Market News and Charts for February 12, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

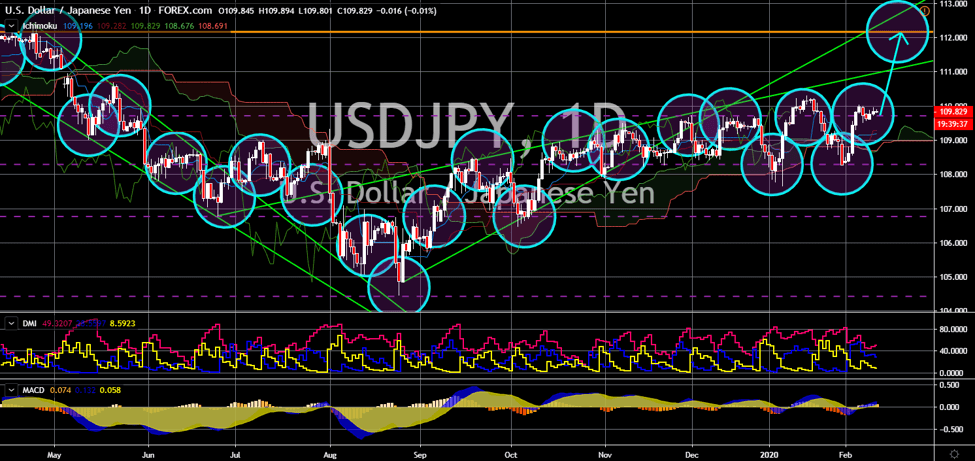

USD/CHF

The pair will continue its rally in coming sessions, sending the pair higher to retest a key resistance line. A US report on expectations for the federal budget for the year 2021 is due today, February 12. Analysts were anticipating a higher budget for next year as US President Donald Trump increased budgets to counter China. In addition to this, Federal Reserve Chairman Jerome Powell is set to speak before the public. He will give updates on the current economic outlook of the country and recent monetary actions it has taken. Meanwhile, President Trump is getting wary of Switzerland. The US places the European country on its trade watchlist after Bern’s trade surplus with Washington totaled to $21.8 billion in the fourth quarter. This was despite the country having a current account surplus of 10.7% of its GDP on the same period. In line with this, Donald Trump is seeking a trading agreement with Switzerland to limit the trade surplus.

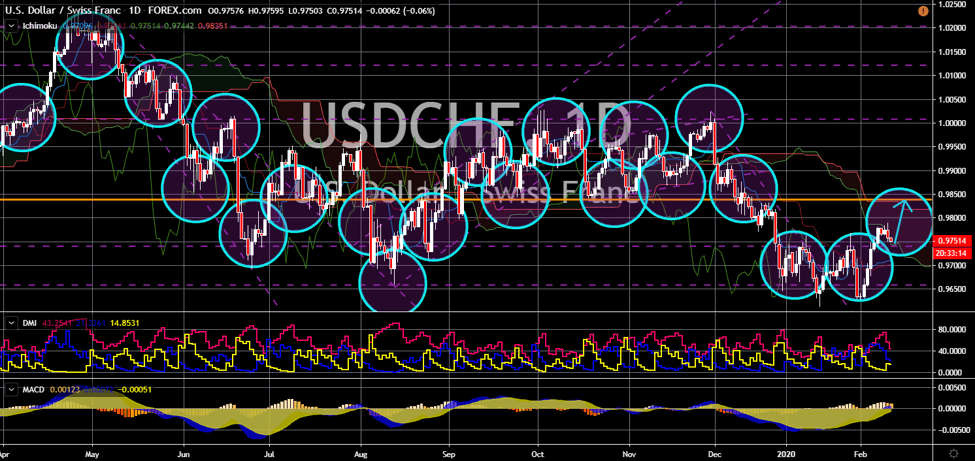

GBP/USD

GBP/USD

The pair will continue to trade lower in the following days. For his first visit after the UK’s withdrawal from the European Union, Conor Burns visited the state of Texas. The UK minister of state for trade policy said Texas is a “beacon” of free market capitalism. The comments came after he said the United Kingdom is now open for business. Britain’s withdrawal from the EU allows it to make bilateral trade agreements with other countries without the supervision of Brussels. The US-UK trade agreement will be the first for the United Kingdom in more than 47 years. Meanwhile, the National Institute of Economic and Social Research (NIESR) gross domestic product (GDP) for January will be sluggish. This was amid uncertainty surrounding the Brexit deal between the United Kingdom and the European Union before the Brexit. Analysts are also anticipating the country to have slower growth as its transitions to be an independent country.

