Market News and Charts for August 12, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

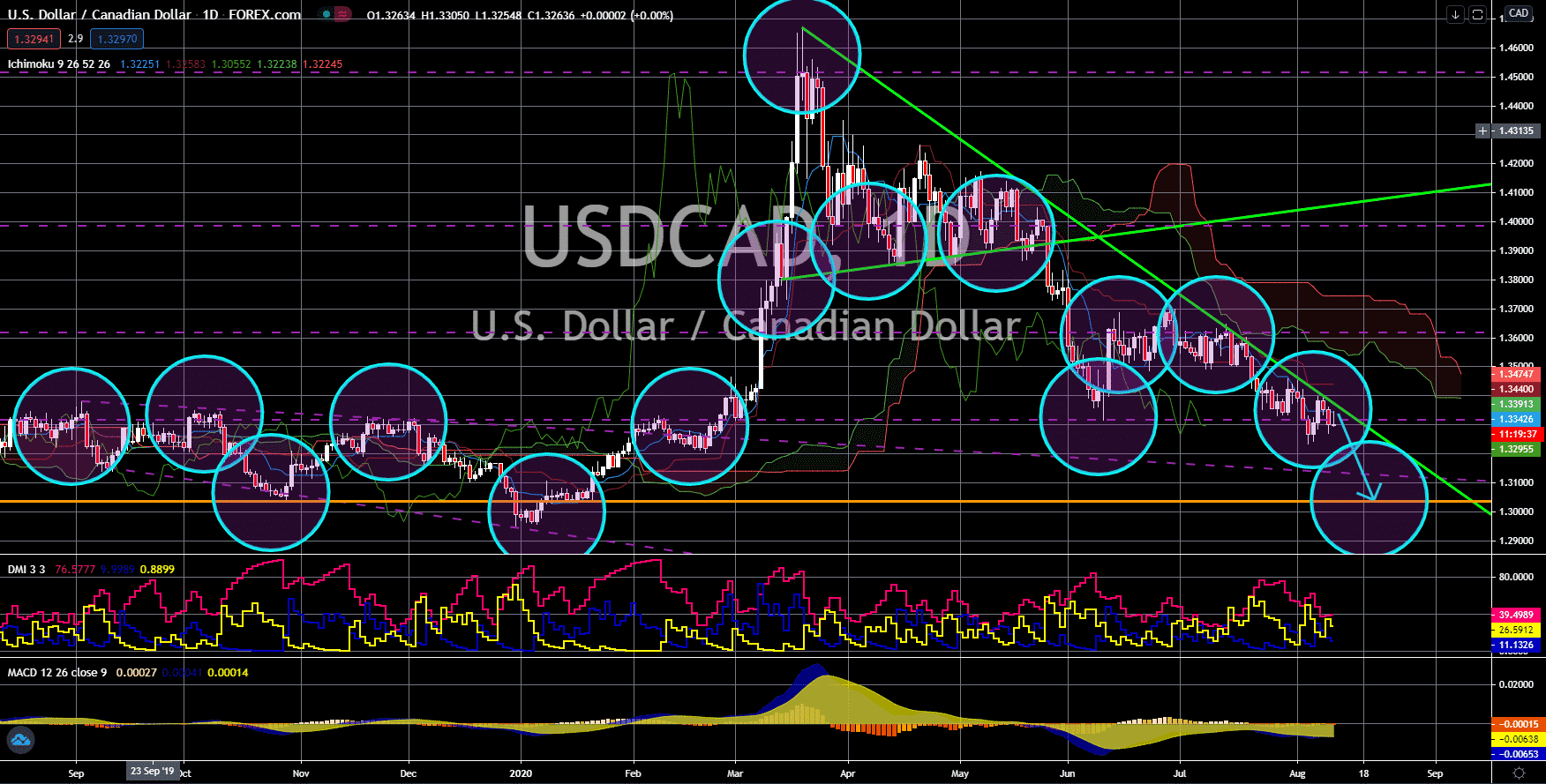

USD/CAD

The pair will break down from its current support line, sending the pair lower towards a major support line. Canada added 418,500 jobs in July, which represents 55% of lost jobs during the pandemic. This result is expected to help the Canadian dollar to continue its stellar performance against the US dollar in coming sessions. On the other hand, the United States recorded 1,763K additional jobs for the month of July. Over the past three (3) months, NFP report employed 9,072K people compared to the total job losses of 20,570K from March to April. The lower count in jobs addition is causing pessimism among investors, thus, a selloff in the USDCAD pair is expected in the coming days. Meanwhile, former Bank of Canada Governor Mark Carney jumps up to advise Prime Minister Justin Trudeau for COVID-19. His expertise in the banking sector is expected to help the government’s response for the pandemic.

