Market News and Charts for August 13, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

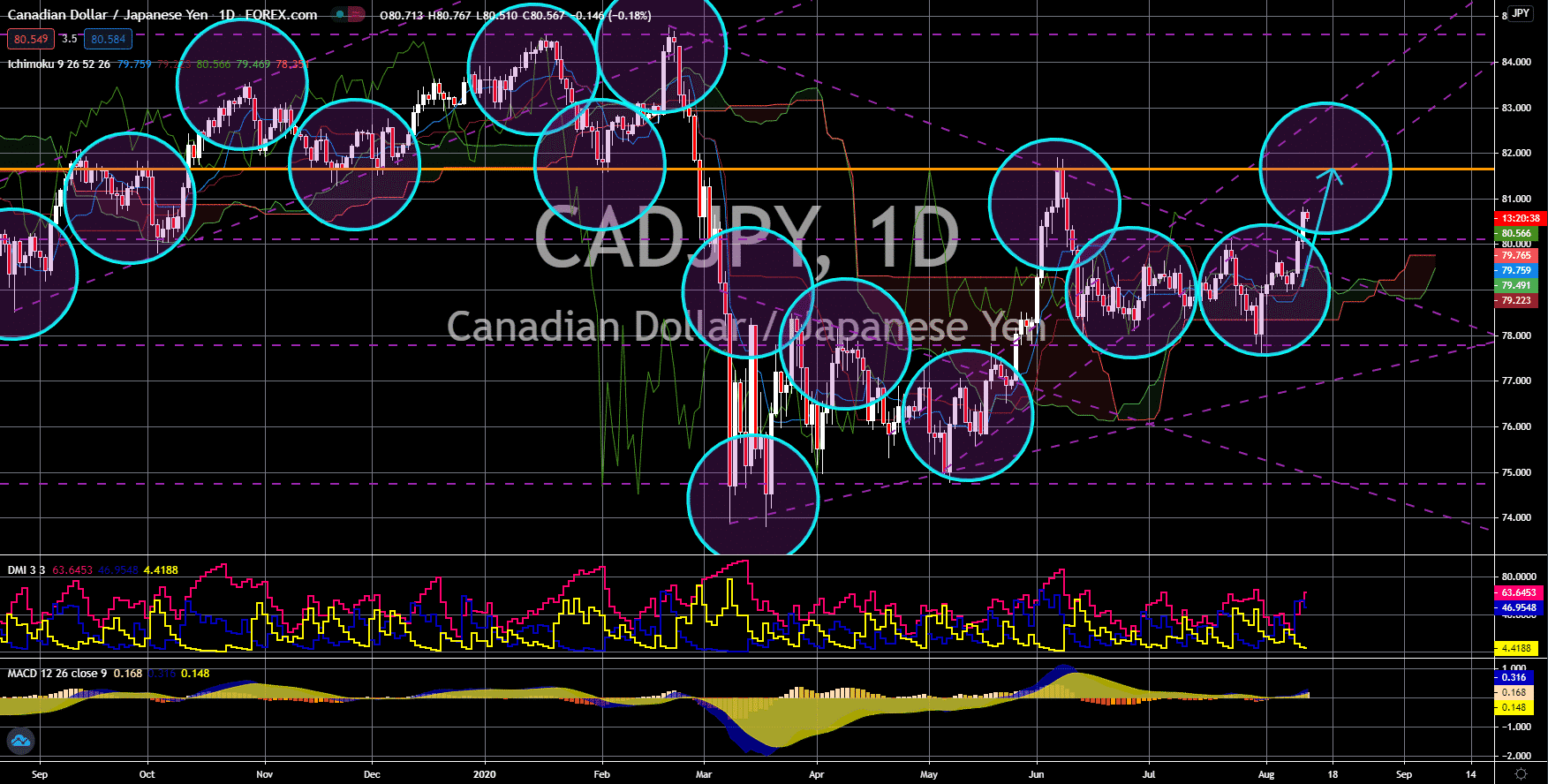

AUD/CAD

The pair will break down from an uptrend support line, sending the pair lower towards a major support line. Australia and Canada both published their reports for unemployment this month. The report from the Australian government showed employment change for the month of July reaching 114.7K. This is almost half the figure it posted for June’s report. Meanwhile, Canada added 418.5K for the same month. Cumulatively, the Canadian economy regained more than 55 of its unemployed workers during the coronavirus pandemic. On the other hand, Australia was only able to employ a third of its citizens who lost their job due to the lockdown. On yesterday’s report, August 12, Australia’s unemployment rate increased to 7.5% compared to 7.4% in the prior report. Westpac Consumer Confidence report also posted a disappointing figure in yesterday’s report of -9.5%. Investors are becoming skeptical of Australia’s U-shaped recovery due to these figures.

