Market News and Charts for August 02, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

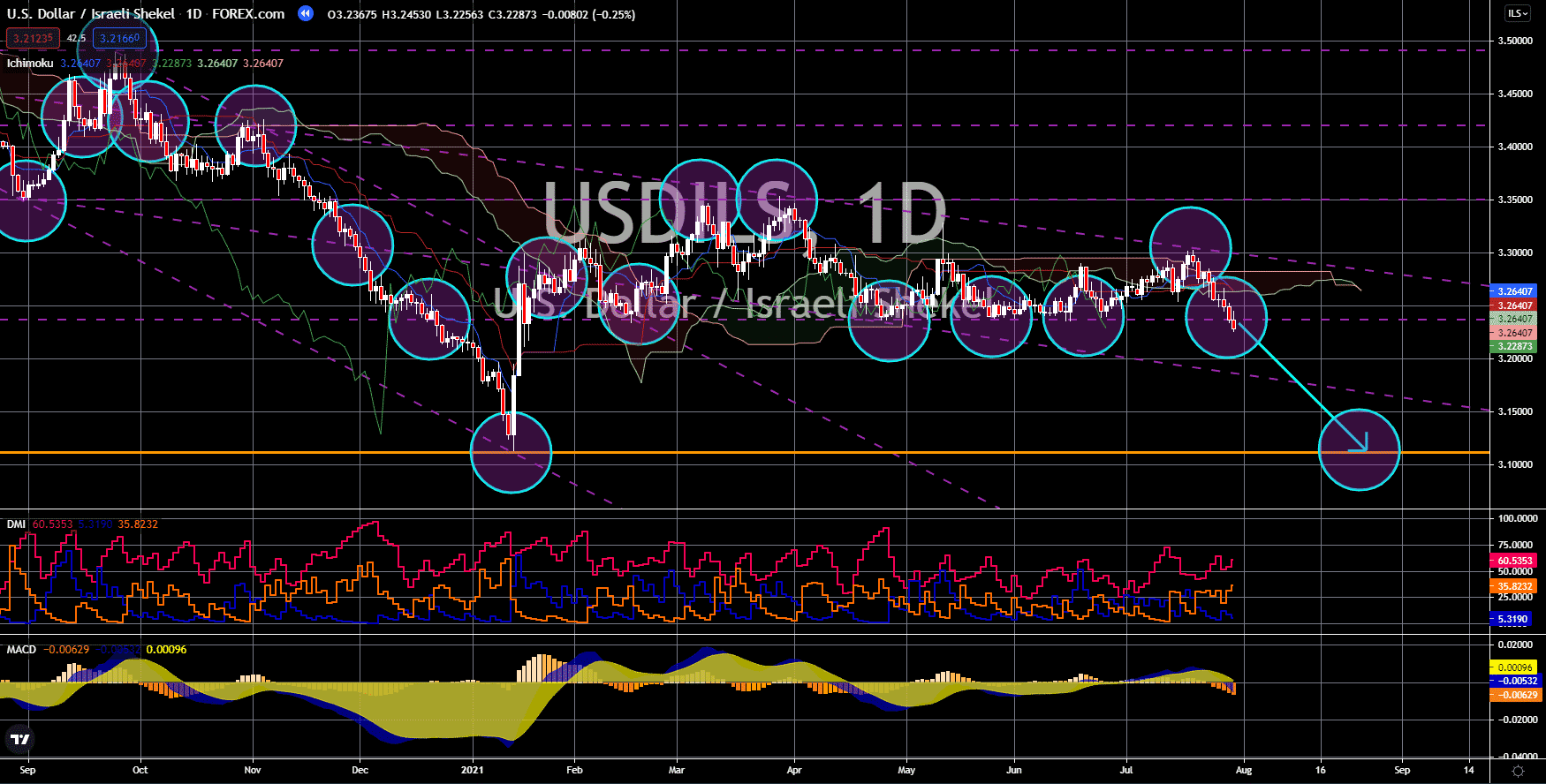

USD/MXN

The pair will rebound from a key support area around 19.80000 and retest the 21.50000 price level. Mexico’s economy advanced by 1.5% in the second quarter of fiscal 2021. On an annualized basis, the country’s GDP was up by 19.7%. Both figures beat their previous records of 0.8% and -3.6%, respectively. The Ministry of Finance and Public Credit added that activity in the country is near the pre-pandemic level. While these comments are encouraging for investors, the GDP missed in Q2 against estimates will send the peso lower. Quarter-on-quarter, analysts are expecting a 1.7% growth while the YoY figure slightly fell below the 1.8% forecast. Adding to the bearish sentiment is the rising coronavirus cases. On July 24, Mexico recorded its highest single-day covid infections at 32,244. Analysts are worried that the economy might go back to the pandemic level. Last year, Mexico’s gross domestic product (GDP) fell -8.24% following a -0.06% contraction in fiscal 2019.

