Market News and Charts for August 16, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

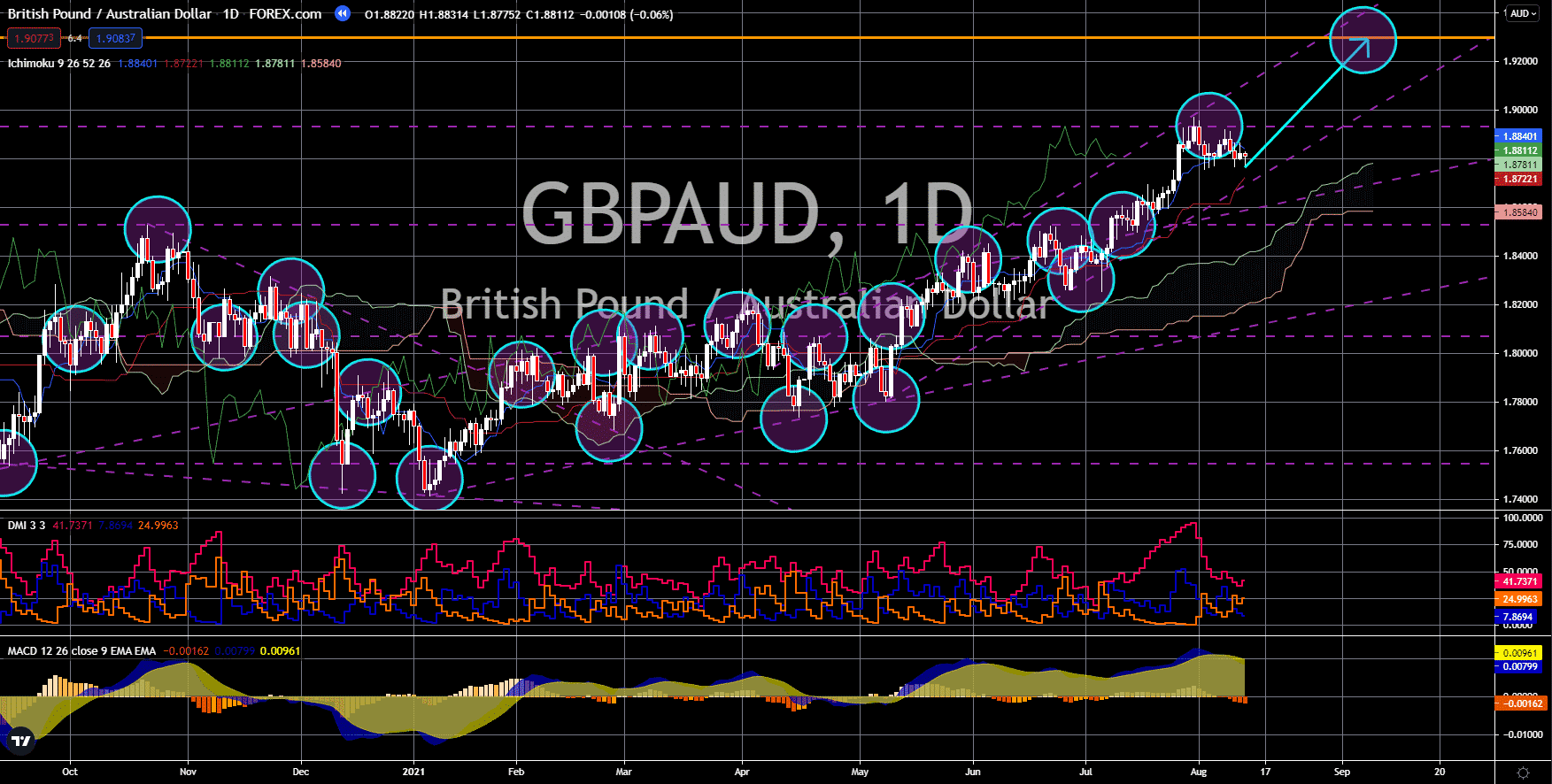

GBP/AUD

The pair will continue to move higher in the following days towards 1.93000. The UK economy posted an upbeat GDP report for the annual and quarterly reports. Year on year, the world’s fifth-largest economy expanded by 22.2%. The figure is an inch higher from the 22.1% estimates and is a massive improvement from the first quarter’s -6.1% contraction. Meanwhile, the quarterly data came at 4.8%, in line with analysts’ forecasts. In Q1, the result was -1.6%. The impressive numbers are despite the slowdown in some economic reports. The trade deficit in the last month of Q2 2021 widened to 11.99 billion. Meanwhile, industrial and manufacturing productions are lower at 8.3% and 13.9%. The previous results were 20.7% and 28.2%, respectively. On the other hand, the construction output fell for the third consecutive month in June at -1.3%. Analysts cited the reopening of the British economy in March as the catalyst for higher gross domestic product.