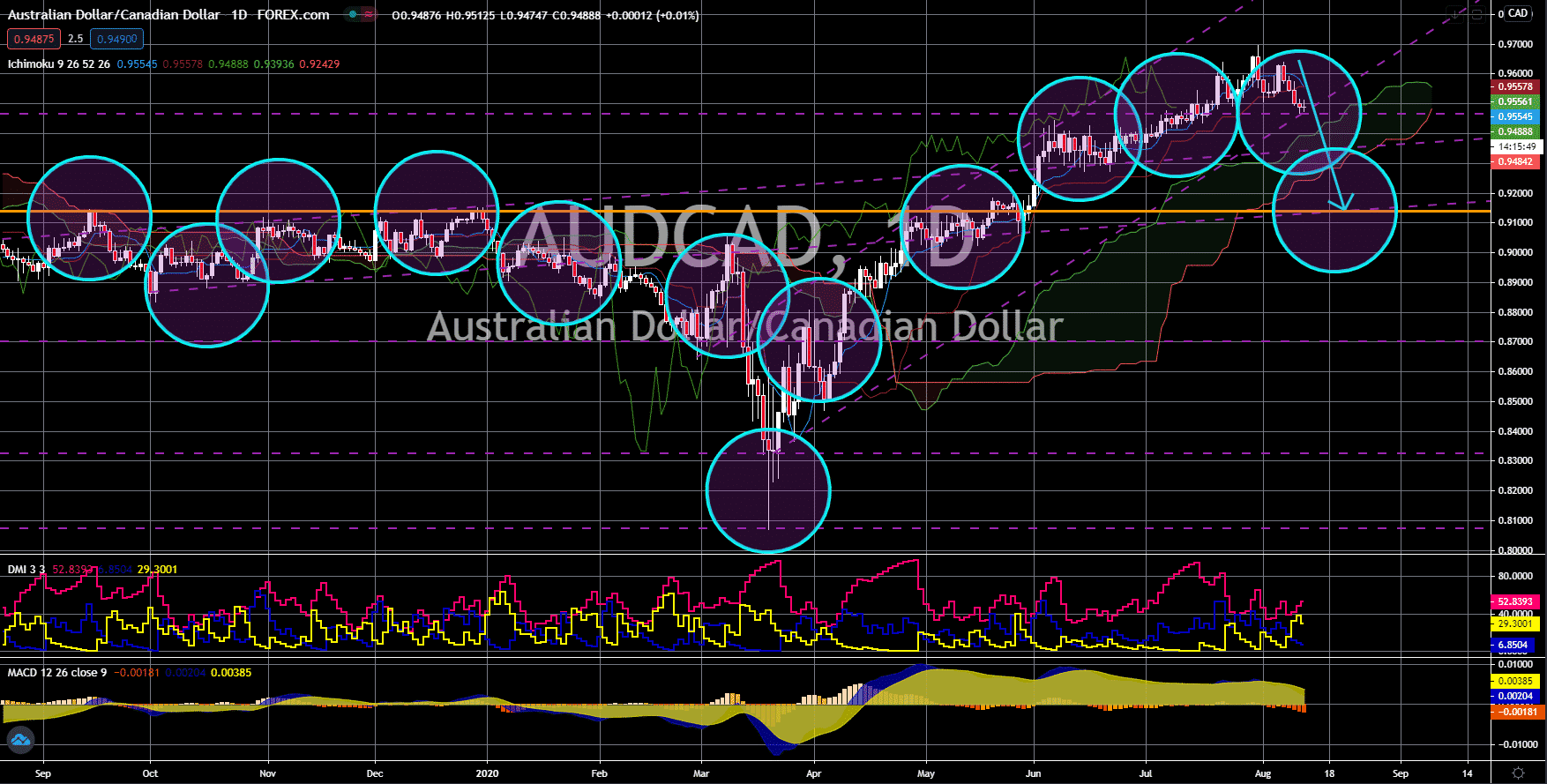

AUD/CHF

The pair will continue to move lower in the following days towards a key support line. The mixed results from Europe’s largest trading bloc and the uncertainty in the global market is boosting the safe-haven appeal of the Swiss franc. The government reported that only 20% of companies went out of business due to the pandemic, which is better than their expected outcome. Analysts credited the country’s success to its government who imposed strict coronavirus measures during the pandemic. Starting October 01, the government will now allow a gathering of more than 1,000 people. Following this success, however, was the increasing call for the Swiss government to scrap a bilateral agreement it signed with the EU with regards to immigration. Right-wing politicians said it is time for the country to take back its immigration control. When it comes to the country’s economy, this means less pressure on job security and salary for its citizens.

