Market News and Charts for December 12, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

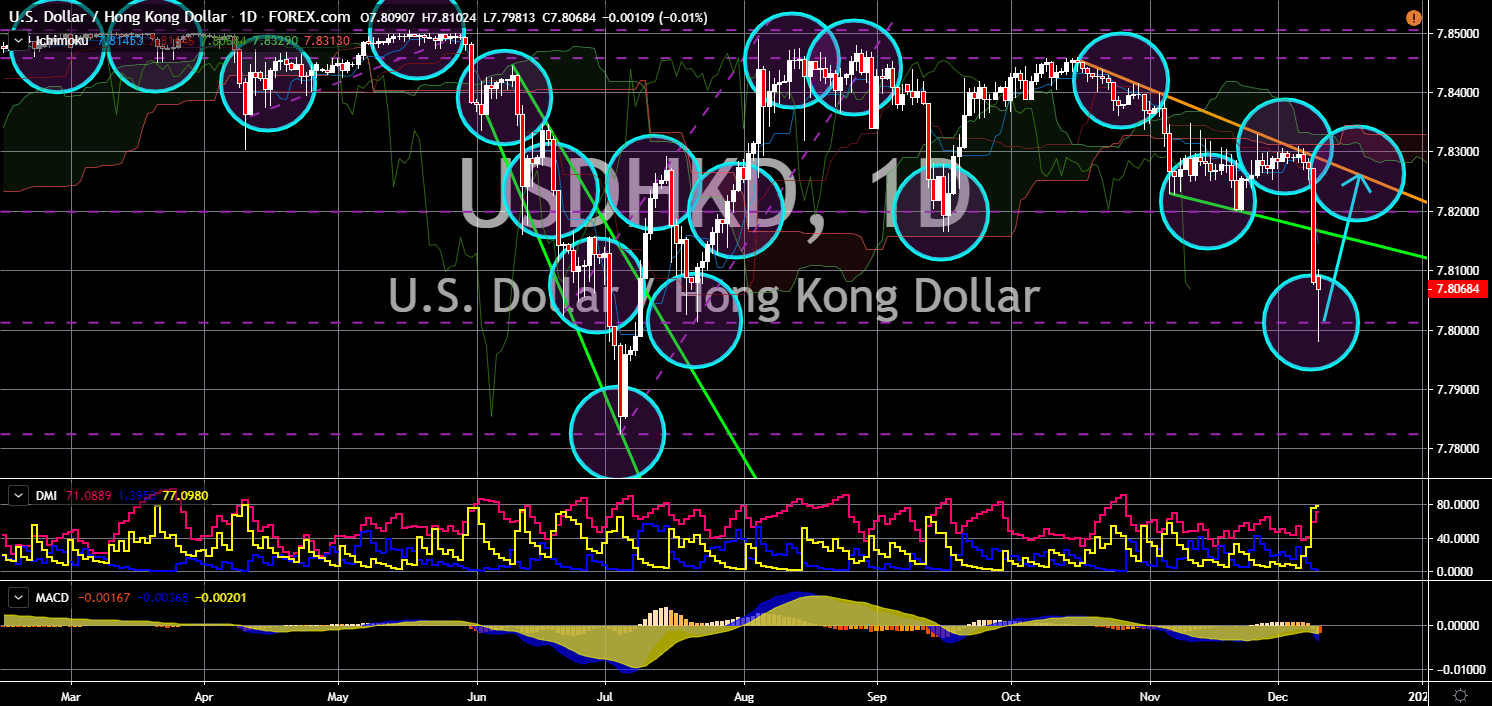

USD/HKD

The pair will bounce back from key support line, sending the pair higher. The Federal Reserve hold onto its current interest rate of 1.75% despite pressure from US President Donald Trump. This will give investors and traders hope that the central bank will not cut rates anytime in the near future. Aside from this, the Hong Kong dollar has been suffering from the month-long protests. Recession is also expected to continue as the US government is set to impose a second round of tariffs to Chinese exports on December 15, which will directly hit Hong Kong economy. Aside from this, the self-governing island of Taiwan announced its support to Hong Kong as a protest to China. Taiwan Foreign Minister said his country supports Hong Kong citizens pushing for freedom and democracy. This is expected to further drag the relationship between the United States and China. The US is bound by constitution to support groups seeking democracy.

