Market News and Charts for August 11, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

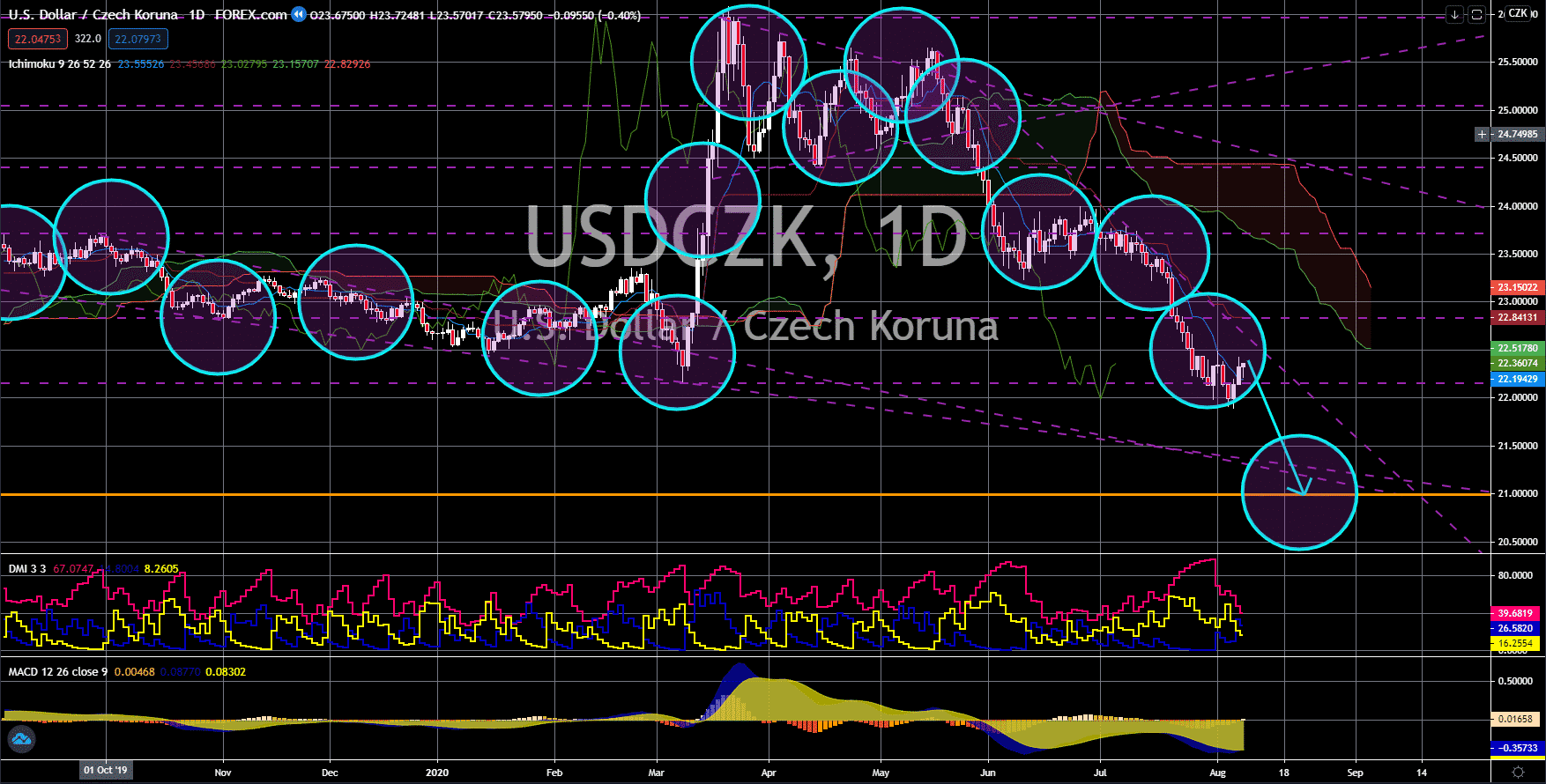

USD/CZK

The pair will break down from a major support line, sending the pair lower towards its April 2018 low. The Czech central bank retained its current benchmark interest rate of 0.25% for the third consecutive meeting. This was following the 175 basis points cut they made in March due to the pandemic. Meanwhile, the US government and the Federal Reserve are pressured to intervene in the local economy to further support businesses and individuals. The central bank already slashed 150 basis points since March while the Fed and the government together injected a total of $6 trillion stimulus. By doing another cut or approving ore stimulus, however, the US dollar will continue to depreciate. Another factor that investors should be looking at was the looming 2020 US Presidential Election. The election expenses are expected to help the greenback in short to medium-term. However, an interest rate cut and stimulus will derail USD’s recovery.