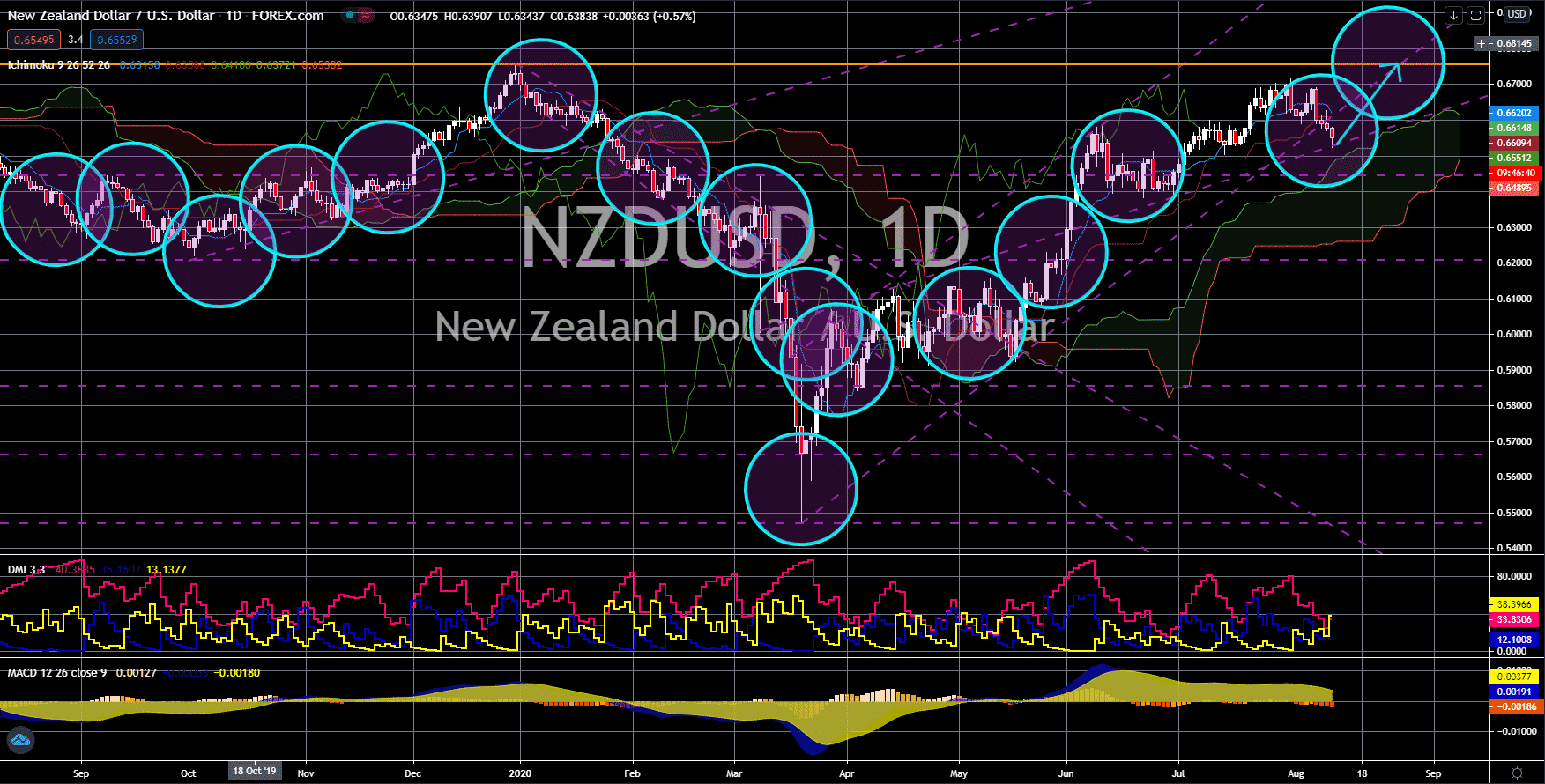

NZD/USD

The pair will bounce back from an uptrend support line, sending the pair higher towards its 2020 high. The Reserve Bank of New Zealand retained its current benchmark interest rate of 0.25% for the fourth consecutive meeting. This was amid the successful response by the NZ government to contain the virus. Analysts are expecting a V-shaped recovery for the country in the coming months. This, in turn, rejected the need for any intervention by the government and the central bank in the local economy, Meanwhile, the Federal Reserves is under pressure to send its rate to zero after US President Donald Trump refused to sign another stimulus package. The $1 trillion stimulus was aimed to further help the economy to weigh down the uncertainty brought by COVID-19. In total, the US government and the central bank already injected more than $6 trillion in stimulus. The increased supply of greenback in the market causes the weakness of the USD.

