Market News and Charts for December 04, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

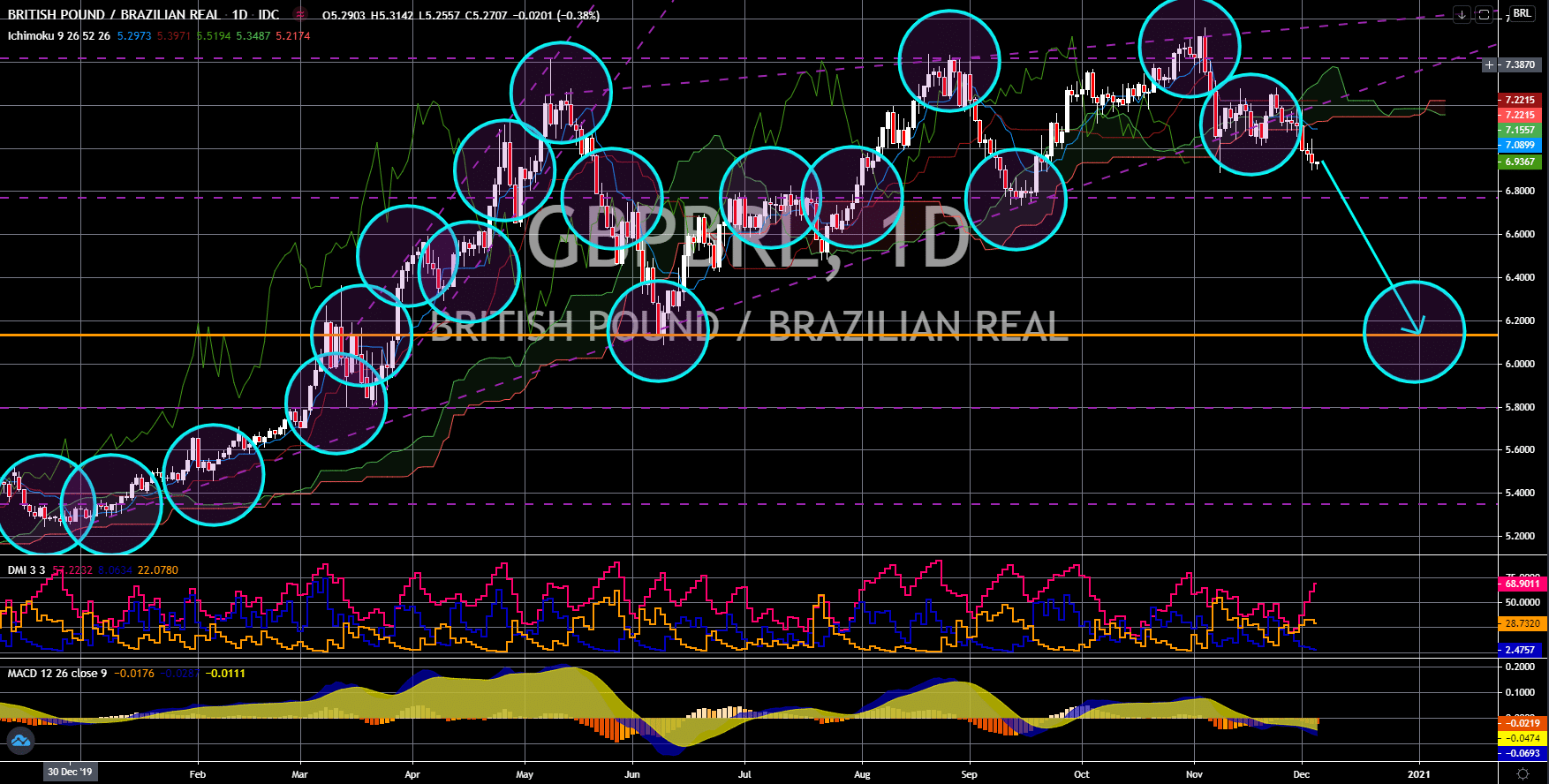

EUR/NZD

The pair broke down from a major support line, sending the pair lower towards the 1.62000 price area. The EU and its member states’ reports this week is a disaster. The week started with a disappointing consumer price index with figures for the MoM report for Germany, Italy and Spain recorded at -0.8%, -0.1%, and -0.2%. Meanwhile, the report declined by -0.3%, -0.2%, and -0.8%, respectively. On the following day, the Manufacturing PMI reports were released which gave investors some hope that the impact of the second wave of COVID-19 will not be as catastrophic as the first wave. The numbers were 53.8 points for the EU, 57.8 points in Germany, 49.6 points for France, 51.5 points in Italy, and 49.8 points in Spain. However, for the Composite and Services PMIs, only Germany’s Composite report recorded an above 50 points figure. These results show the impact of the resurgence of COVID-19 in the region.