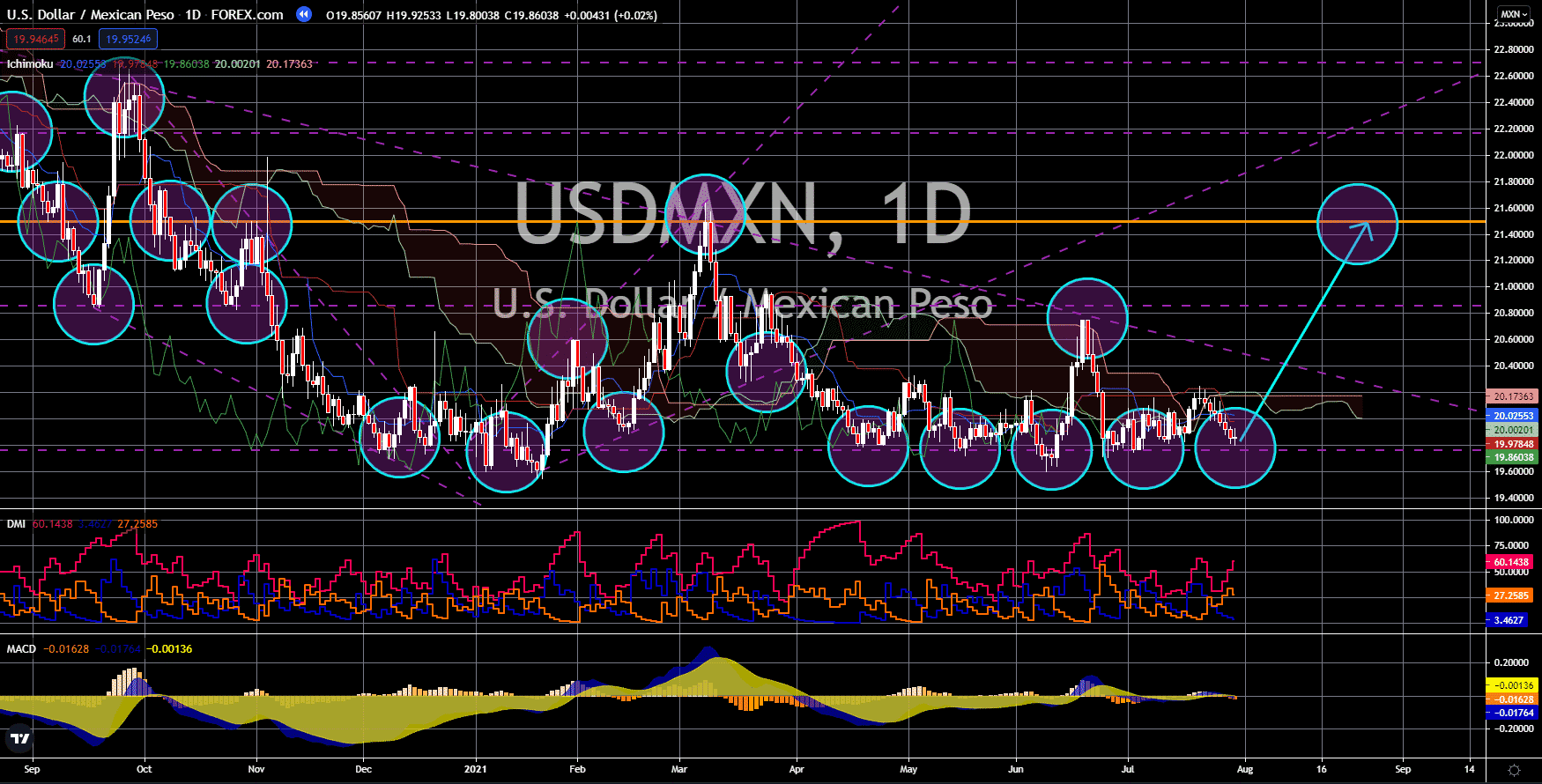

USD/NOK

The pair will form a higher high in the coming sessions with a target price of 9.60000 to reach an 8-month high. Norway’s unemployment rate was up by 0.2 percentage points to 3.10%. The result ended six (6) consecutive months of data improvement. The figure represents an unemployment change of 103,390 in July. The numbers contrast with the positive data from the country’s PMI. The result from the manufacturing sector was up to 63.3 points which was a 13-year high. Analysts expect a further increase in unemployment as Norway extended the lifting of covid restrictions for the second time. In other news, the UK signed bilateral trade agreements with the European Free Trade Agreement (EFTA) members Norway, Iceland, and Liechtenstein. Meanwhile, the UK and Switzerland have an existing bilateral deal from February 2019. Analysts are expecting deeper cooperation among non-EU countries as it transitions to a post-Brexit, post-pandemic economy.

