Market News and Charts for January 04, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

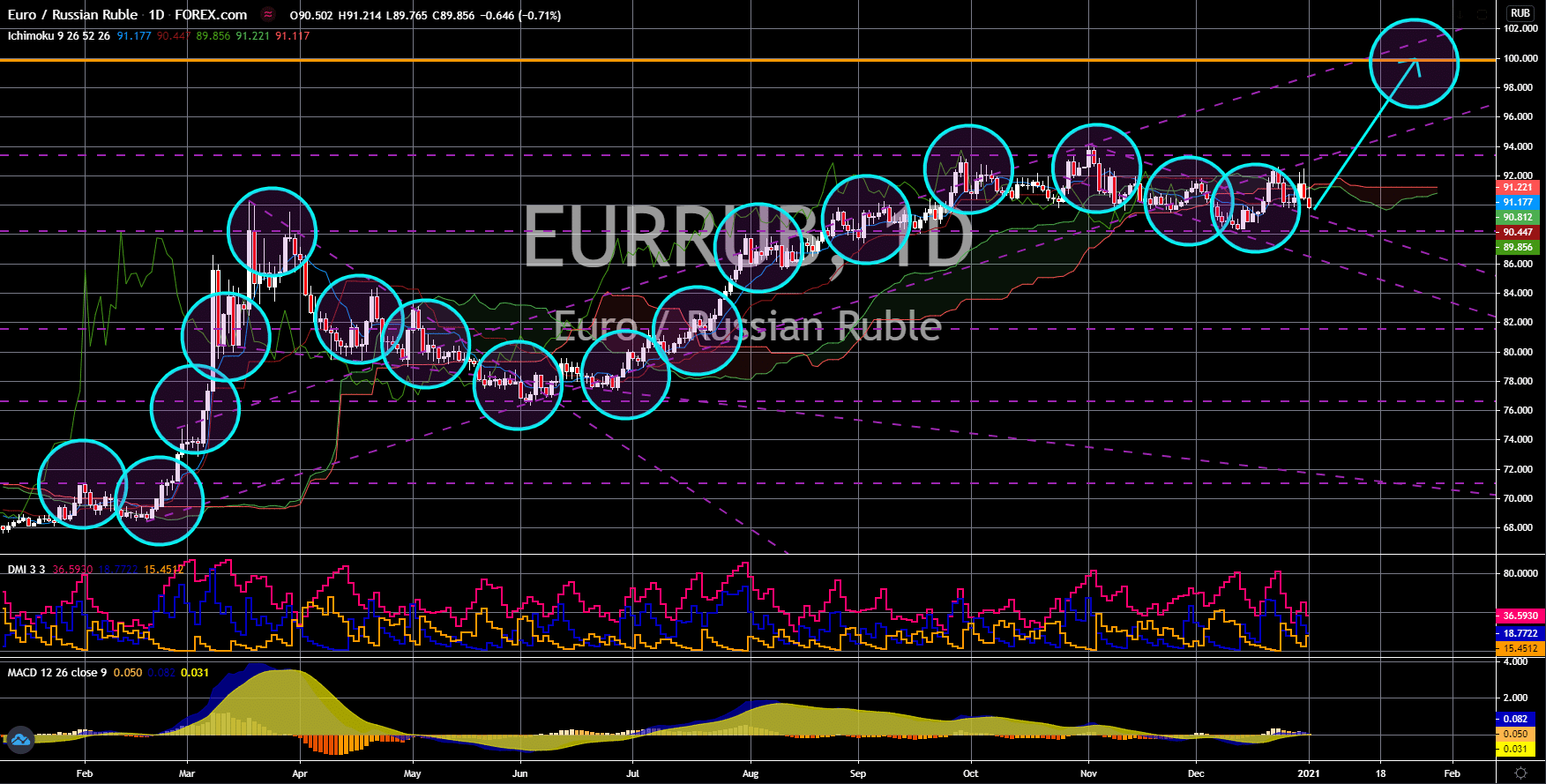

EUR/RUB

The pair will continue to move higher in the following days after it broke out from a downtrend resistance line. PMI reports of Russia were mixed. Markit Manufacturing PMI advanced to 49.7 points from 46.3 points on December 30. Meanwhile, Markit Services PMI dropped to 48.0 points for the month of December. The prior record for November was 48.2 points. Both reports were below the 50.0 points benchmark, meaning these sectors continue to contract. On the other hand, while most EU member states failed to beat estimates, their reported figures were still above the benchmark. The ruble benefits from the rising crude oil and wheat prices. The price of the black gold will continue to increase due to COVID-19 vaccine optimism. Meanwhile, the Russian government has increased export quota and levied $31.10 on wheat exports. The inauguration of president-elect Joe Biden remains as the biggest challenge for the Russian currency.

