Market News and Charts for April 26, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

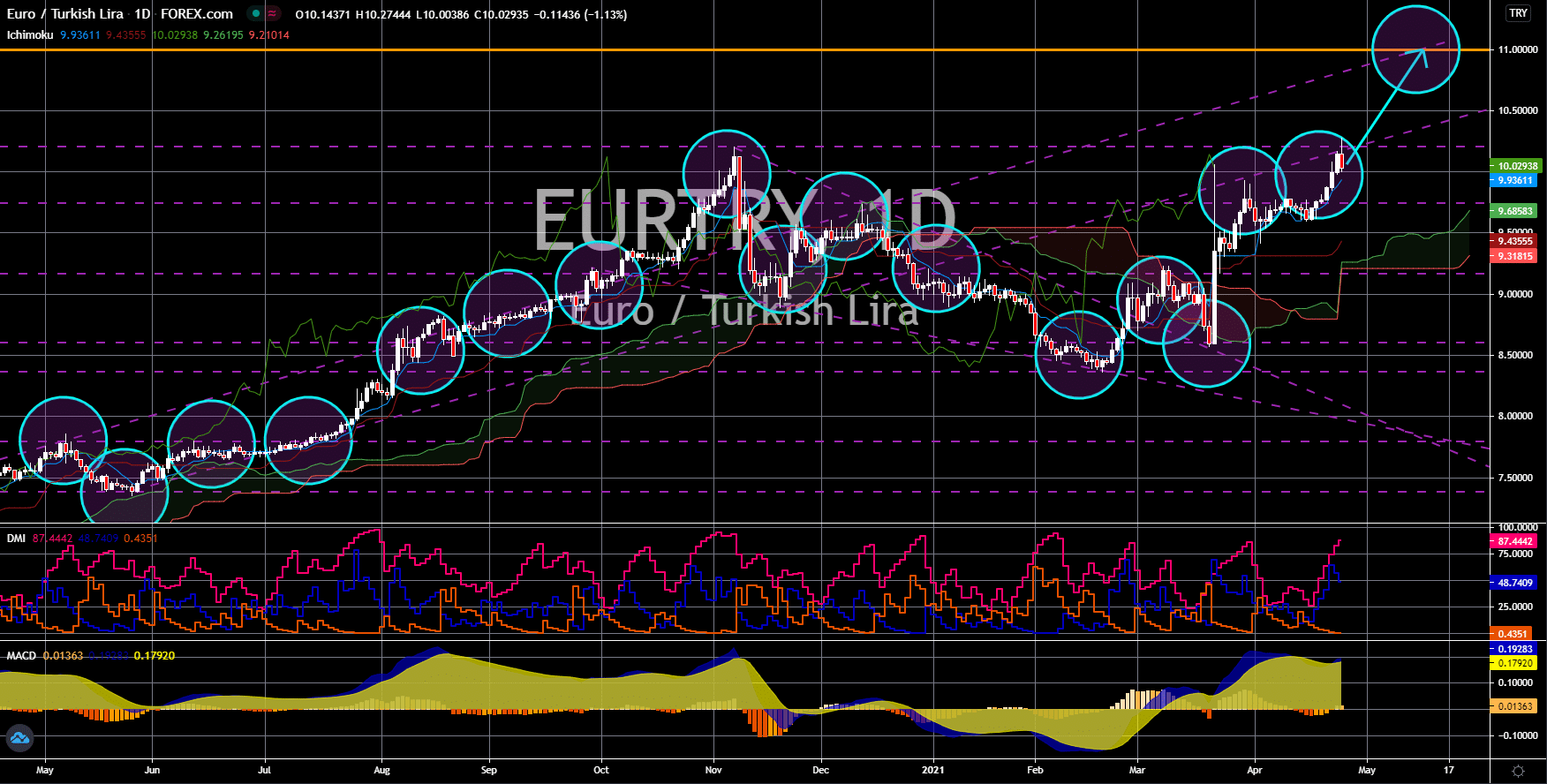

EUR/TRY

The pair will continue its rally to reach an all-time high record of 11.00000. A possible interest rate cut along with narrowing relations with the United States will send the lira towards a historical low against the euro. The Turkish central bank signaled a dovish tone on the benchmark rate, stating that tightening monetary policy would do harm for the economy. The new central bank governor Sahap Kavcioglu is seen as more aligned with President Recep Tayyip Erdogan’s view that higher interest rate causes an increase in inflation. Former central bank head and hawkish Naci Agbal along with his deputy were sacked by Erdogan after raising the rate to 19.0%, which sent the lira into a turmoil. Another pressure of the local currency was the acknowledgement by US President Joe Biden that the 1915 killing of Armenians by the Ottoman Empire, now modern Turkey, is an act of genocide. The tension could send Turkey back into recession just like in 2018.

