Market News and Charts for February 15, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

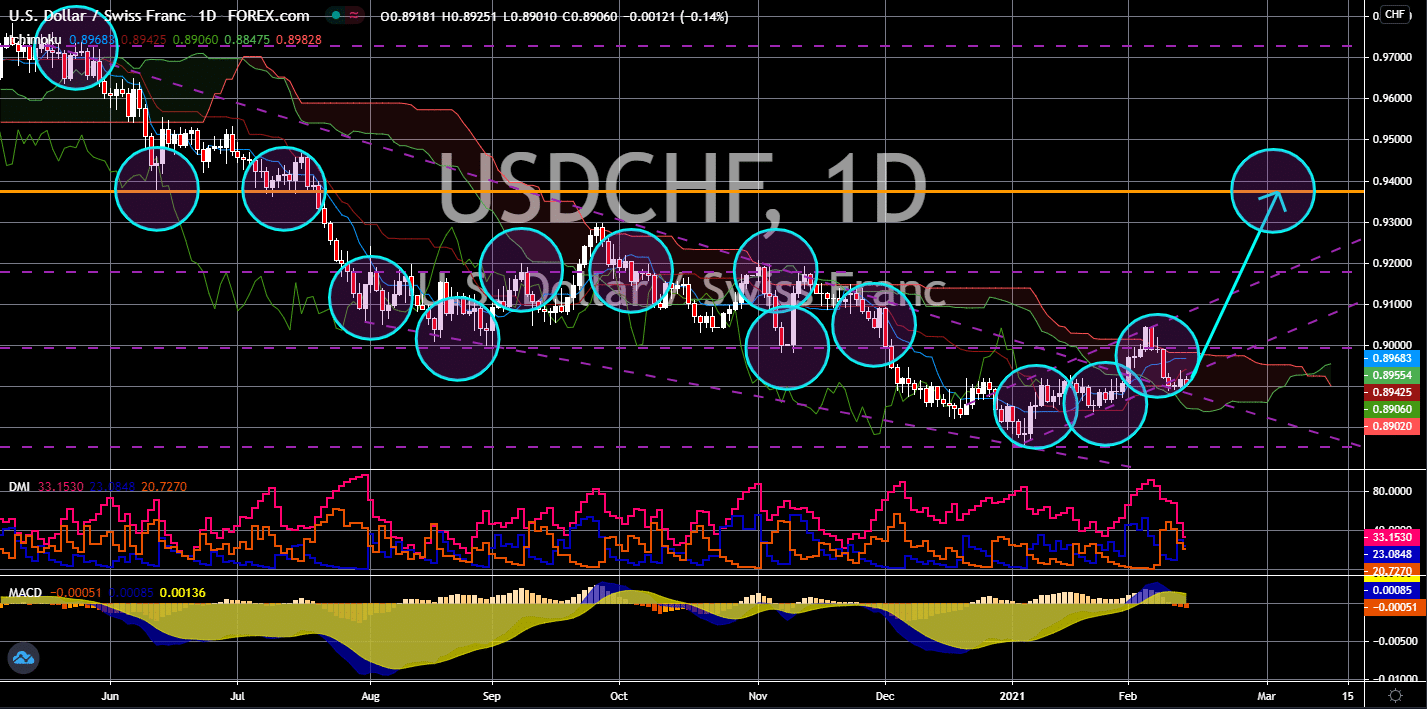

USD/CHF

The pair will continue to move higher in the following days towards the 0.93750 resistance area. Switzerland’s consumer price index (CPI) for the month of January advanced by 0.1% against -0.1% result prior. Despite the positive figure, the figure still represents a -0.5% drop from the same month in 2019. In addition to this, analysts are expecting the fourth quarter of 2020 to shrink by -0.7%, which they believe will be followed by -0.6 decline in the first three (3) months of fiscal 2021. The bleak forecasts are expected to put a dent of the safe-haven status of the Swiss franc. On the other hand, investors are divided over the increased consumption of crude oil and the looming passing of the $1.9 trillion stimulus proposal. A continued decline in crude oil inventories is positive for the greenback as lower inventory projects higher economic activity. On the other hand, the passing of President Joe Biden’s economic aid proposal will lessen the value of the USD.

