Market News and Charts for August 14, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

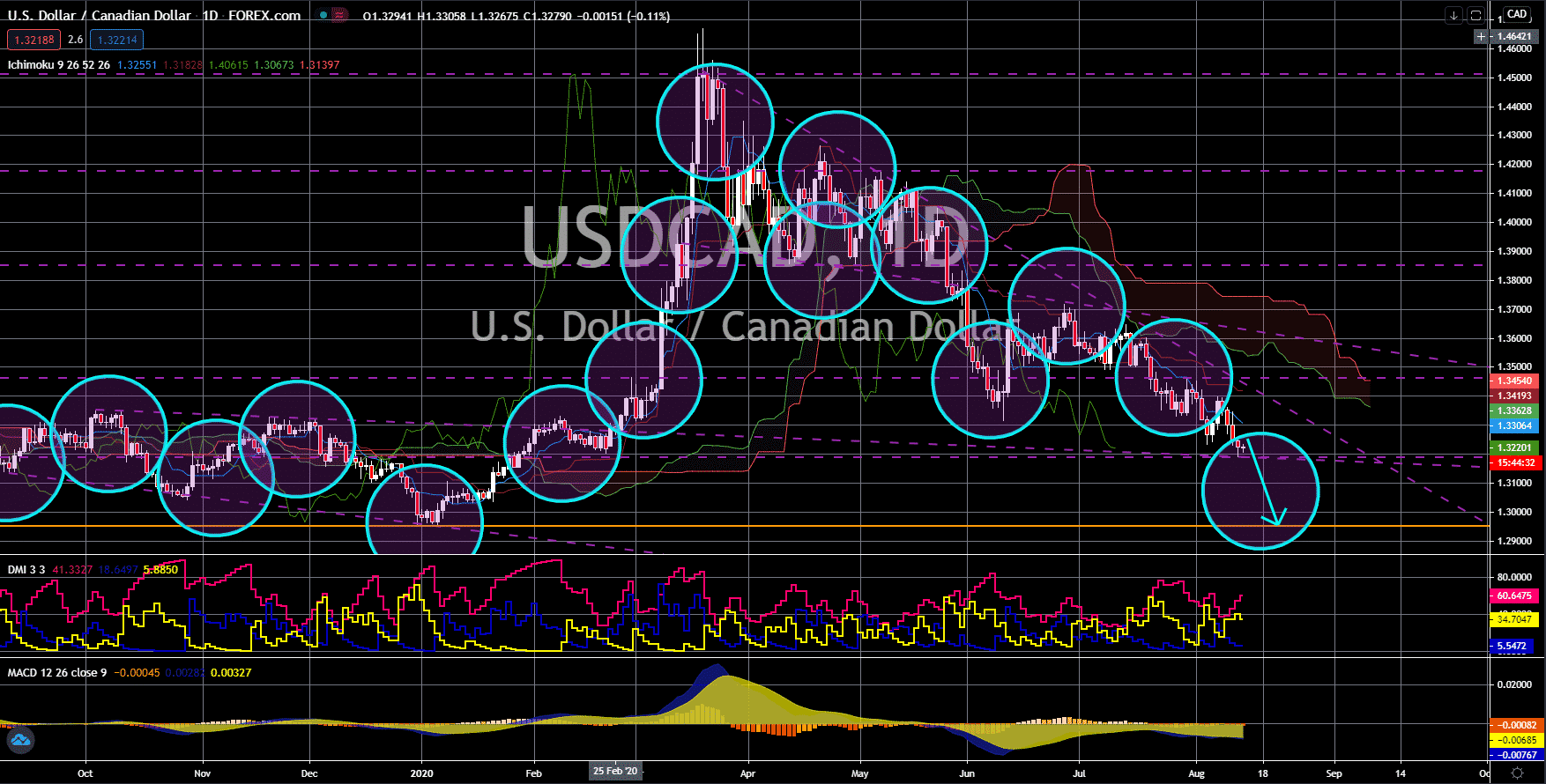

USD/CAD

The pair is expected to break down from a key support line, sending the pair lower towards its January 2020 low. Analysts were expecting a 1.9% growth for the US Retails Sales report today, August 14. This figure was way lower than the 7.5% growth recorded in the prior month. Because of this, investors are expected to minimize their exposure with the greenback. Thus, the value of the US currency is expected to plummet in the coming days. On the other hand, Canada is anticipated to publish a higher growth figure for the Car Manufacturing Sales MoM report today. Expectations were at 16.4% for June compared to 10.7% growth in May. Analysts credited the higher expectations for the report on the strength of Canada’s labor industry. Canada added 419K jobs in July, which represents 55% of the lost jobs due to the pandemic. Analysts are expecting the country to employ the remaining 1.3 million unemployed people in the coming months.