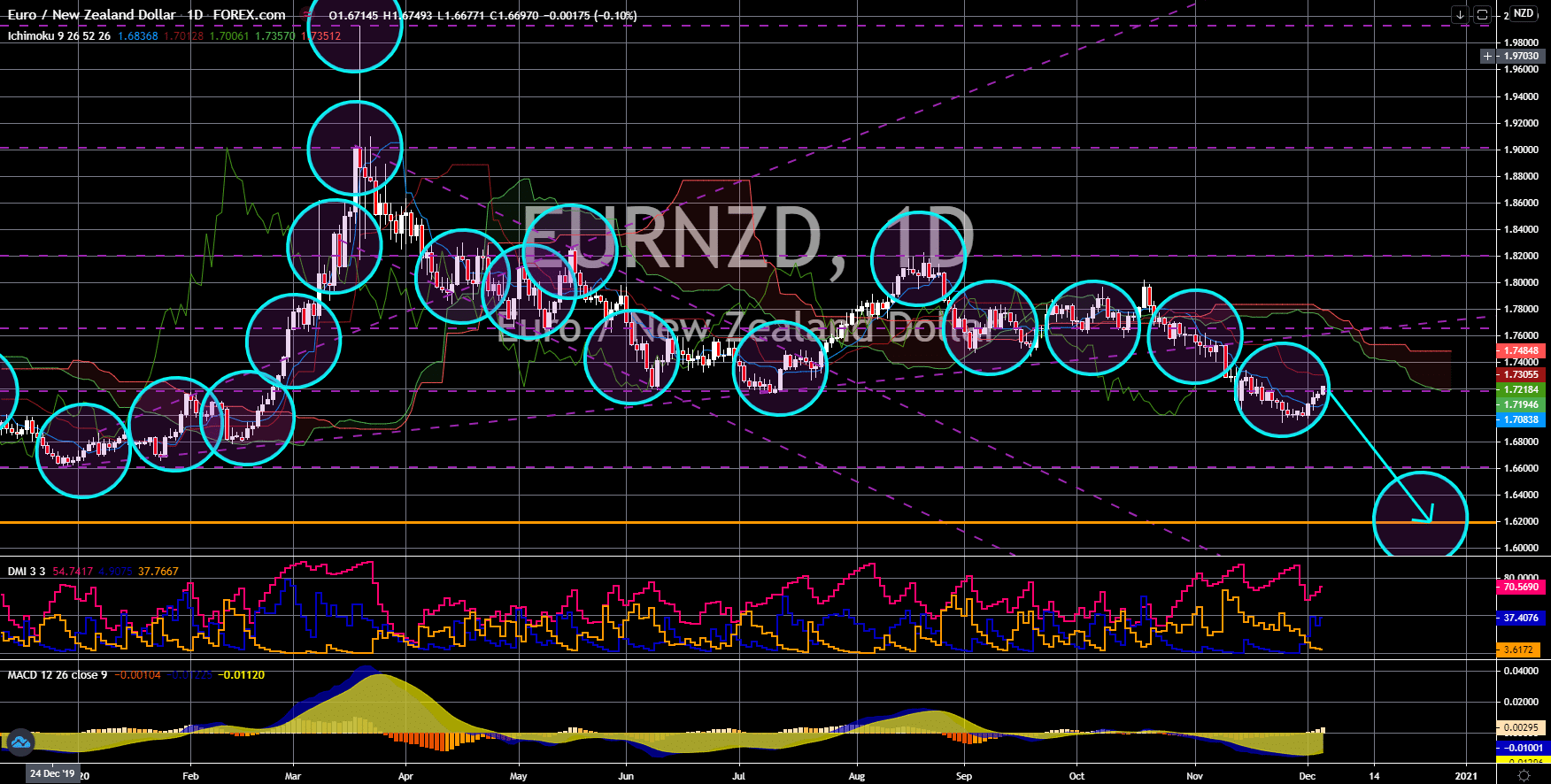

AUD/NZD

The pair bounced back from a major support line, sending the pair lower towards the October 13 high. Australia and New Zealand successfully contained the virus. However, the two (2) countries took different approaches in dealing with COVID-19. As for New Zealand, it closed its borders from the rest of the world. Although there has been some recovery in the country based on its previous reports, it is still slow compared to its peers. Meanwhile, Australia reopened its economy on May 11 despite the continued increase in the number of coronavirus infections. The easing of restrictions along with the record low interest rate of 0.10% helped the economy to recover in the medium-term. It is only in the month of October when Australia sees some positive signs on its economy. During that time, imports and exports increased by 1.0% and 5.0%, respectively. Meanwhile, Manufacturing and Services PMIs reported 55.8 points and 55.1 points.