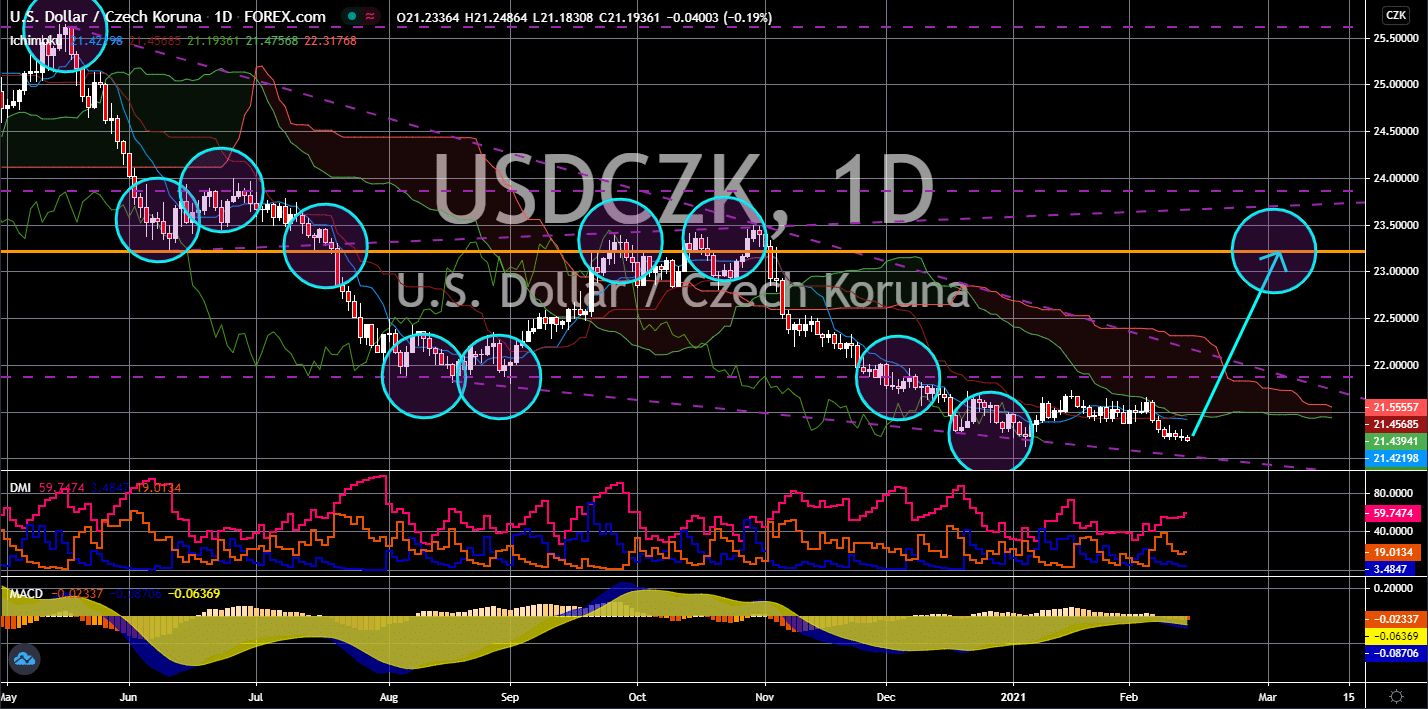

USD/CZK

The pair will reverse back from its lows to retest its previous high in the coming days. Germany shut its border with Czech Republic at a time when the latter was tightening its FDI restrictions. Czechia’s ruled out a stricter examination of foreign direct investments in the country, which could make Prague an unfavorable investment location among foreign investors. In addition to this, the government’s budget in December incurred a deficit of -3.910 billion. This was the first reported negative figure since June 2020. Investors are expected to shrug off the positive data from the consumer price index (CPI) reports due to the above-mentioned factors that will affect the local economy. As for the US, investors should keep an eye on the weekly report from the American Petroleum Institute (API) and Energy Information Administration (EIA) for short-term trades.