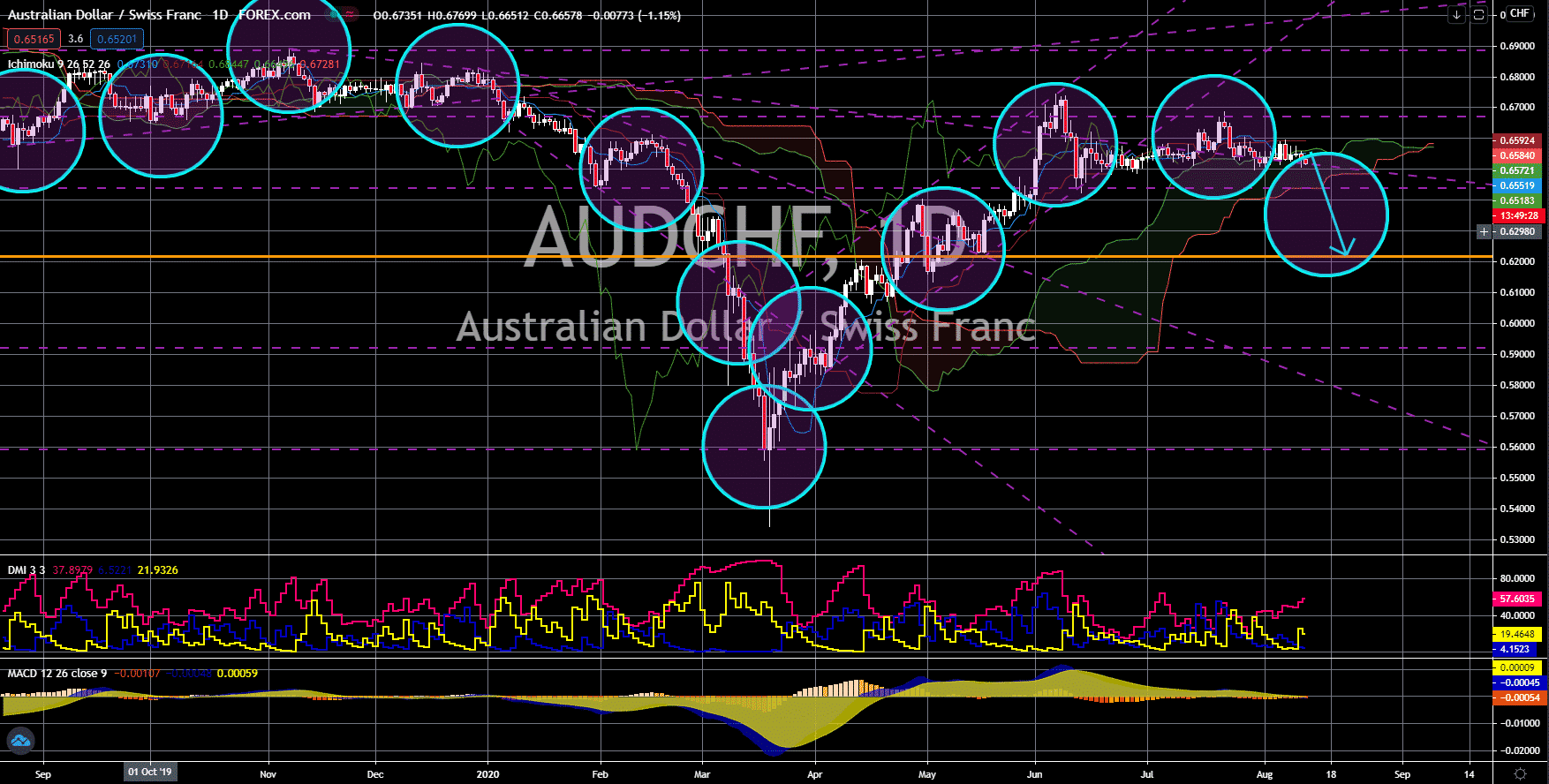

GBP/JPY

The pair will break down from an uptrend channel support line, sending the pair lower towards a major support line. The United Kingdom’s GDP report for the second quarter of 2020 was the headline of major news reports around the globe. On the UK’s report yesterday, it said Q2 contracted by 20.4%, sending the county in a technical recession. This is the first time that the country entered a recession in a decade. The last time was in 2009 following the global recession. Meanwhile, the country’s business investment report dropped by 31.4%. These figures are expected to send the British pound lower in the coming days. Just like Britain, Japan also posted several disappointing results. One of them was Machine Tools Order YoY which declined by 31.1%. However, investors are expected to move away from the British currency in the short-term and prefer the safe-haven currency, the Japanese Yen.