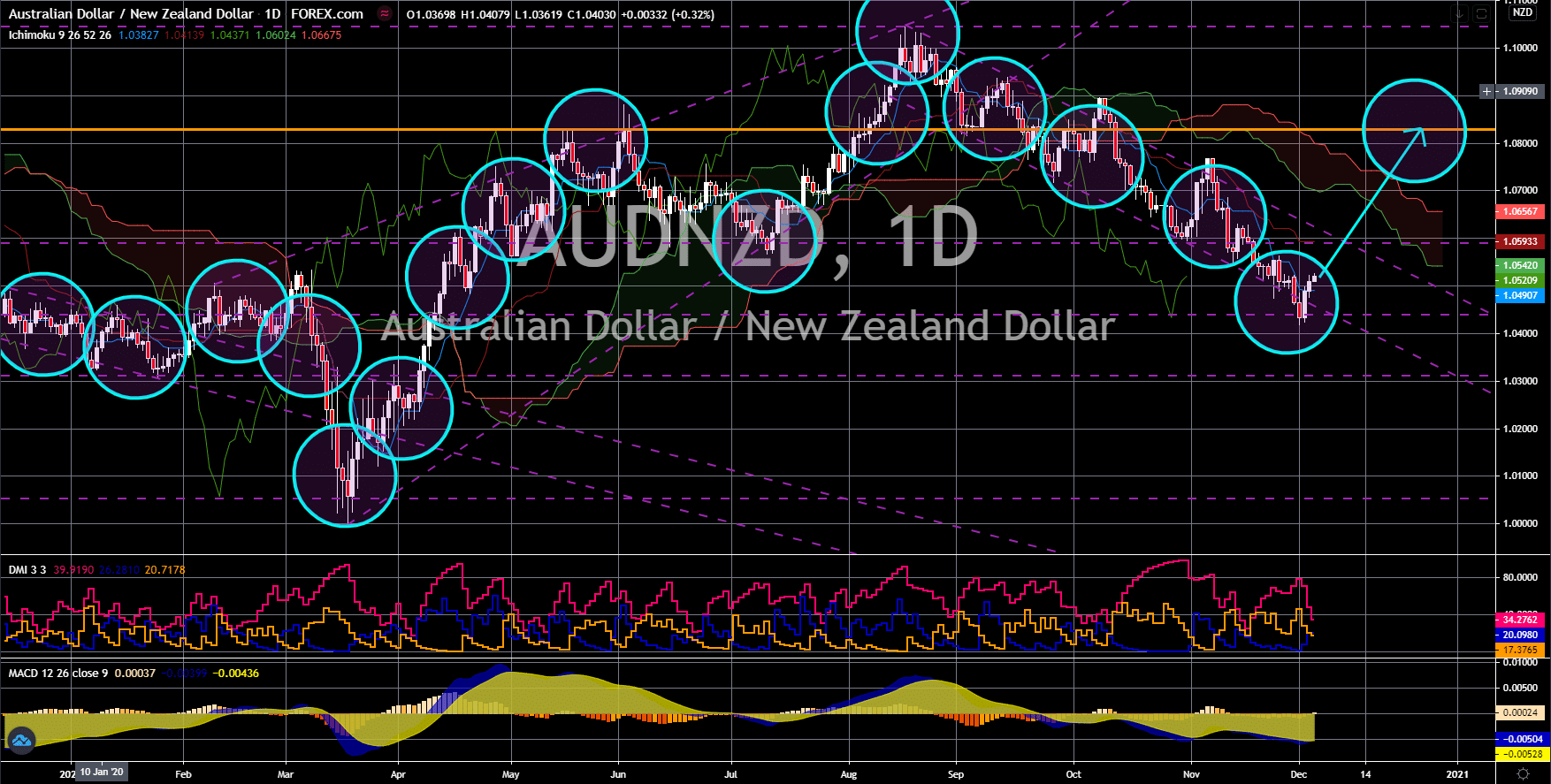

EUR/BRL

The pair will break down from a major support line, sending the pair lower towards another major support line. Brazil’s data were mixed in the last three (3) days of the week. The country’s GDP QoQ for the third quarter expanded by 7.7% against the prior month’s -9.7% result. Meanwhile, GDP declined by -3.9% on an annual basis compared to -11.4% in the previous report. Both reports were below the 9.0% and -3.5% consensus data by analysts. Brazil also published its purchasing managers index reports for the composite and services sector at 53.8 points and 50.9 points. Although these figures are lower compared to their previous data, the reports still expanded for the third consecutive month. On the other hand, while some reports in the EU and its member states beat analysts’ expectations, there are still below the 50 points benchmark, which means that the manufacturing and services sector in the EU bloc contracted in the reported month.

