Market News and Charts for January 02, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

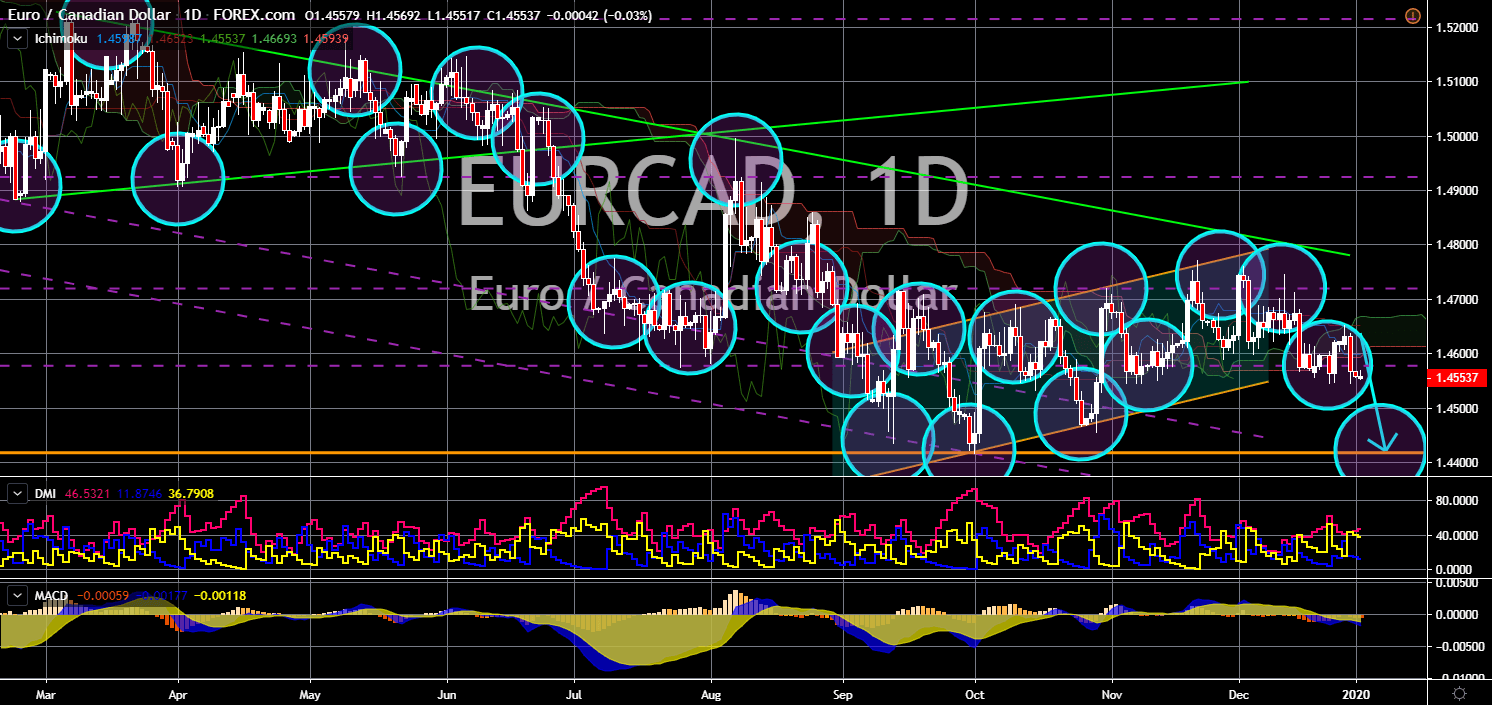

EUR/CAD

The pair will move lower below its support line, sending the pair lower towards a major support line. The Euro is mixed following several reports from its member states. Spain and Italy reported a better-than-expected result for their Manufacturing Purchasing Managers Index (PMI). However, this was quickly overshadowed by the disappointing results from the EU’s two (2) largest economies – Germany and France. Meanwhile, Canada also released PMI report, which is below analyst’s estimates, but was higher compared to its previous result. Investors and traders were skeptical with the Eurowide amid the looming withdrawal of the United Kingdom on January 31, 2020. Britain is currently the bloc’s third largest economy and its departure is expected to hurt the overall economy of the European Union. Canada, on the other hand, is preparing to strike a deal either from the European Union or from the United Kingdom.