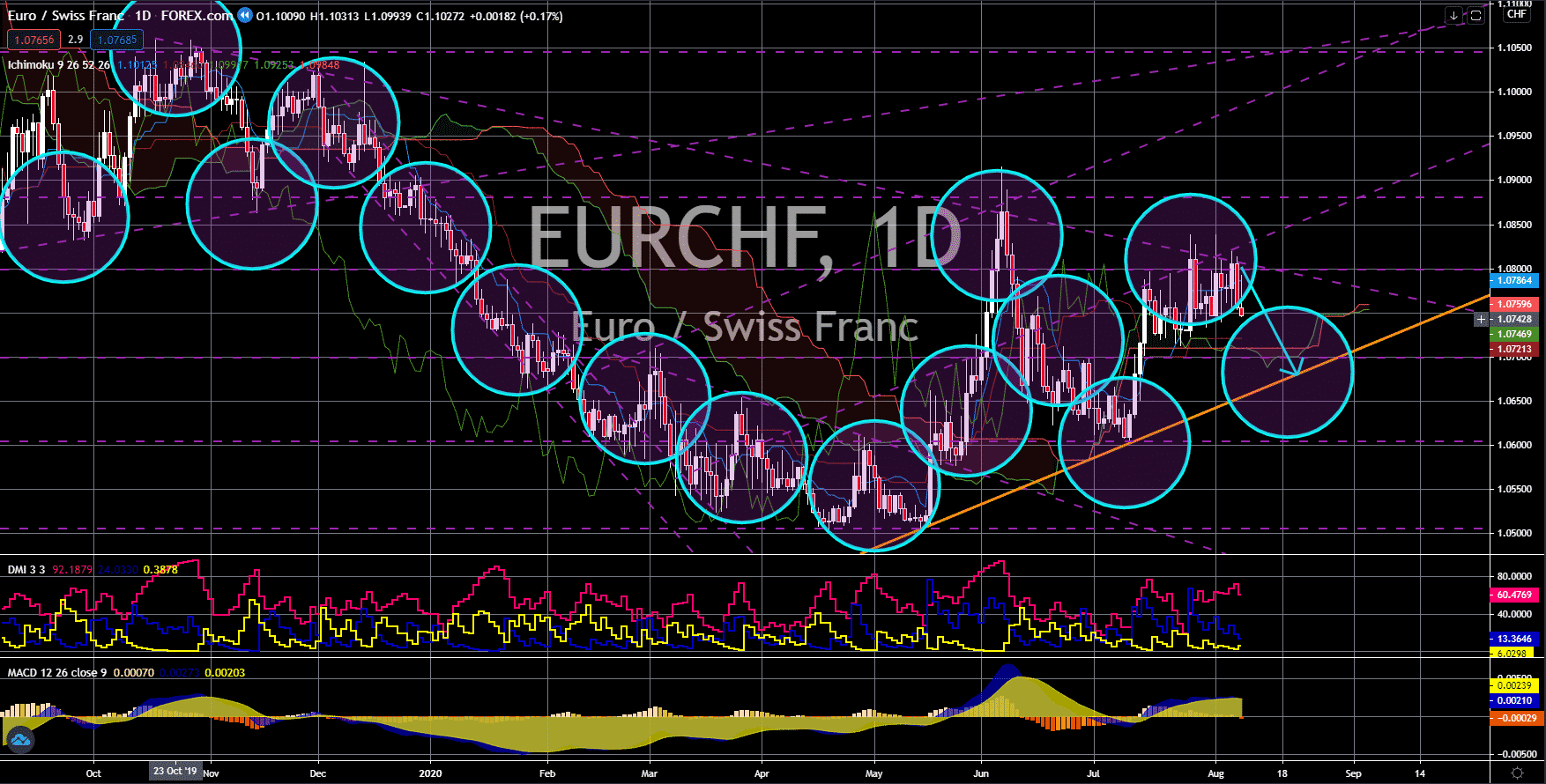

EUR/CHF

The pair failed to break out from an uptrend channel middle resistance line, sending the pair lower towards the channel’s support line. Yesterday, August 10, Switzerland posted its unemployment rate report. Figure came in at 3.3%, which is the same figure from June, beating analysts’ expectations of 3.6%. This suggests that the worse for the Swiss economy is over and that investors can expect a recovery in the country in the coming months. Meanwhile, Europe’s largest economy, Germany, reported mixed results for today’s report. ZEW Current Conditions slide by -81.3 points for the month of August compared to -80.9 points in July. On the other hand, ZEW Economic Sentiment climbed to 71.5 points for the current month compared to 59.3 in the month prior. This means that investors are skeptical of the current economic health of Germany while being optimistic in the future performance of the EU’s economic powerhouse.

