Market News and Charts for April 19, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

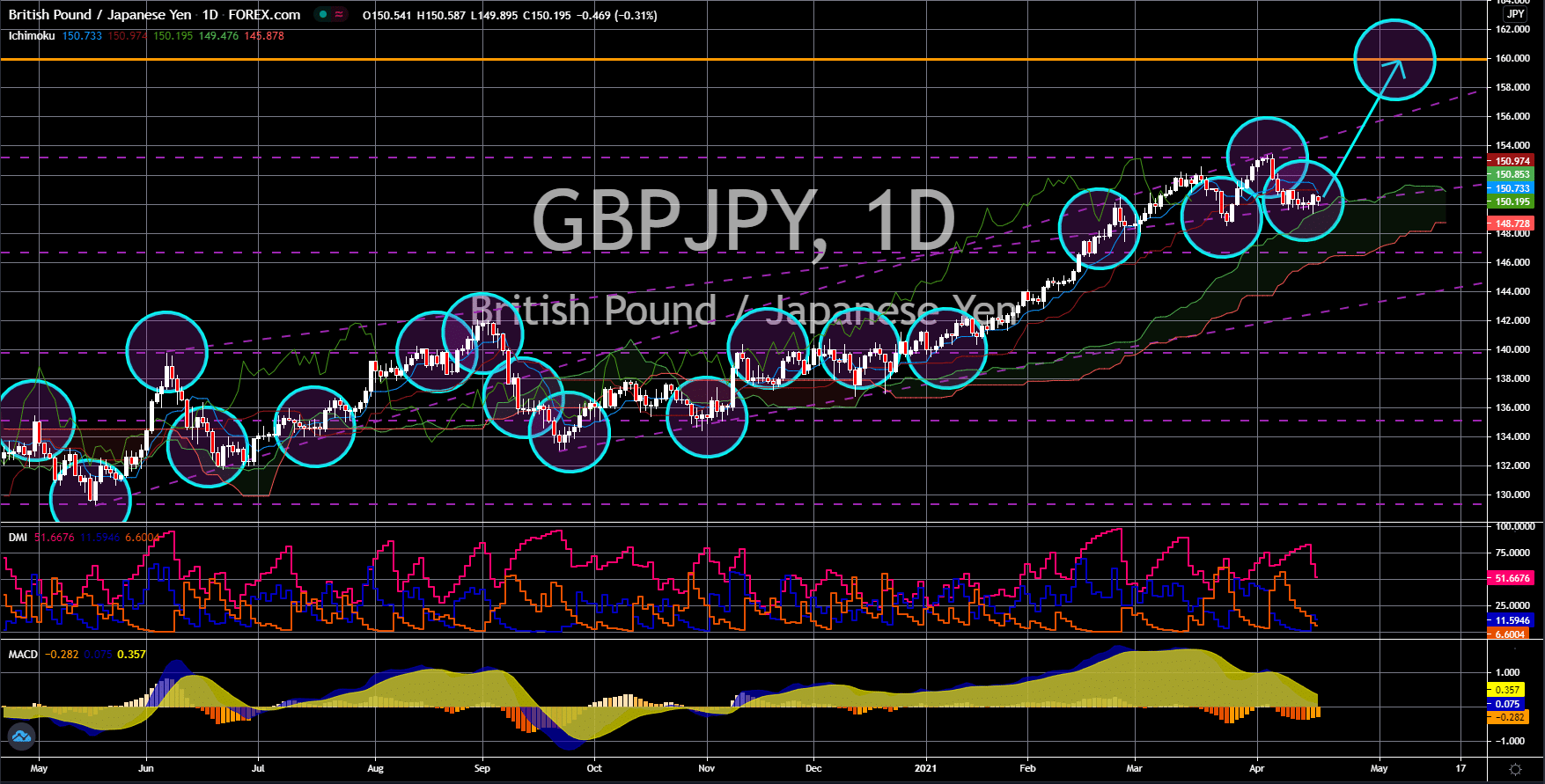

AUD/USD

The pair will continue to advance in coming sessions towards the 0.85000 key resistance area. The US dollar is losing its momentum due to the improving economic outlook in the world’s largest economy and the easing of the US bond yields. The number of unemployment benefit claimants rose by 576,000 in the reported week, the lowest during the pandemic. Meanwhile, retail sales jumped by 9.8% in March, beating both expectations and previous records of 5.9% and -2.7%. In addition to this, both the industrial and manufacturing production entered the positive territory and grew by 1.4% and 2.7%. While the expansion of the US economy, investors are worried that it will cause a pike in inflation. But the 10-year maturity notes continue to decline since reaching its 2021 high of 1.745% on March 31. As of writing, the fixed income asset is trading at 1.566%, the lowest in April, or 0.018 percentage points lower from the previous closing price of 1.584%.