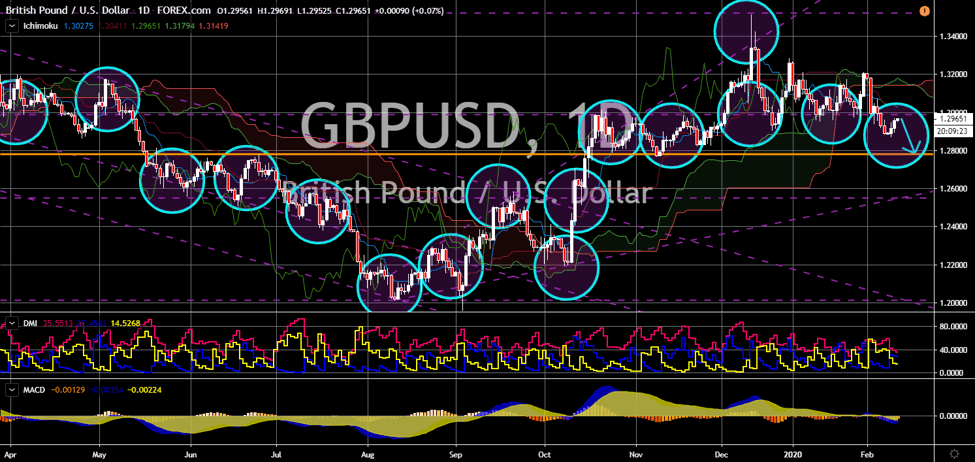

EUR/USD

EUR/USD

The pair will continue its steep decline and revisit its 34-month low. Investors anticipate the EU to post negative figures for its Industrial Production reports MoM and YoY. Last month, the report failed to beat analysts’ forecast of -1.1% for its Industrial Production year-over-year (YoY). The same thing is true for its month-over-month (MoM) Industrial Production after it posted 0.2% result, below 0.3% forecasted. Analysts further expect the report to continue to fail to beat their targets, making the EURUSD pair to fall. The projection came from analysts anticipating that the economic impact of Brexit will be hard for the EU. The United Kingdom is the third largest economy in Europe. The country was also the fifth largest economy in the world. As the EU and the UK move against each other, the UK is building its ties with the US. A trading deal between the two (2) countries is at hindsight in the months to come.

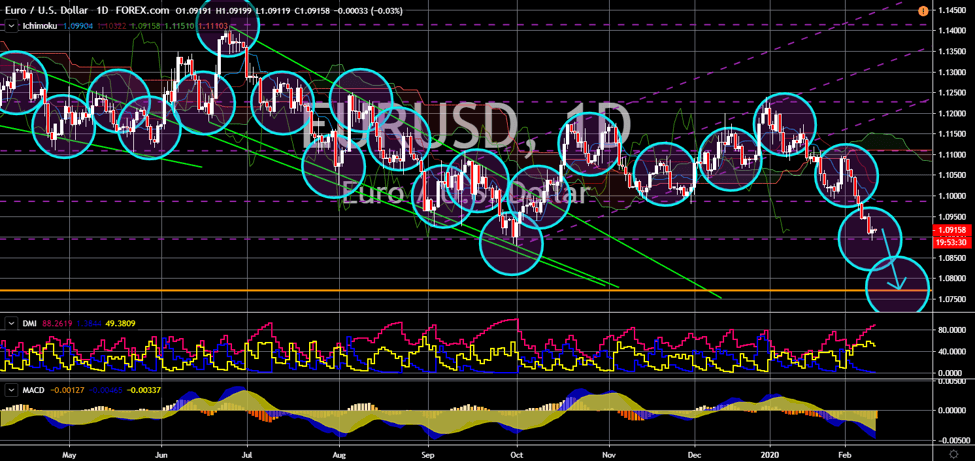

USD/JPY

USD/JPY

The pair will continue to go up in the following days to continue its “Cup and Handle” formation. Japan’s Producer Price Index (PPI) month-over-month (MoM) and year-over-year (YoY) will continue posting disappointing results. The PPI YoY’s January result was the second positive result it had following five (5) consecutive negative results. Analysts were pessimistic that January figures was just an effect of the holiday season. On the other hand, PPI MoM continues to decline after three (3) positive results. Analysts expected the report to dip on the negative territory this month. All anticipations from analysts came from Japan’s Machine Tool Orders report, a key report for producers. This report is also due today, February 12. Since December 2018, the report was sitting at the negative territory with last month’s result recorded at -33.6%. A possibility of higher US federal budget will also strengthen the dollar against the Japanese yen.