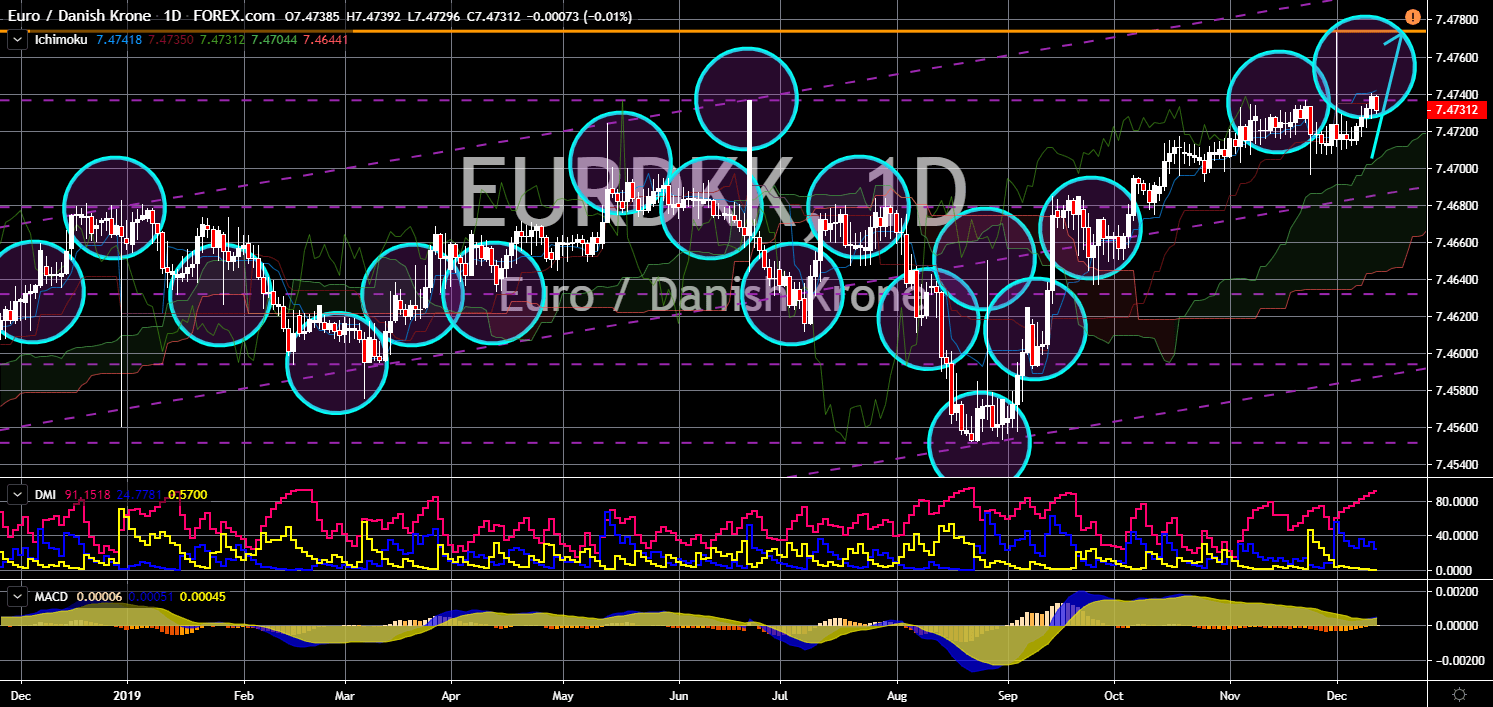

EUR/DKK

EUR/DKK

The pair is expected to breakout from a major resistance line. On his first speech as the president of the European Central Bank (ECB), former IMF Chief Christine Lagarde hold the bloc’s interest rate. This had sent the single currency higher against currencies pegged to the Euro. The move was in line with the Federal Reserve’s decision to also hold onto its benchmark interest rate in the last month of the year. In other news, The European Commission sued Denmark in the European Court of Justice after it accused the member state of violating the EU law in regard to the use of the trademark name Feta. The Danish government has been exporting cheese to non-EU countries using the name Feta. This name is associated with a type of cheese which is only produced by Greece. Despite this, the relationship between the EU leaders and Denmark is expected to become stronger following the reappointment of Margrethe Vestager as Competition Chief.

