Market News and Charts for February 27, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

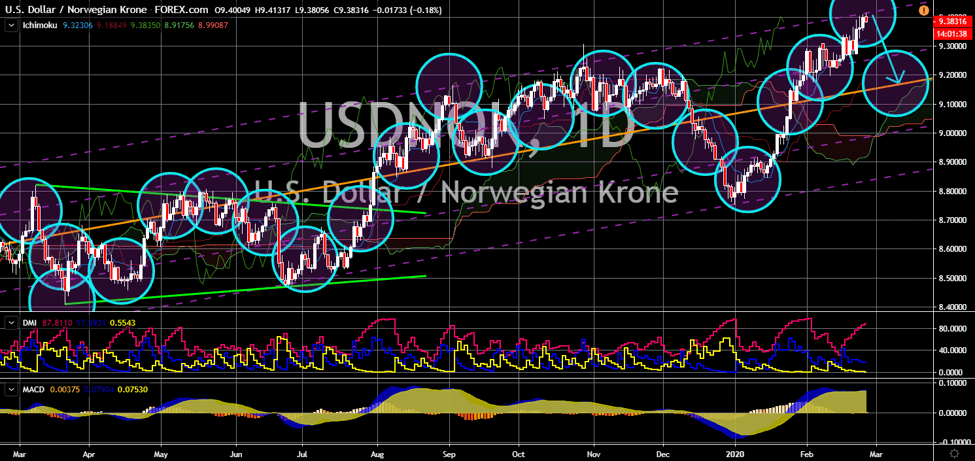

EUR/CZK

The pair will fail to break down from a “Falling Widening Wedge” pattern resistance line. The European Union is due to publish major reports today, February 27. Among these reports were European Business Climate and European Consumer Confidence. The two (2) reports posted negative results on the previous month. These figures reflect the current economic status of the largest trading bloc in the world. In addition to the weak figures on the two (2) reports were the declining Eurozone M3 Money Supply report. Data shows that M3 (coins, notes, cash convertible assets, and short-term and long-term deposits) declined by 5.0%. Meanwhile, the bloc still has a sluggish inflation result. The weak M3 figures will drag the single currency in coming sessions. Meanwhile, the low tax burden for each household in Czech Republic is one (1) of the lowest in the European Union The highest was Germany at 38.3%.

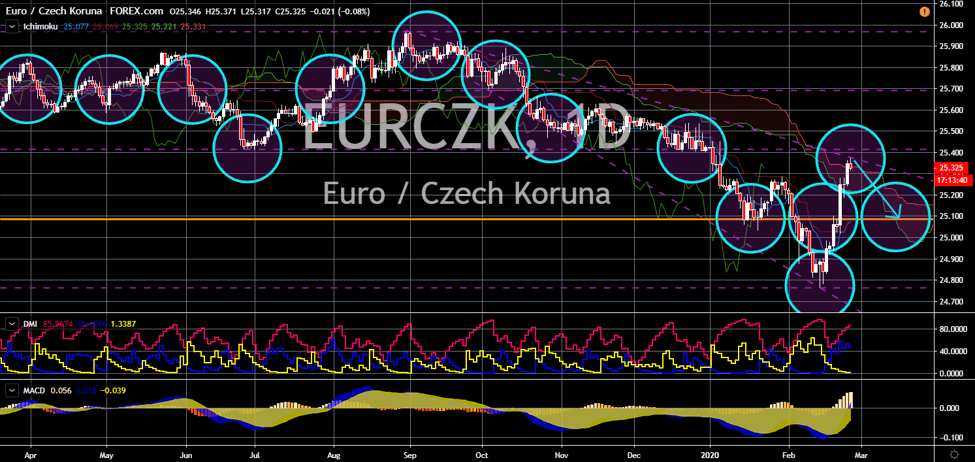

USD/HUF

The pair will break down from a steep uptrend channel resistance line. Analysts anticipate Hungary to retain its GDP growth of 4.5% in today’s trading session. Hungary is one of the fastest growing economies in the European Union. Its low exposure to the German economy gave investors relief that Budapest will outperform the broader EU economy. Meanwhile, the US is also set to publish its gross domestic product (GDP) report today, February 27. On January 30, Washington published the fourth and final GDP results for 2019. The country was able to tap expectations of 2.1%, which is also the same figures for the third quarter. However, the threat of coronavirus creeps on the report to be published today. The COVID-19 originated from Wuhan, China. As the Chinese government prioritizes the virus, it may not fulfill its obligations under the phase one trade deal with the US. This, in turn, might spark the continuation of the US-China trade war.

