Market News and Charts for August 23, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

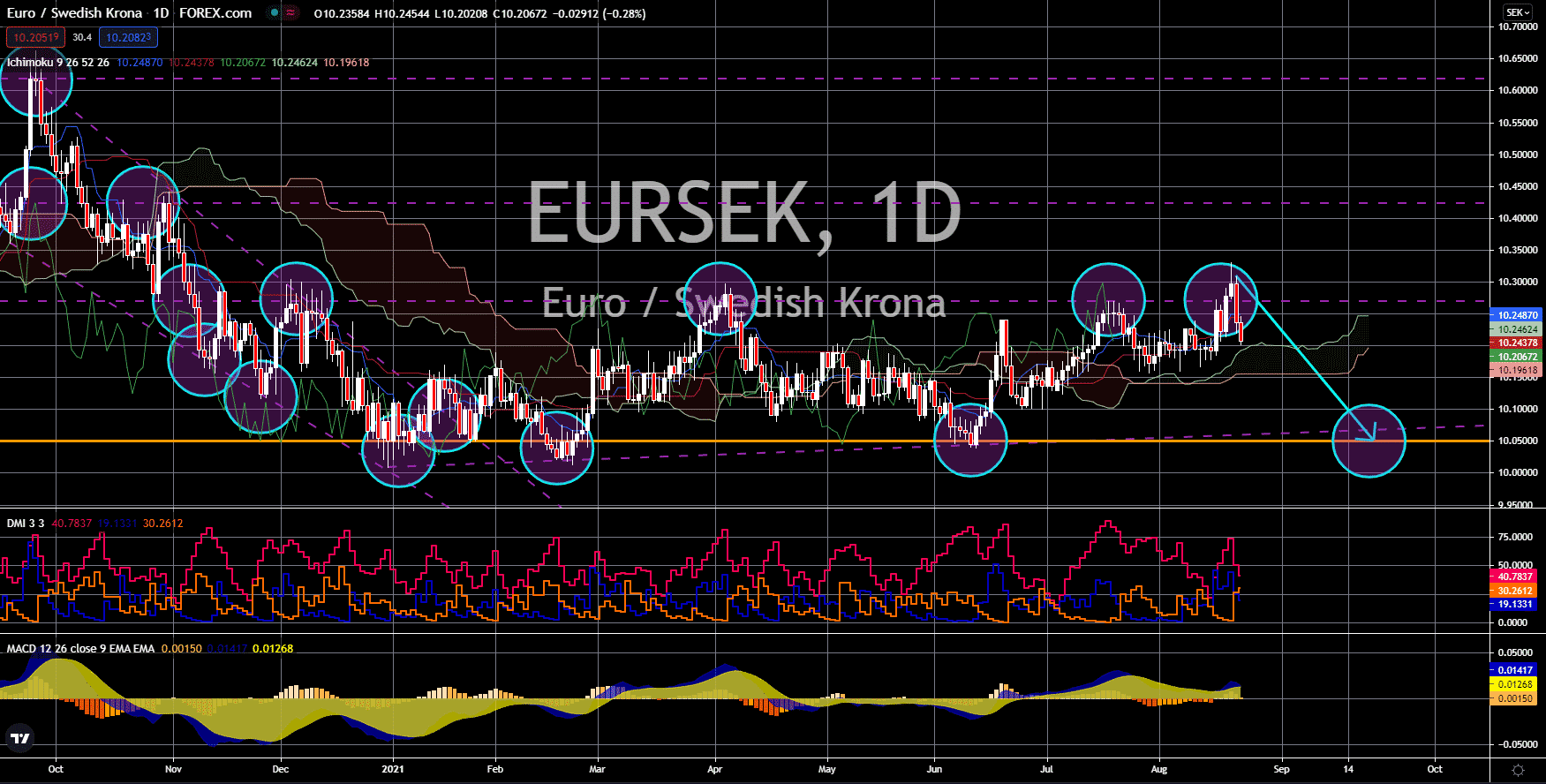

EUR/SEK

The pair will continue to trade lower towards its previous low at around 10.05000. On August 24, the Eurozone’s largest economy is anticipated to post a 9.6% expansion YoY for the second quarter of the year. Meanwhile, the quarterly data could increase by 1.6%. Both numbers would be able to beat the previous records of -3.4% and -1.8%. Despite this, investors are pessimistic about the EU’s economic activity as the manufacturing and services sectors slowed down in August. This could send the currency bloc into a double-dip recession. In Germany, the reported figures were 62.7 points and 61.5 points. As for the EU average, the result came in at 61.5 points and 59.7 points. France also posted disappointing numbers of 57.3 points and 56.4 points, respectively. Adding to the pessimism is the low forecast for the Eurozone’s annual and quarterly growth for Q2. The year-on-year growth is expected at -1.8%, while the QoQ report could deliver -0.6%.