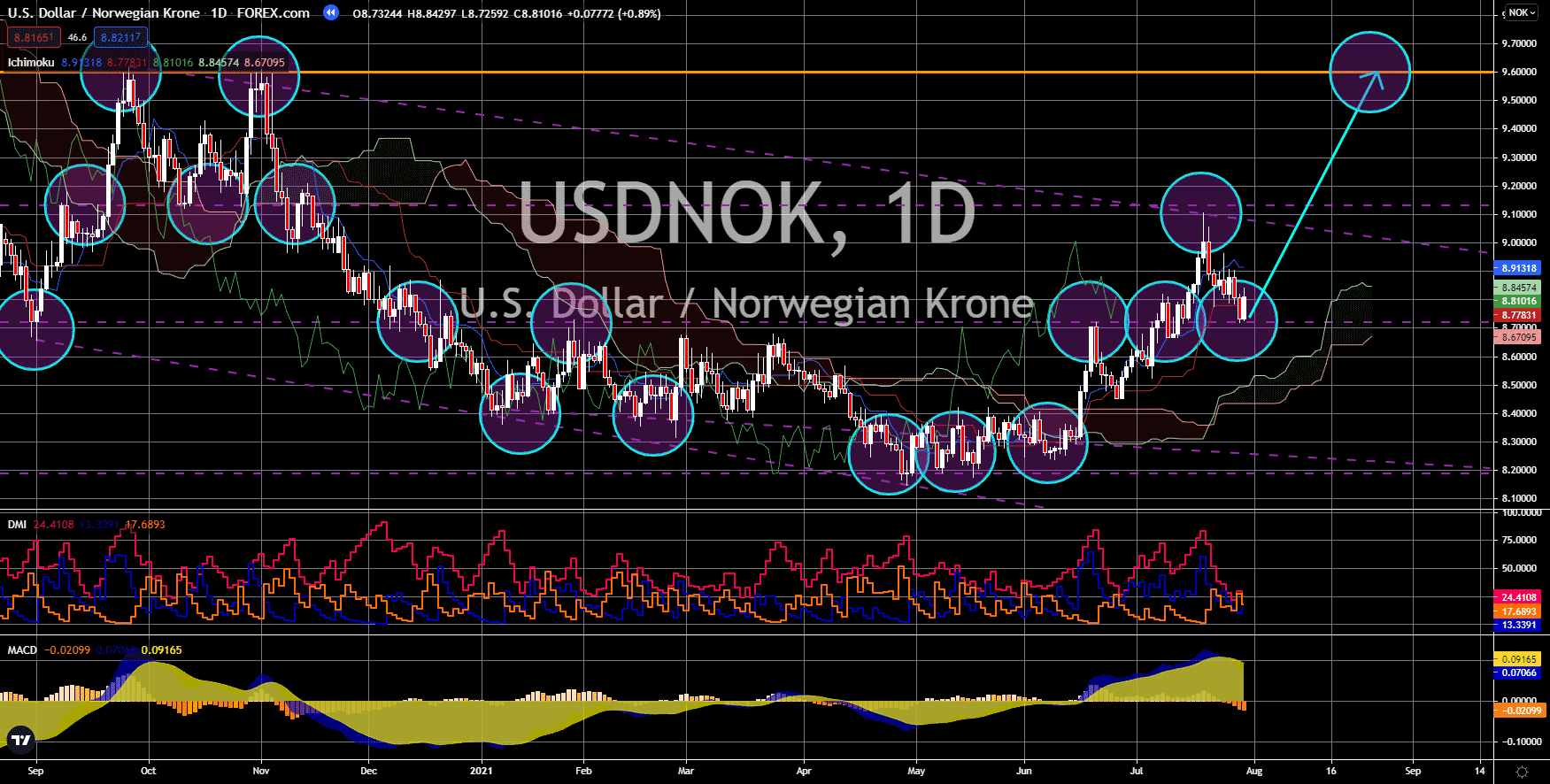

USD/PLN

The pair will fail to break out of a key support area and head towards 3.76821. Poland’s Consumer Price Index (CPI) jumped 0.4% based on July’s preliminary report. If the actual result comes near the initial forecast, it will be the country’s highest monthly increase in three (3) months. On a year-on-year basis, headline inflation was up 5.0% which was the same figure recorded in May 2011. The figure is above Narodowy Bank Polski’s annual inflation target of 2.5% with a +/- 1.0% range. July’s CPI (P) is also above analysts’ 3.9% annual reading for inflation. Meanwhile, the Purchasing Manager Index (PMI) data fell 1.80 points, from a historical high of 59.40 points to 57.60 points. The Polish Economic Institute (PIE) anticipates an economy to expand by 4.8% in 2021 from the previous 4.4% forecast. Meanwhile, political tension in Poland could hurt the economy. Deputy Prime Minister Jaroslaw Gowin vetoed PiS’ attempt to use the EU’s 750 billion recovery fund.