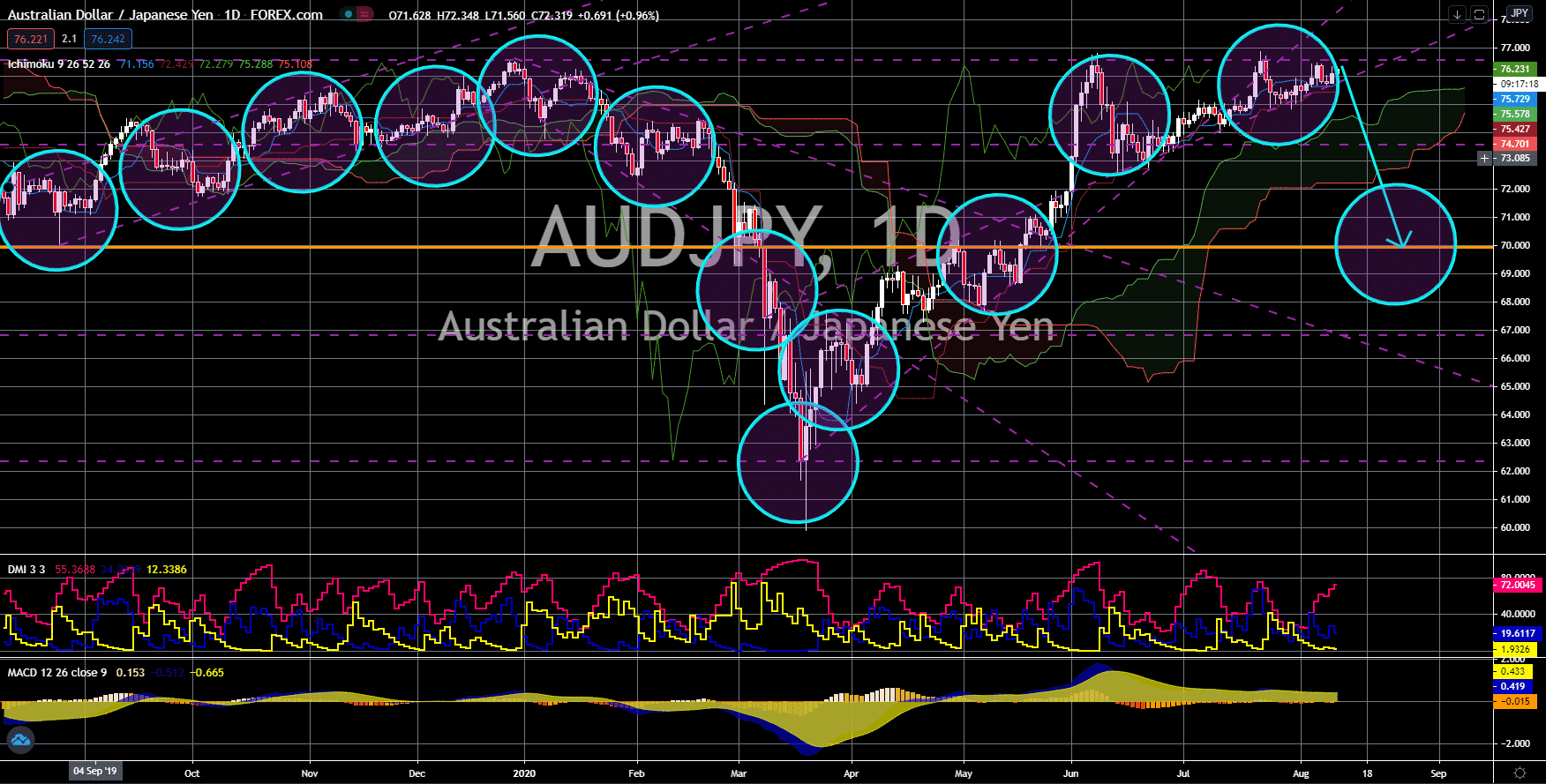

AUD/JPY

The pair will fail to break out from a major resistance line, which will send the pair lower towards a major support line. The high figure expectations for Australia’s unemployment rate will hurt the Australian dollar in the short-term. Analysts are expecting a 7.8% increase in unemployment for the month of July despite optimistic outlook in the country’s economy. This will be the fastest rise in the unemployment rate since the April figure. Meanwhile, only 40.0K jobs are expected to be added for last month compared to June’s 210.8K addition. On the other hand, the high bank lending YoY report on Monday, August 10, will help the Japanese yen to recover its losses. The 6.3% figure was the highest recorded number for the report. This means that businesses are now taking risks to go back to operations. This also follows the end of the national emergency by Japanese Prime Minister Shinzo Abe which shut down most businesses due to the pandemic.

