Market News and Charts for December 31, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

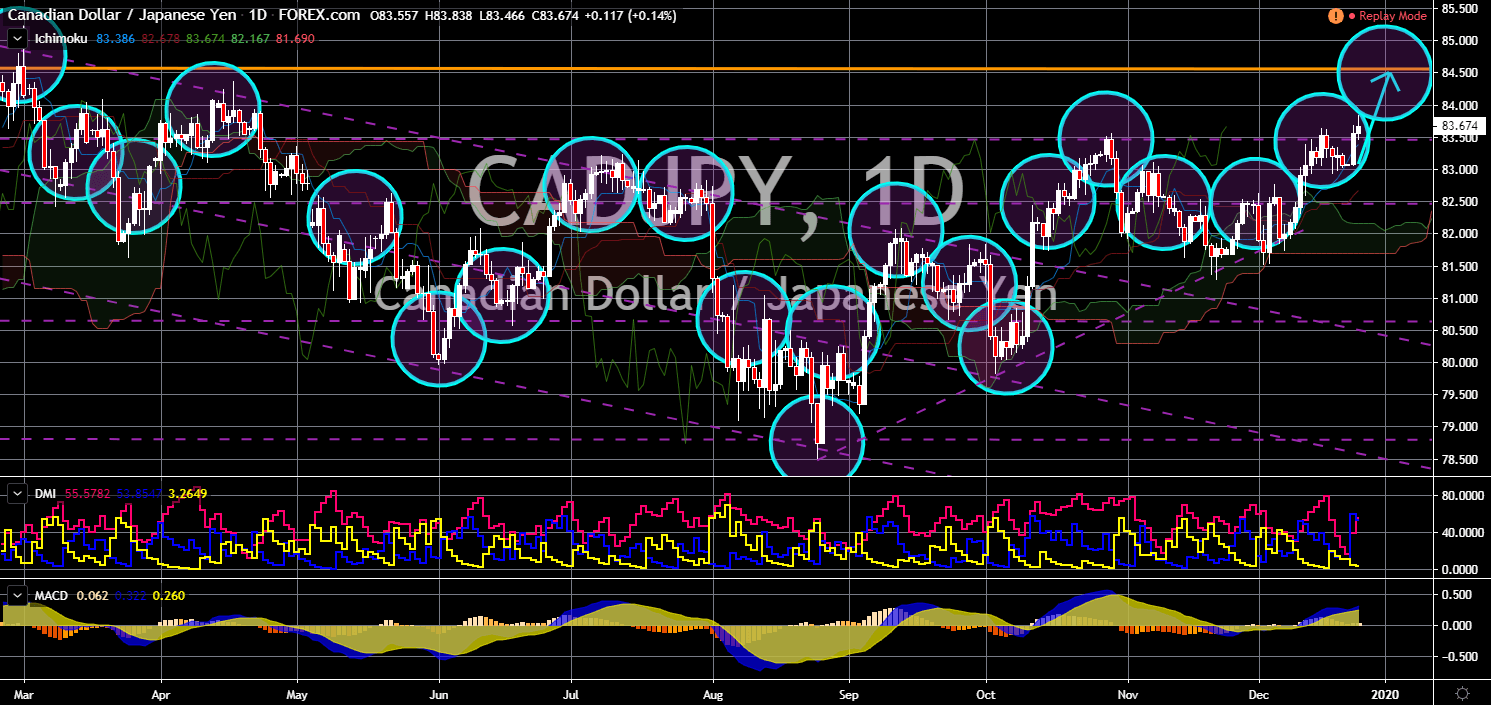

CAD/JPY

The pair will continue to move higher in the following days after it broke out from a major resistance line. Japan started 2019 with a bang following the ratification of the pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Aside from this, the country expanded its trading agreement with the European Union with the new EU-Japan free trade deal. Canada, on the other hand, was struggling with the signing of the ratified USMCA (United States-Mexico-Canada) deal following the tension in the US Congress between Democrats and Republican. Despite the strong international presence, however, Japan was struggling with its domestic fiscal and monetary policy. The Bank of Japan (BOJ), despite being one (1) of the only four (4) countries with a negative interest rate, was pressured to yet again cut its rates. This was amid the US-China trade war and its own trade war with South Korea.