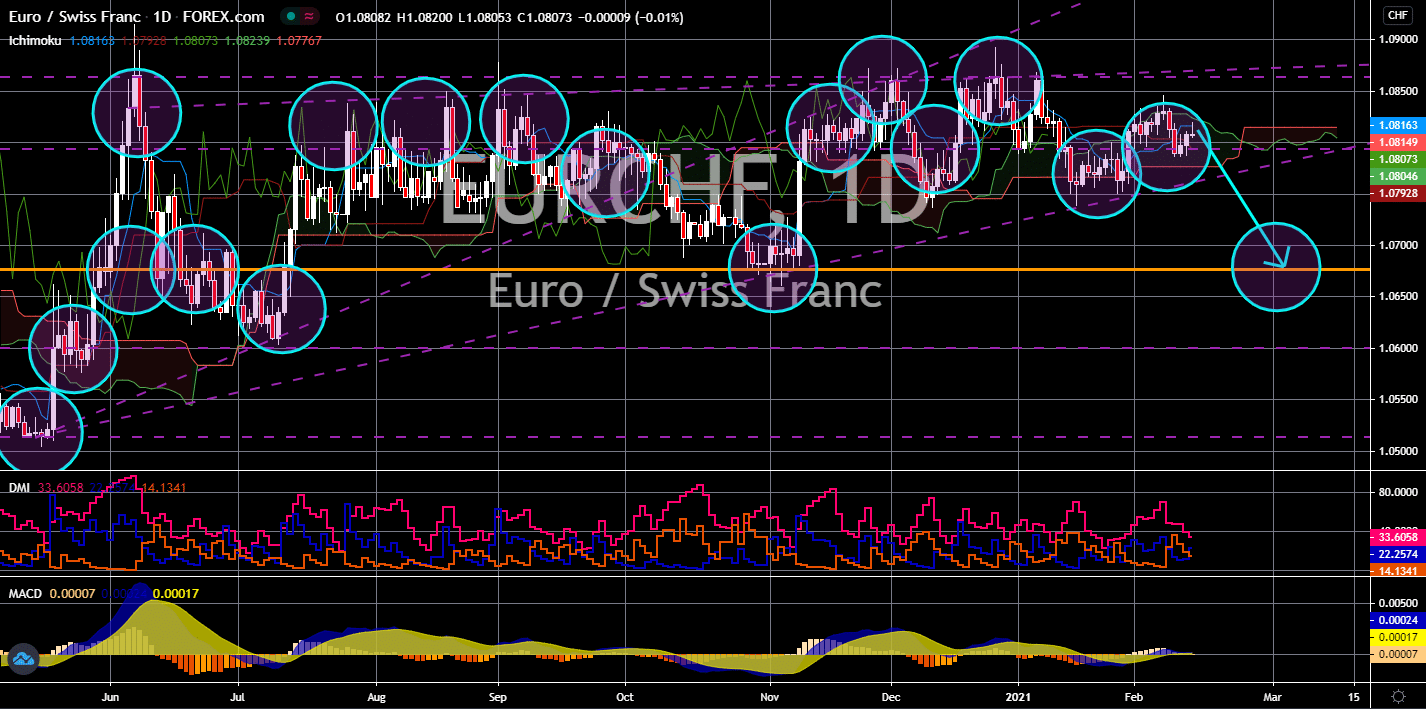

EUR/CHF

The pair will decline towards November 2020’s low of 1.06766. The Eurozone is projected to shrink in the fourth and final quarter of fiscal 2020 due to the resurgence of COVID-19 in October. Analysts further expected the currency bloc to contract in the first three (3) months of 2021 due to the delay of vaccine delivery. But EU officials were optimistic for Q2 recovery when additional deliveries for the European Union arrived. However, 2021 GDP forecast is still expected to lag behind the initial target of 4.2% with 3.8% estimate. As for the recently published report from the EU, Industrial Production MoM and YoY both posted worse-than-expected results. Figure came in at -1.6% and -0.8%, respectively. For the monthly report, the -1.6% data was the worst published result since June 2020. On the other hand, the year-over-year report ended eight (8) months of improvement for the report. The euro currency will lag in the short-term against the Swiss franc.