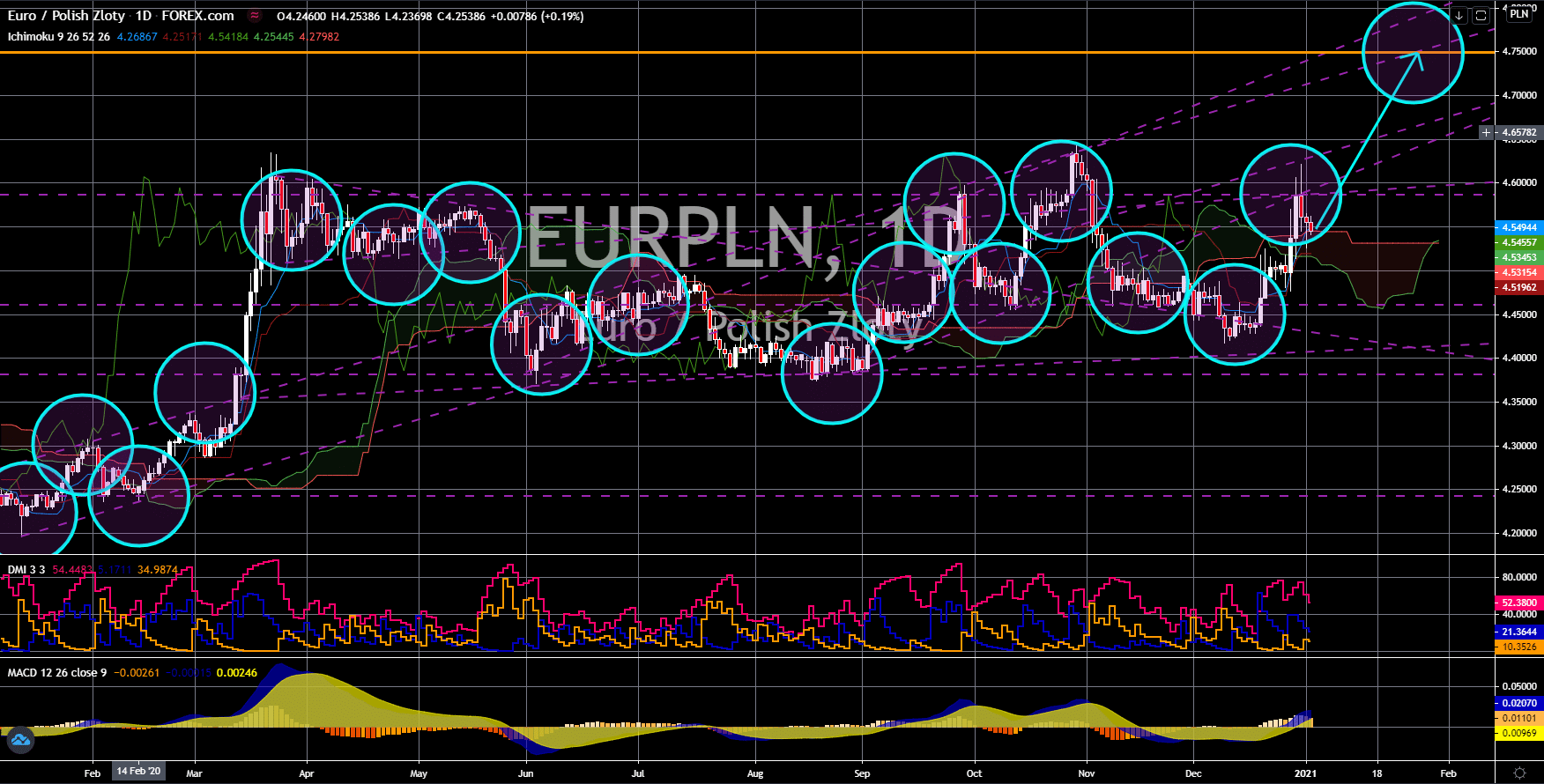

EUR/PLN

The pair will continue its rally and break out from a range’s resistance line, sending the pair higher towards the 4.7500 resistance area. Poland was the only EU member state which beat the consensus estimate for Manufacturing PMI. The reported figure from Poland was 51.70 points. This number was higher than estimates of 51.50 points and from its November record of 50.80 points. Another factor that could support the continued strength of the Polish zloty was the EU’s fear of Polexit. Poland and Hungary vetoed the $1.3 trillion EU budget for the next seven years. This was after the European Commission linked each countries’ budget to their adherence to the EU rule of law. Germany had then brokered a deal between the parties involved to end the stalemate. Just days after Poland lifted its veto, the EU approved €650 million aid LOT Polish Airlines. Aside from this, investments are pouring after Fiat Chrysler unveiled its $204 million investment in Poland.