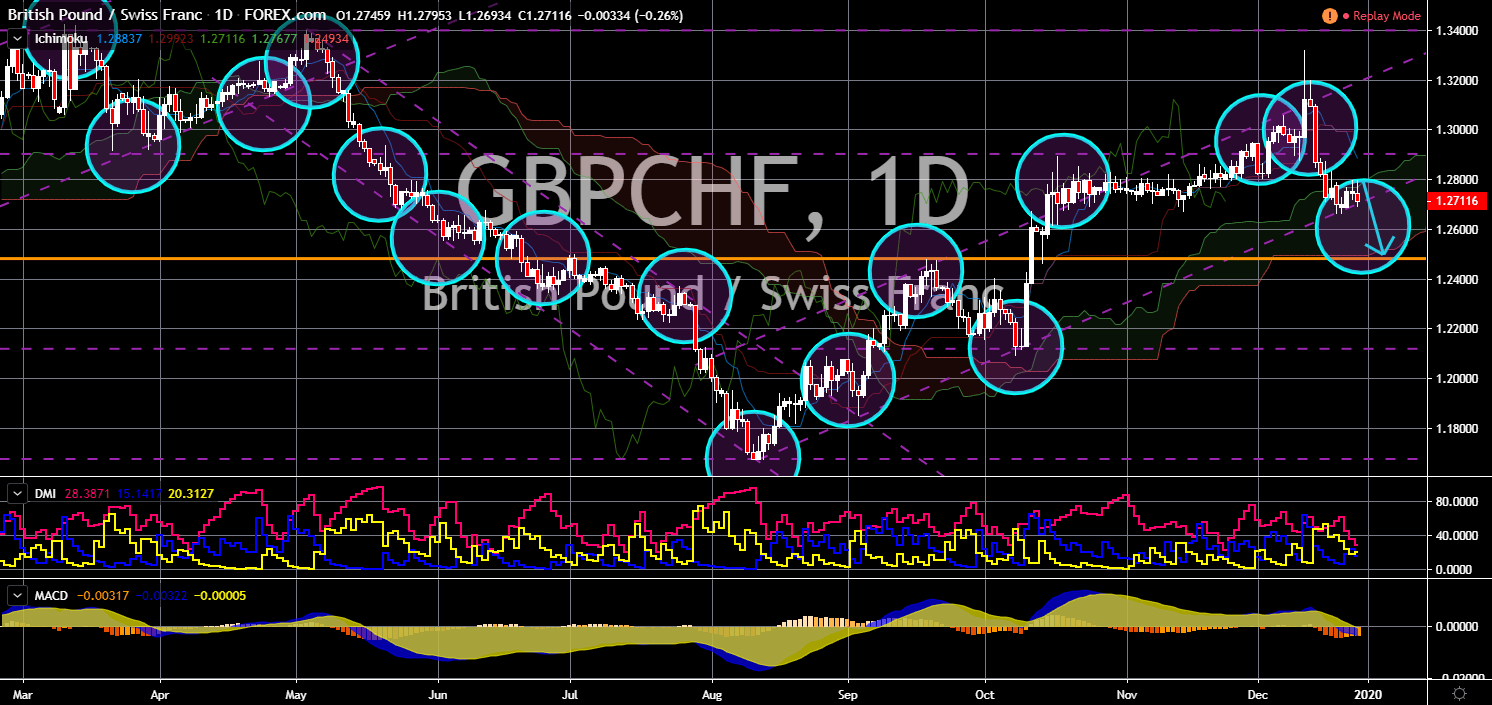

GBP/CHF

GBP/CHF

The pair is expected to break down from an uptrend channel support line, sending the pair lower towards the nearest support. The chance of getting Brexit done on January 31 is at its high following the landslide victory of UK Prime Minister Boris Johnson on the December 12 election. The Conservative Party was able to gain 365 of the 650 seats in the parliament, beating Labour Party’s record of 262 seats. However, a possible “no-deal Brexit” scenario is threatening an orderly Brexit and putting the UK economy in the brink of uncertainty. The no-deal Brexit is also expected to trigger the post-Brexit trade agreement. Switzerland is watching closely as the event unfolds following the recent announcement of the Swiss National Bank (SNB). The central bank said it is planning to lift its negative rates and begin 2020 on the positive territory. Switzerland has currently the lowest interest rate in the world at negative 0.75%.

