Market News and Charts for April 28, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

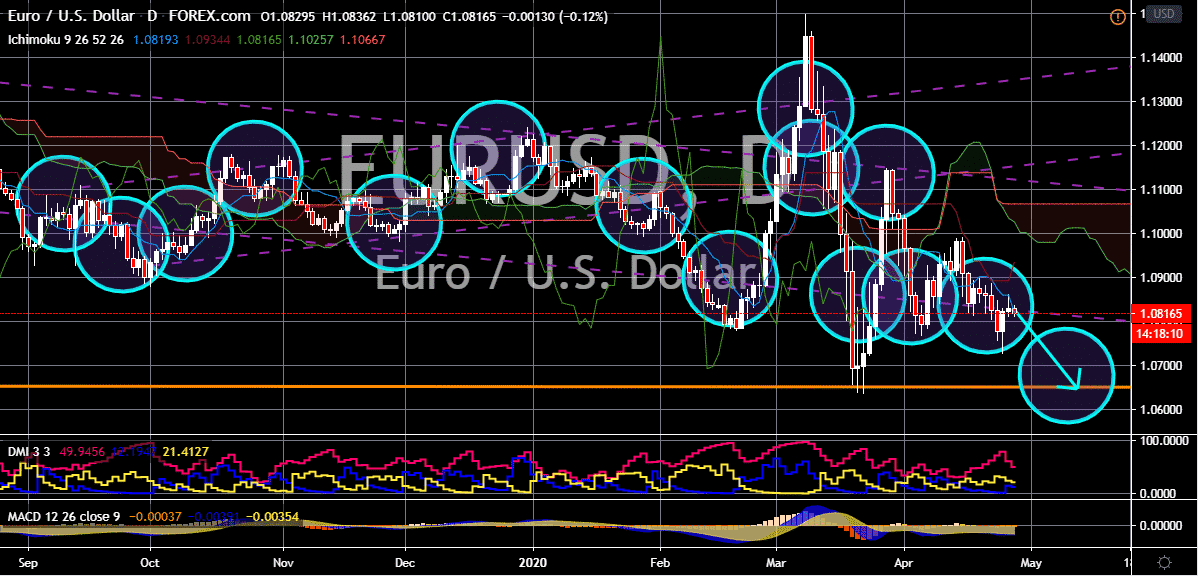

EUR/USD

The euro is erasing the gains of the US dollar in the trading sessions. The fact that investors are bracing themselves for a stimulus package from the European Central Bank has placed the single currency in trouble against the beloved US dollar. Actually, both the ECB and the United States Federal Reserve are expected to cause volatility to the EURUSD pair. But the ECB’s decision should earn more attention as it could reflect or further highlight the political rift between European leaders. See, a decade of stagnant growth and the failure to fully recover from the impact of the Great Recession and the Eurozone debt crisis, the bloc is barely ready to face the massive and devastating problem at hand. The pandemic has pushed central banks to their boundaries and the failure of European leaders in coming up with a consensus solution has made it worse. Experts are expecting more than an interest rate cut from ECB it steps up to buoy the economy.

