Market News and Charts for December 02, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

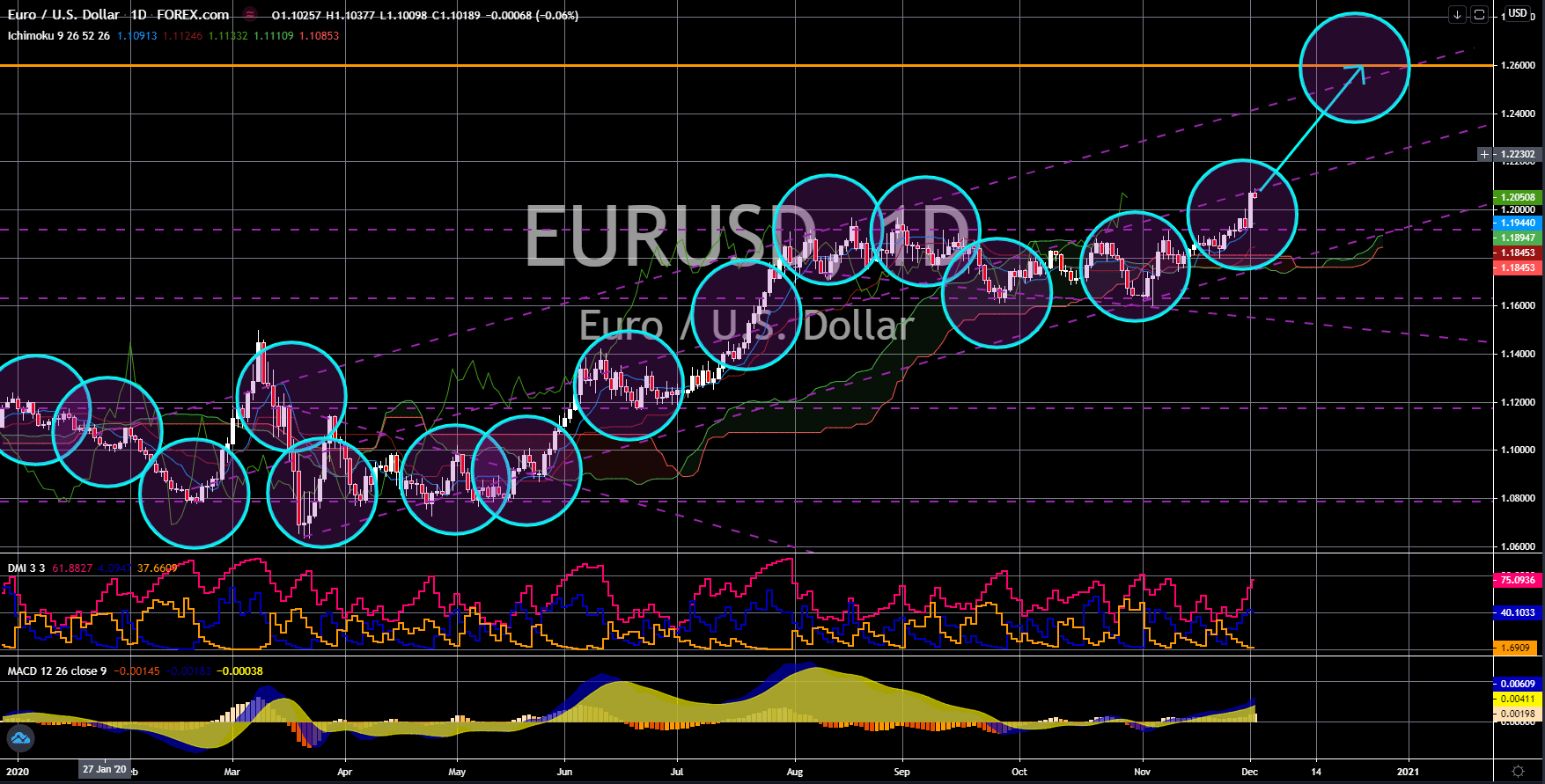

EUR/USD

The pair will continue to move higher in the following days after it broke out from a major resistance line. There has been some major improvement in the EU and its member states’ reports on Wednesday, December 02. Germany’s retail sales soar in October despite the resurgence of COVID-19 during the month. The figure for the MoM retail sales was 2.6% against September’s decline of -1.9%. Meanwhile, retail sales increased by 8.2% on an annual basis. The fourth largest economy in the European Union also posted a positive result on its recent report. Unemployment in Italy jumped to 8.85%, which beats analysts’ estimate of 8.9%. As for the EU, the unemployment dropped down to 8.4% in October against the prior month’s 8.5% result. Also, the announcement by German Chancellor Angela Merkel that the second lockdown will end this December will boost hopes by investors that the economic environment will improve in 2021.

