Market News and Charts for August 04, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

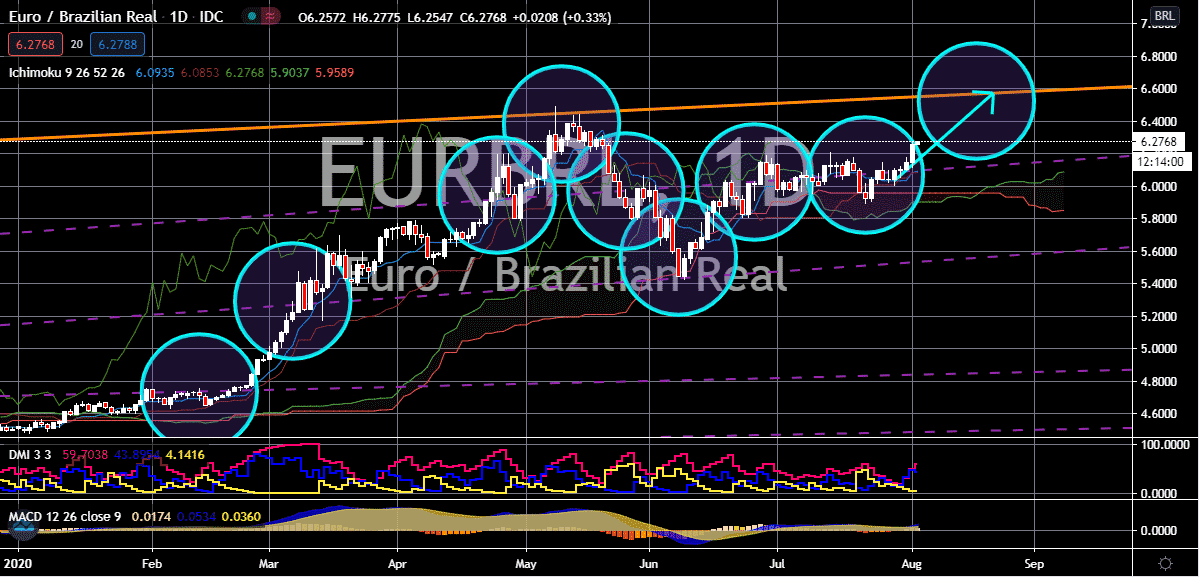

AUDNZD

The Australian dollar aims higher against the New Zealand dollar. The Aussie seeks to push the trading pair towards its resistance level by the latter half of the month. However, the rising number of coronavirus infections in Victoria is slowing down the power of bullish investors. As of August, Victoria has been recording an average of 500 to 600 new coronavirus cases and the number is gradually slowing down. It’s believed that it has reached its peak and the lockdown is working. Despite that, experts continue to warn that there is still a long way to go to fully flatten the curve. And as for the kiwi, its performance is heavily affected by the news related to the reserve bank. Later this month, the RBNZ is due to give its official interest decision, and if it leaves its rates unmoved, the kiwi might further slowdown. And just recently, the reserve bank issued a warning to the country’s banking sector as the antipodean country continues to recover from the pandemic.

