Market News and Charts for February 24, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

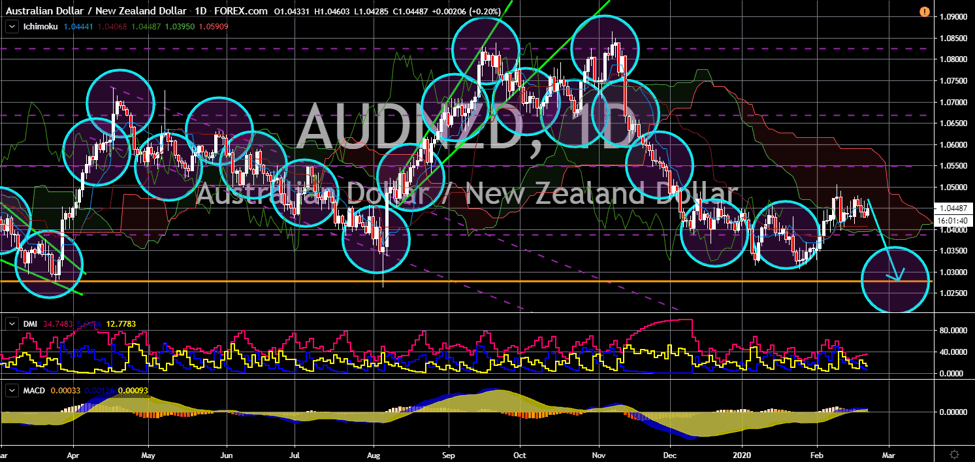

USD/CNH

The pair will continue to move higher after it broke out from a downtrend channel resistance line. The US Federal Reserve hold onto its current benchmark interest rate of 1.75%. Fed Chair Jerome Powell said America’s economic outlook had gotten stronger. This was amid the signing of the phase one trade deal between the United States and China. However, the central bank might reassess this claim following the economic threat posed by coronavirus. The COVID-19 began to make headlines in mid-January. The virus originated from Wuhan, China and many analysts warned of its economic implications. The US is a tourist destination for many Chinese nationals. There are 2.84 million Chinese who visited America in 2019 and projection shows it will boom to 3.52 million by 2024. However, the effect on China’s economy will be bigger. The sluggish Chinese economy will further slow with the spread of coronavirus.

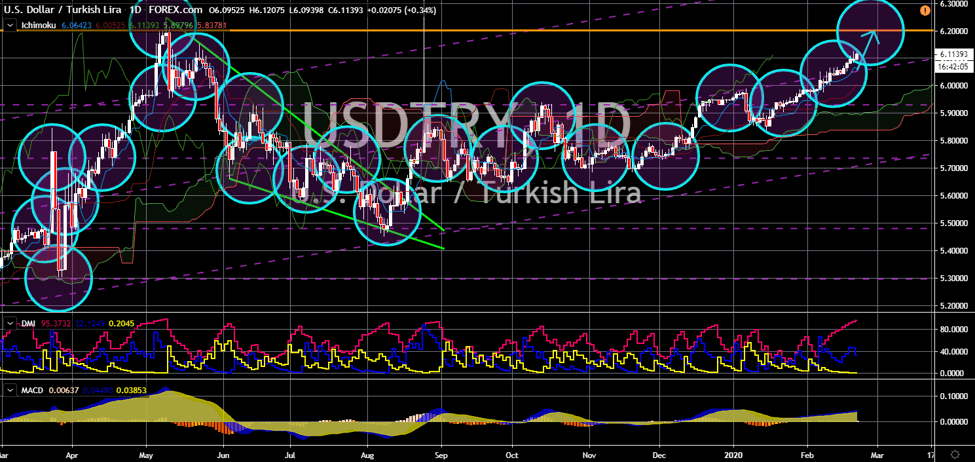

USD/TRY

The pair will continue its rally and head towards its previous high. The United States and Turkey’s relationship is in a better position these days. Turkey asked the US to deploy its homegrown THAAD (Terminal High Altitude Area Defense). This was despite Ankara purchasing Russia’s S-400 missile defense system, which angers the United States. The fallout of the Turkey-Russia relationship was due to the killing of Turkey soldiers by the Assad government in Syria. With regards to lira, the Turkish currency continues to plunge in value amid interest rate cuts. Since 2019, the country slashed 13,250 basis points, from 24% in the first half of 2019 to 10.75% in February 20. As Turkey asked for US support, a possibility of the F-35 program being brought back to life is imminent. The US cancelled Turkey from the program after its purchase of the S-400. The demand for US dollar will increase if the F-35 program reinstated.

