Market News and Charts for February 21, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

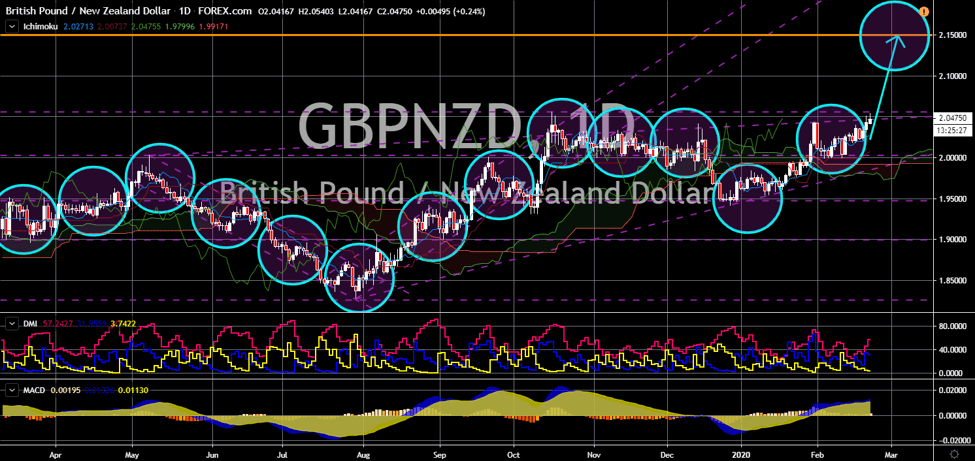

GBP/AUD

The pair bounced back from a major support line, sending the pair higher towards its previous high. Despite worries of a looming recession, the United Kingdom was able to publish positive results today, February 21. The result for UK Composite and Manufacturing Purchasing Managers’ Index (PMI) were higher from Wall Street expectations. For composite, the figure is 53.3 versus 52.8 expectations. Meanwhile, manufacturing is still expanding at 51.9 despite the forecasted contraction at 49.7. Above 50 points results represents expansion while contraction occurs when figures drop below 50. As the United Kingdom frees itself from the European Union, Australia is lock with its high exposure with China. The country took a hit from the US-China trade war and has been suffering from the slump of Chinese tourists in the country. The threat posed by the coronavirus has left Australia’s tourism industry vulnerable.

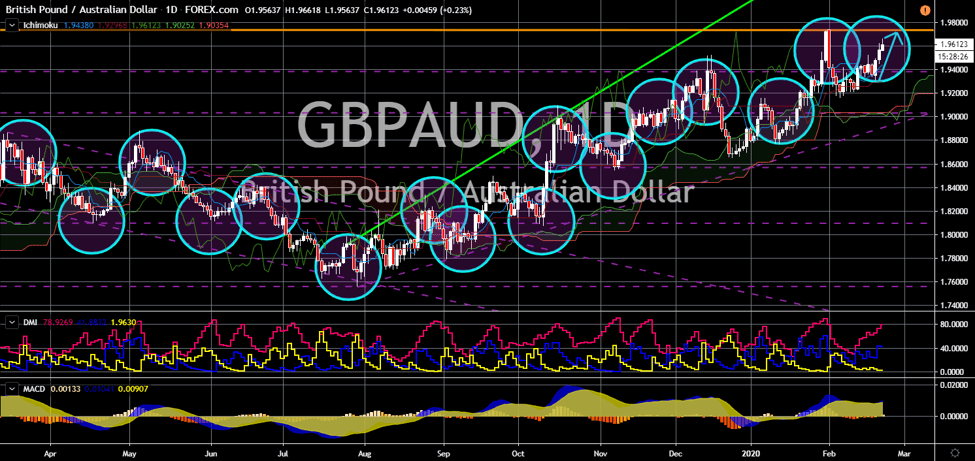

GBP/CAD

GBP/CAD

The pair bounced back from a “Rising Widening Wedge” pattern support line, sending the pair higher. With the Brexit coming to an end, the Megxit is starting out. In January 31, the United Kingdom officially withdraw from the European Union. Meanwhile, a rift between the British Royal Family is starting to unfold. The Dutch and Duchess of Sussex is leaving their royal duties to live as private citizens in Canada. At first, many investors became optimistic with the decision of the royal couples. Until Queen Elizabeth II intervened and announced that Prince Harry and Meghan Markel cannot use their “royal” brand. This means that Canada will not reap the benefit of having the couple in their country. In other news, Canada might lose its special status with the European Union after the UK seeks a similar agreement with the EU. Brussels argued that Britain cannot have the same benefit with its member states.