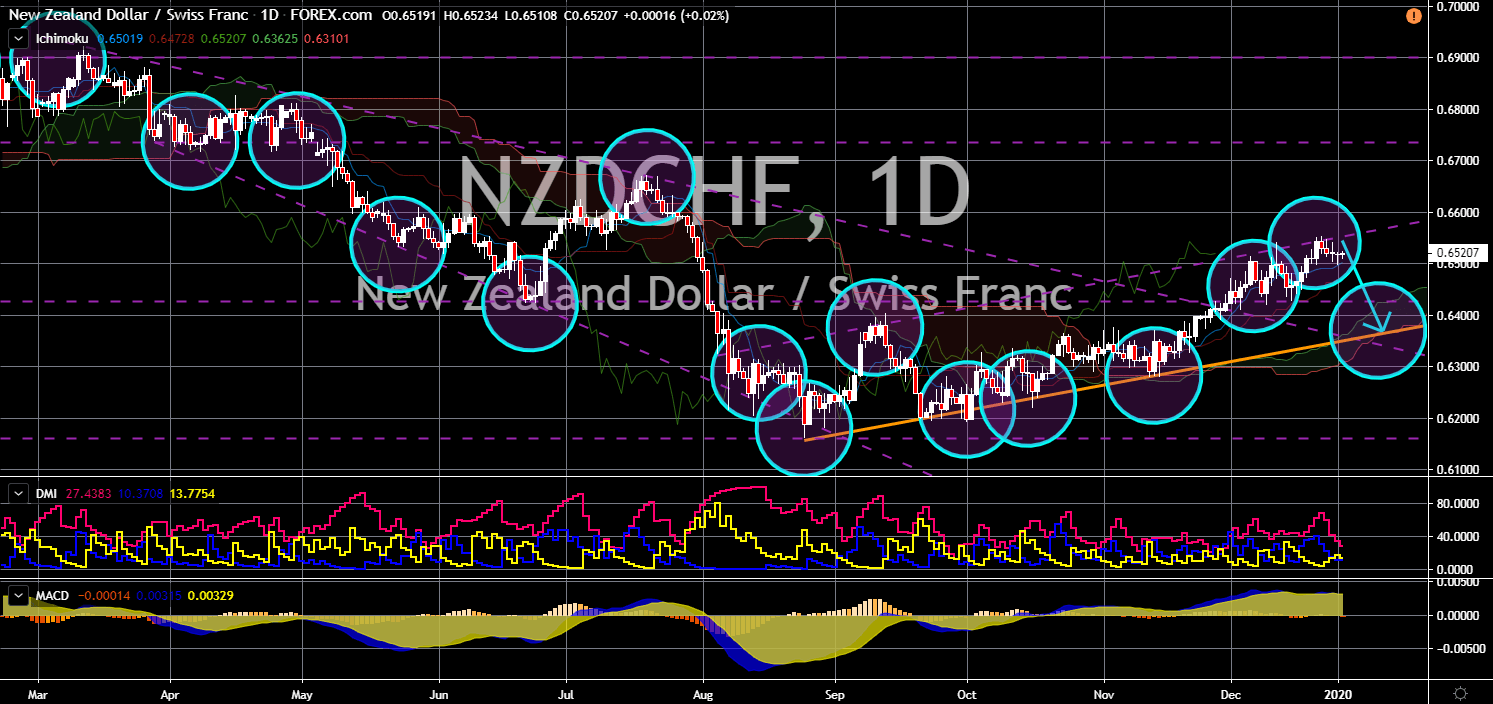

NZD/CHF

NZD/CHF

The pair is expected to continue moving lower after it failed to breakout from an uptrend channel resistance line. Switzerland was able to beat analysts’ estimates for its Purchasing Managers Index (PMI) despite sliding from its previous report. Analysts and investors were also optimistic about the Swiss Franc following the recent announcement by the Swiss National Bank (SNB) that it is considering raising its interest rate into positive territory this year. Switzerland has currently the lowest interest rate in the world at negative 0.75% along with Sweden, Denmark, and Japan. The country was also recently hailed as the second freest country in the world behind New Zealand. As Switzerland plans an interest rate hike in the days to come, New Zealand was among several countries cutting their rates to weigh down economic uncertainty bought by the US-China trade war. However, the phase one trade deal between the two (2) countries is pushing the NZD higher.

