Market News and Charts for August 31, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

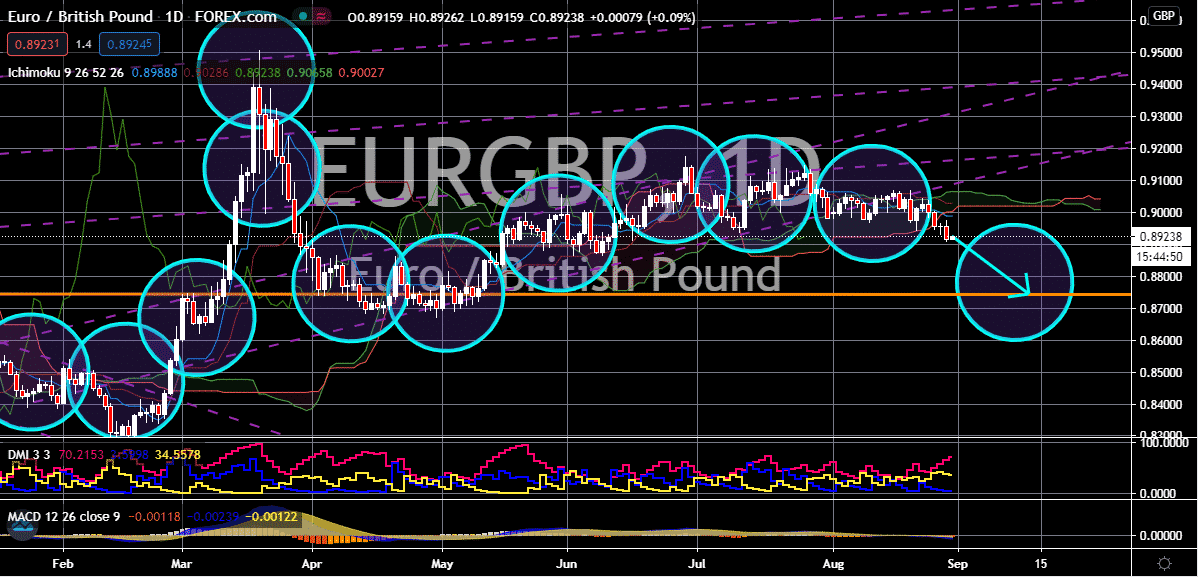

USD/CHF

The Swiss franc continues to strengthen against the US dollar in the trading sessions. At first, investors believed that the pair would finally bounce off its support once it reached that point. Unfortunately for the US dollar, the Swiss franc is still stronger than the US dollar. Prices are now projected to crash lower towards their support levels by the middle half of September. Most experts believe that the once-mighty greenback is projected to remain weak in the foreseeable future thanks to geopolitical tensions, the virus, political rifts, and other factors. Last week, the greenback plummeted against most major currencies thanks to the recent news that the United States Federal Reserve wants to boost inflation in the country, a move that could further strain the power of the US dollar in the trading sessions. Fed Chair Jerome Powell reiterated that the new inflation strategy would be “flexible” and that the bank is looking to reach its target of “overtime”.

