Market News and Charts for April 21, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

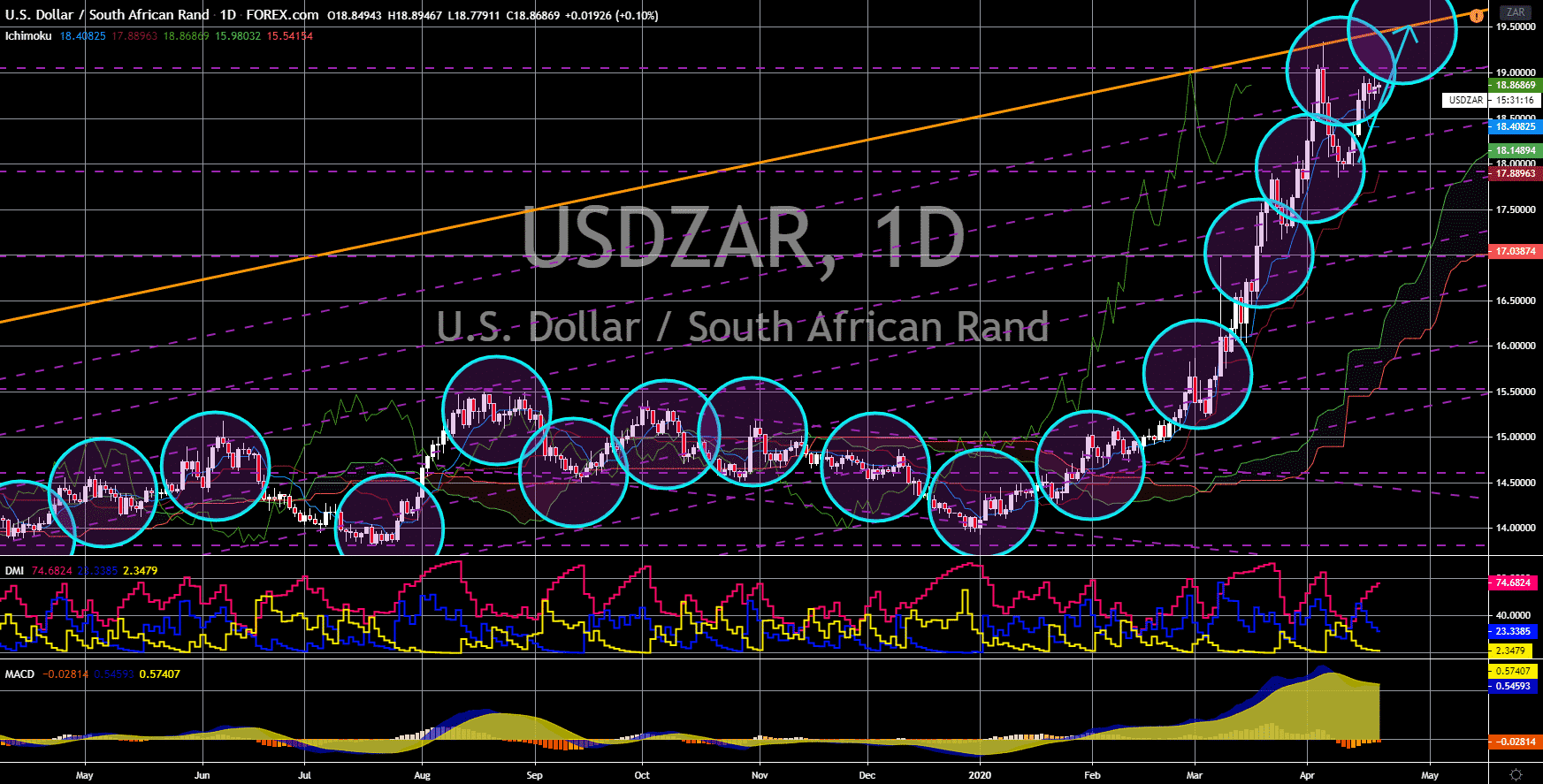

USD/PLN

The pair will break down from a “Pendant” pattern support line, sending the pair lower towards a major support line. The United States is suffering from a double whammy of events, including the coronavirus outbreak and the collapse of crude oil prices. The US has now the largest number of coronavirus cases around the world at 798,742 as of writing. The country’s death toll from the virus is at 42,604 or more than double from Italy’s number. These figures represent a third and a quarter of global coronavirus cases and deaths, respectively. Meanwhile, crude oil entered the negative territory for the first time in history. This was amid concerns of investors and traders on the oversupply of oil in the United States. As the number of cases and deaths in the US continue to soar, the center of the pandemic, Europe, is now recovering. Poland is among the countries in Europe who reopened their economy after they successfully contain the coronavirus.