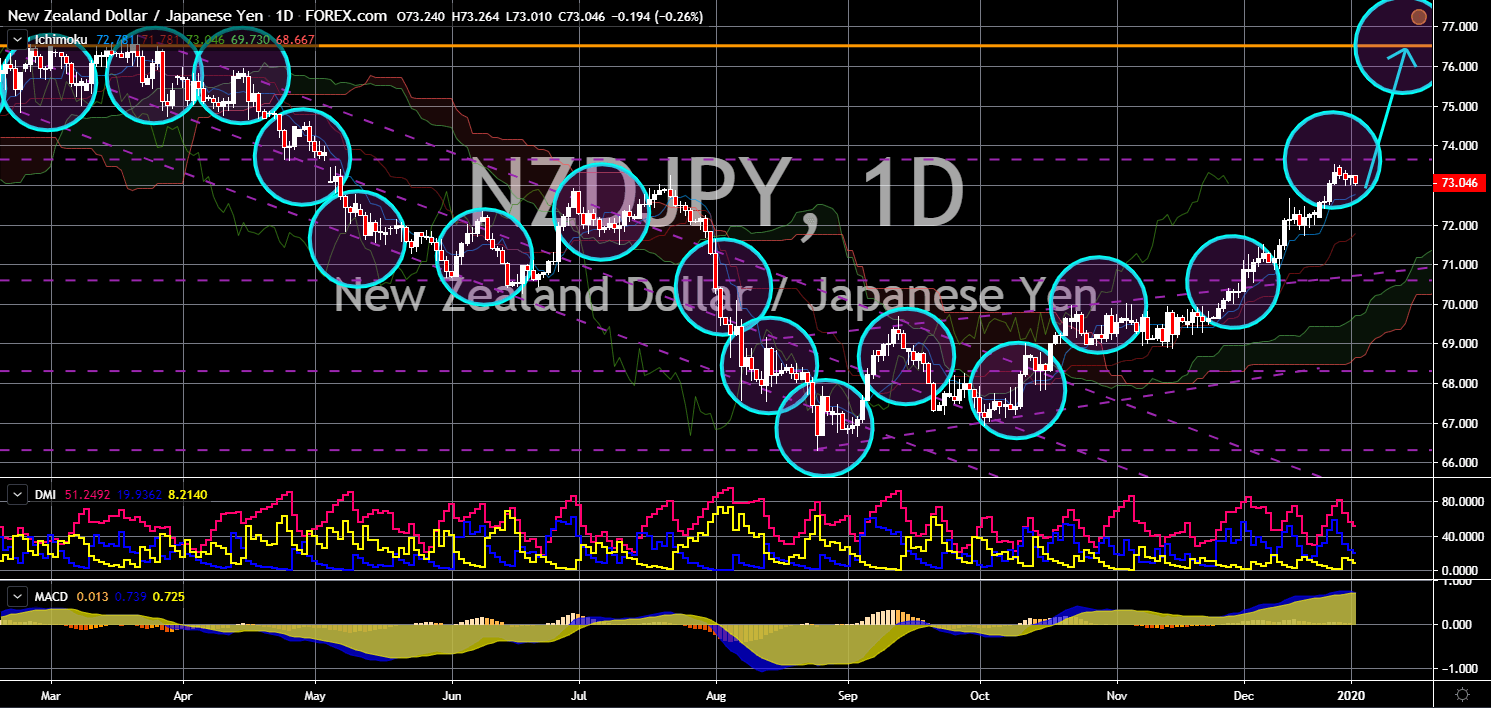

NZD/JPY

The pair will break out from a resistance line, sending the pair higher to form a “Cup and Handle” formation. Japan is under fire following the departure of Carlos Ghosn, chairman and CEO of the Renault–Nissan–Mitsubishi Alliance. He was known as “Le Cost Killer” for his cost reduction efforts and turning Renault and Nissan away from bankruptcy. In 2018, he was arrested on allegations of under-reporting his earnings and misuse of company assets. On December 30, it was reported that Ghosn escaped Japan through a musical box on flight to Lebanon. With 99% of conviction rate in Japan, Ghosn is supposed to serve 15 years in prison. Despite the domestic issue, Japan is seen to expand its role as a free trade champion in the new decade. In 2019, Japan strike several trading agreements. It ratified pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) and signed the EU-Japan free trade deal.