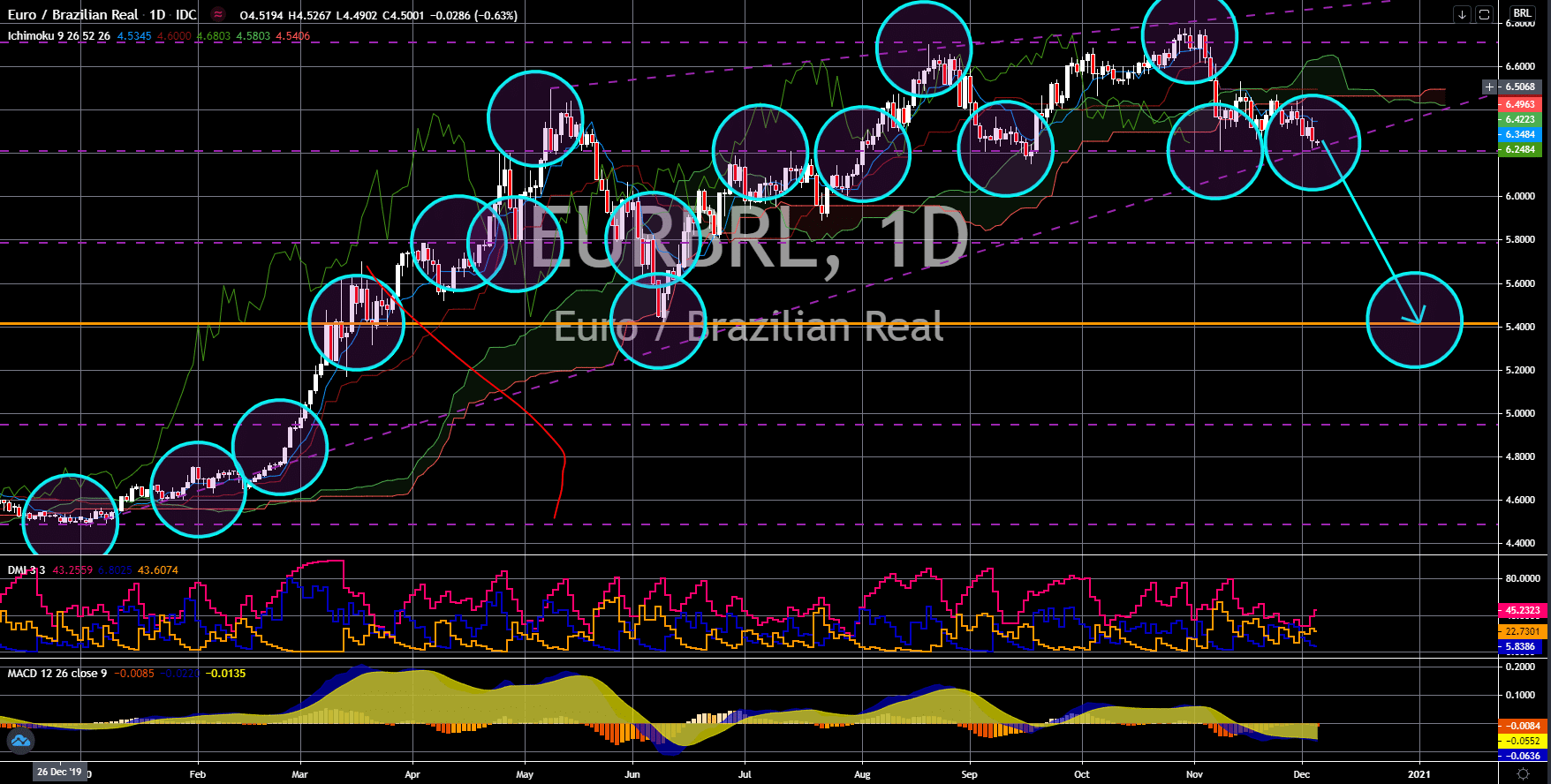

GBP/BRL

The pair broke down from an uptrend support line, sending the pair lower towards its June 09 low. Investors are minimizing their exposure with the United Kingdom due to uncertainty in the Brexit negotiations. The EU and the UK haven’t reached an agreement yet just 27 days before Britain is set to leave the bloc. Analysts said that a no-deal Brexit might cost the UK economy about $25 billion by 2021. On Thursday, December 03, officials in the UK said that their French counterpart is making it hard for the parties involved to reach an agreement. As for the UK’s reports this week, the Manufacturing PMI remains unchanged at 55.6 points. However, the Composite and Services PMIs finally touched the below points area with 49.0 points and 47.6 points, respectively. Investors should keep an eye with the development in the Brexit negotiations, particularly on how the two (2) parties will make concessions to prevent a hard Brexit.