Market News and Charts for December 13, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

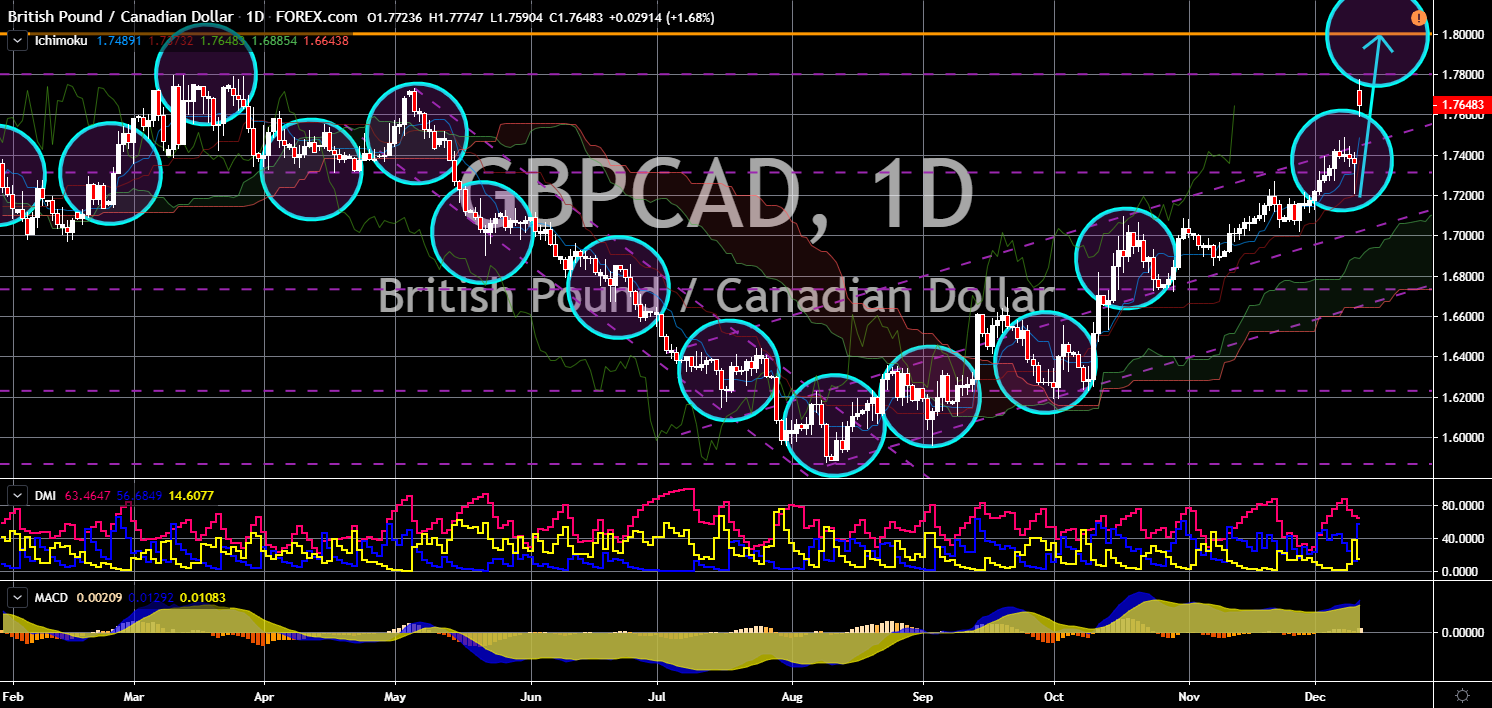

GBP/CAD

The pair is expected to continue moving higher in the following days and to breakout from a major resistance line. UK Prime Minister Boris Johnson’s Conservative Party captured the majority of seats in the parliament with 43.6%. This shows a major gap with Opposition Leader Jeremy Corbyn’s Labour Party of 32.2% win. This was Conservative Party’s best election win since 1987. The election result is expected to cause the British pound to jump against currencies pegged to sterling. Following the announcement of his win, Johnson reiterated that the UK is ready to leave the European Union on January 31. Canadian Prime Minister Justin Trudeau was also able to secure his position on the country’s October election. The win of the two (2) prime ministers is expected to secure a post-Brexit trade agreement between the UK and the US. Canada also get a green light from the EU Parliament to conduct a bilateral trade agreement with the bloc.