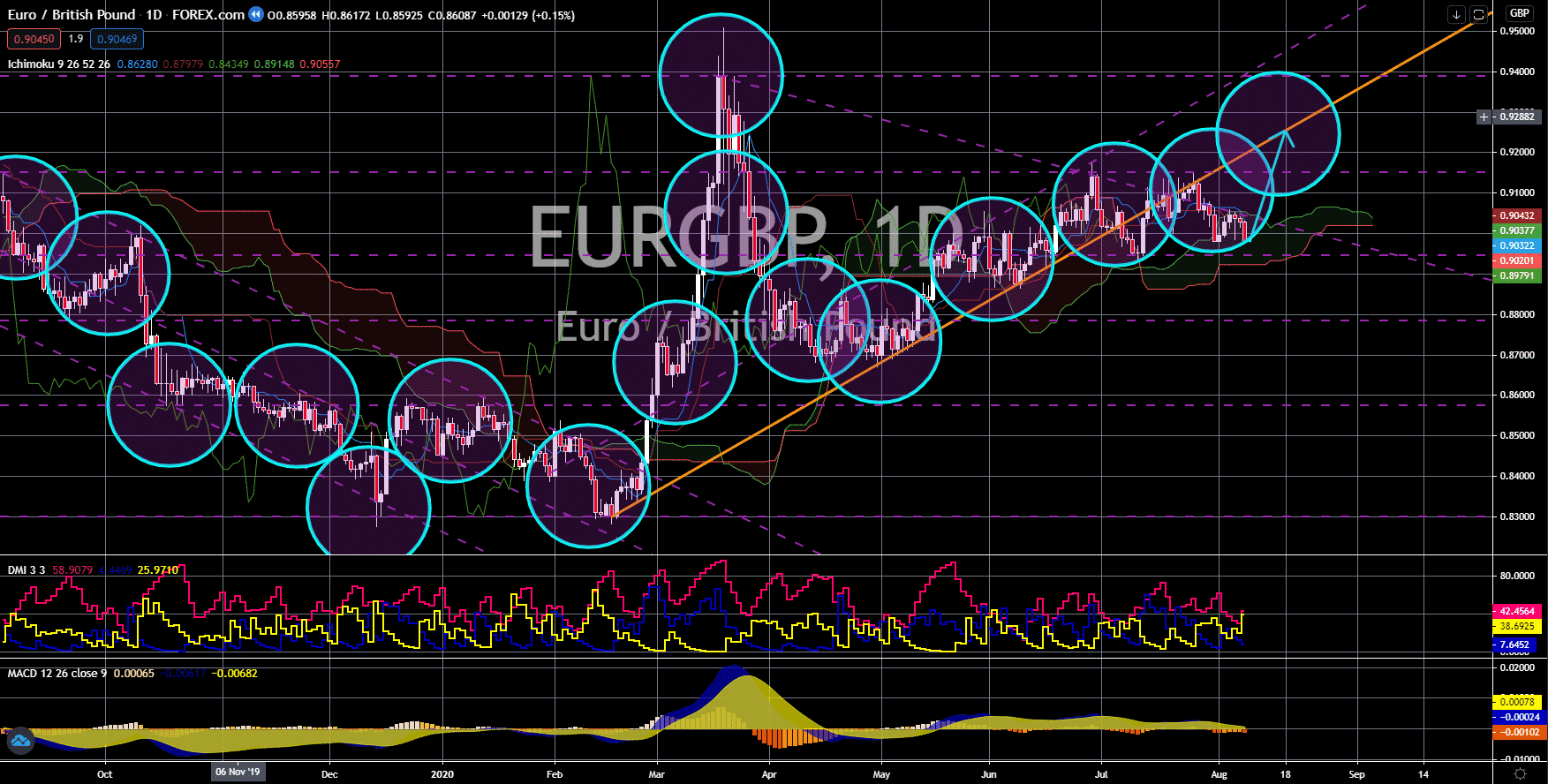

EUR/GBP

The pair will break out from a downtrend resistance line, sending the pair higher to retest an uptrend channel support line. The United Kingdom posted its unemployment report today, August 11. Figure came in at 3.9% for the month of June compared to expectations of 4.2%. Britain maintained the same figure over the past four (4) months. However, claimant count change for the month of July went up once again following the decline in June of 28.1K. This suggests that investors should expect a higher unemployment rate in the coming months. Aside from this report, analysts are also waiting on the much anticipated second quarter GDP report of the United Kingdom tomorrow, August 12. Expectations for Q2 2020 was 20.5% which could send Europe’s third largest economy into a technical recession. On the other hand, Germany, the EU’s economic powerhouse, posted mixed results for its several reports over the past weeks.

