Market News and Charts for August 06, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

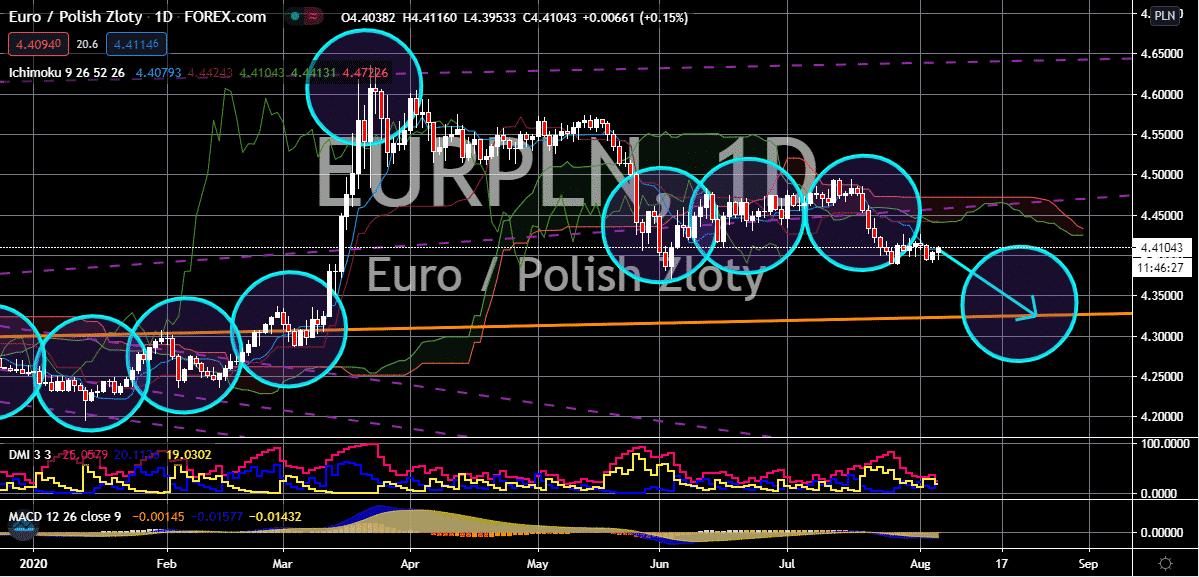

EUR/PLN

Despite the strength of the euro against other major currencies such as the US dollar, it, unfortunately, doesn’t stand a chance against the Polish zloty. In fact, bears have been slowly and steadily dragging the pair, and now it’s heading towards its support level. It’s believed that prices will go down to its lowest ranges in nearly five months as the Polish zloty works to recover the euro’s major gains from the beginning of the pandemic. What’s slowing down the Polish zloty now is the fears of another wave of coronavirus infections in the nation. That would further harm the economy and do more damage to the zloty. The reopening of economies in the region has benefited almost all of the currencies there, and the zloty is no exemption. One of the main factors that have affected the Polish zloty is the recent election in the country. Just recently, Poland’s top court ruled that the results of the presidential elections were valid, closing the argument for now.