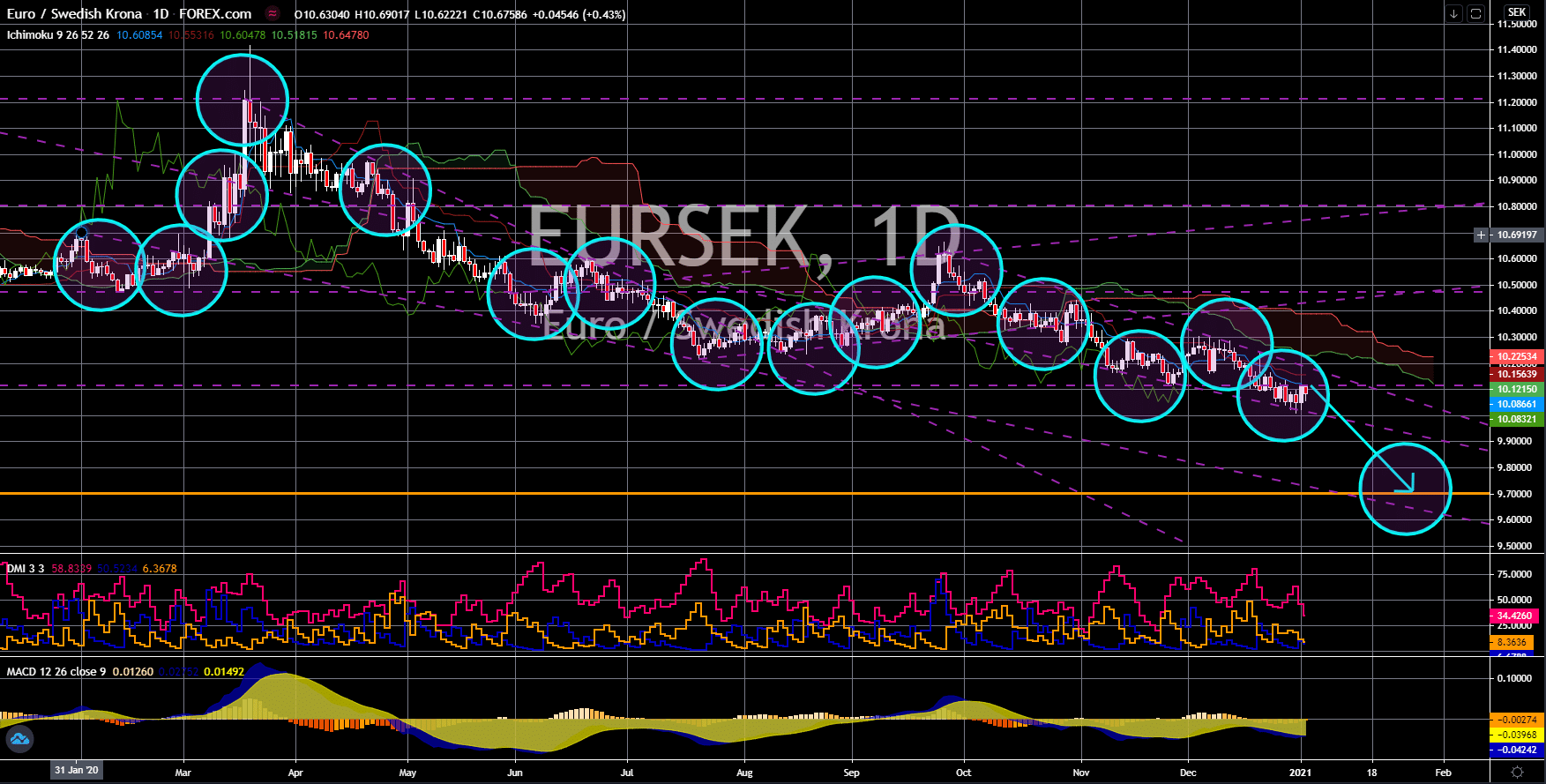

EUR/SEK

The pair will continue to move lower in the following days towards the 9.70000 support area. Sweden recorded the highest Manufacturing PMI points for the month of December on Monday’s report, January 04. Figure came in at 64.9 points, 5.1 points increase from November’s 59.8 points. The figure represents the eight-consecutive growth on the report since its May 2020 result of 36.4 points. It is also the highest recorded number since April 2017. This upbeat result coincides with the better-than-expected Q3 GDP growth of 4.9% against 4.3% expectations. What investors should look forward to for Sweden was the development of eKrona, the central bank backed digital currency. If Sweden goes cashless, it will be able to efficiently control the monetary supply with the use of the digital currency. Thus, it will make the krona more stable. In addition to this, it will be the first to take advantage of a digital economy compared to other advanced economies.

