Market News and Charts for February 26, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

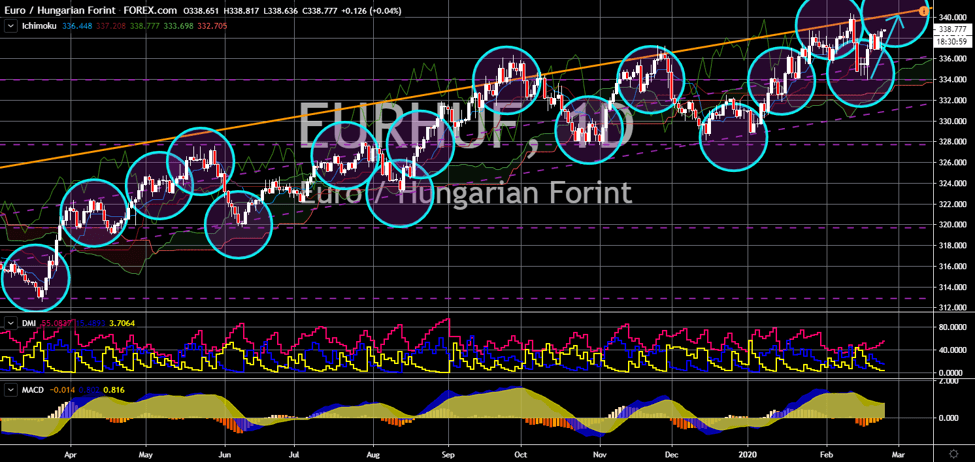

EUR/HUF

The pair bounced back from a key support line, sending the pair higher towards its previous high. The Nemzeti Bank, Hungary’s central bank, hold onto its current benchmark interest rate of 0.90%. This was despite investors’ concern on Hungary’s surging inflation. Hungary is one of the fastest growing economies in the European Union. However, the country also holds the record for the largest inflation among EU member states in 2019. Brexit Party leader Nigel Farage predicts Italy, Denmark, and Poland to be next countries to exit the European Union. However, Hungary is not on the list. This was despite Hungary being the leader of the eastern and nationalist bloc, the Visegrad Group. Analysts claim that the reason for its exclusion was its dependency on the EU funds. Moreover, Hungary is holding the Enlargement Portfolio of the European Union. This ensures that the opposition to the Germany-Franco leadership will not be the first to secede.

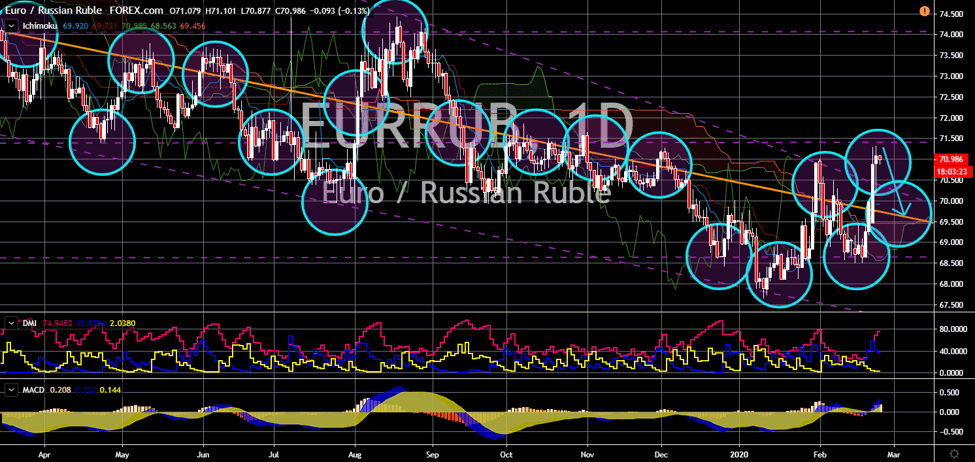

EUR/RUB

The pair failed to breakout from a major resistance line after its four (4) day rally. Croatia will take over the presidency of the European Council on June 30, 2020. Croatia said its strategy will be based on the main pillars: “A Europe that develops”; “A Europe that connects”; “A Europe that protects”; and “An influential Europe”. However, the “influential” part of it is at stake. Russia backs the ruling party of Croatian Democratic Union. Croatia also considers Russia as its third largest trading partner. It is also one of the largest importers of Russia’s liquified natural gas. Meanwhile, Serbia bought Russia’s Pantsir S1 air-defense system. Serbia is one of the five candidate countries for EU membership. In line with this, the EU cut its budget for Kaliningrad Transit Scheme. The transit allows Russian citizens in the exclave Russian territory to travel in Lithuania by road towards mainland Russia.