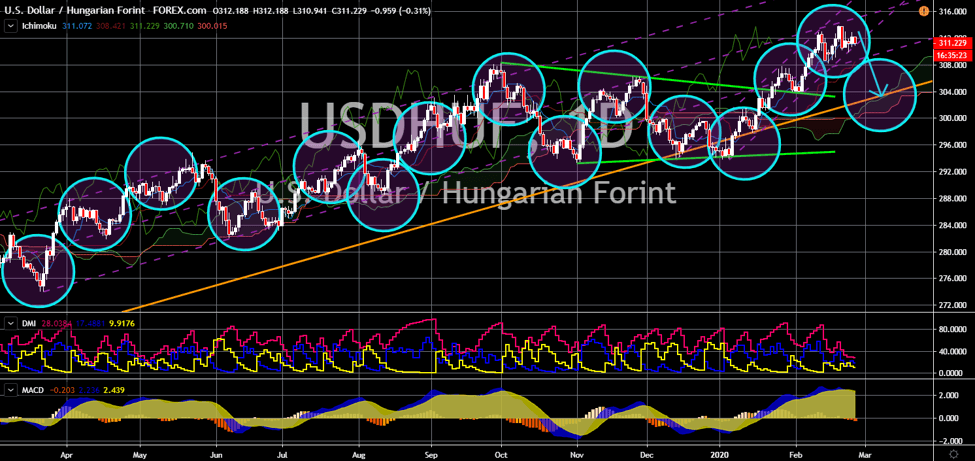

USD/MXN

The pair will continue its rally and go up to retest a major resistance line. Mexico made several milestones in January. The country had its lowest unemployment in decades after it posted 3.10% unemployment rate last month. At the same time, its trade balance is picking up at $3.068 billion. The figure in January was the highest since 1980. This was amid the signing of the phase one trade deal agreement between the United States and China. US President Donald Trump also signed the ratified NAFTA (North American Free Trade Agreement) in January. The new NAFTA will further boost the trading deal between the trilateral alliance of the United States, Mexico, and Canada. However, the country is unprepared for the next recession. The Banco de Mexico has no standing monetary policy to counter global economic uncertainty. Its high exposure to the US dollar could be the culprit for the weakness in the Mexican peso.

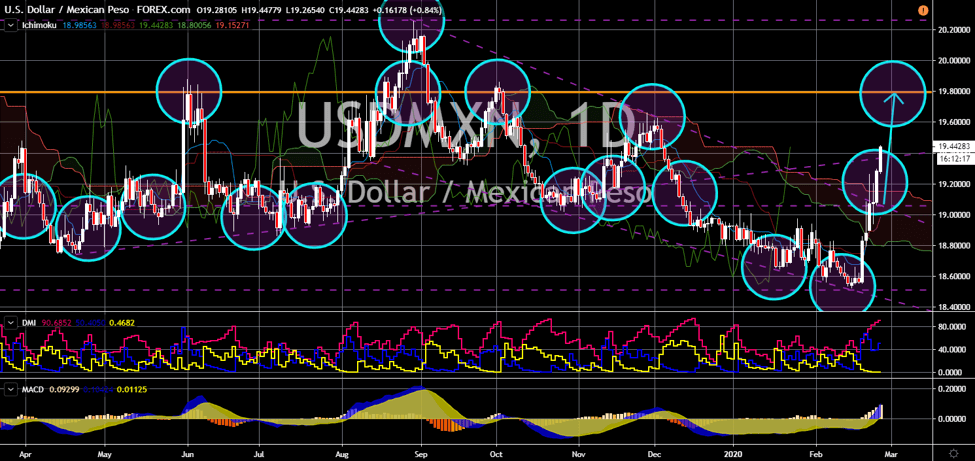

USD/NOK

The pair failed to break out from an uptrend channel resistance line, sending the pair lower. Norway is on track to keeping its currency stable. Oslo released additional coins and notes in circulation at the beginning of 2020. In January, the country released $500 million worth of Norwegian kroner. This was in response to its surging interest rate from 0.75% to 1.5% for fiscal 2019. The decline in the credit indicator also adds luster to the Norwegian kroner. For January, the gross domestic debt of the country increased by 5.1% which is lower than the 5.4% forecasted. It is also lower than the 5.6% recorded in December. Moreover, the unemployment rate dropped to 3.9% from 4.0% prior. Meanwhile, the record for unemployment change in January was 75.67K, lower than 76.70K expected and 76.68K prior. The United States has also reached a milestone last year with lower unemployment. However, fears of global economic slowdown creeps on the USD.