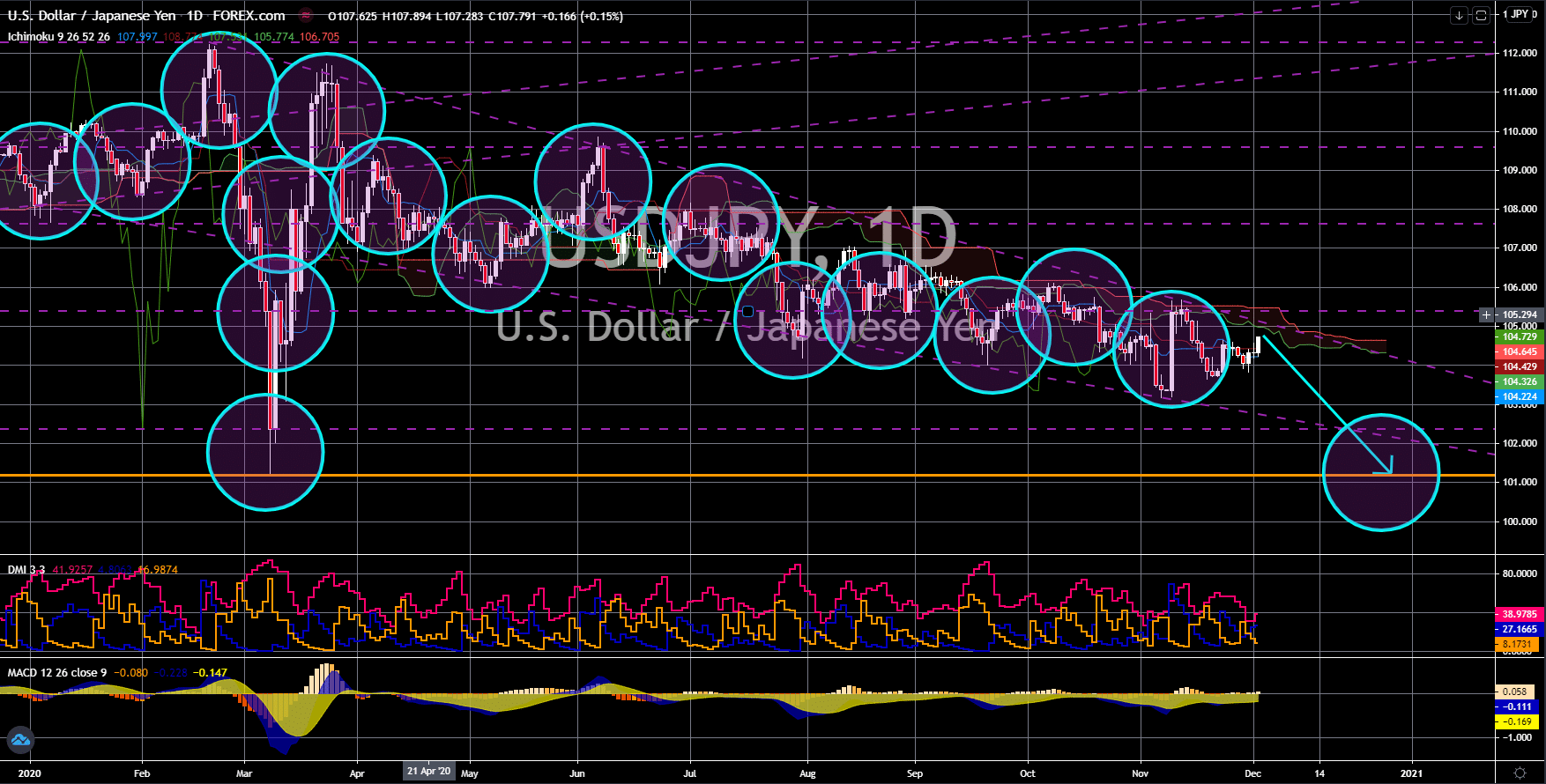

USD/JPY

The pair will fail to break out from a downtrend channel resistance line, sending the pair lower towards a major support line. Investors are expected to weigh the current status of the labor market in assessing a country’s recovery from the pandemic. The US initial jobless claims on Wednesday last week, November 25, showed an increase in the number of claimants of unemployment benefits. The figure came in at 778,000 against expectations of 730,000. In addition to the disappointing result, an improvement of only 3,000 individuals for this week’s report is expected. That puts the forecast by analysts on Thursday, December 03, to 775,000. On the other hand, Japan’s unemployment rose to 3.1% on Monday, November 30. However, the Jobs/Application ration increased to 1.04%. In other words, out of 100 applicants there are 105 vacant positions. This will give investors confidence that recovery in Japan will be faster than the US.