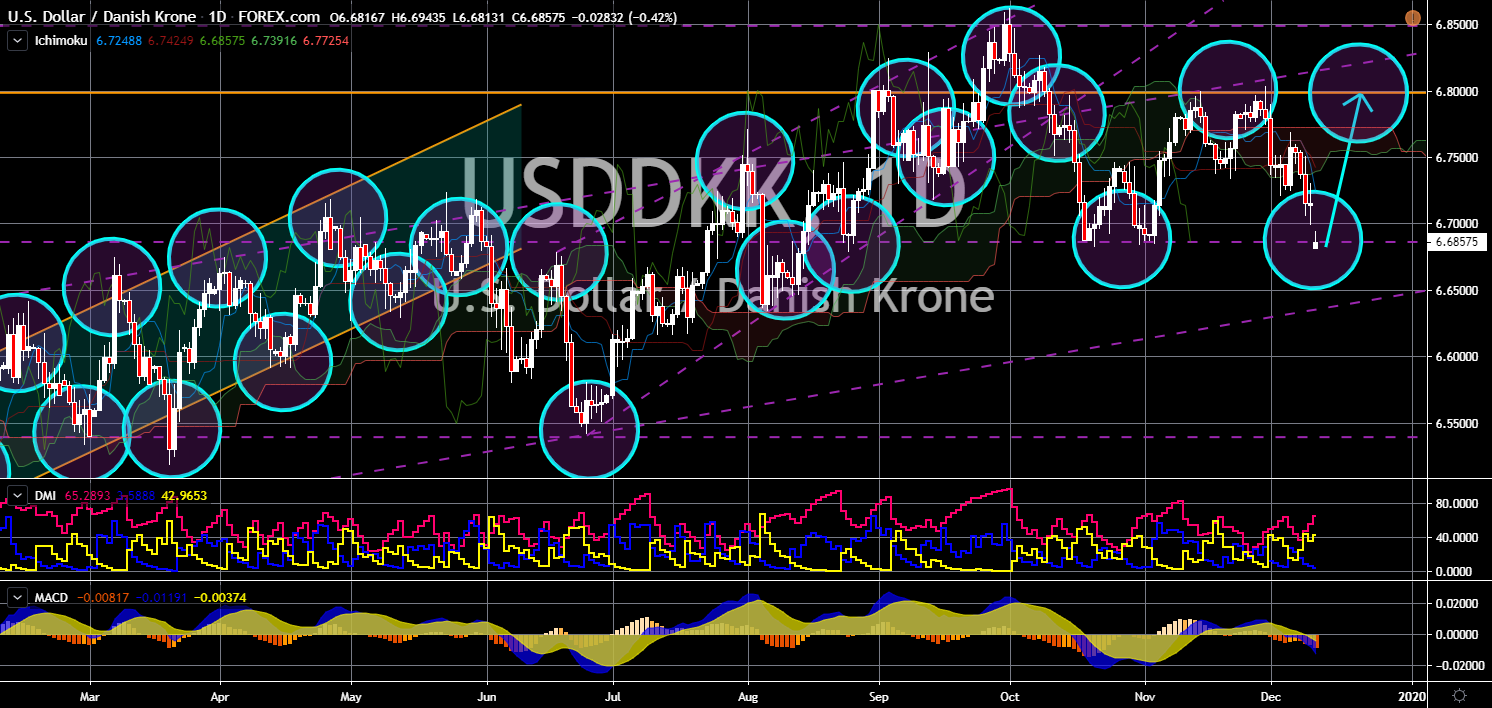

USD/DKK

USD/DKK

The pair is expected to bounce back from a major support line, sending the pair towards a key resistance line. The US dollar inched lower in today’s trading session after demand for European currencies like the Danish krone. However, analysts are speculating the greenback to pickup losses as the government releases its Retail Sales report month-over-month (MoM). The report will cover the Thanksgiving holiday, Black Friday event, and Cyber Monday event. The figure from the report is anticipated to help the US dollar to get back on its feet. In other news, the European Union sues Denmark over its misuse of the term “feta” on Danish cheeses. Feta has been a registered Protected Destination of Origin (PDO) since 2002. Names under the PDO can only be used by countries producing it and, in this case, only Greece can use the word feta for its cheese exports. Meanwhile, the relationship between the EU and Denmark continue to deepen.