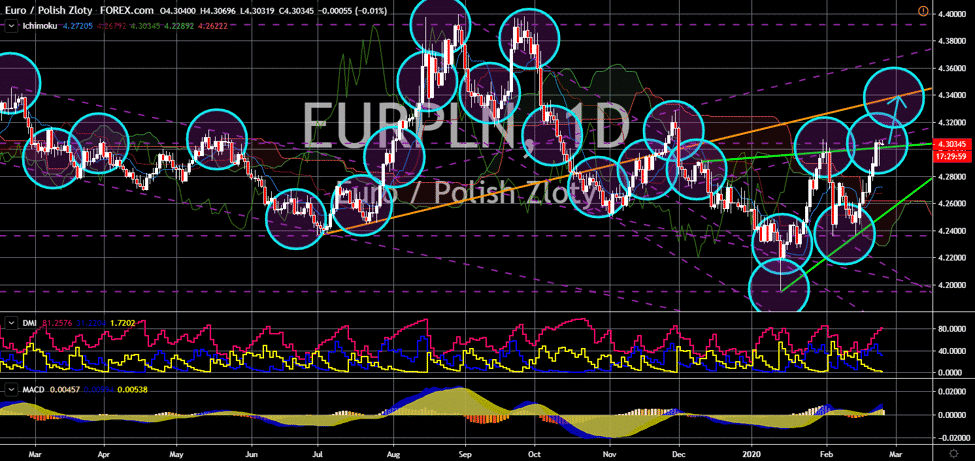

EUR/PLN

The pair will continue its rally towards a major uptrend resistance line. Poland unemployment rate grew for the third consecutive month to 5.5%. Though its part of the country’s unemployment cycle, the increase in M3 Money Supply is threatening to weaken the Polish zloty. M3 includes coins and notes in circulation and other assets that are convertible to cash, and short-term and long-term bank deposits. The increase in M3 for the month of March 2020 is 9.3%, higher than its previous record of 8.3%. It is also higher than the 8.8% increase forecasted by analysts. This will be catastrophic for its already high inflation rate at 4.4%. Meanwhile, the Eurozone recorded a slump in M3 at 5.0% from 5.6% in February, also lower from 5.5% expectations. The control in money supply will be good for its inflation data and for its economy. The weak economy will also weaken the political stance of Poland in the European Union.

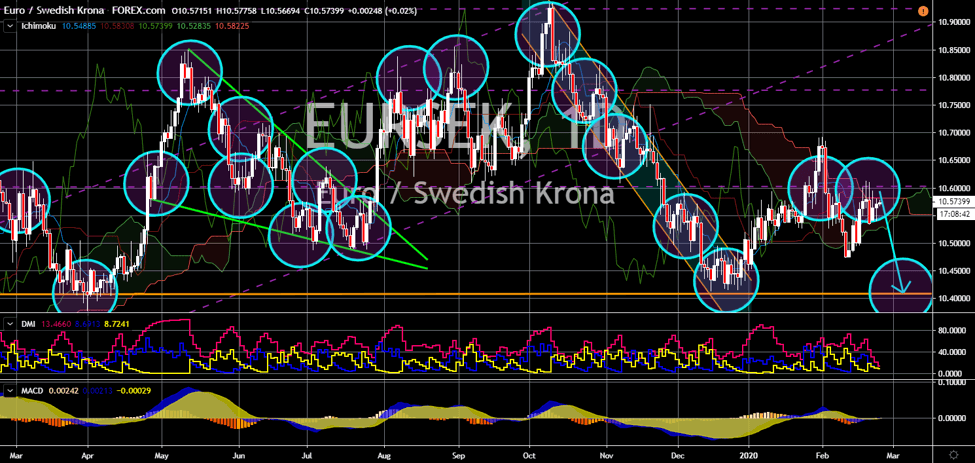

EUR/SEK

The pair failed to break out from a key resistance line, sending the pair lower towards its previous low. The European Union is under pressure to fill the gap that the United Kingdom left. This was after Britain officially leave the largest trading bloc in January 31, 2020. It is now requiring its member states to increase their contributing to the EU budget fund for the coming years. Brussels demanded Sweden to its annual share by 44%. However, Swedish Prime Minister Stefan Lofven stunned the EU after it said that “Brussels is not my priority”. Sweden is known as one of the frugal four (4) European countries who resisted the call for a budget hike. He argued that countries with much bigger economies should pay for the increase. He was directly referring to Germany, the economic powerhouse of the EU. However, Berlin is also experiencing problems with its own economy. For the fourth quarter of 2019, the country recorded a zero (0) percent growth.