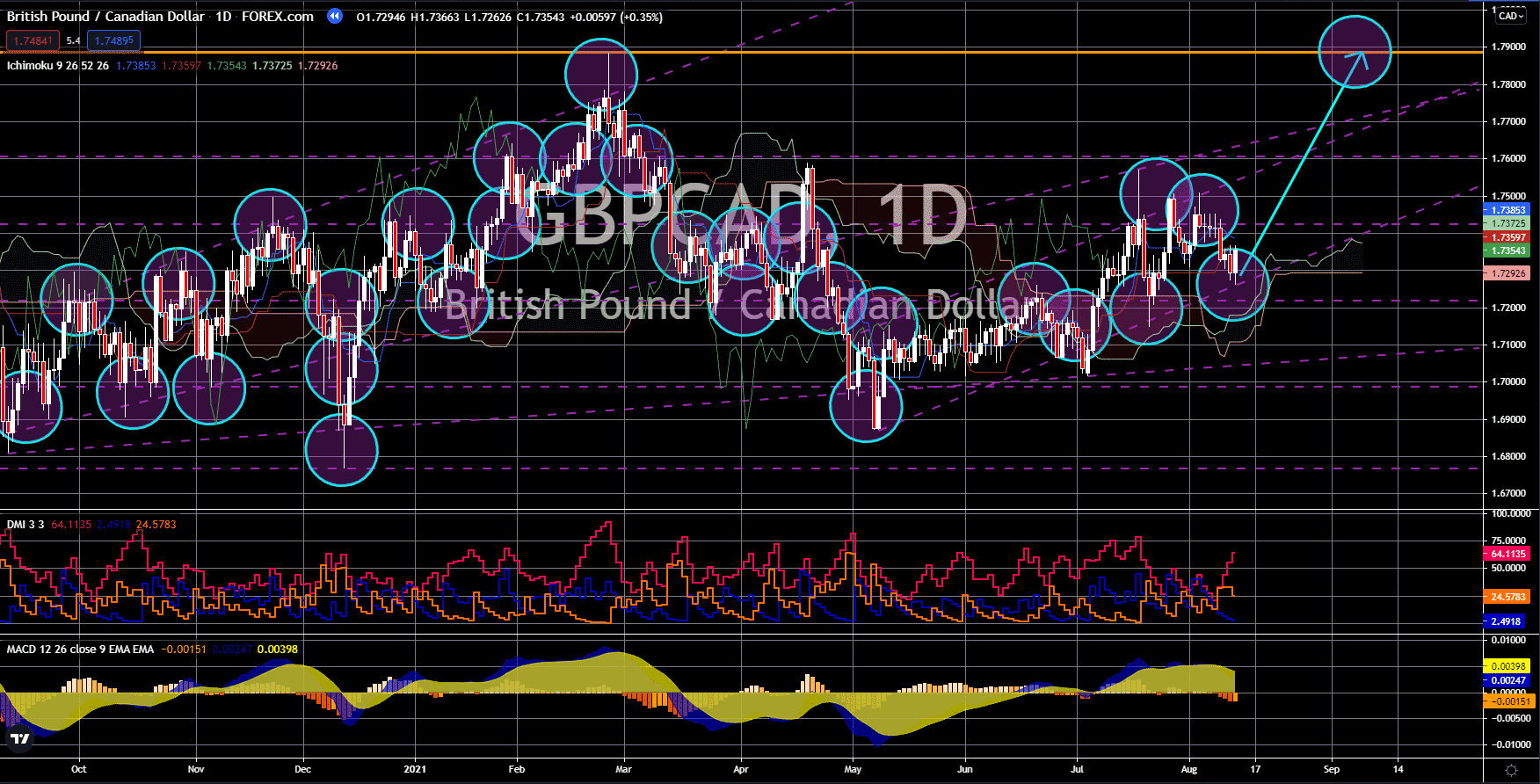

GBP/CAD

Continued bullish momentum is expected to revisit 2021’s high of 1.78848. Canadian PM Justin Trudeau called a snap election on September 20 to gain a majority government. Trudeau seeks an ambitious multi-billion stimulus to kickstart the country’s post-pandemic economy. The decision is timely as the manufacturing sales report due on Monday, August 16, is expected to jump 2.5%. If the actual figure came in line with the estimates, it would be the highest record in three months. Meanwhile, Canada’s most populous province expects a smaller deficit of 25.0 billion US dollars or C$32.4 billion. Ottawa is expecting -C$33.1 billion previously. Earlier this month, the country reopened its border for fully vaccinated US citizens. The positive news gave confidence among investors that economic expansion in Q4 2021, or between October to December, will be better. This will send CAD lower as the improved outlook increases the chance of monetary tightening.