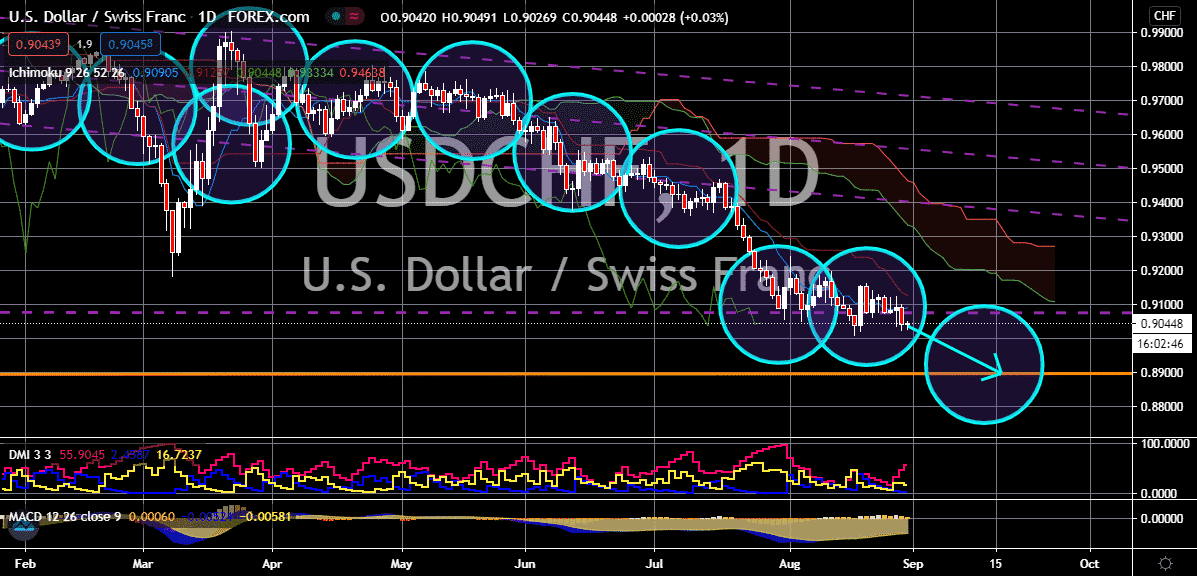

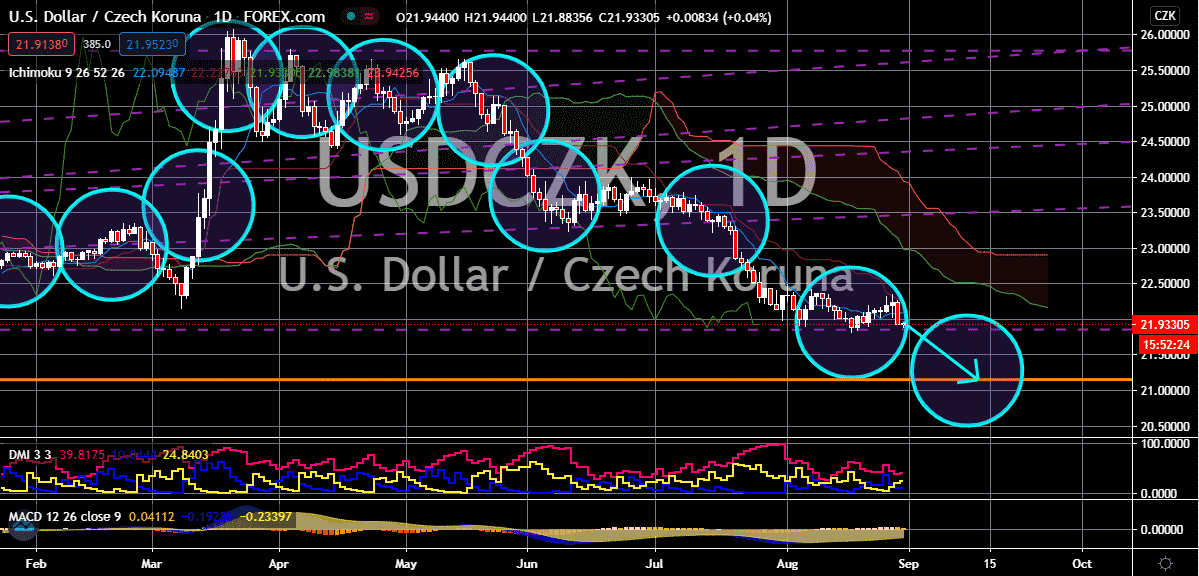

USD/CZK

Bearish investors of the US dollar to Czech koruna exchange rate are expected to regain the momentum and push the pair towards its support level in the coming sessions. Prices are on track to go down to levels last seen in April 2018. Moreover, the chief of the Czech National bank expressed his rare public criticism on the country’s political leadership, commenting that the plan to cut personal taxes will, in fact, put more pressure on the budget. Yesterday, Governor Jiri Rusnok said that this year’s record fiscal shortfall is natural as the Czech government is trying to mitigate the detrimental impact of the virus on the country. However, the central bank head also warned that the decision of cutting taxes will create a long-lasting problem in the Czech Republic’s finances. Before that, billionaire prime minister Andrej Babis announced a personal income tax cut which would curb the budget revenue by approximately 3.4 billion US dollars.