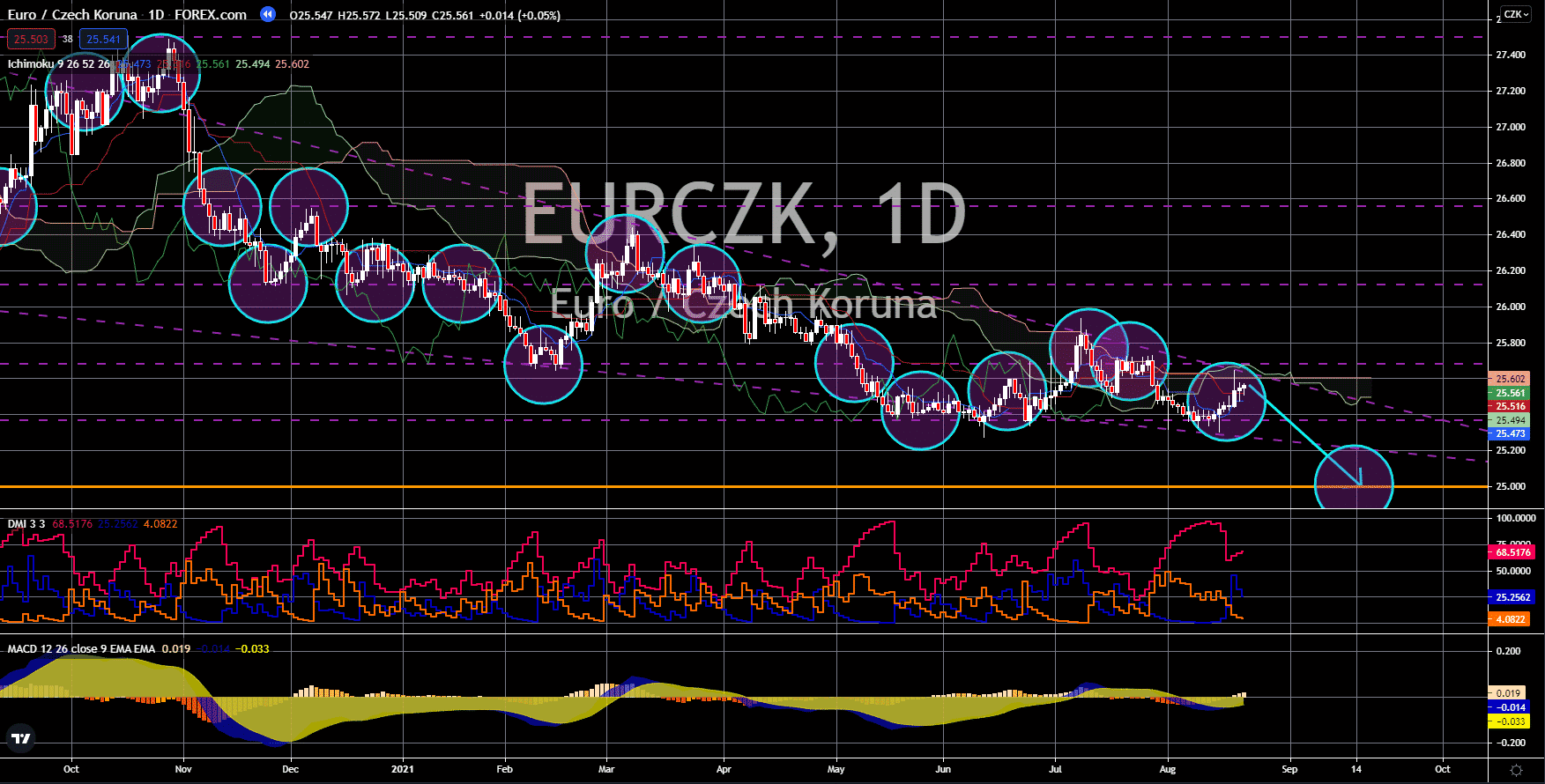

EUR/CZK

The pair will fail to break out from a downtrend resistance line and move past the support towards 25.000. Analysts anticipate the Czech Republic to follow an interest rate hike at its next meeting. On June 23, Prague started to tighten its monetary policy just a day after its fellow V4 country kickstarted Europe’s first rate hike. Czechia raised the benchmark by 25 basis points to 0.50%. Meanwhile, the second increase came on August 05 with another 0.25% increment to 7.50%. Prior to the pandemic, the country had a 1.00% interest rate. Hence, analysts anticipate the key rate to advance by another 25-basis points to return to its pre-pandemic level. The highest rate in 2020 is at 2.25%. This gives more room for Czechia to tighten its monetary policy in the upcoming meetings. The catalyst for further hikes could be the rising domestic prices. The country tightened its border and quarantine protocols against unvaccinated individuals outside the European Union.