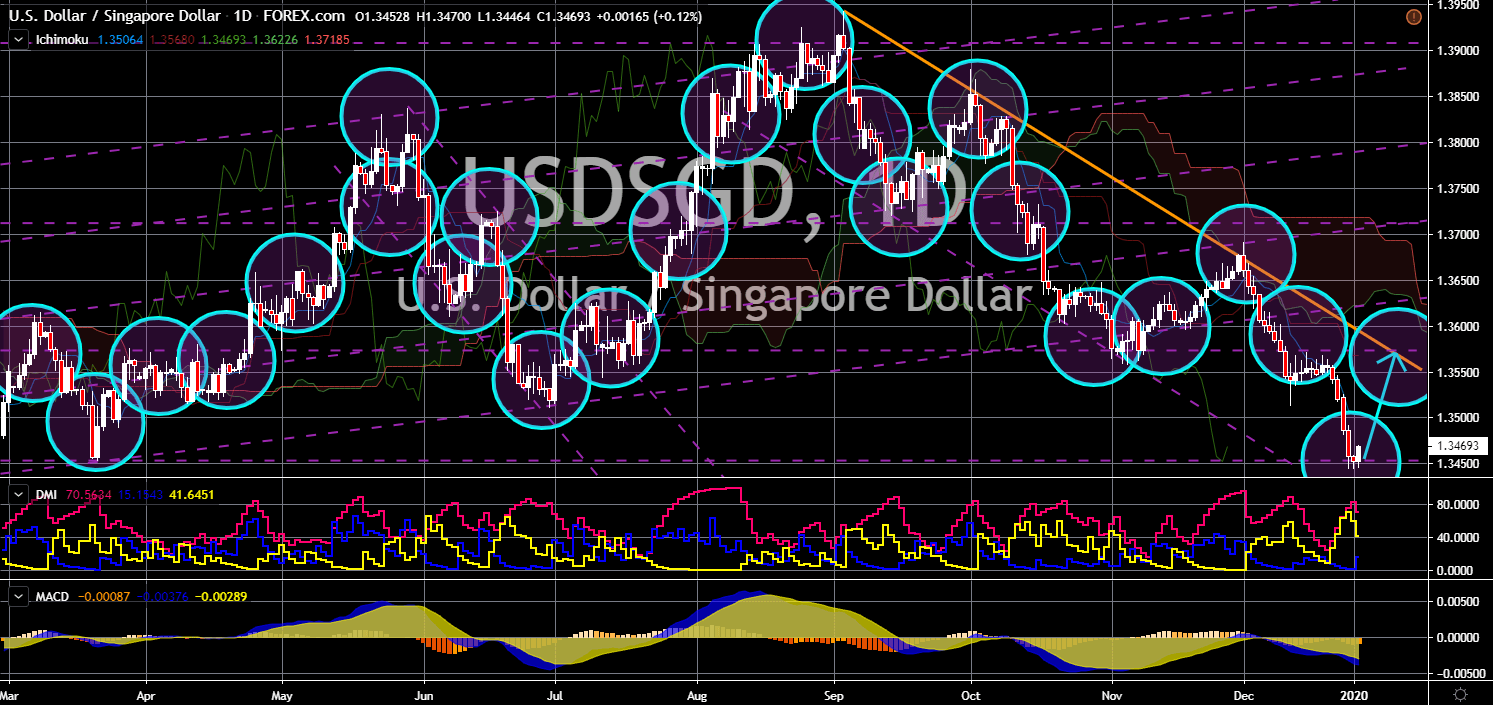

USD/SGD

The pair is expected to bounce back from a major support line, sending the pair higher towards a downtrend resistance line. The United States is due to publish its Non-Farm Payrolls (NFP) report tomorrow, December 03. The report will include the final month of 2019 on which productivity is expected to spike amid the holiday seasons. In line with this, the Federal Reserve will have its first meeting today, December 02, to discuss fiscal and monetary plans for the year 2020. Fed Chair Jerome Powell is expected to give a dovish tone on the said meeting following the recently signed phase one trade deal between the United States and China. The U.S.-China trade war saw the central bank cutting its interest rate three (3) times in 2019, a slashed of 0.75 basis-points. This is expected to spell a recovery for the greenback. Meanwhile, the Singaporean economy expands 0.7% in 2019, down from 3.1% in 2018, the slowest in a decade.