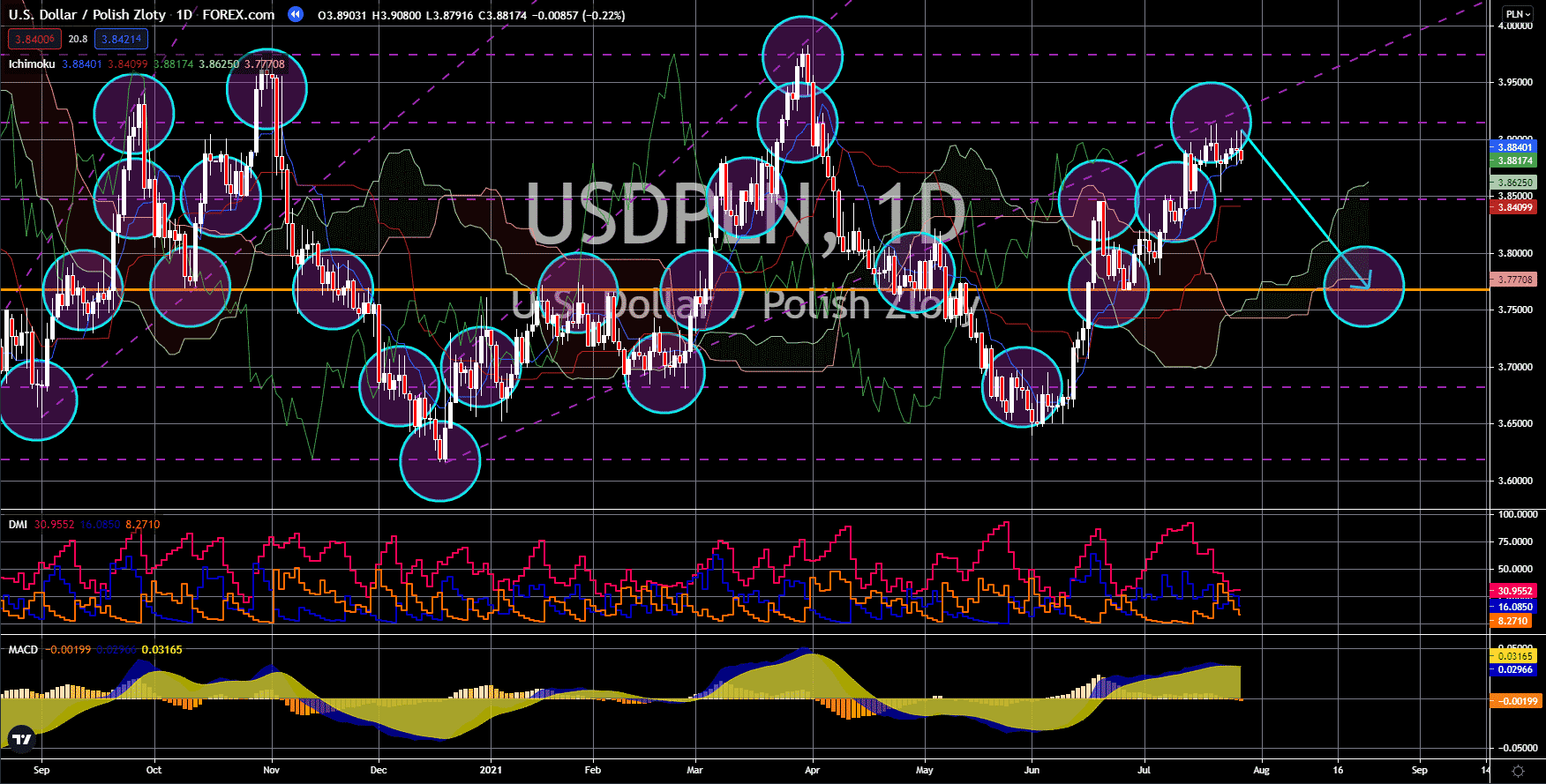

USD/ILS

A continued sell-off in the pair is expected towards a yearly low of 3.11308. The US economy was up 6.5%, from April to June, beating Q1’s 6.3% performance. However, the reported figure is a massive miss from the 8.5% consensus estimate. Just like GDP, the initial jobless claims failed to deliver impressive figures. The number of individuals filing for unemployment benefits rose by 400,000 against 380,000 projections. The major reports overshadowed June’s Personal Income and Personal Spending reports. Individual expenditure was up 1.0% despite a minimal increase in salary of only 0.1%. Analysts are now looking for the upcoming Federal Reserve’s short-term monetary policy on Wednesday, August 04. The expectations for interest rate are to remain at a record low of 0.25% and a monthly bond purchasing program of 120 billion. Meanwhile, the week is expected to end with the Non-Farm Payrolls report which has an estimate of 870,000 jobs added.