Market News and Charts for February 19, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

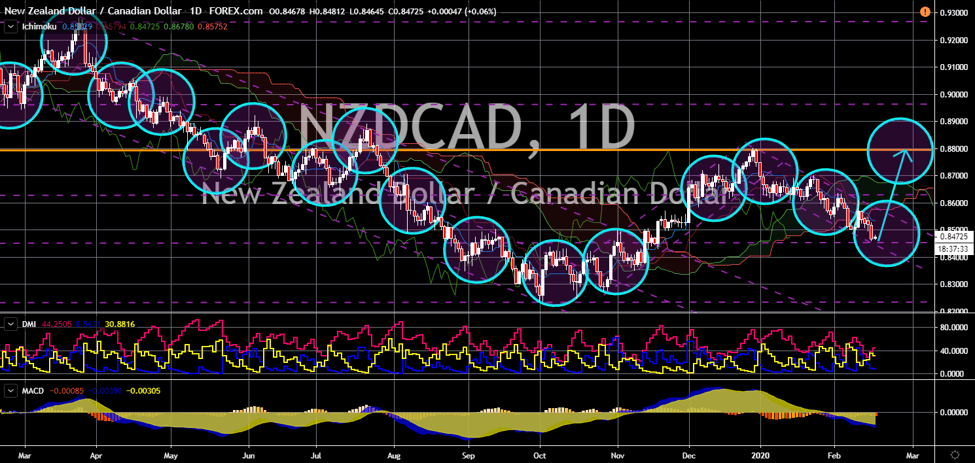

NZD/CAD

The pair will bounce back from a downtrend channel support line, sending the pair higher towards its previous low. Yesterday, February 18, Canada reported a weaker-than-expected manufacturing sale for January. It posted a negative growth of 0.7% while analysts expect a positive result of 0.5%. Despite this, the figures were still above December’s record of -1.0%, though still on the negative territory. With lower manufacturing sales, Canada’s Consumer Price Index (CPI) month-over-month (MoM) and year-over—year (YoY) is under pressure. Lower sales signify a lower increase in the price of goods and services, except for food and energy. This, in turn, will dampen the inflation rate, making it hard to achieve the 1%-3% target range. New Zealand is also set to publish a major report today. Last month, the result for the NZ’s Producer Price Index (PPI) Output and Input were both positive. Analysts were expecting another positive result for this month.

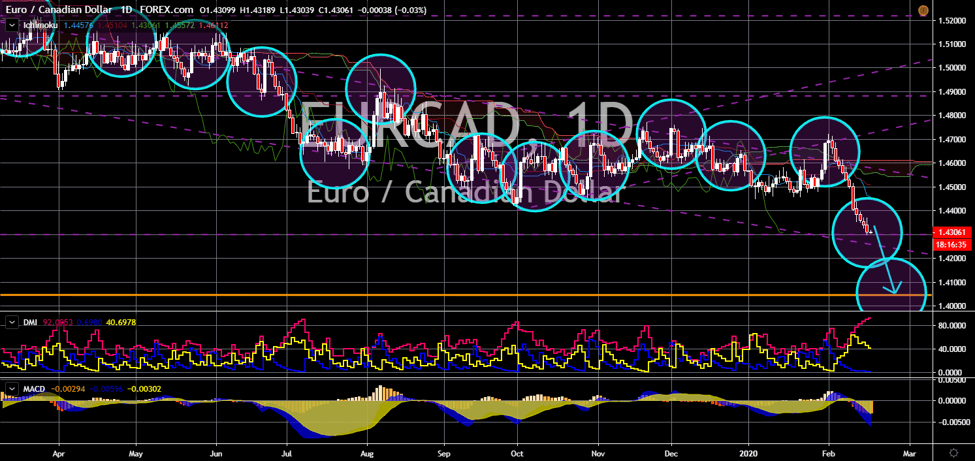

EUR/CAD

The pair will continue its steep decline, sending the pair lower towards its April 2017 low. Despite having good data for its car manufacturing industry, Germany is still struggling to make its economy afloat. Analysts further warned a vacuum hole in the EU economy following the withdrawal of the United Kingdom. The UK is the second largest economy in Europe and fifth in the world. Moreover, Brussels might lose its trading partners over Britain as the latter begin its post-Brexit negotiations. Former UK colonies – Australia, Canada, and New Zealand – are leading the agreement. Canada will have a special place for the UK as the Dutch and Duchess of Sussex move into the country. The Royal Family will be increasing its ties in Canada to support the members of their family. Canada is one of the most resilient economies in the world. The Bank of Canada (BOC) haven’t cut rates yet despite the world racing to the bottom.