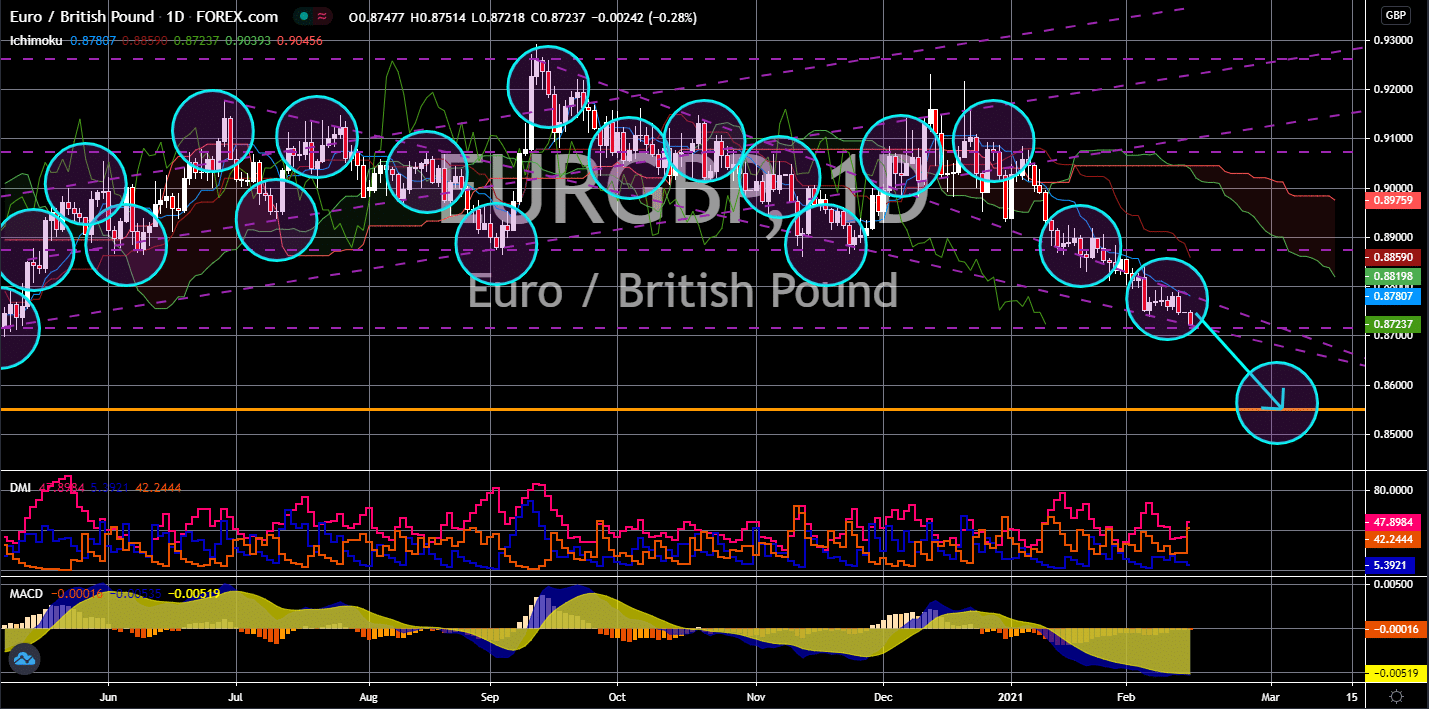

EUR/GBP

The pair will break down from its current support line to reach the 0.85500 price zone. Investors in the UK economy are now turning to the British pound after annual GDP recorded 10% contraction in 2020. The reported figure was the steepest decline since the “Great Frost” in the United Kingdom three (3) centuries ago. Meanwhile, Britain avoided a double-dip recession after its economy grew by 1.0% in Q4 2021. On a year-on-year basis, the figure came in at -7.8%. Both Construction Output and Manufacturing Production also posted disappointing results on Friday’s report, February 12. The figures were -2.9% and 0.3% for the month of December. As for the construction output, the negative result was the first in eight (8) months while the 0.3% growth from manufacturing production was the slowest since October. Investors expect the British economy to continue to lag with the rising tension between the United Kingdom and the EU.