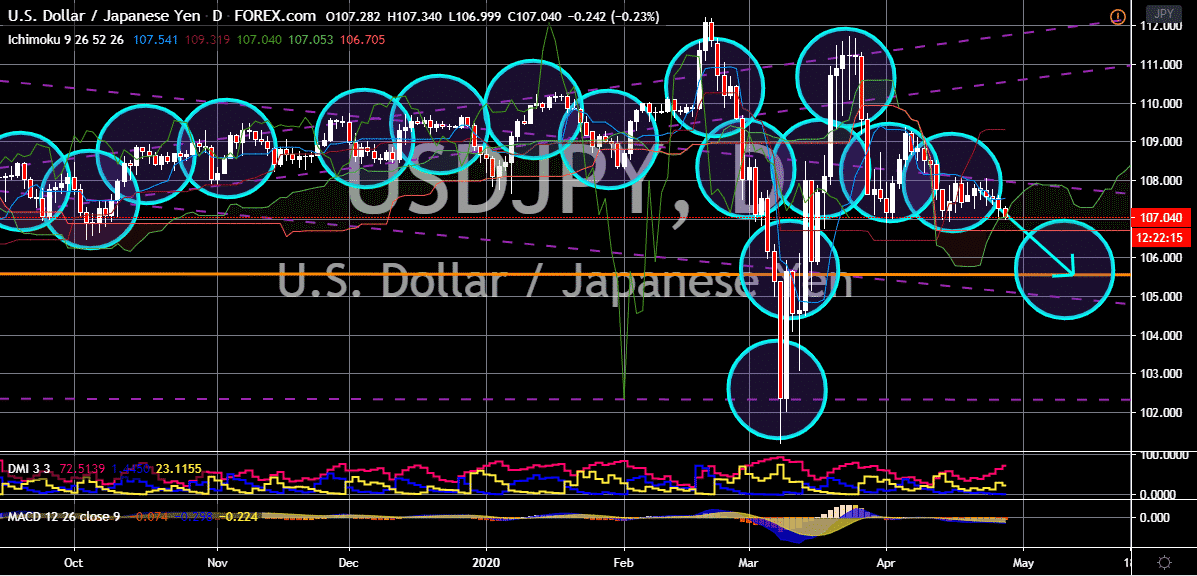

USD/JPY

The US dollar to Japanese yen exchange rate is struggling to break past the 107 mark in recent sessions. However, the pair will most likely remain bearish as the Japanese yen gradually gets stronger against the greenback. The key difference between the two currencies are the approach of their leaders towards the impact of the pandemic to their economies. Unlike the United States President Donald Trump who isn’t reluctant to reopen the economy despite the number of cases in the US, Japanese policymakers are looking to extend the national emergency flag in the country amidst the widespread outbreak. However, due to the Bank of Japan’s scheduled meeting today, investors of the Japanese yen are approaching this Tuesday’s trading with caution as further guidance could come from the meeting. Unfortunately, the BOJ is widely expected to cut its economic and price forecasts for this year because of the coronavirus pandemic.