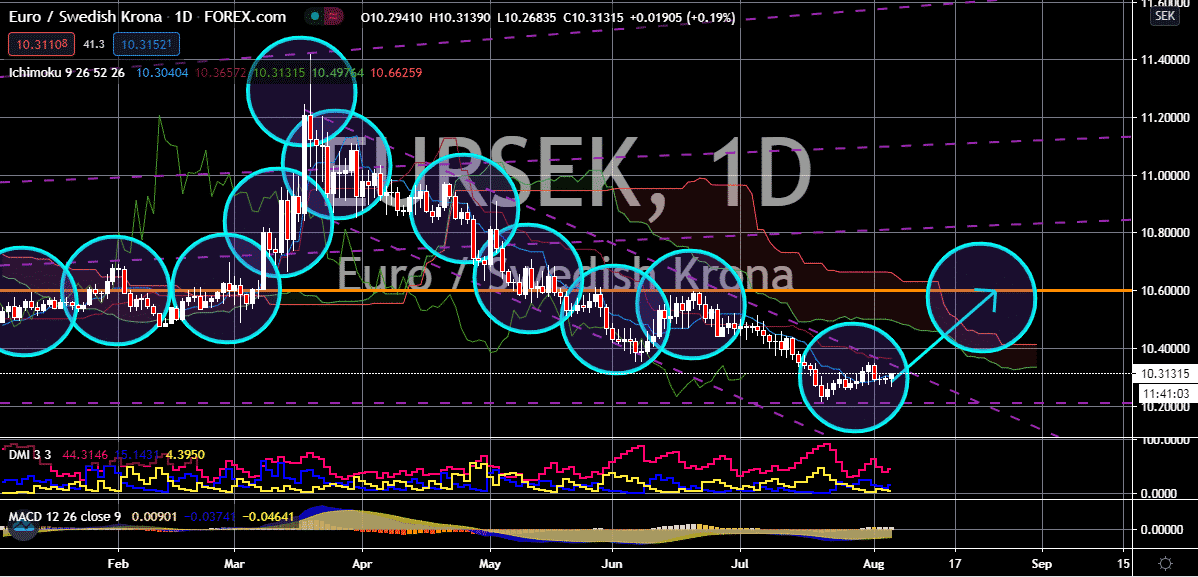

EUR/SEK

The euro is set to redeem itself against the Swedish krona. After weeks of bearish waters, the trading pair is expected to sail in bullish markets as the euro sets its eyes on the highly anticipated non-farm payroll in the United States. The results of the report will strengthen the currency, allowing it to make a comeback against the Swedish krona. The decision of the Swedish government to leave its economy wide open despite the pandemic is argued by many as the reason for the Swedish krona’s strength. Earlier this year, the Swedish krona was pinned down by the euro, but over the summer, it has staged a successful recovery. Now, as the pandemic continues to affect millions of lives around the world, the euro could have an upper hand in the coming days thanks to positive news ahead. The weak stance of the greenback is one of the reasons why the euro could strengthen further as investors would then prefer other major currencies.