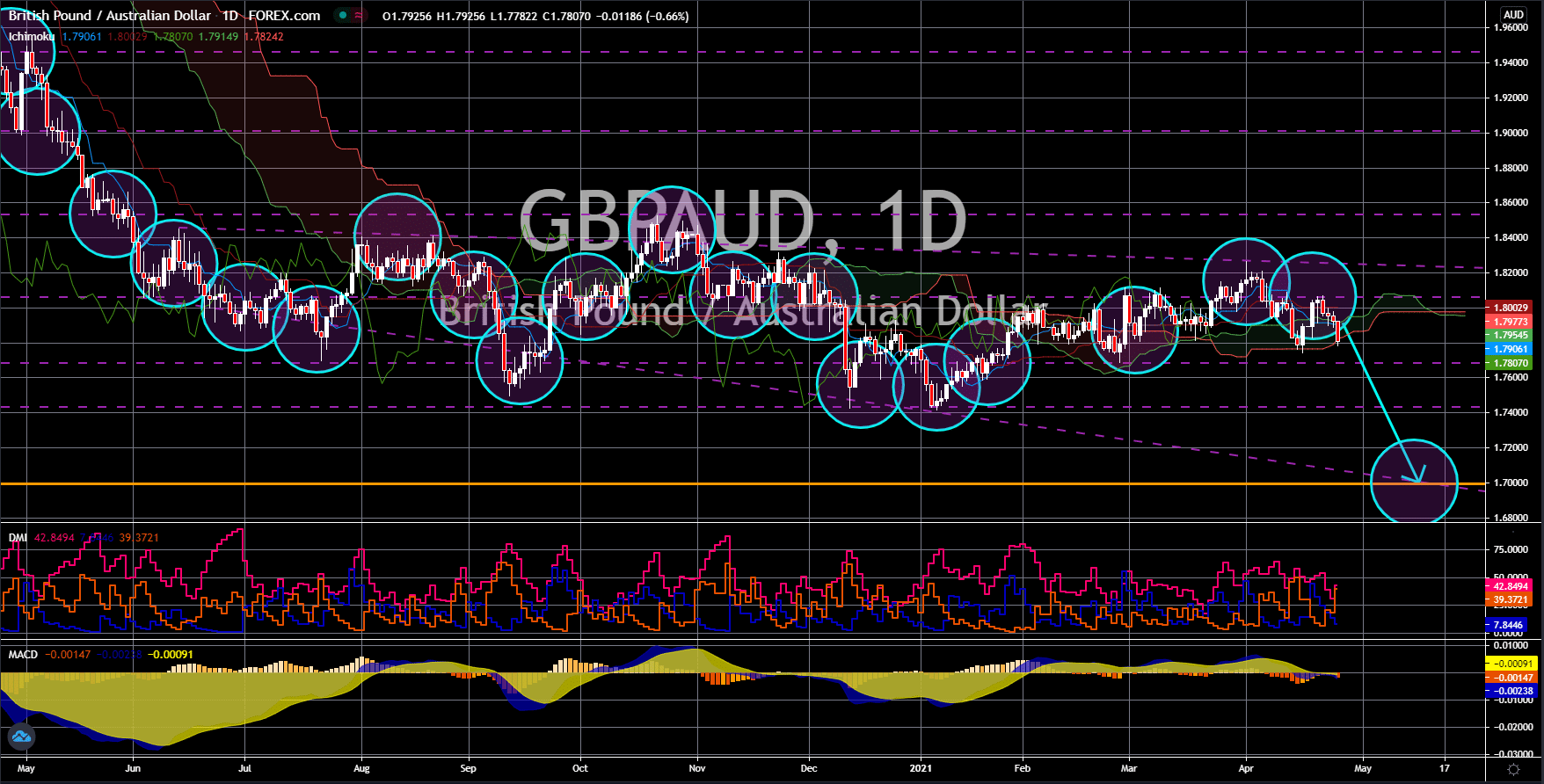

GBP/AUD

The pair will continue to move lower in coming sessions towards the 1.70000 price area. Australia had impressive results for Manufacturing and Services PMIs on Thursday’s report, April 22. Figures for the month of March came in at 59.6 points and 58.6 points, both of which were higher than their previous record. These numbers were historically high for Canberra. Meanwhile, the International Monetary Fund (IMF) revised its economic outlook for Australia in fiscal 2021 to 4.5% from 3.5% in January this year. This made the economic recovery in Australia the fastest among all major economies. For 2022, the projection is a 2.8% expansion. Meanwhile, the international financial institution sees the world economy rebounding by 6.0% in 2021 followed by a 4.4% increase next year. The IMF also eased investors’ worries over the rising inflation as figures remained stable at 1.7%, just 0.3% away from the 2.0% to 3.0% range target by the RBA.