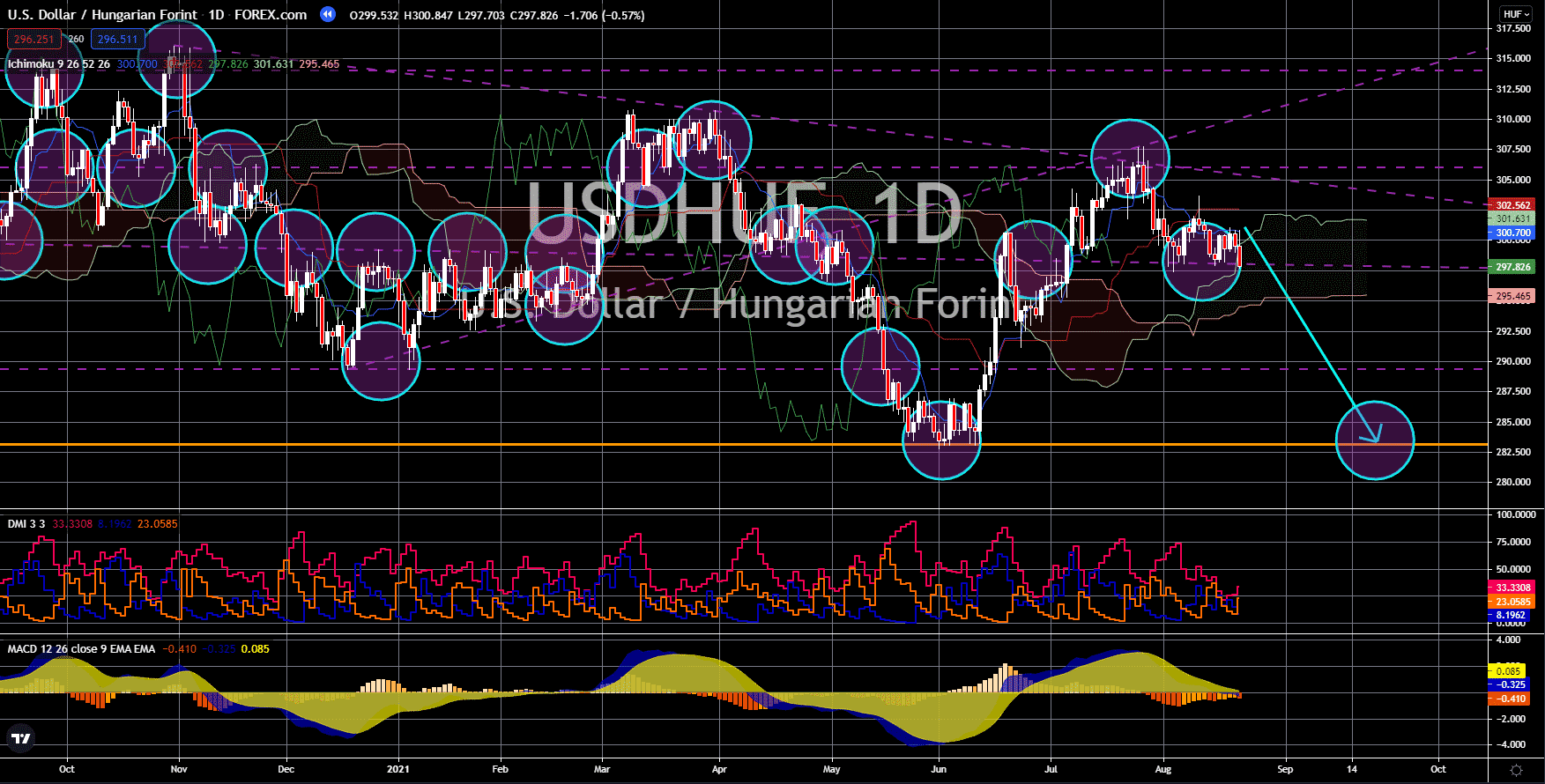

USD/HUF

The bulls will continue to push prices lower towards their previous low near 282.500. Hungary could raise its benchmark for the fourth consecutive time with 1.50% expectations. On June 22, Budapest became the first in Europe to raise its benchmark with a 30-basis points hike to 0.90%. This could pave the way for emerging markets in the region to follow suit. On July 27, the second increase was published. Analysts were expecting 0.20% additions but came out at 1.20%. This led analysts to expect the next meeting on August 24 to jump by another 30 basis points to 1.50%. The estimate could send the interest rate at a 6-year high, or since June 2015. Just like in Czechia, the MNB (Nemzeti Bank) is expected to shrug off concerns on the delta variant to tame inflation. In relation to this, Budapest recorded 340 new coronavirus cases on August 23. This is the highest daily covid infection in nearly 3 months, which could result in further restrictions in the country.