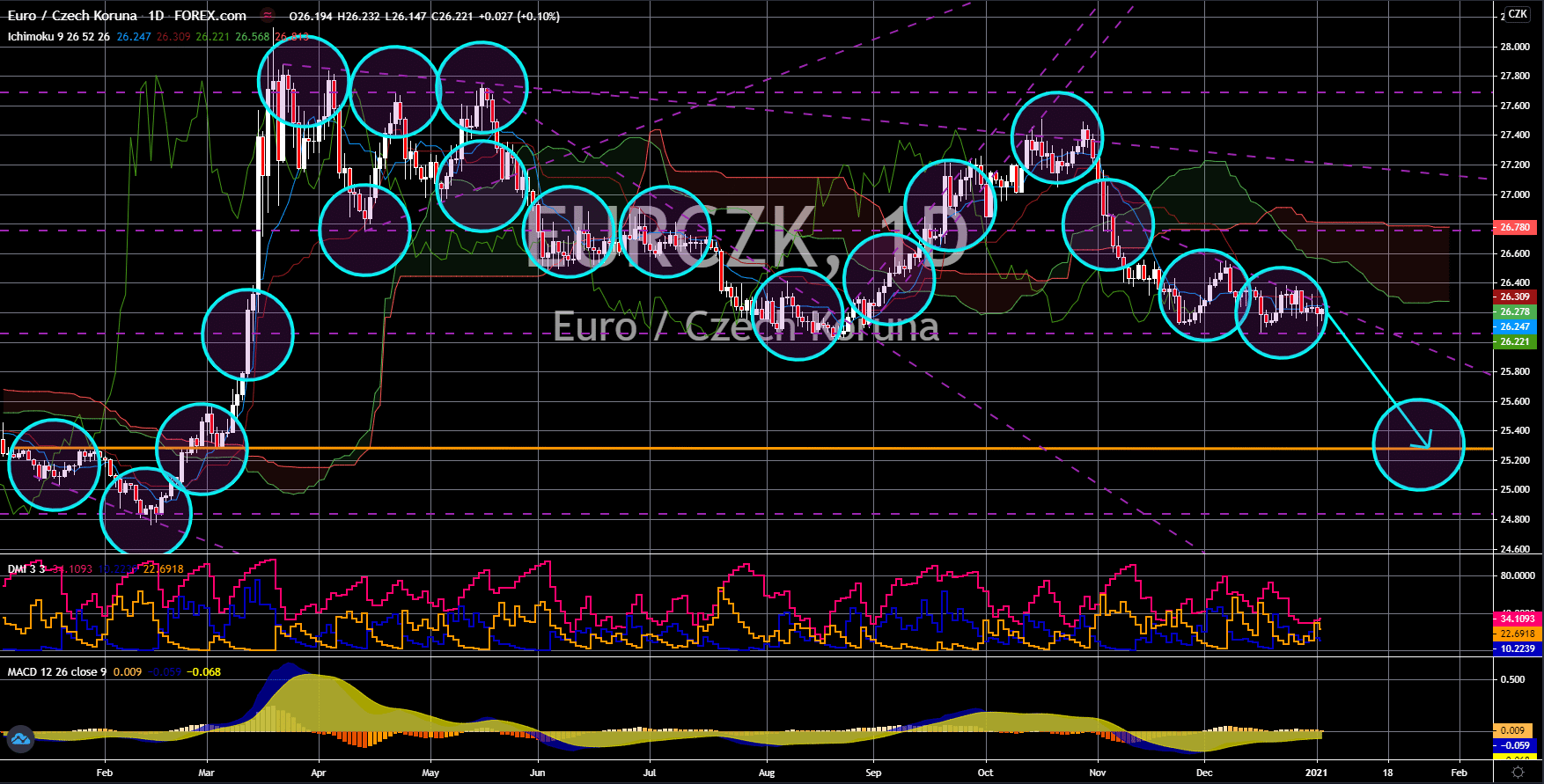

EUR/CZK

The pair failed to break out from a downtrend resistance line, sending the pair lower towards its March 2020 low. The EU member states had mixed results on their Manufacturing PMI reports. Among the four (4) members of the Eurozone, one (1) saw its number for December decline compared to the previous month, one (1) increased and tapped consensus estimate, and two (2) posted higher figures against their November results but failed to beat forecasts. The figures came in at 58.3 points, 51.1 points, and 52.8 points and 51.0 points, respectively. The reported numbers suggest the slowdown in the EU bloc, particularly in the Eurozone amid then the looming withdrawal of Britain from the EU. The UK is the second-largest contributor of EU funds and its departure will surely leave a hole in the budget. Another reason for the bearish outlook on the single currency was the renewed lockdown in Germany due to a new strain of COVID-19.