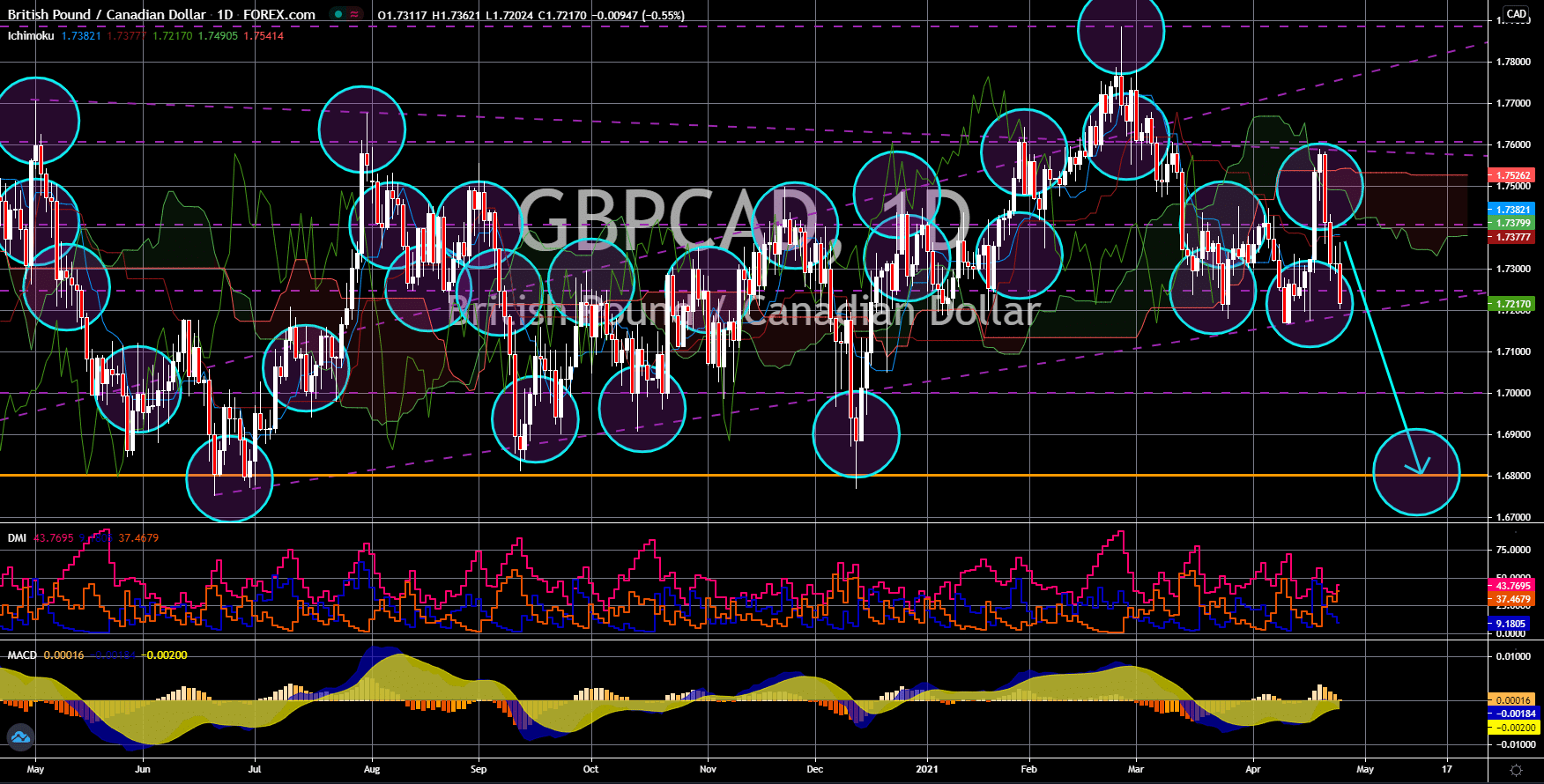

GBP/CAD

The pair will break down from a key support area and retest its previous low around the 1.68000 area. The improving economic data from the United Kingdom is boosting investors’ confidence in the local market. Hence, an increase in the UK index is anticipated while the pound sterling will underperform against quoted currencies like the Canadian dollar. US investment banking giant Goldman Sachs estimates a 7.2% expansion in the British economy in fiscal 2021, which is higher compared to the 7.1% readings for the United States. The investment firm cited the massive economic activity in the country following the lifting of several COVID-19 measures starting mid-March. As evidence, retail sales data in the third month of 2021 jumped by 5.4%, the highest recorded figure in the past nine (9) months. Meanwhile, the year-over-year (YoY) figure was 7.2%.