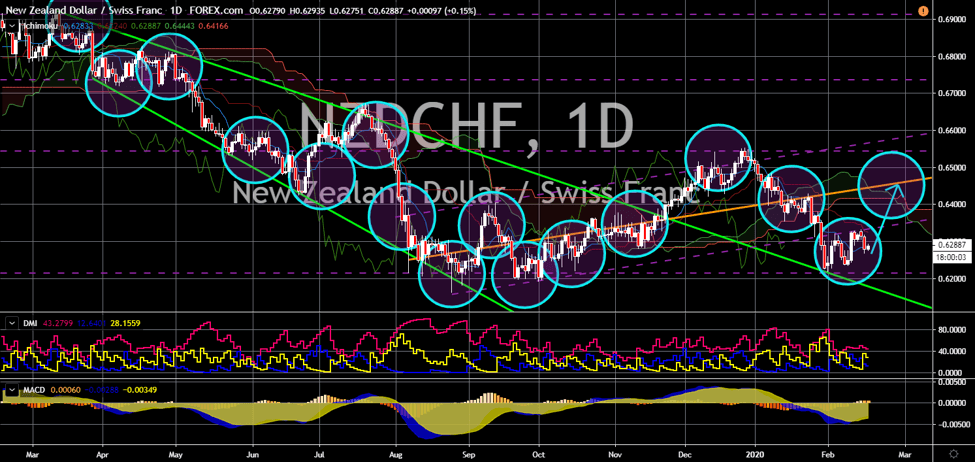

NZD/CHF

The pair will continue to move higher in the following days after hitting a major support line. Switzerland is in a political chaos after it passed a referendum cutting the free movement agreement with the European Union. On May, Switzerland will have the result for its Brexit moment, and this could begin a new ear for Europe. However, this could also spell a new rift between Switzerland and the European Union. Recently, Bern rejected the framework deal with Brussels which will incorporate all their existing bilateral trade agreements. Though Switzerland is not an EU-member state, it can access the Single Market through bilateral agreement. The turmoil could cost Switzerland its safe-haven status, which will be beneficial for New Zealand. In the recent months, NZ has been keen on establishing its independent foreign policy. It shrugs off pressures from the US and increase ties with China and the Arab countries.

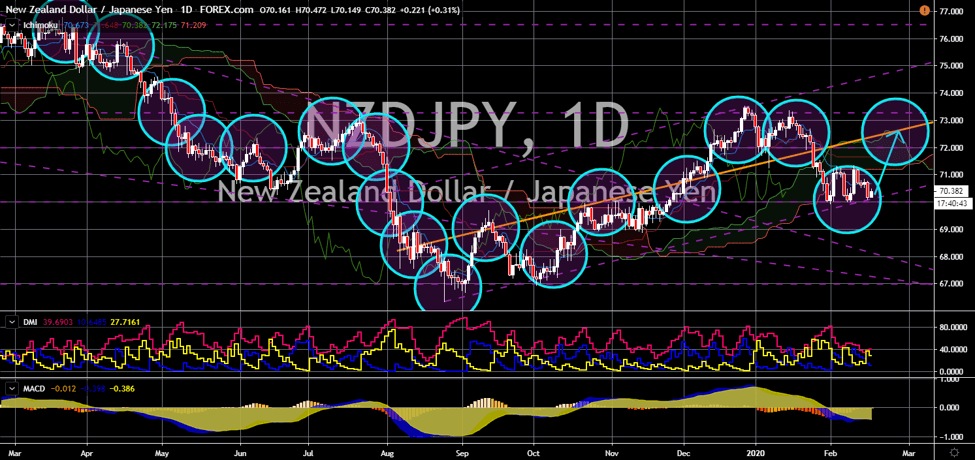

NZD/JPY

The pair will bounce back from an uptrend support line, sending the pair higher towards the channel’s middle resistance line. Japan is on the verge of recession after posting a negative growth of 1.6% in the fourth quarter of 2019. This is the biggest decline in GDP growth in six (6) years. The weak consumer demand combined with the drop in Chinese trades haunted the final quarter GDP of Japan. In addition, the economic threat posed by the coronavirus will make it hard for Japan to recover from the recent slump. The COVID-19 will affect Japan’s tourism. In the first half of 2019, there are 4.5 million Chinese tourists in the country. This is a massive surge of 11.7% compared to the first quarter of 2018. Meanwhile, New Zealand will shrug off the threat as it was able to diversify its economy. The country is currently in negotiation for a post-Brexit trade agreement and possibly a free movement with the UK.