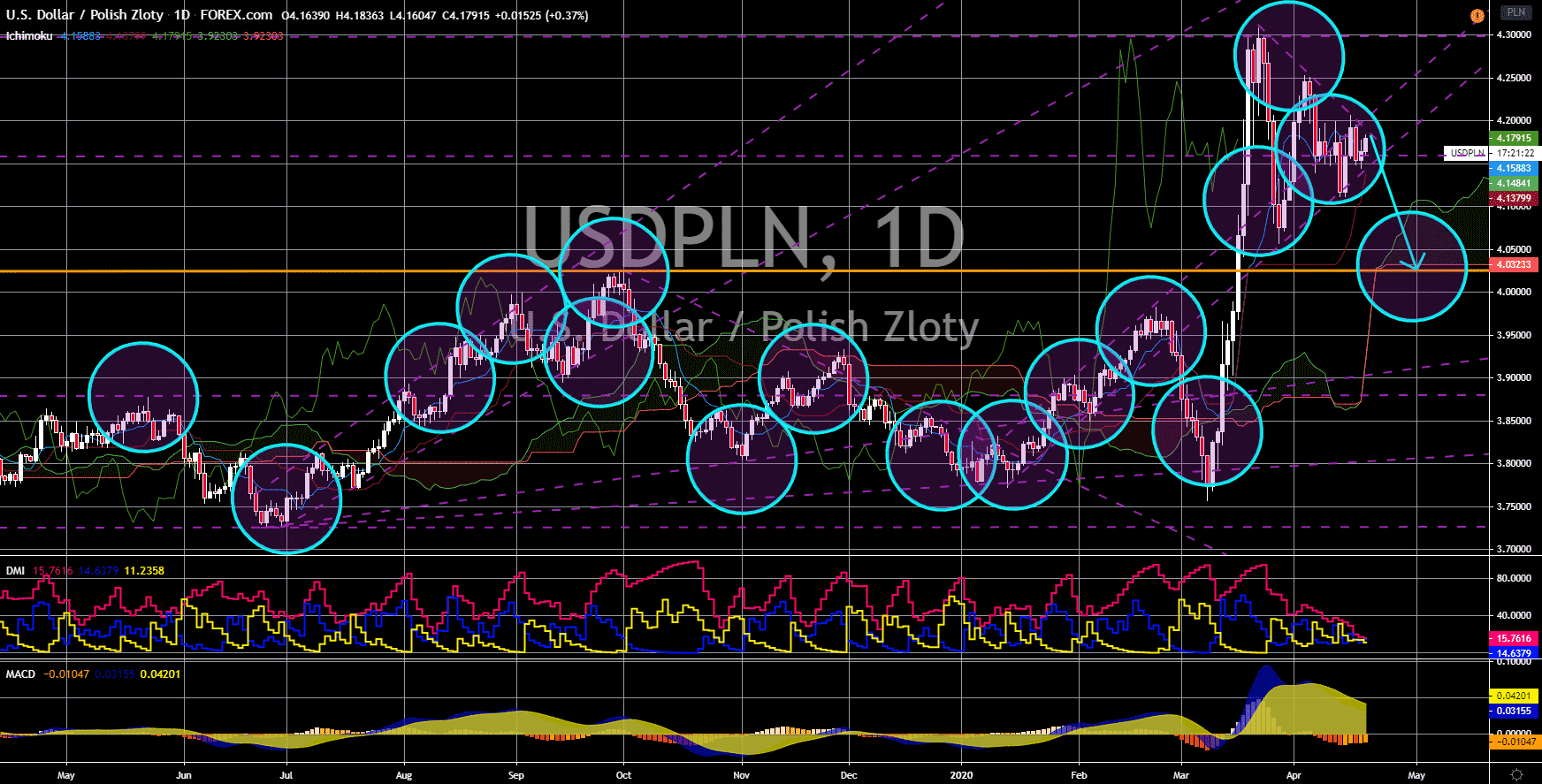

USD/ILS

The pair will break down from a key support line, sending the pair lower towards a downtrend support line. A demonstration happened in Israel despite the coronavirus outbreak. The rally calls for the incumbent prime minister, Benjamin Netanyahu, to resign. In recent months, the Israeli government came under pressure after Netanyahu failed to form a coalition government. This led to the 2 major parties to agree on a term sharing agreement. Netanyahu will end his 11-year run as the country’s prime minister. Yesterday, April 20, Netanyahu and his rival, Speaker of the Knessett Benny Gantz, agreed to form a unity government. This will end Israel’s year-long political crisis. In other news, Israel has still one of the lowest coronavirus related deaths. Meanwhile, the US is nearing the 800,000 mark of coronavirus cases and 45,000 deaths. Unemployment in the country is also surging, which will lead to the US economy and the US dollar to fall.