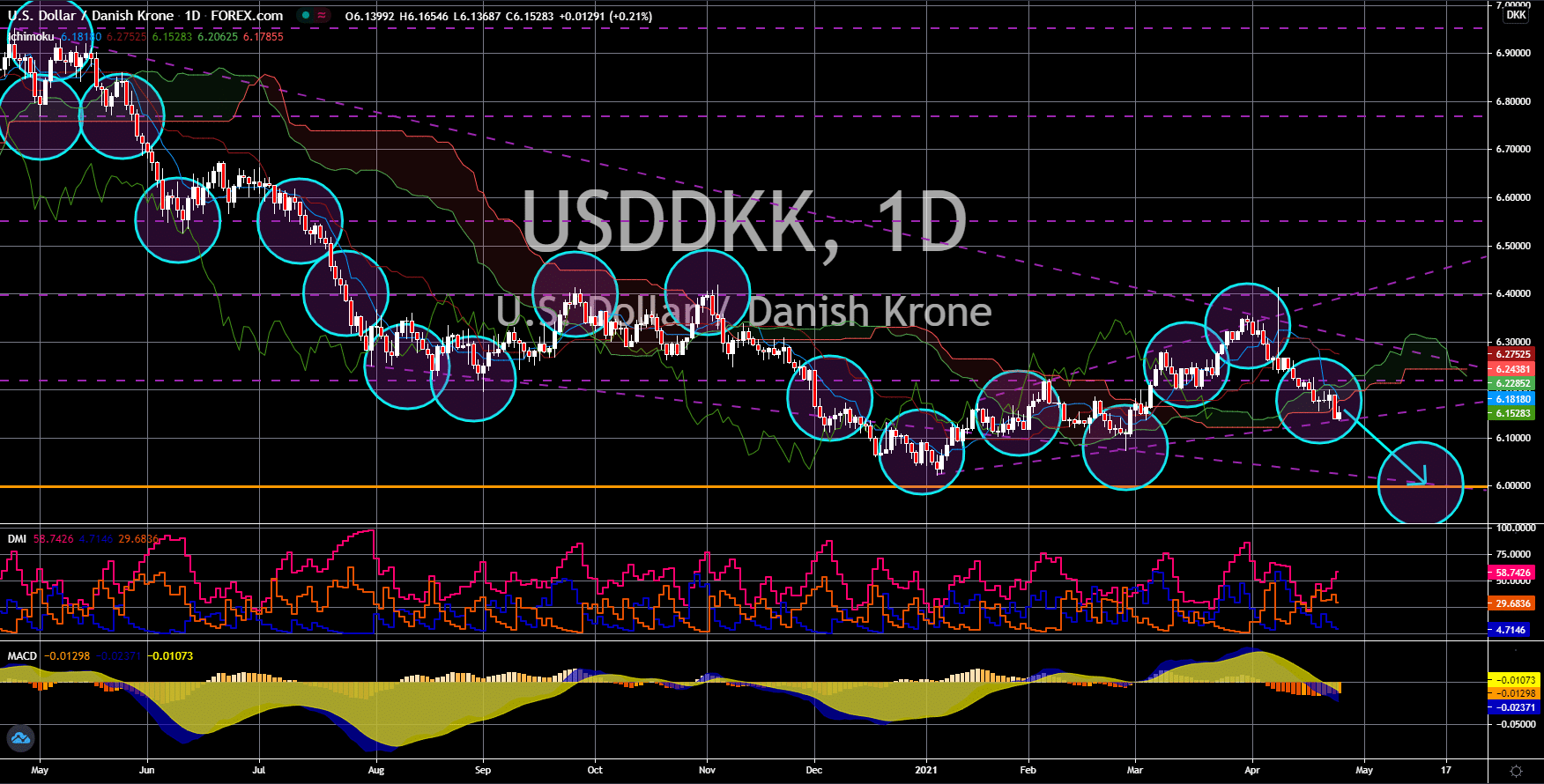

USD/DKK

The USDDKK pair will continue with its downward movement in the coming session. The US dollar loses its momentum with the declining US bond yield, which is trading at 1.571% as of writing. The figure is way lower than the opening coupon rate of 1.745% for the month of April. In addition to this, the US equities market is looking attractive to investors with the upbeat performance in corporate Q1 2021 earnings. Other factors that could affect the performance of the US dollar is the GDP data for the first three (3) months of fiscal 2021 and the Federal Reserve’s interest rate decision. Forecast for the Q1 performance of the US economy is 6.1%, a major improvement from Q4’s 4.3% result. Also, the US central bank will unveil its benchmark interest rate until the next meeting on the same day that GDP will be published or on April 29. Analysts are expecting the Fed to reaffirm its commitment into keeping rates at record low until 2023.