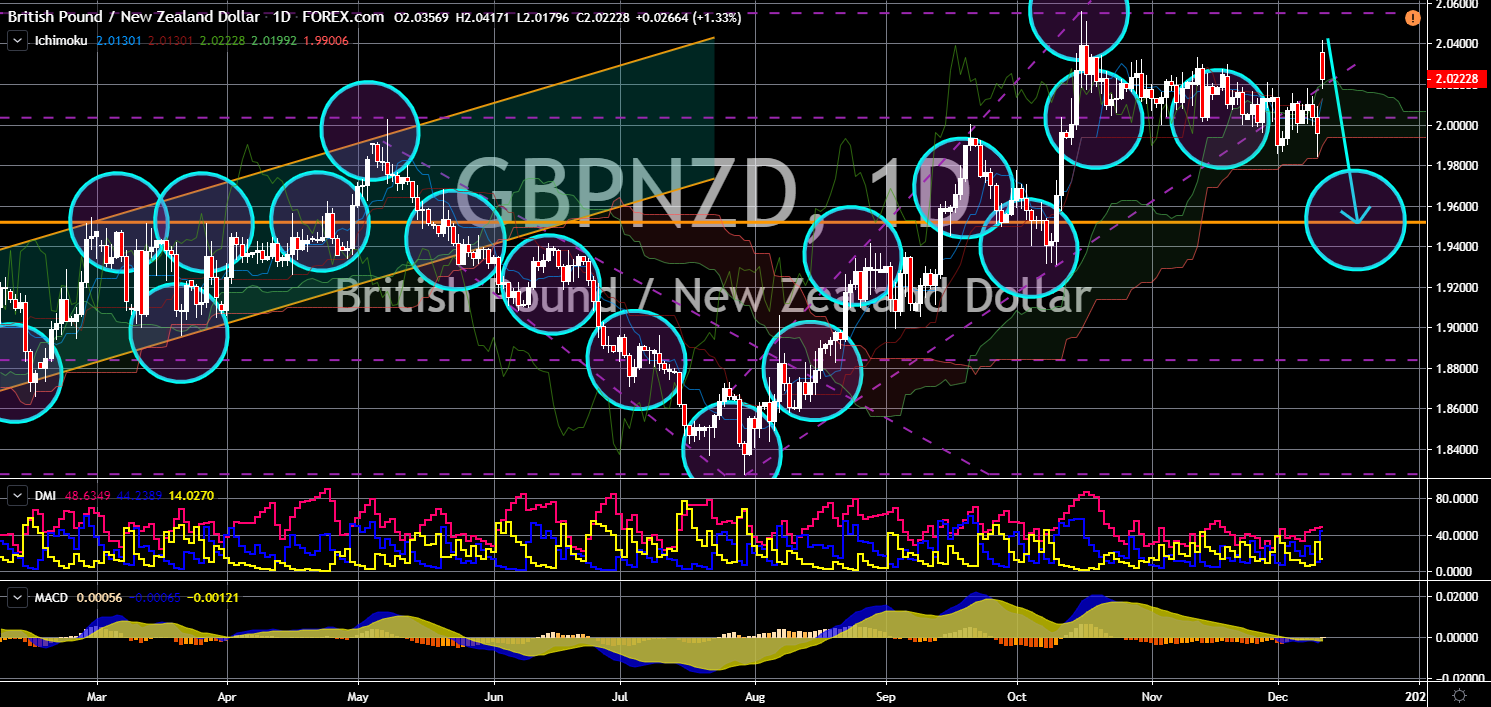

GBP/NZD

The pair is expected to drop towards a major support line in the following days. The bullish NZD traders are pulling the pair lower in today’s trading session. The win of the UK Conservative Party is also a win for the New Zealand economy. On September 16, UK Trade Secretary Liz Truss met with New Zealand counterpart David Parker to discuss trade talks. This was following the call between UK Prime Minister and NZ Prime Minister Jacinda Ardern discussing a post-Brexit trade agreement a month prior. After the meeting, the UK diplomat said that New Zealand was the country’s top priority for a post-Brexit trade agreement. New Zealand was the first country to open its UK embassy following the 2016 British referendum. Aside from Britain, New Zealand was also engaged in a free trade agreement (FTA) with the European Union. The country was also a member of the ratified CPTPP (Comprehensive and Progressive Trans-Pacific Partnership).