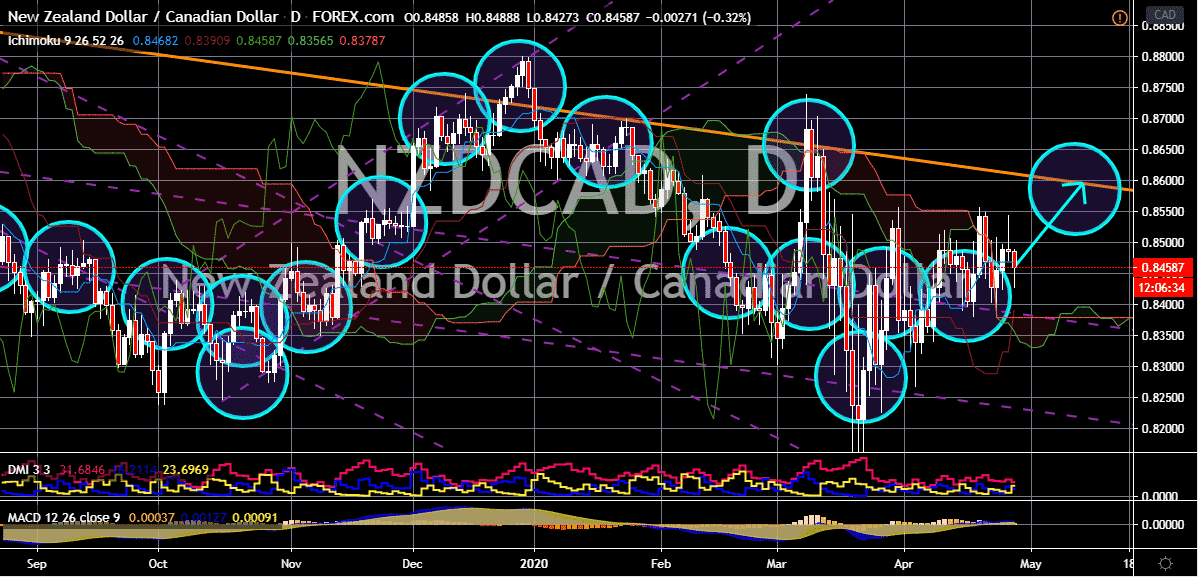

NZD/CAD

Both the New Zealand dollar and the Canadian dollar weakening in the forex market. But in the matchup between the two, the New Zealand dollar is projected to have a better chance against the Canadian dollar. The pair is expected to climb up to its resistance level in the coming sessions. Looking at the reasons, the New Zealand dollar’s recent weakness comes from the forecasts of negative interest rates from the Reserve Bank of New Zealand later this year. However, looking at it, the RBNZ has promised in the past that it will not be moving its interest rates for at least twelve months. And, the fact that New Zealand has successfully flatten the coronavirus curve there and is looking to reopen the economy soon will give the kiwi a boost. As for the Canadian dollar, as long as the crude market remains unstable, it will remain vulnerable. And considering that most major economies are still paralyzed, the supply and demand for crude will be difficult to offset.

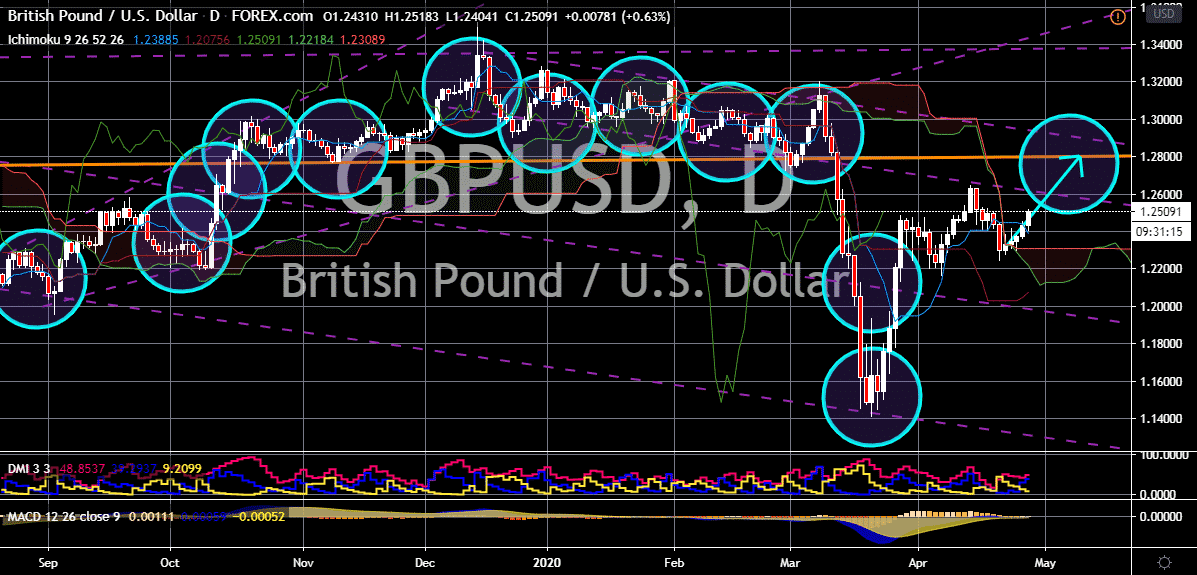

GBP/USD

The British pound to US dollar exchange rate appears widely bullish in the recent sessions. Although gains aren’t as big compared to its past jumps, the pair is looking recover its major losses from the previous months. The pair is expected to steadily reach its resistance by the first half of May thanks to the optimism of bullish investors. However, some forecasts say that the pair is already showing signs of reversal and are questioning whether the pair could break past its resistance or bounce off it. Although as of today, investors of the US dollar are moving cautiously as they eye the crucial CB consumer confidence index for April. Unfortunately for bearish investors, the data is expected to crash from 120.0% on March to just around 87.9 this April. And if the data comes weaker than projected, it could raise another wave of concern for more possible stimulus that will be detrimental to the strength of the US dollar.