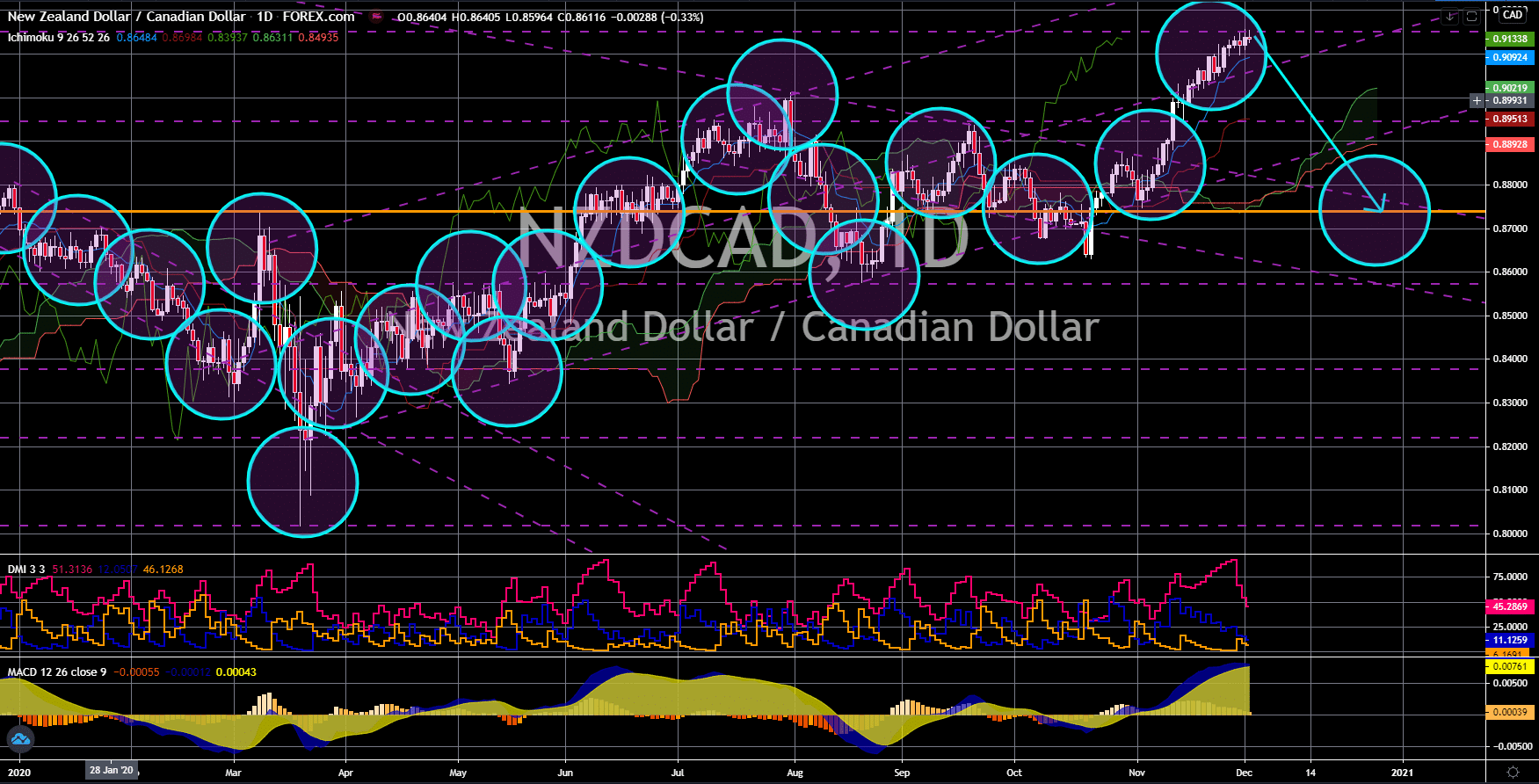

NZD/CAD

The pair failed to break out from a major resistance line, sending the pair lower towards a major support line. Canada’s import and export prices for the third quarter unexpectedly fell. The export price index for Q3 dropped by -8.3%. This represents the steepest decline in the report since it began in the third quarter of 2014. Import prices also slide by -3.7% in the third quarter of fiscal 2020. In contract, the volume increased by 5.6%. These figures mean that there has been an increase in the business inventories as New Zealand remains isolated from the rest of the world. The country implemented one of the strictest measures around the world by closing its borders from foreign individuals and businesses. As a result, the economy has suffered despite the country successfully containing the deadly virus. However, analysts said that this is only temporary and that New Zealand will outshine its peers once the pandemic is over.