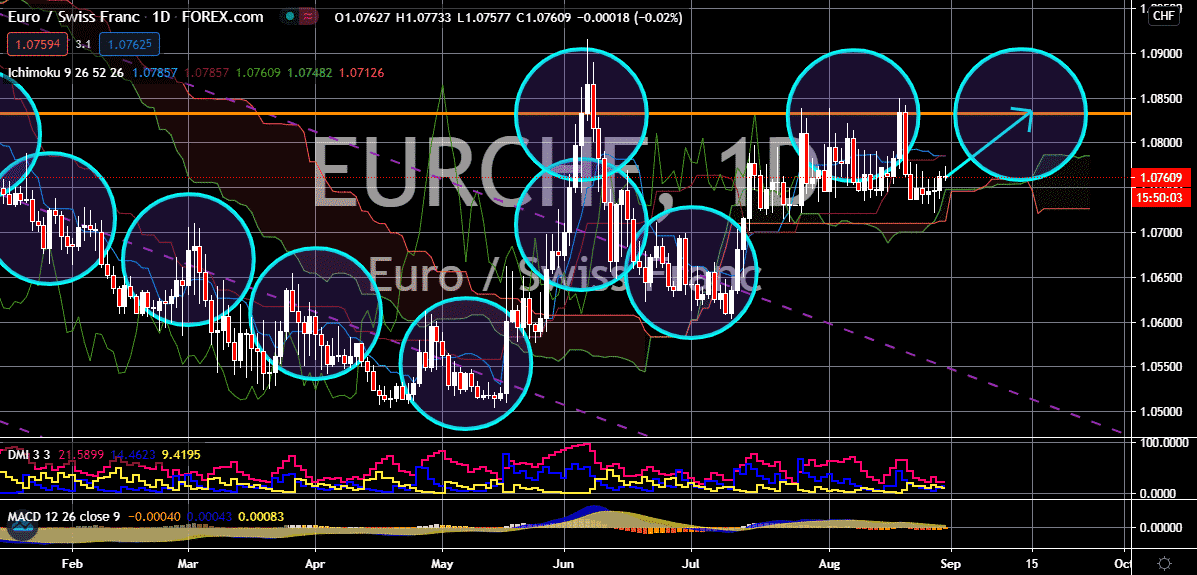

EUR/CHF

The Danske Bank revived the optimism of bullish investors last week when it said that it expects it to recover modestly over the next months. The euro to Swiss franc exchange rate is now slowly going up towards its resistance level and it’s actually believed that it will hit it by the mid-point of September. Looking at it, the pair is actually steady this Monday, this is because of the strength of the euro is mainly influenced by the US dollar and the markets’ sentiment. The US dollar is struggling right now due to the latest speech of the Federal Reserve’s chair about the new strategy. Some experts, however, say that the beloved single currency has “gone too far too fast”. As for the Swiss franc, the poor economic activities of the country are slowing down the safe-haven currency. A recent study in the country found that Switzerland’s economy recorded the sharpest fall since 1980 and this all thanks to the unforgiving impact of the coronavirus pandemic.

EUR/GBP

The euro to British pound is evidently bearish in today’s trading sessions. It’s seen that over the past few days, bears have attempted to break out and force the sterling to secure more gains against the euro. Now, due to their determination, prices are projected to fall down towards their support level. However, it’s also believed that there is a huge potential for a bullish correction for the trading pair once it hits its support thanks to Brexit-related news. Just recently, it was reported that the United Kingdom is already ready to walk away from the trade negotiations with the European Union if it does not drop its stance and demand to align with its state aid rules, particularly the subsidy policy. Brexit negotiator from Britain, David Frost has told his EU counterpart Michel Barnier that the UK is not willing to compromise. The two clashing sides are set to meet later this week to work out a deal amidst the heightening concerns from two sides.