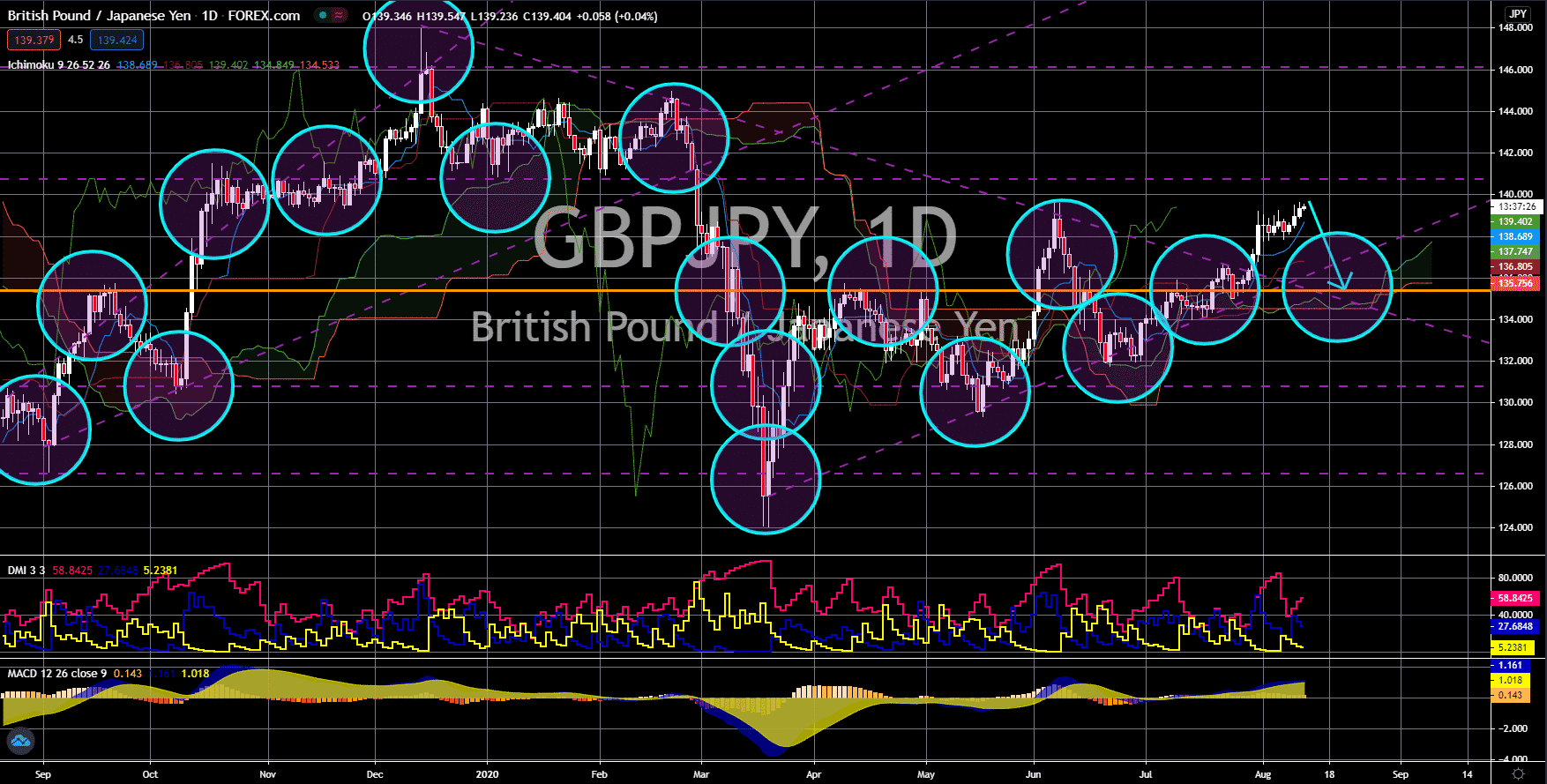

CAD/JPY

The pair will continue its rally towards its previous high in the coming days. The absence of strong figures from the safe-haven Japanese yen will drag the currency lower against the Canadian dollar. Canada added an impressive 418.5K jobs in July, which represents more than half of the job losses from April to June. Meanwhile, the recent report from Japan showed a decline of 31.1%, which is disappointing to investors considering that the country lifted the national emergency back in May. Also, foreign investors are still refusing to invest in Japanese stock despite the trillion-dollar stimulus packages approved by Prime Minister Shinzo Abe. Last week’s figure was a sell off of $578.6 billion while the government refused to give estimates for this week’s report. The strong employment data for Canada is expected to reflect in the country’s economic performance in the coming days particularly its second quarter gross domestic product (GDP) report.