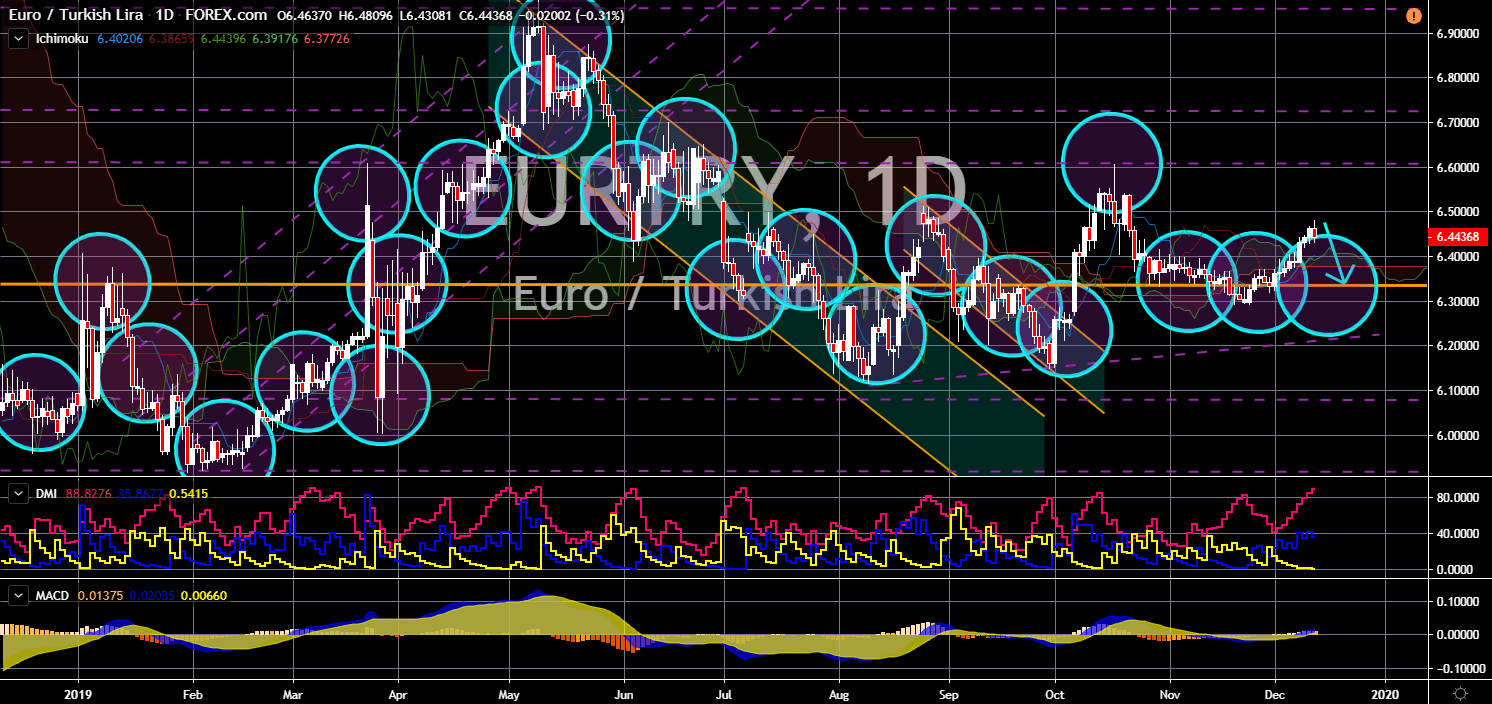

EUR/TRY

The pair is seen to reverse back and move lower towards a key support line. The European Union recently announced a statement regarding the EU refugee aid in Turkey. The trading bloc said it was able to mobilize the $6.68 billion operational budget in line with its commitment to the implementation of the EU-Turkey statement. The $4.79 billion in the budget has already been contracted and the remaining $1.89 billion disbursed. This statement comes amid the threat by Turkish President Recep Tayyip Erdogan that it will open its border to the EU for the Syrian immigrants. This was after the European Union refused to back Turkey’s proposed Syrian safe zone. Turkey has been applying to become a member of the largest trading bloc in the world since 1999. However, accusations to Erdogan of power abuse has been preventing the two (2) parties into reaching an agreement to accommodate Turkey inside the bloc.