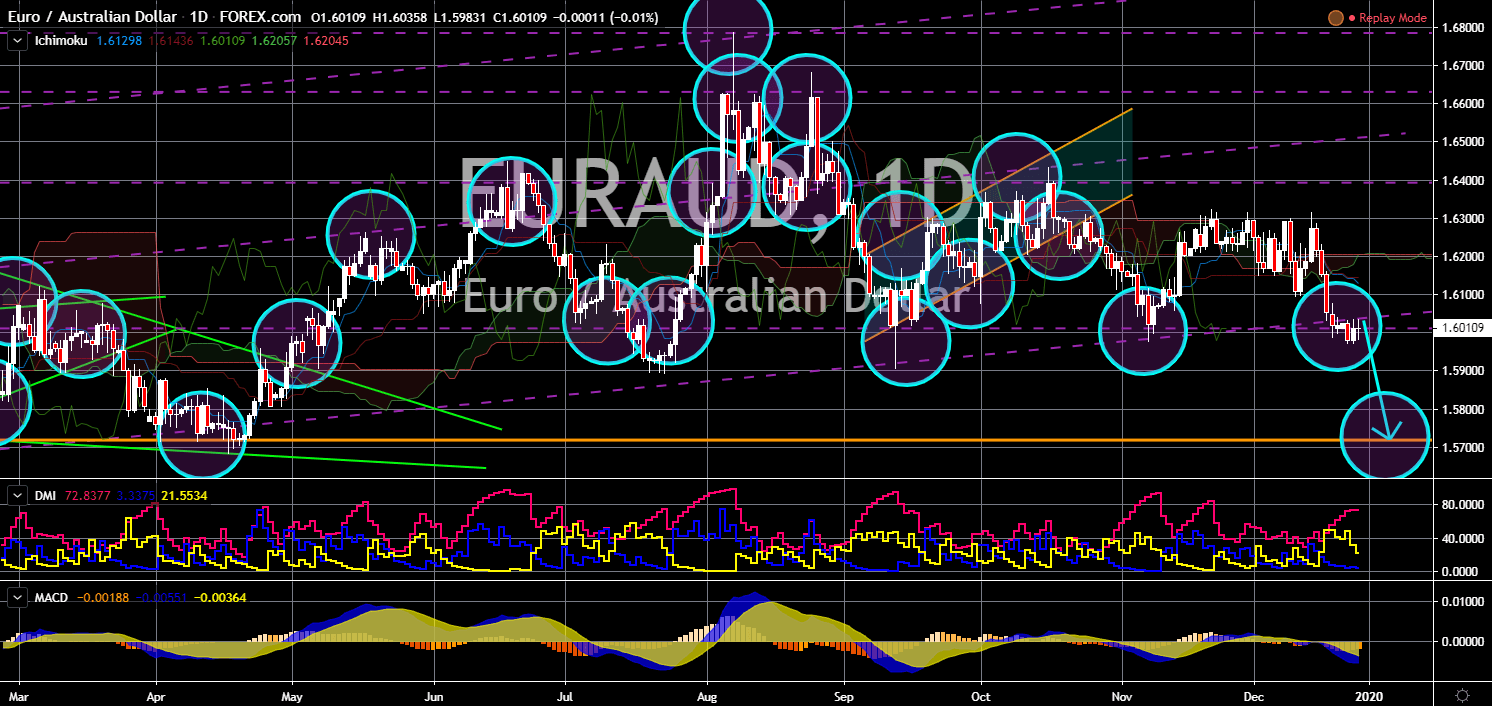

EUR/AUD

The pair will break down from a major support line, which will send the pair lower toward its 10-month low. Trade optimism made major currencies afloat. The United States and China signed a phase one trade deal which could end the year-long trade war between the two (2) largest economies in the world. Aside from this, uncertainty over the Brexit was lifted following the win of UK Prime Minister Boris Johnson. The Conservative Party now holds the majority seats in the parliament with 365 seats among the 650 total seats. This certainty will also let the European Union to focus on fixing its economy amid the economic slowdown in Europe, particularly in Germany. Australia, on the other hand, was still struggling with the decade-low growth and the widening EU-Australia relationship. Australia’s economy was hit by the ongoing trade war between the United States and China and Brexit uncertainty in 2019.

