected to continue its downward movement and head towards a key support line. Brazil became the largest beneficiary of the US-China trade war. During the height of the trade war, Brazil accounted for 80% of total Chinese soybean import. However, this is about to end as the two (2) largest economies in the world agreed to a phase one trade deal, which will take effect on Friday, January 10. However, Brazilian real traders are optimistic that the African Swine Fever could give Brazilian farmers a new way to make money as the phase one trade deal begins to be implemented. In 2019, Brazil broke two (2) record for pig industry. Pig’s meat production took over 4 million tons and 2019’s export reached 740,000 tons. Analysts and investors were also hopeful that Brazil and the European Union will be able to finalize the EU-Mercosur deal. The deal will bring together 32 countries, 28 from the European Union and 4 from South America.