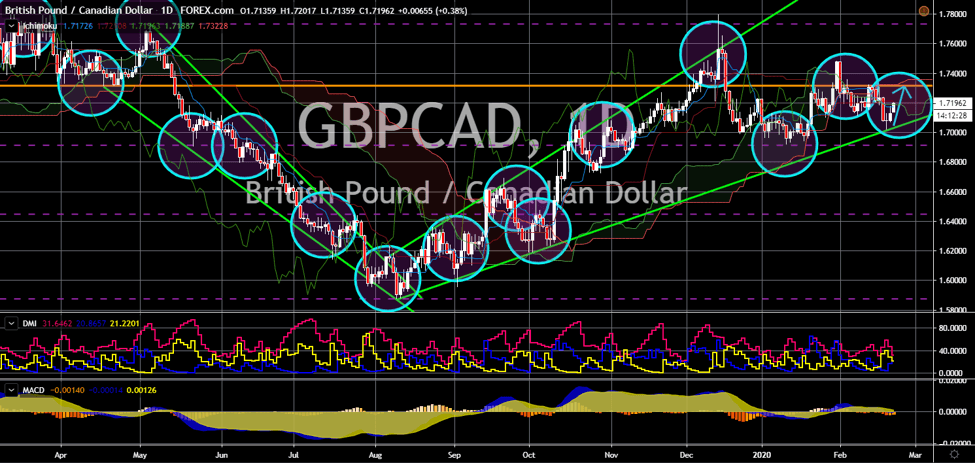

USD/DKK

USD/DKK

The pair will continue to move higher in the following days towards its 34-month high. US President Donald Trump is not giving up on Greenland. On his budget proposal for 2021, Trump allocated $587,000 to open a full-time US Consulate in Greenland. In August, the US president expressed his interest in buying the Danish territory. His announcement came as the issue of global warming and ice melting in the Arctic region became mainstream. The United States and Russia also pull out from the 1987 nuclear pact treaty, the INF (Intermediate-range Nuclear Forces). This means that the two (2) nuclear-armed countries can develop more nuclear weapons. Political analysts warned that the Arctic region will become the next battleground of the two (2) countries. Once the ice melted in the Arctic, the US will be closer to Russia. Greenland is an autonomous region and part of the Kingdom of Denmark.

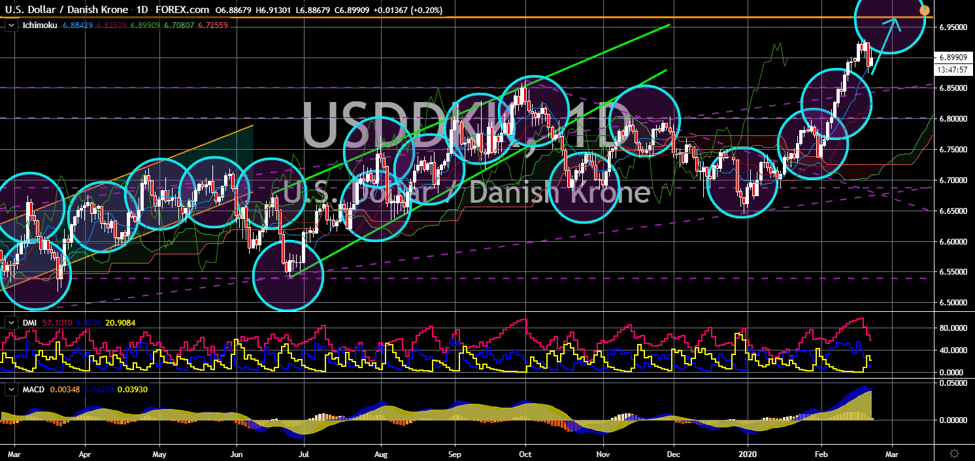

GBP/NZD

GBP/NZD

The pair will break out from a major resistance line, sending the pair higher towards its nearest resistance line. Today, February 21, the United Kingdom published three (3) key reports for composite, manufacturing, and services PMIs. 2 out of 3 reports turn out to be positive, fueling the demand for the British pound. Moreover, all figures were above 50-points, which means that the UK economy is still expanding. Many economists and investors became wary of the UK’s withdrawal from the EU. However, the decision by Prime Minister Boris Johnson showed that majority of the UK Parliament back his Brexit deal. This resulted to an orderly Brexit. Among the countries who first expressed their interest in post-Brexit trade agreement is New Zealand. However, analysts are worried that its exposure to China might derail that benefits it is set to reap. A UK representative previously told his NZ counterpart that the country kiwis were UK’s priority.