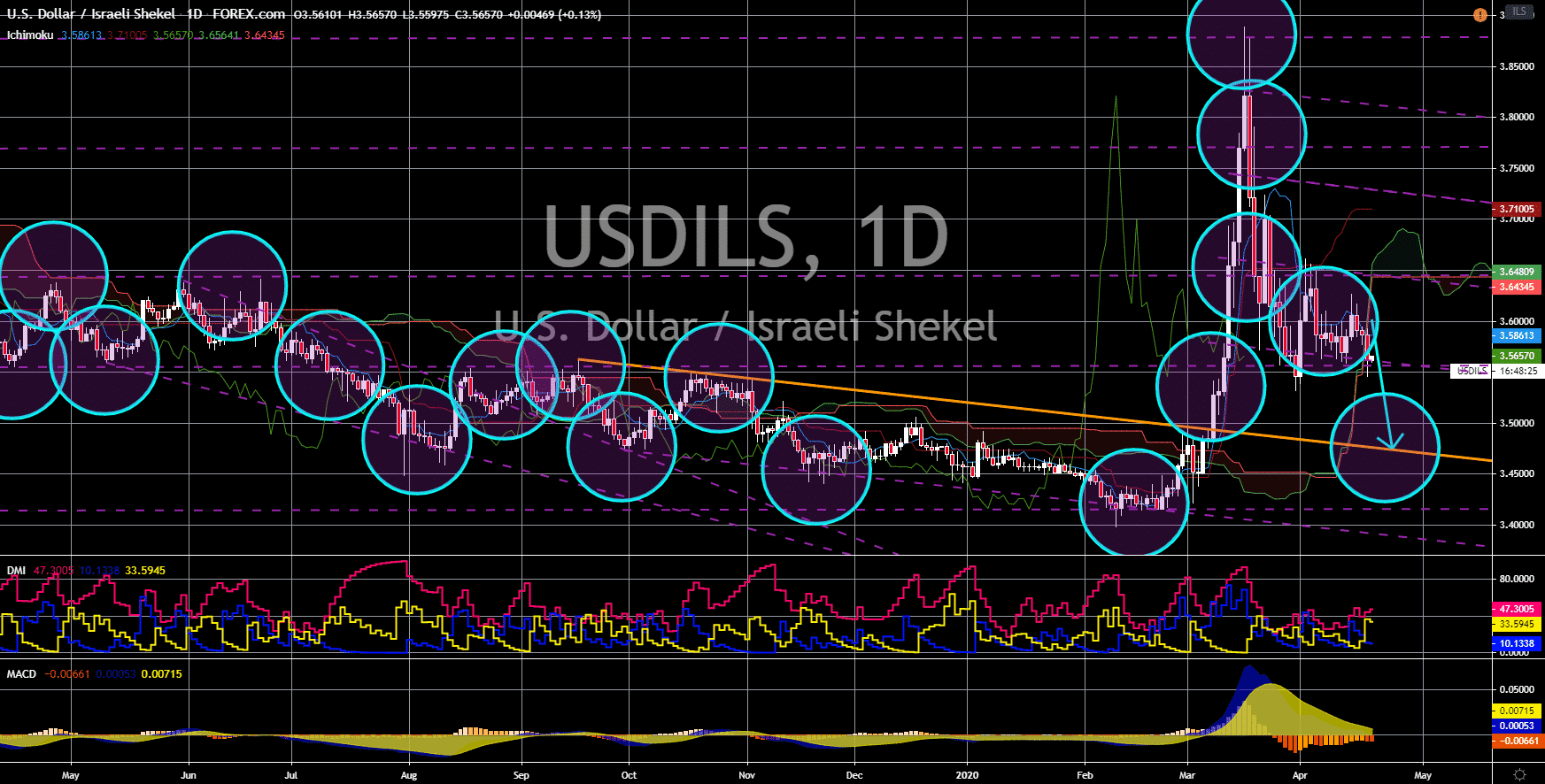

USD/SEK

The pair will head lower towards a major support line in the following days. Sweden is thriving despite Europe being the center of the coronavirus pandemic. Most of the European countries are in a lockdown after the World Health Organization named Europe as the epicenter of the pandemic. However, Sweden is defying the odds after it made another experiment. In December, the country ended its 5-year experiment of having a negative interest rate, arguing that Sweden’s economy is stable. Now, the country is letting its citizens be exposed to the virus to develop “herd immunity”. Businesses are still open, and analysts are betting on the Swedish Krona to weigh down the economic impact of the coronavirus. The country has one of the lowest numbers of coronavirus cases in Europe and the lowest coronavirus related death. The US, on the other hand, is suffering from the coronavirus pandemic and from the collapse of crude oil prices.