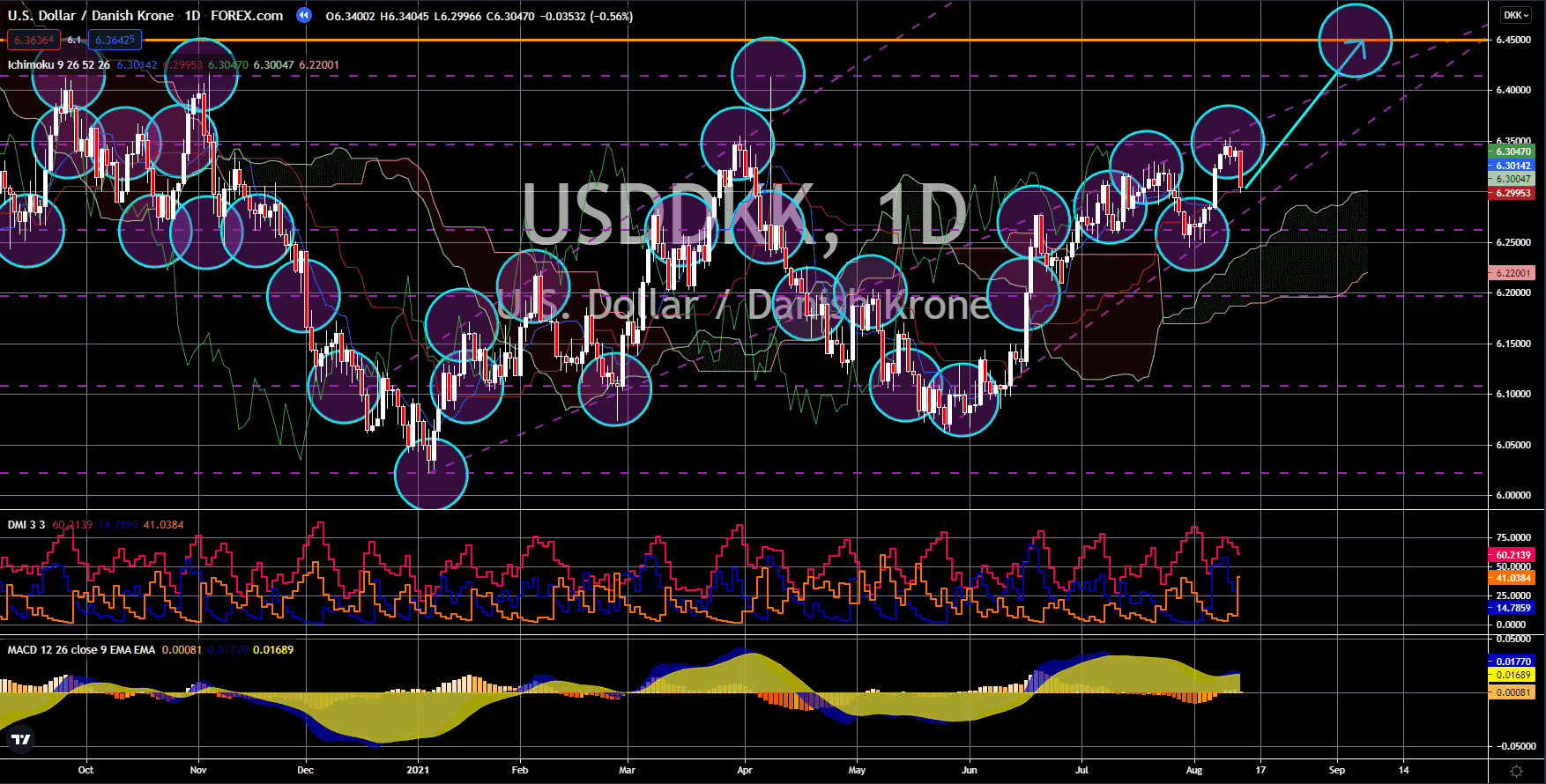

USD/DKK

The pair will retest 6.35000 and head towards 6.45000 within the week. The US dollar is buoyed by encouraging employment and trade results last week. The number of Americans filing for their unemployment benefits fell to 375,000. The figure is the fourth-lowest report during the pandemic and the fourth consecutive improvement in the initial jobless claims. Meanwhile, the continuing jobless claims, or individuals who passed the initial screening, dropped to 2.866 million. Following August 12’s report are the import and export price index. Based on July numbers, the exports are higher by 1.3% from the previous month. On an annualized basis, the result came in at 17.2%. The numbers suggest a faster pace of growth, a bullish signal. On the other hand, imports slowed down to 0.3% and 10.2%, respectively. In other news, coronavirus cases in the US recorded the highest daily infection since February at 259,493 on August 16. This could derail America’s recovery.