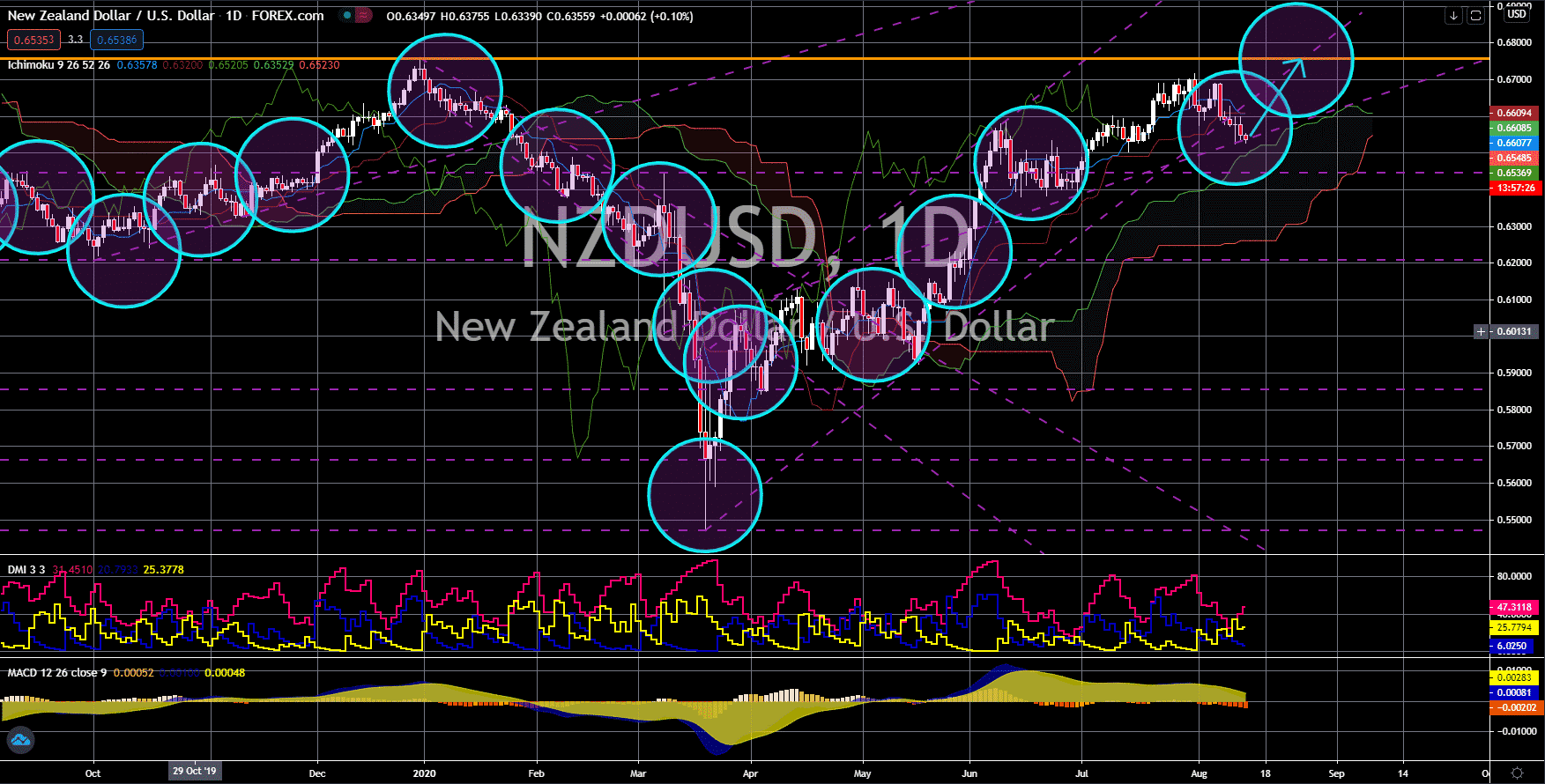

NZD/USD

The pair will bounce back from its support line, sending the pair higher to retest its previous high. The New Zealand dollar was in a free fall for the past five (5) days following the expectations that the RBNZ will expand its QE. On Wednesday, August 12, the central bank finally confirmed that it is raising its quantitative easing capacity to $100 billion. The previous cap was at $60 billion. The RBNZ already cut its interest rate to record low at 0.25% and only QE is the only option for the central bank. Meanwhile, pressure is mounting for the US government and the Federal Reserve to unveil their latest fiscal policy to keep the largest economy afloat. The US central bank has also an interest rate cut of 0.25%. It has also already injected trillions of dollars in the local economy along with the government. But investors are worried if the Fed already loses bullets to help the economy. Thus, investors are now looking for Trump to approve the proposed additional stimulus.