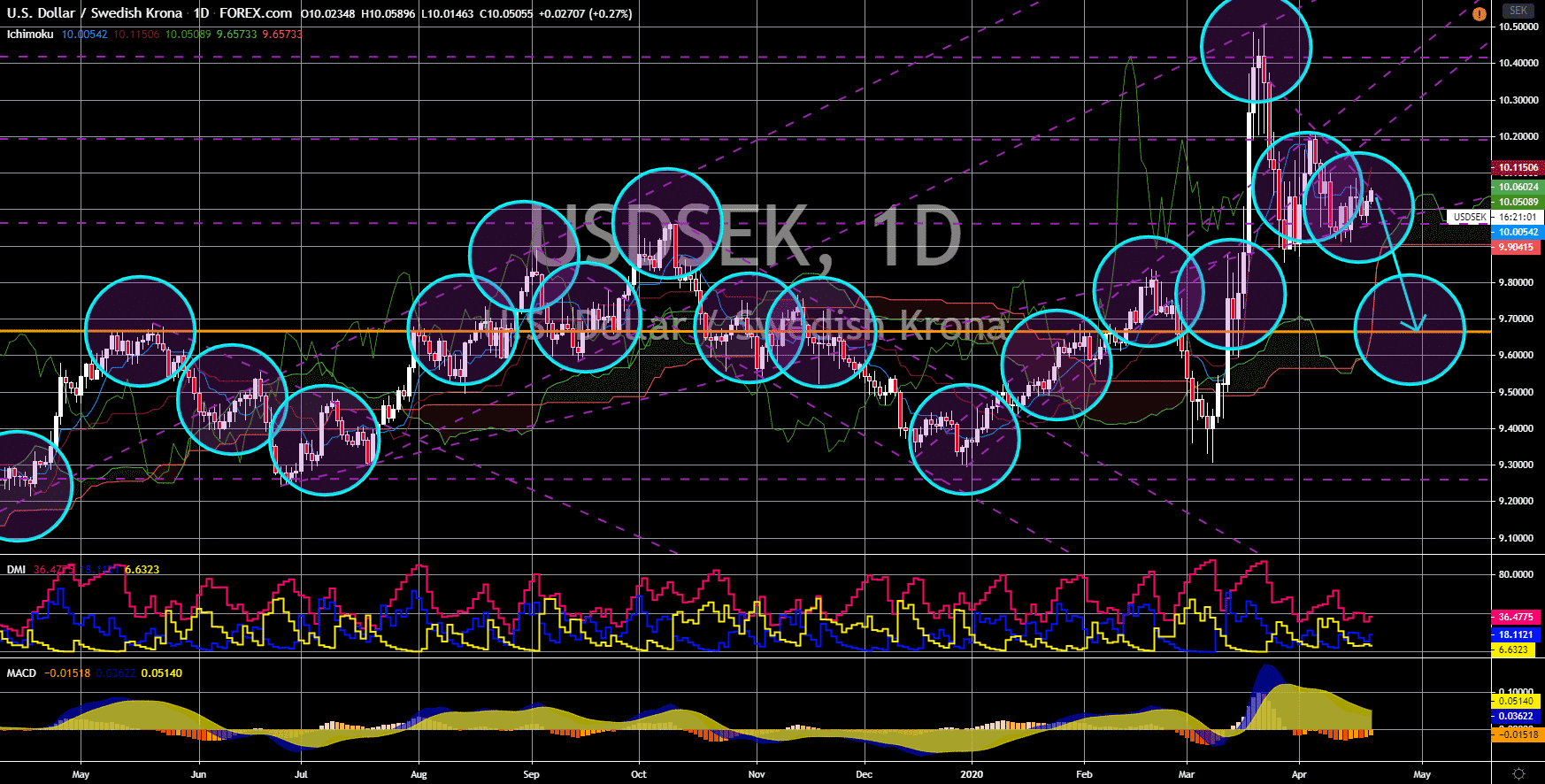

USD/ZAR

The pair will continue to move higher in the following days and break out from its previous high. South Africa was able to flatten the curve of its coronavirus cases. However, the World Health Organization provided a grim outlook on the African region. The WHO said Africa might experience a rise of coronavirus cases up to 10 million in the next 6 months. Despite flattening the curve, the country hasn’t initiated mass testing which could trigger a second wave of coronavirus cases. The country’s economy could also deteriorate as major businesses suffer losses during the lockdown. Furthermore, it’s large exposure to the Chinese economy and the yuan could slow down the economy. The US, on the other hand, is countering the economic effect of COVID-19 through economic stimulus. The US government unveiled a $2 trillion package to aid the economy. Meanwhile, the Federal Reserve unveiled the largest stimulus in history at $2.3 trillion.