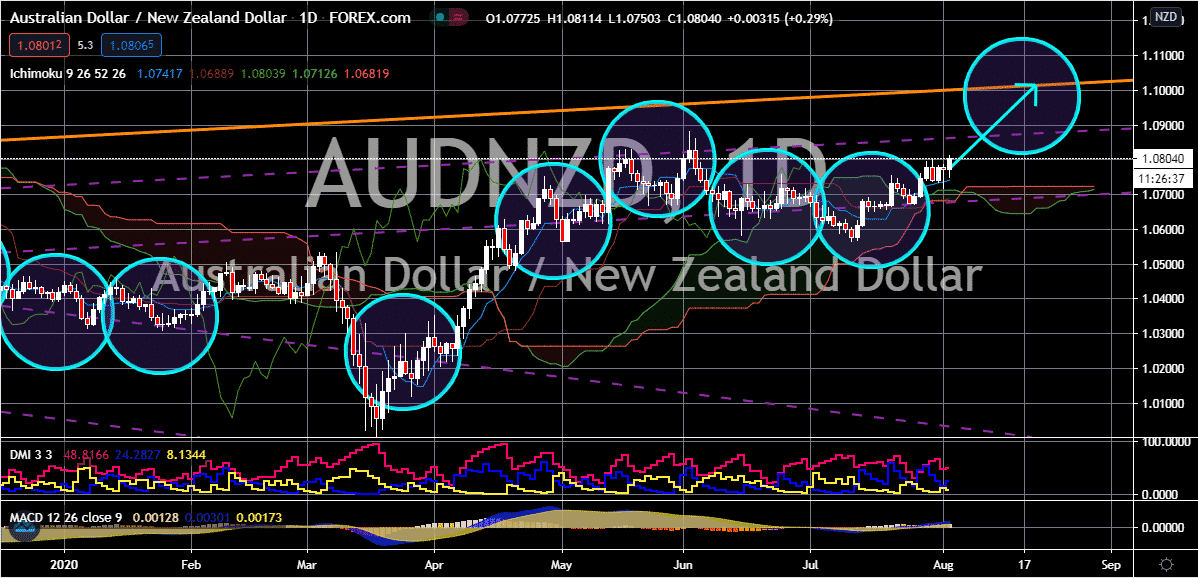

USDBRL

Despite the alarming weakness of the US dollar in the global market, the USDBRL trading pair is still on an uptrend. That means that the Latin American currency is significantly weaker and that prices could soon hit their resistance in the second half of the month. According to one analyst, the broader appreciation of the pair could actually force a profit-taking sell-off once it reaches the resistance level. The greenback is severely struck by multiple fundamentals including political and economical risks. However, most experts believe that it will stand against the test of the coronavirus pandemic, but it will get weak. In the past, the Brazilian real has benefitted from the improvements in the foreign and domestic markets. Now, the currency is seen struggling to buoy itself as Brazil sees an uncontrollable surge in coronavirus cases, the rate might not be as high as America’s, it’s still forcing the economic slump to get even deeper.