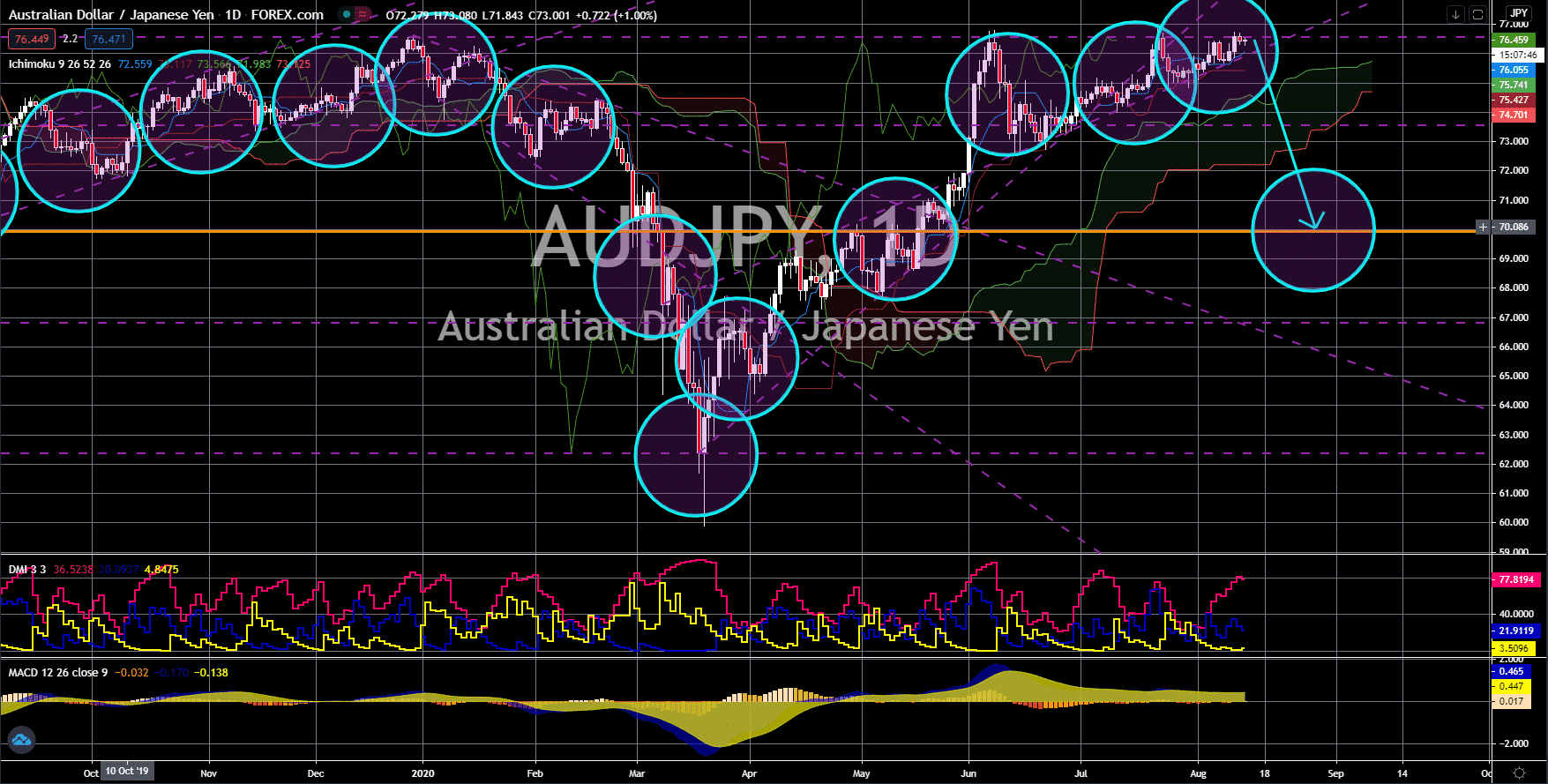

AUD/JPY

The pair will fail to break out from a major resistance line, sending the pair lower towards a key support line. Despite the expectations of U-shaped recovery for Australia, investors are still unimpressed with the recent reports from the country. On Wednesday, August 12, Australia published reports for its labor market. Employment change added 114.7K jobs for the month of July, which is comparatively higher from the 40.0K estimates. However, this figure is still almost 50% lower than the figure from June. Aside from this, the unemployment rate was still going up with the most recent figure recorded at 7.5%. The rising unemployment might derail its economic recovery from the pandemic. On the other hand, the rising foreign investment on the third largest economy in the world gave investors confidence. Japanese stocks and bonds bought by foreigners both went up for the week. Figures were $233.8 billion and $1,434.9 billion, respectively.