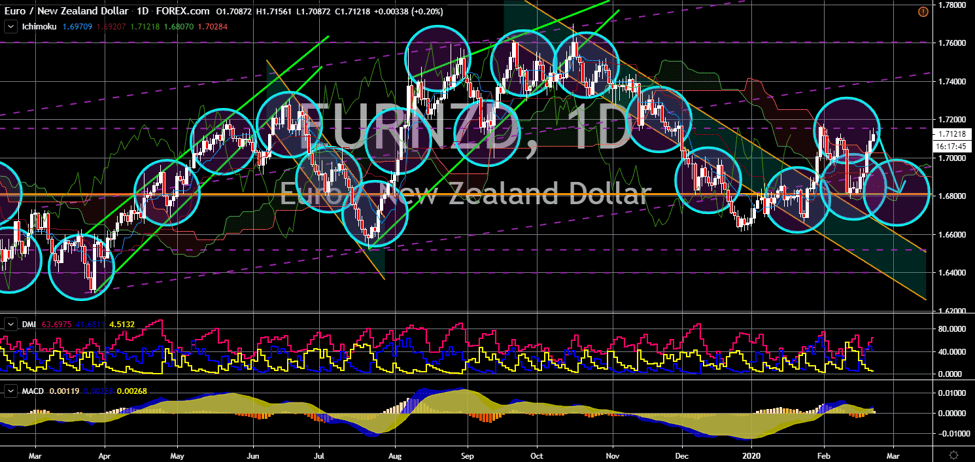

EUR/NZD

The pair will fail to breakout from a major resistance line, sending the pair lower towards a key support line. The European Union is under pressure to hold its member states together. This was after the United Kingdom withdraw from the bloc last month. Populist governments across the bloc are also on the rise, threatening the Germano-Franco leadership. Brexit Party leader Nigel Farage said Italy, Denmark, and Poland are the next members to exit the European Union. He further added that the collapse of the largest trading bloc is imminent within the next ten (10) years. However, these are not the only reason for the weakness of the single currency. The UK began on negotiating post-Brexit trade agreements with non-EU countries. Among the potential countries to join the post-Brexit agreement were Australia, Canada, and New Zealand. These countries were former UK colonies and had an ongoing free trade agreement (FTA) with the European Union.

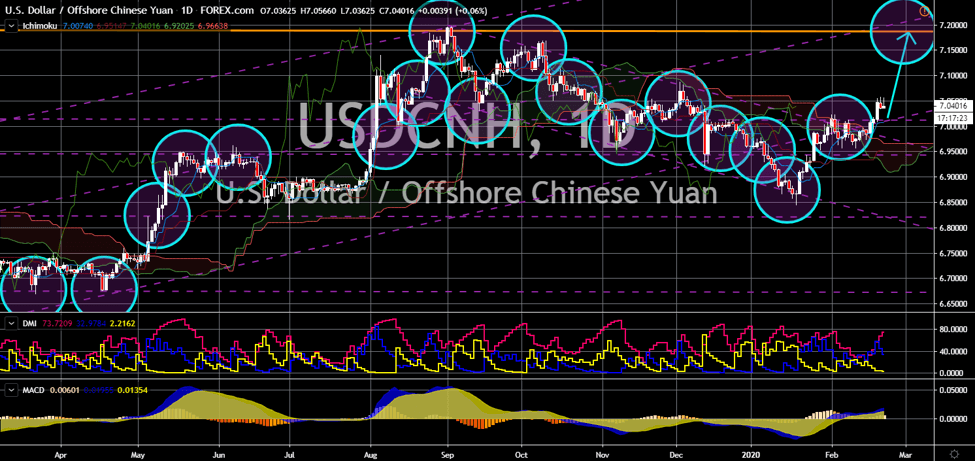

AUD/NZD

The pair will move lower in the following days towards its March 22 low. Australia’s economy is contracting after it published a below 50-points report for Manufacturing and Services Purchasing Managers Index (PMI). For manufacturing PMI, figures were at 49.8 which is higher from the previous record of 49.6 points. Meanwhile services PMI was at 48.4, lower than the 50.6 points previously recorded. Below 50 points is a contraction in the economy while above 50 is an economic expansion. The two (2) economies took a hit from the escalating US-China trade war in 2019 and from coronavirus this 2020. They are also the prime beneficiaries from the UK’s withdrawal to the largest trading bloc. However, New Zealand economy is far resilient from Australia. The country improved its ties with China and the Muslim countries at the last quarter of 2019. New Zealand Prime Minister Jacinda Ardern is hailed for her independent foreign policies.