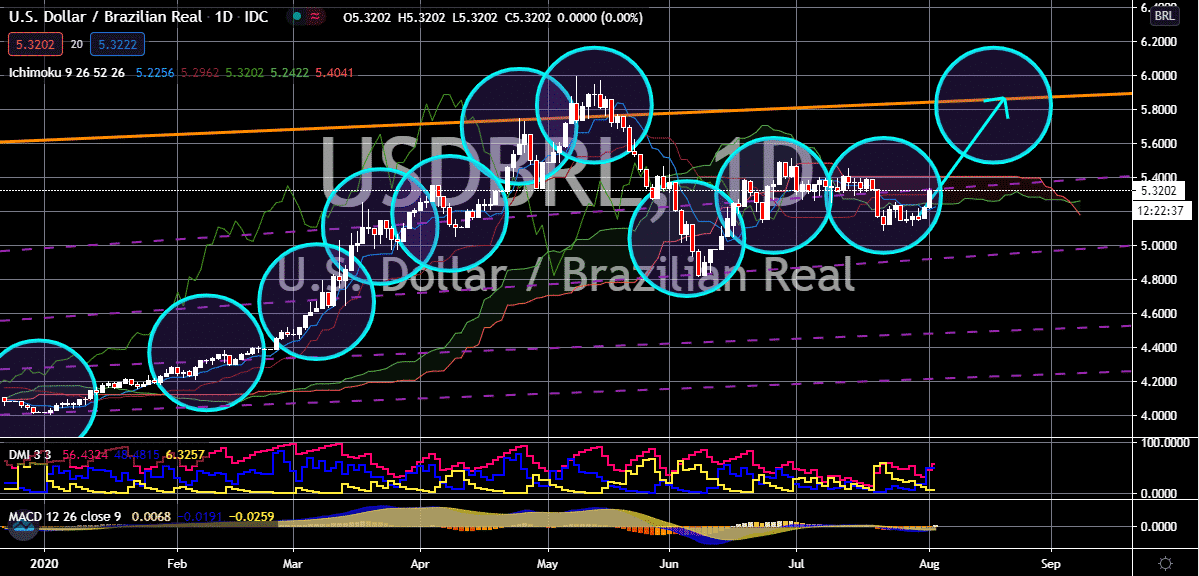

GBPBRL

The British pound is forecasted to face more upside in the coming days. The poor Brazilian real will be pushed to levels last seen in early March as the pound sterling continues to power through. Just recently, an expert from Citibank, an American financial servicing company, said that pound could still secure more gains. The pound sterling will be rather bullish as hopes that a UK-EU divorce trade deal may be struck in the third quarter of the year amidst the cyclical global rebound. The British pound entered the month of June on a rough note, but it still managed to gradually climb up and prevent the real from taking the momentum. Perhaps another reason that helped its cause is the significant increase in coronavirus cases in Brazil. Over the recent weeks, the number of infections in the Latin American nation has drastically gone up and this poses a great threat to the economy, the domestic market, and the Brazilian currency.

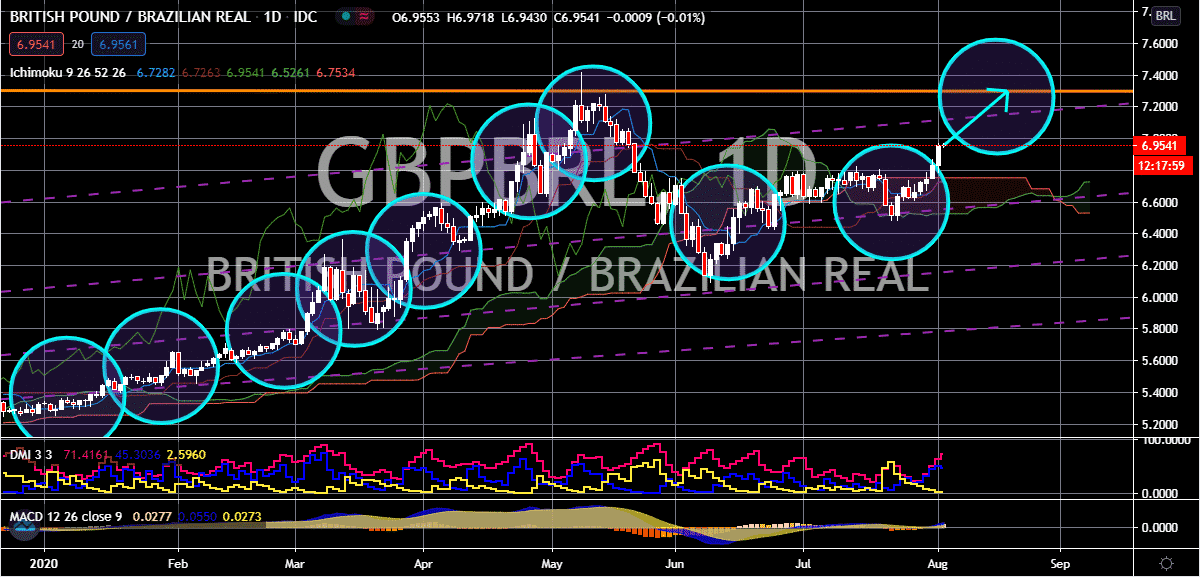

EURBRL

Positive results recorded by the bloc’s economy has propelled the beloved euro against the Brazilian real. The exchange rate is predicted to go higher and higher, eventually reaching its resistance level in the latter part of the month. Despite the deep contraction faced by the eurozone’s economy, the odds are still better for it compared to Brazil’s. Aside from that, since the European Union agreed on a joint stimulus program for the bloc, the confidence of bullish investors have gone off the roof. Just recently, it was reported that the eurozone’s factory activity in July bounced back, marking its first expansion since early 2019. The rebound could be attributed to countries easing the lockdown restrictions to reopen economies. Meanwhile, there is still hope for the Brazilian real in the near future as a recent central bank poll found that economists predict that the economy’s slump is looking slightly better compared to months ago.