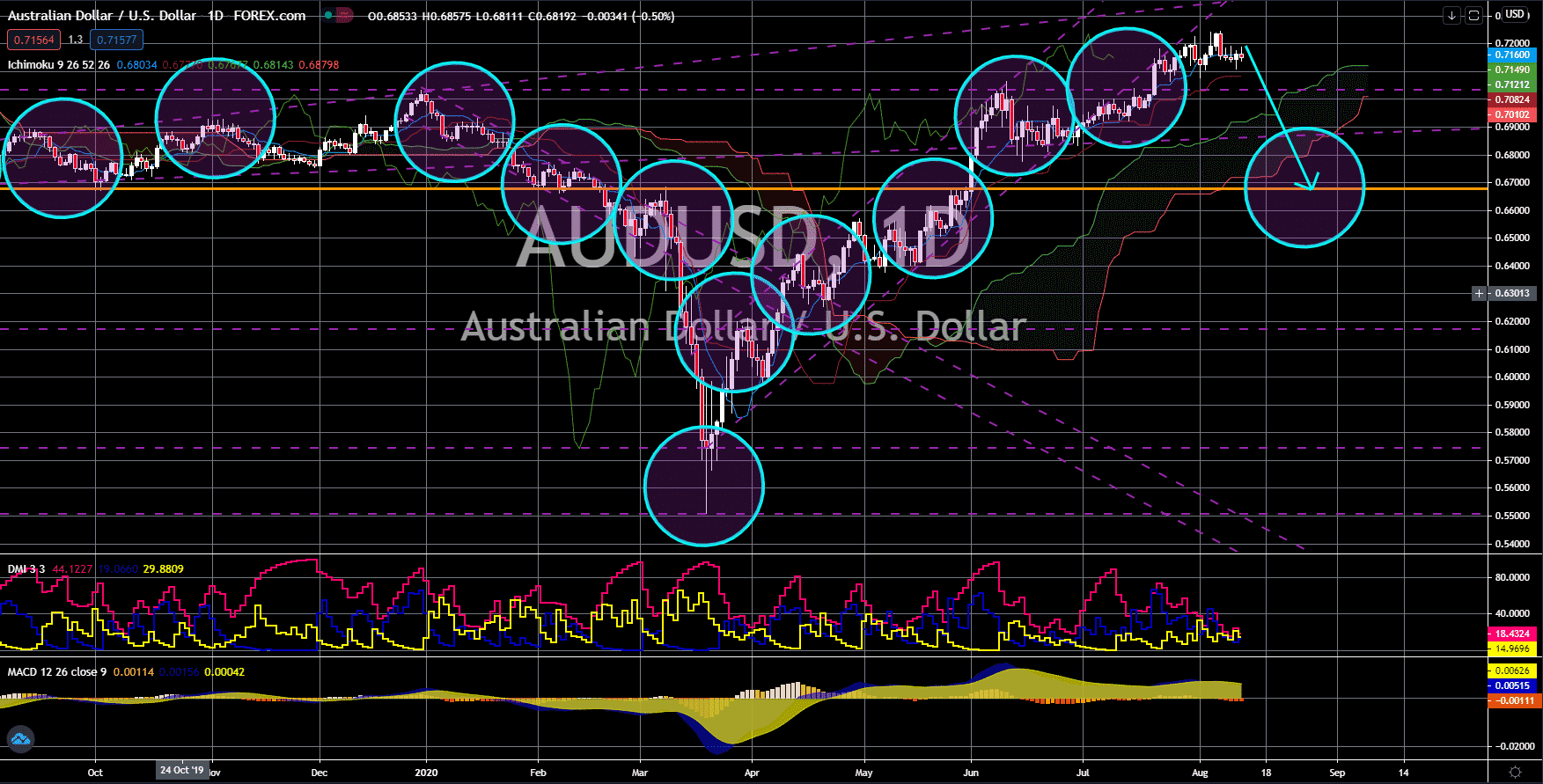

AUD/USD

The pair will reverse back towards a key support line in the coming days. Both Australia and the United States were struggling with their employment reports. The US Initial Jobless Claims report saw a 936K figure in yesterday’s report, August 13. Despite this, investors are still pessimistic following the disappointing result on the NFP report from last Friday. Meanwhile, employment change in Australia employed 114.7K in July. Although this is higher than the 40.0K expectations, the figure was still 50% lower than June’s record of 210.0K. However, the US dollar will thrive against the Australian dollar. US President Donald Trump extended unemployment benefits until October to minimize the impact of the coronavirus in the labor market and in the local economy. On the other hand, the Reserve Bank of Australia (RBA) began preparing its next set of quantitative easing after it held its benchmark interest rate of 0.25%.