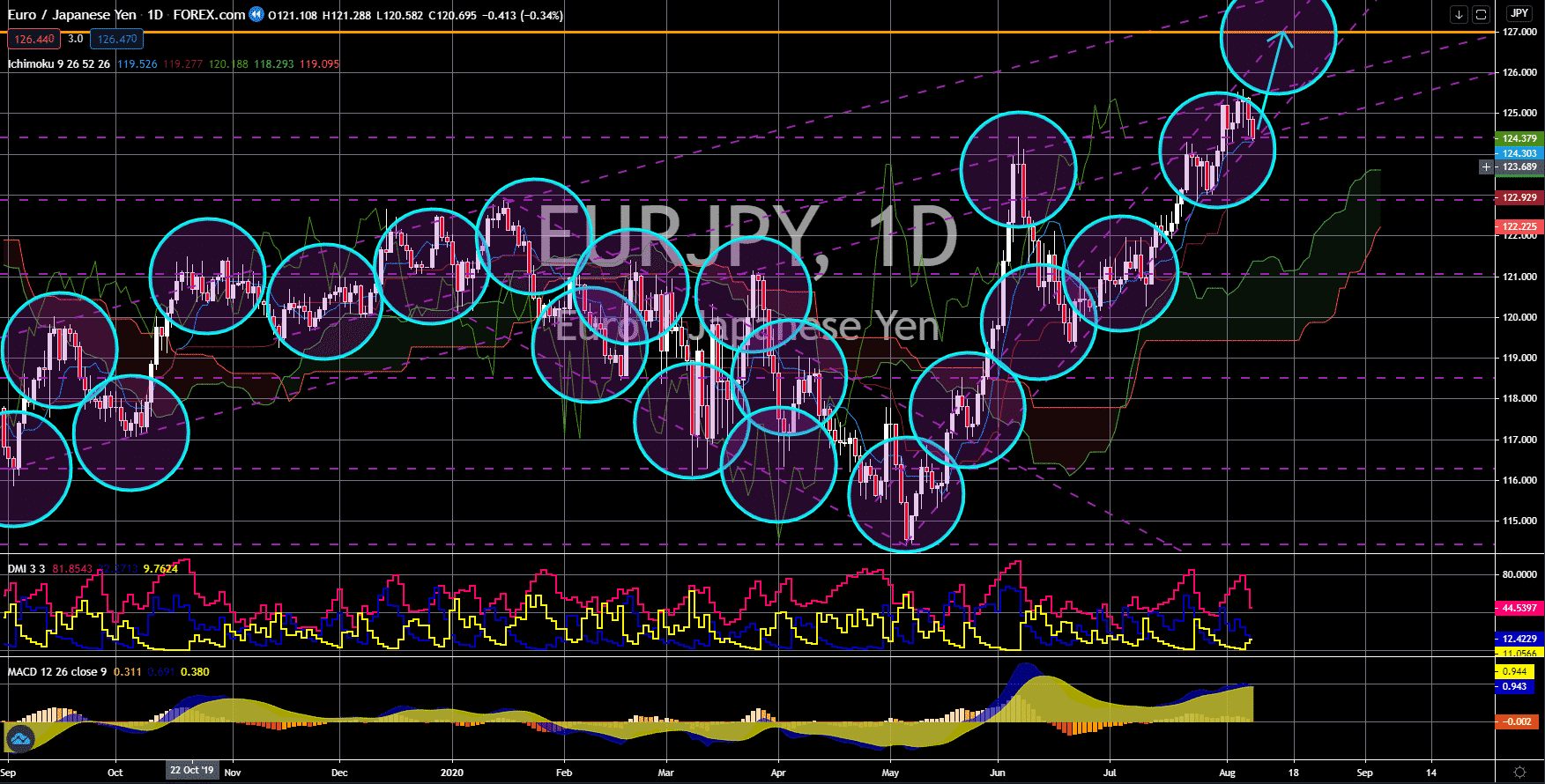

EUR/JPY

The pair will continue to move higher in the following days towards the $127.00 price level. Japan is losing on all ends. The country posted a decline of 25.7% for the month of June for its Current Accounts report, the lowest in 5 years. This was due to its low export as countries still limit their exposure from other countries with high numbers of COVID-19 cases. Japan also failed to secure an upper hand on the post-Brexit negotiation with regards to the levies on Japanese cars. Prime Minister Shinzo Abe is also pressured to impose another national emergency through the country as the coronavirus cases continue to soar. He argued that doing so will badly hurt the already ailing third-largest economy in the world. Just like Japan, sentiments in the European Union were also mixed as reports from Germany and France were mixed with positive and negative data. However, the gradual recovery in Europe will help the single currency to thrive against the Japanese Yen.