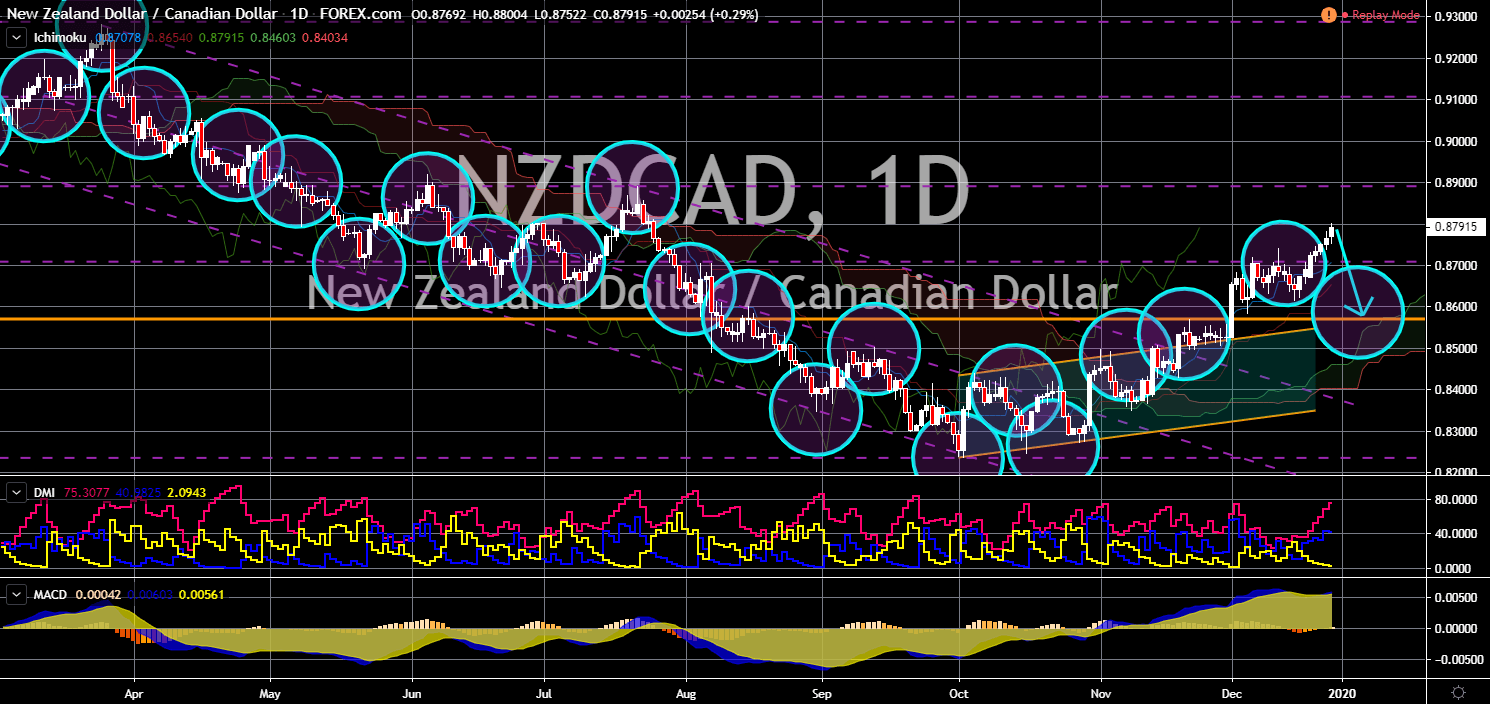

NZD/CAD

The pair is expected to experience a pullback following the recent rally. 2019 was one of the best years for New Zealand following its creation of a foreign policy independent of world powers like the United States and the United Kingdom. Prime Minister Jacinda Ardern was praised for her policies, specifically with immigration and climate change. The country has also been competing with its neighbor Australia to become a regional power amid the weakening Australian economy. New Zealand is also a member of the upcoming regional trading pact, the RCEP (Regional Comprehensive Economic Partnership). Once it commences, the RCEP will be the largest trading bloc in the world, replacing the European Union and placing the NAFTA (North American Free Trade Agreement) on the third spot. Despite its strong economy, however, NZ had cut its benchmark rate twice in 2019. Canada, on the other hand, maintained 1.8% rate throughout 2019.