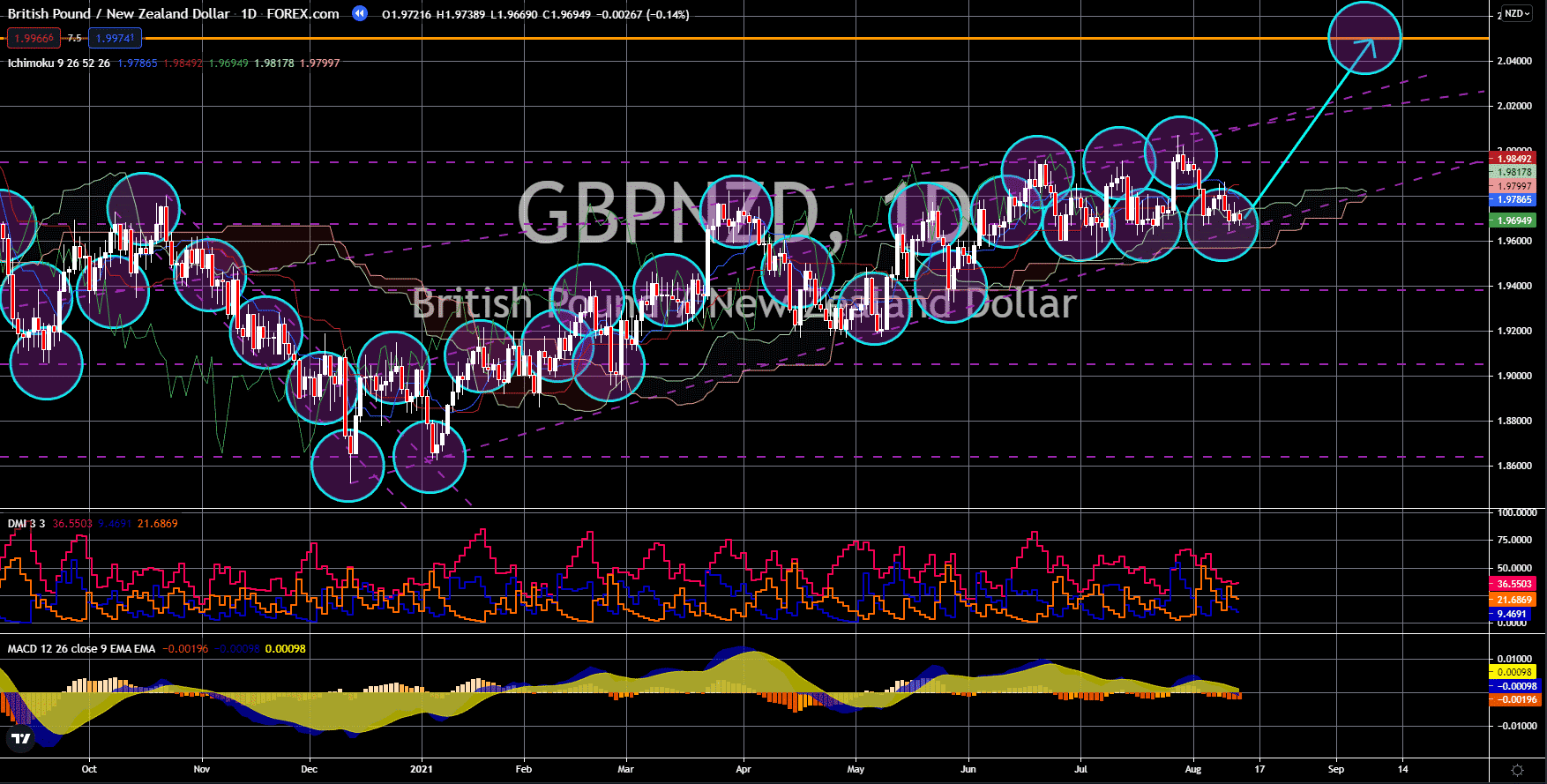

GBP/NZD

The pair will rebound from the support and continue its bullish momentum towards 2.05000. The success of New Zealand in containing coronavirus led Fitch Ratings to name the country Oceania’s fastest-growing economy. It will lead the region this year and in 2022, and Fitch expects the easing of monetary policy this year. The investment research house said that higher interest would benefit the financial sector and tame inflationary concerns. The Royal Bank of New Zealand is anticipated to raise the benchmark rate by 25 basis points to 0.50%. Any additions to the interest will put the country ahead of Asia in a rate hike cycle. The Bank of Korea might follow next week with a hike. Fitch Ratings also see a reopening of New Zealand’s borders amid a lack of labor workers. Prime Minister Jacinda Ardern is expected to relax border restrictions in Q1 2022. On the other hand, the UK will continue with its accommodative policy in the near term with surging coronavirus cases.