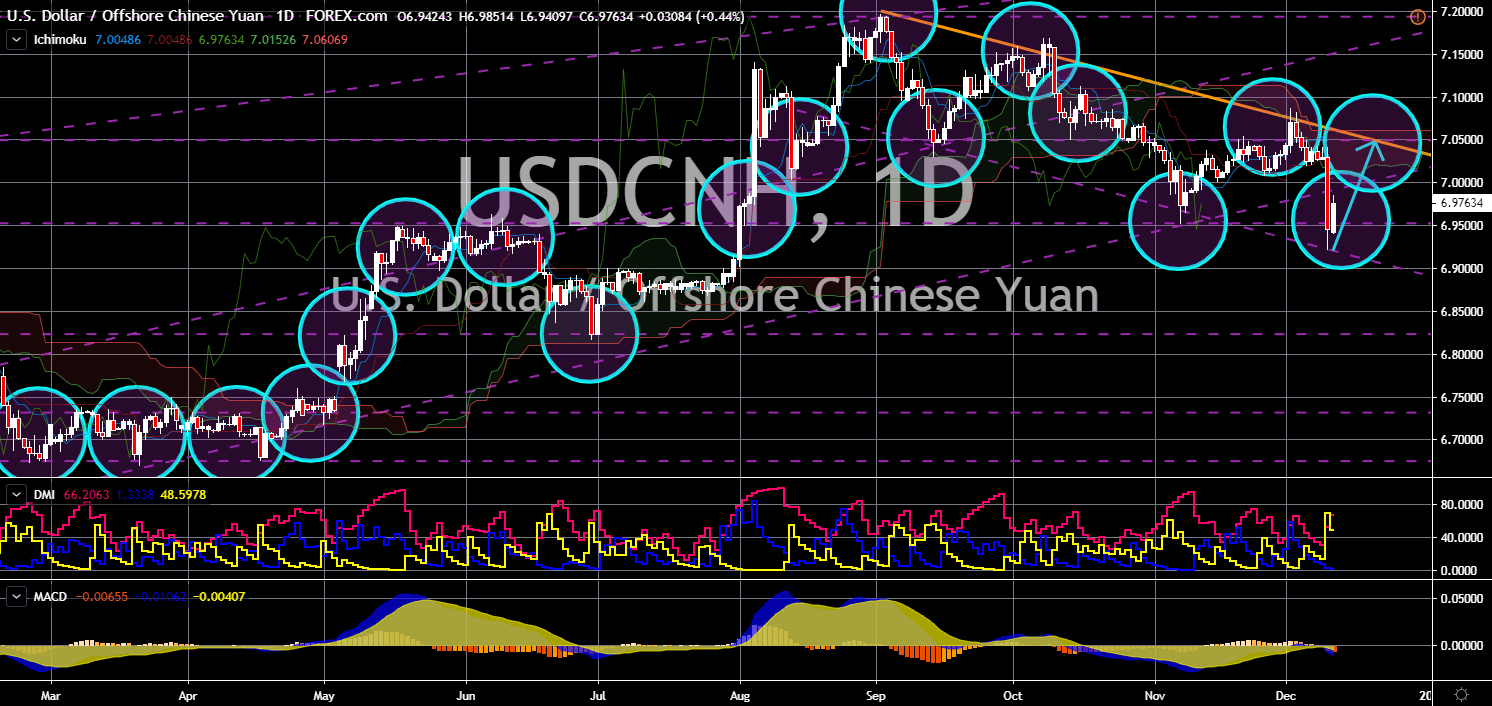

USD/CNH

The pair is expected to bounce back from a downtrend channel support line, sending the pair higher towards the channel’s resistance line. China reported a disappointing Foreign Direct Investment (FDI) report for the month of November. Growth on investment from foreign investors slowed down to 6.00% from 6.60% in October. The slowdown was also attributed to the escalating US-China trade war. Despite this, investment for December is expected to pick up following the recent announcement by US President Donald Trump. Trump said he is halting the imposition of the second round of tariffs on December 15, which will give more room for negotiations between the two (2) largest economies in the world. The two (2) countries’ representatives said they are nearing to sign a phase one trade deal. Meanwhile, the US dollar is expected to continue its strength after the Federal Reserve hold onto the country’s benchmark interest rate at 1.75%.

-

Support

-

Platform

-

Spread

-

Trading Instrument