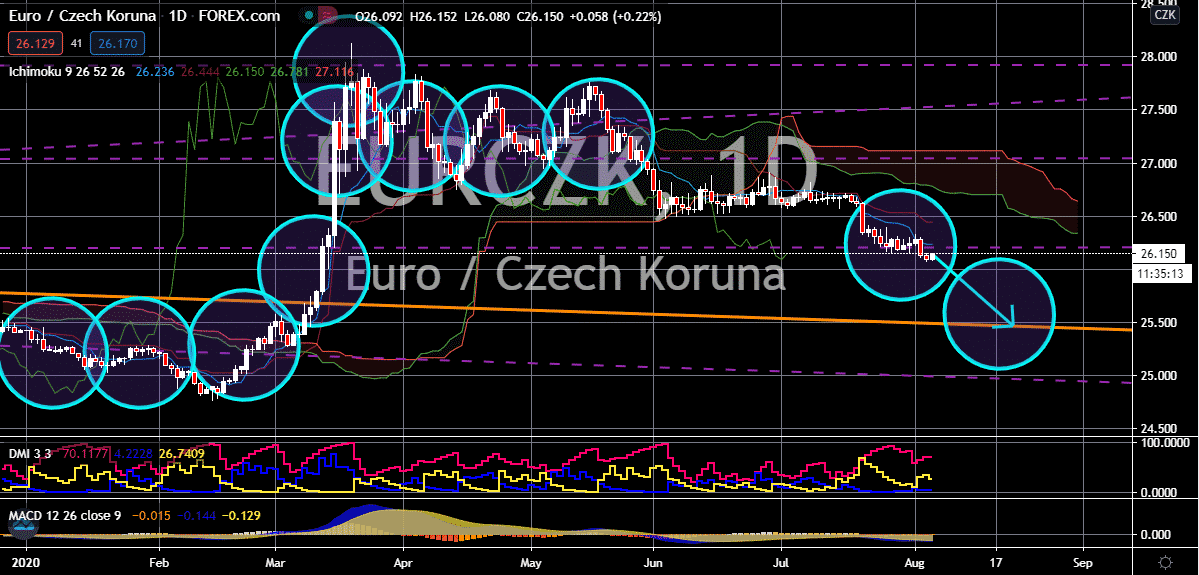

EUR/CZK

As of this Thursday, the Czech krona has steadied against the euro. Despite that, the direction of the pair is projected to be downwards as investors hold on tight for the interest rate decision of the Czech National Bank due later today Prices are expected to crash towards their support level as bearish investors target ranges last seen in March 2019. The strength of the euro against other currencies such as the US dollar fails to shine through against the Czech koruna. Moreover, the Czech National Bank is expected to hold on to its rates at approximately 0.25%. On the other hand, the national bank is reportedly not concerned about inflation being above the upper tolerance band as some economists say that it may be just an initial and temporary effect. Now, as the current situation of the economy remains unclear due to the ongoing pandemic, the Czech National Bank has kept reiterating that it does not want to exclude or promise that it would not use any of the possible unconventional monetary tools in case it may be deemed necessary in the near future.

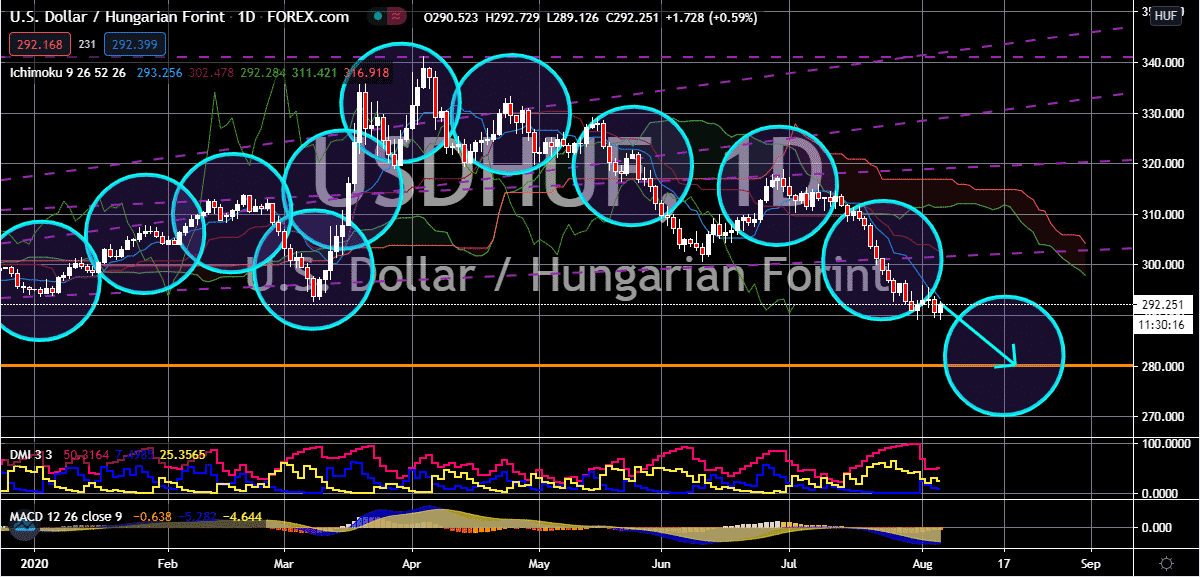

USD/HUF

As of writing, its seen that bullish investors have managed to force the pair to steady despite the weakness of the US dollar in the global market. However, as mentioned, the US dollar is week. And the upcoming US non-farm payroll report tomorrow isn’t projected to help it. Considering that the recently released ADP private sector report, the NFP will most likely be negative, hurting the confidence of bullish investors and allowing the exchange rate’s prices to climb even higher in the trading sessions. As for the Hungarian forint, its strength is mainly influenced by the performance of other currencies in the region. Now, currencies in Europe are gaining as well as the stock market, fueling the tanks of bearish investors. One of the primary events awaited now int the region is the Czech National Bank’s interest rate decision. Also, the hopes for the bloc’s stimulus is helping the region remain in positive markets amidst the pandemic.