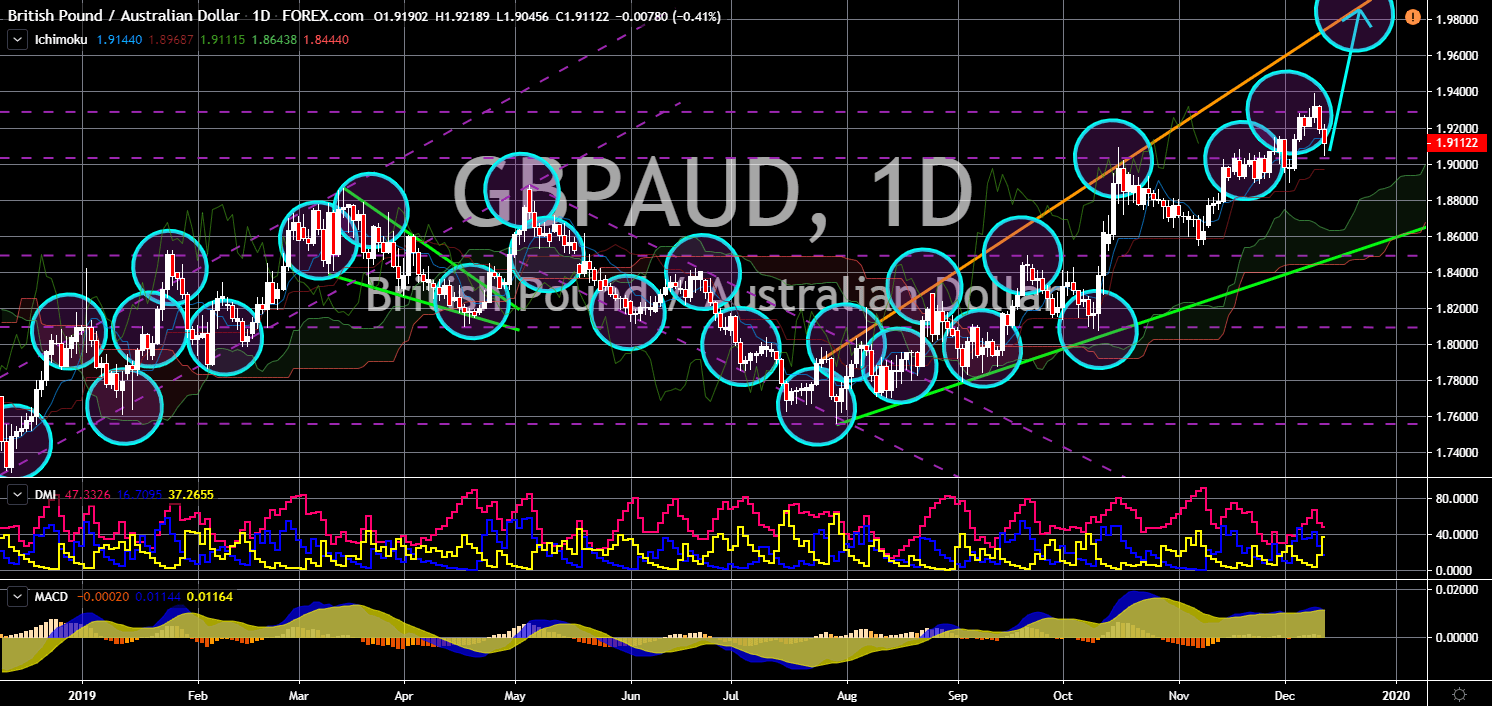

GBP/AUD

The pair is expected to continue moving higher in the following days. The United Kingdom will hold its general election today, December 12, 2019. Among the leading contenders were Conservative Party’s Prime Minister Boris Johnson and Labour Party’s Opposition Leader Jeremy Corbyn. On the recent polls, Johnson is seen to win the election with a huge gap from Corbyn. However, analysts still see a possibility that the opposition might win this election. However, this win will be complicated. Australia might review its intelligence-sharing agreement with the United Kingdom if Corbyn wins. Furthermore, Corbyn promised a second referendum to determine whether Britons really chooses to leave the bloc despite the messy three (3) years Brexit negotiation. On the other hand, Johnson promised to deliver the Brexit once he wins the majority in the UK Parliament.