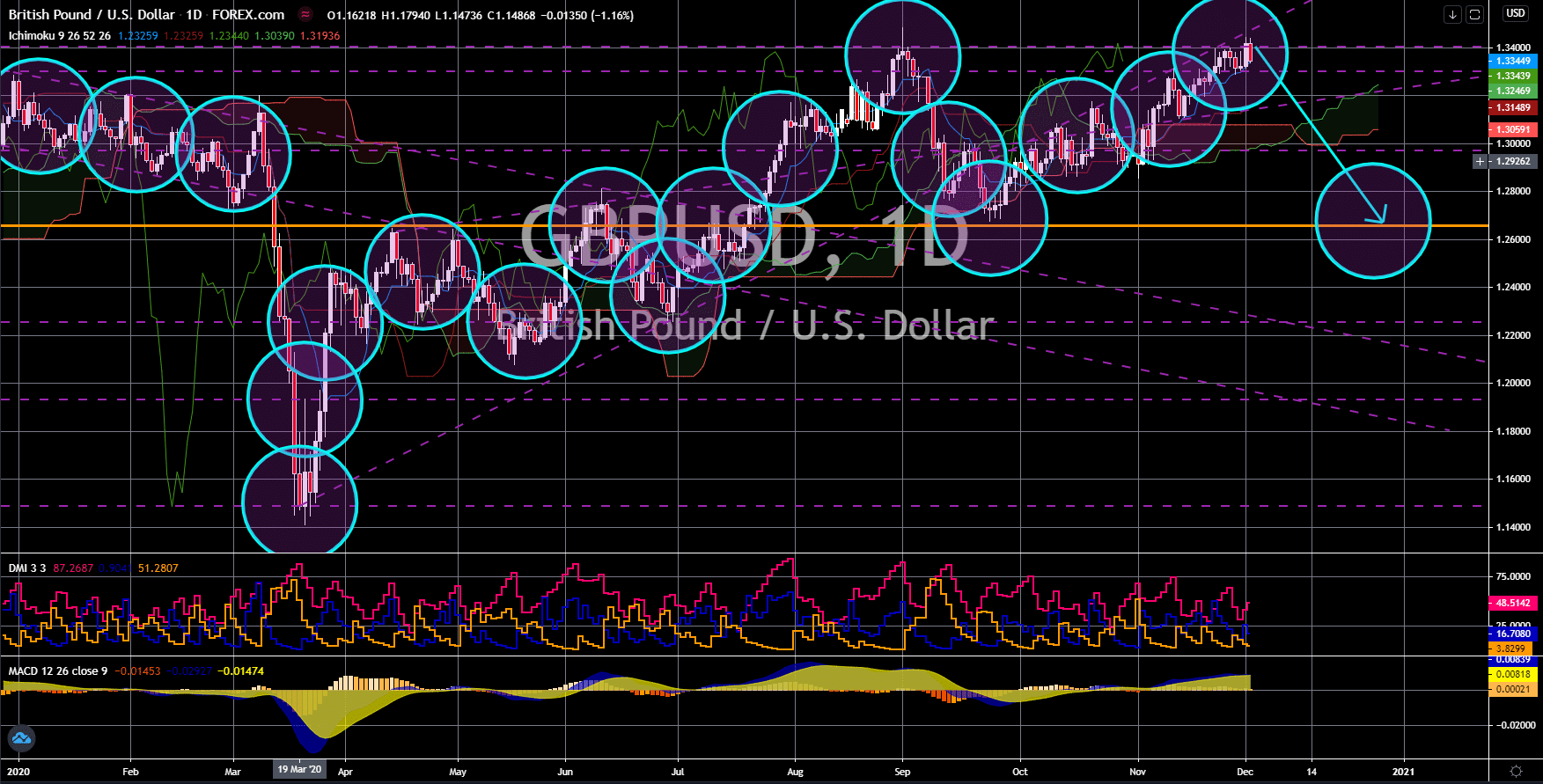

GBP/USD

Despite the weak outlook for the US economy, the greenback will still outperform the British pound in coming sessions. The main reason for this was the unwillingness of banks to approve some business and individuals amid the uncertainty brought by the resurgence of COVID-19 and the Brexit negotiations. While mortgage approvals in October increased by 97,530, there has been a decrease in mortgage lending. Only $4.29 billion loans were released in the said month against September’s $4.86 billion. In addition to this, the possibility that the UK and the EU will not reach an agreement in the last 29 days of the Brexit transition has resulted in lower lending to individuals. The figure for Monday’s report, November 30, was $3.7 billion against the previous month’s record of $4.2 billion. Adding to these worries were the claims by experts that the British economy will lose $25 billion in the event of a no-deal Brexit.