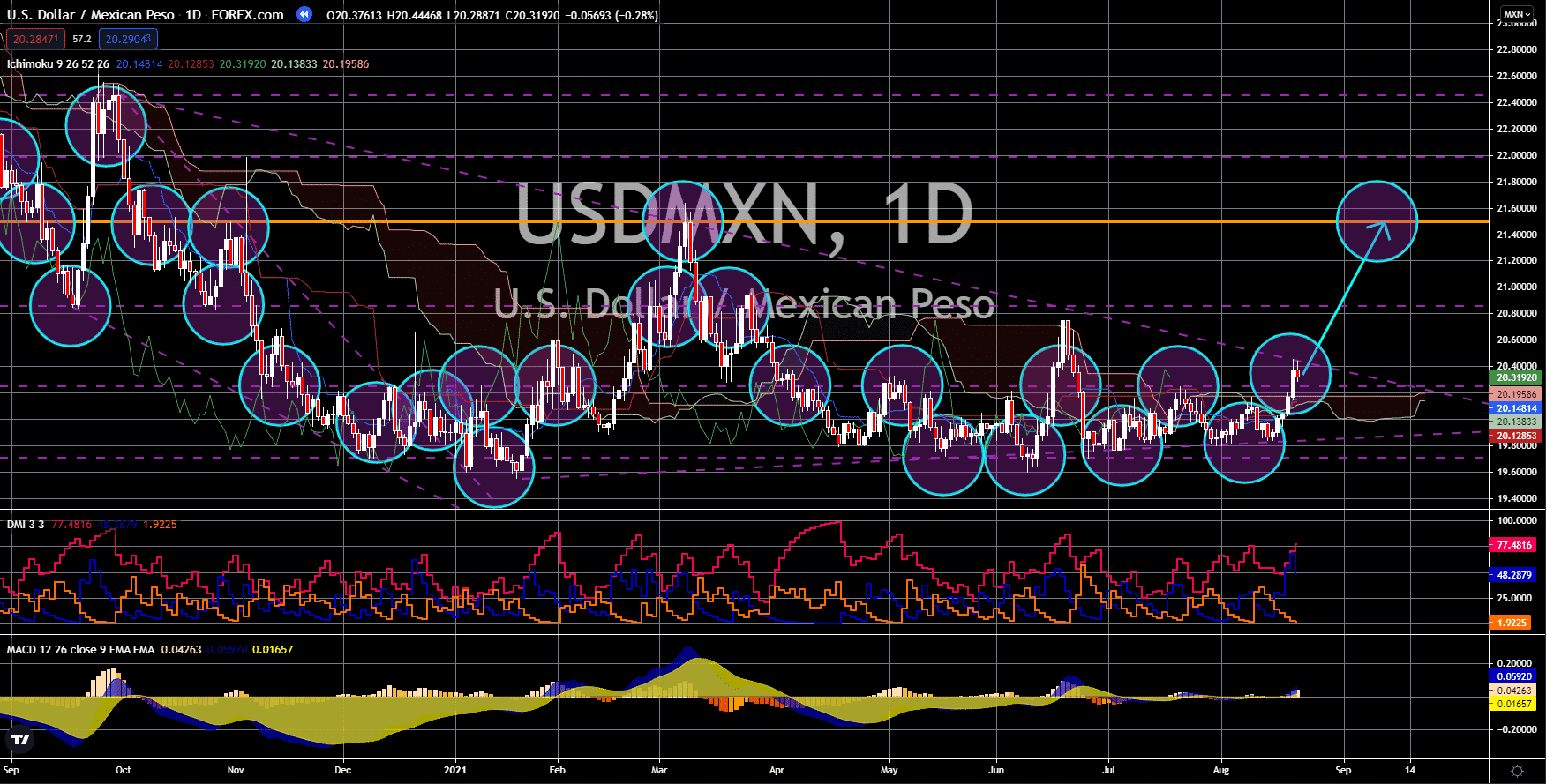

USD/MXN

The pair will break out from the downtrend resistance to retest March’s high at around 21.50000. Mexican President Andres Manuel Lopez Obrador is looking for Banco de México to approve a 12 billion proposal. The amount lent by the International Monetary Fund (IMF) is expected to be used to pay down debts. However, Banxico reiterated that the government must buy the reserve. Cutting the reserve using debt could weaken the peso and send the pair higher in sessions. In other news, Mexico seeks to speak with the US with regards to the implementation of the USMCA on the auto industry. The new trade deal between North American countries is pivotal in rejuvenating NAFTA. However, the rules drafted might work in favor of America and Canada than Mexico. Another news on August 23 is hurricane Grace devastating the oil-rich Mexican state of Veracruz.