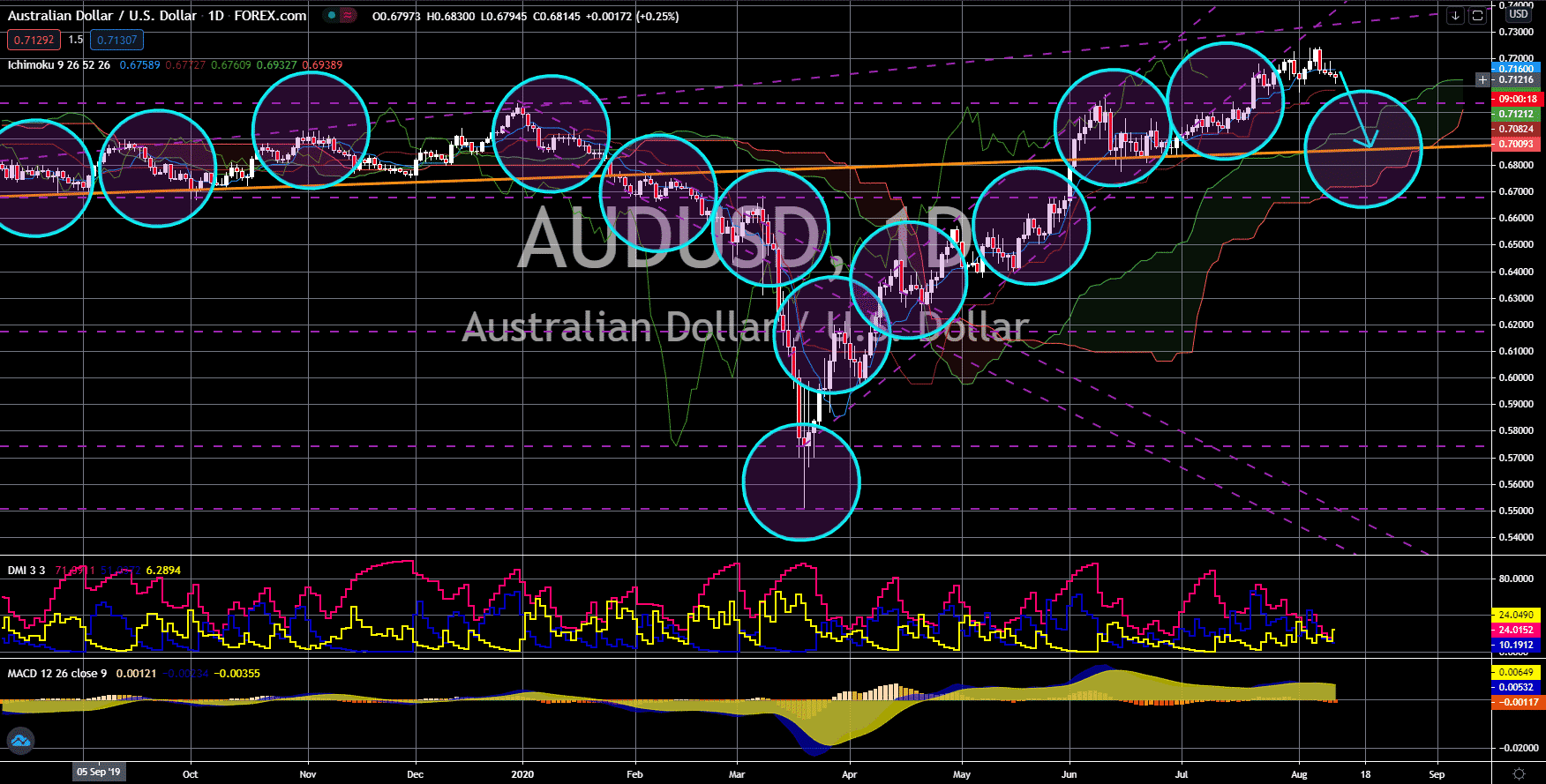

AUD/USD

The pair will reverse back towards an uptrend support line. Business confidence report by National Australian Bank (NAB) recorded another humiliating figure -14 points. This was despite the optimism by the national government of a U-shaped recovery for Australia in the coming months. The country is also expecting only 40.0K employment change in today’s report which is way lower than the 210.8K jobs addition recorded in June. Wage Index Price QoQ also recorded its lowest figure since 2008 of 0.2% for the second quarter of 2020. The US also posted several disappointing results since last week. Today’s report on Consumer Price Index MoM is no different. Expectations for the report were only 0.3% for July compared to 0.6% record in the prior month. Despite this, investors are optimistic that the COVID-19 vaccines that the government funded and ordered will help the economy to go back on track in the coming quarters.