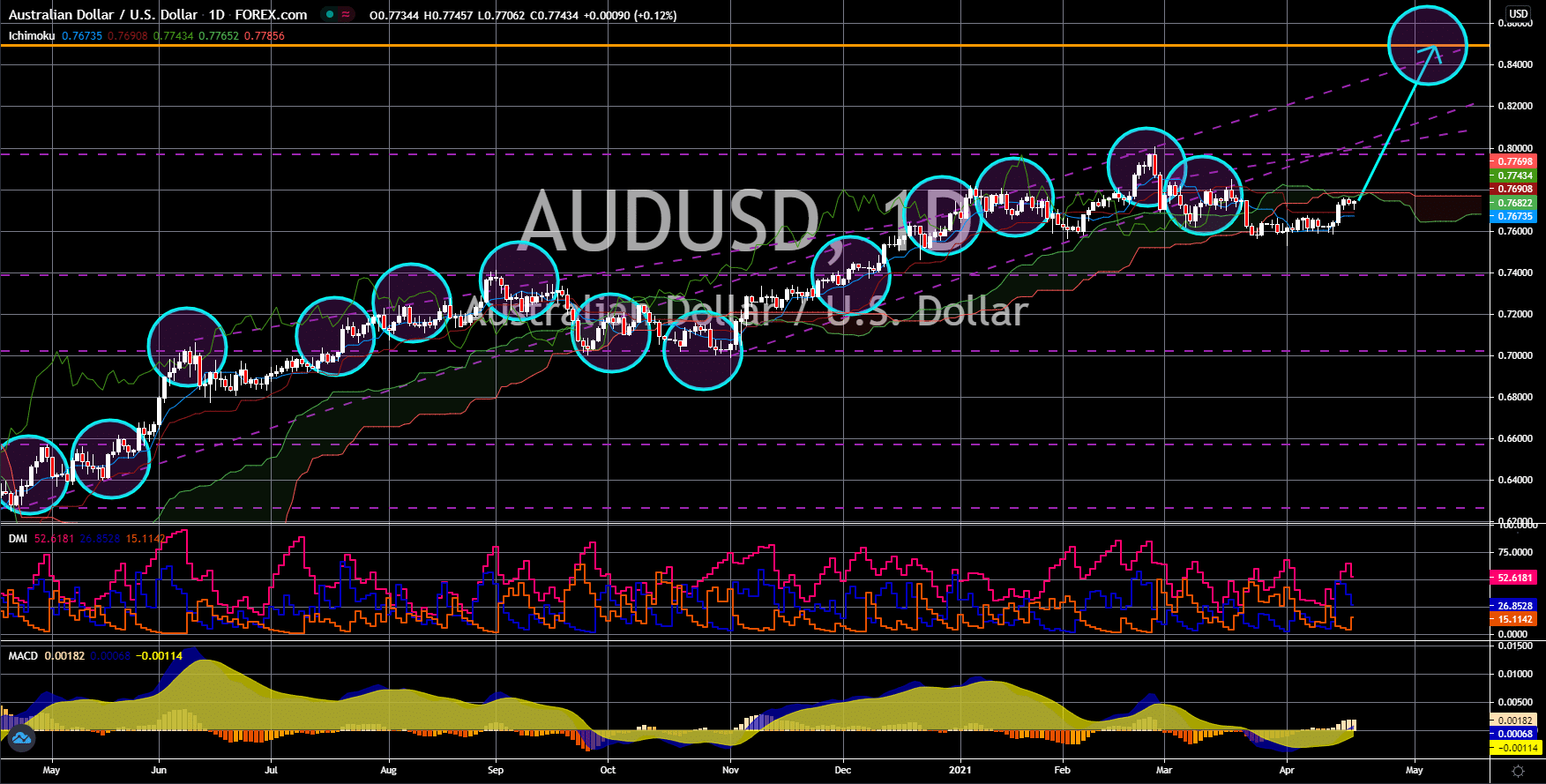

AUD/CAD

The pair broke out from a key resistance line, which will send the pair higher towards 10.05000. The Canadian dollar (CAD) is under pressure from the proposed spending package by the Trudeau government. The prime minister is proposing another 100 billion CAD to extend the government’s support on businesses and individuals, which will send the estimated annual deficit for fiscal 2021 to 250 billion CAD or almost half the stimulus last year. However, there are speculations that Trudeau will push the gap to a record high or more the 400 billion CAD as he prepares his party for the next election in 2023. But Royal Bank of Canada (RBC) warned not to stretch the debt-to-GDP ratio, which now stands at 49.8% against the global average of 60.0%. Meanwhile, analysts noted the positive impact of closer US relations, specifically the Canadian Pacific Railway– Kansas City Southern’s merger, which would connect Canada, the United States, and Mexico.

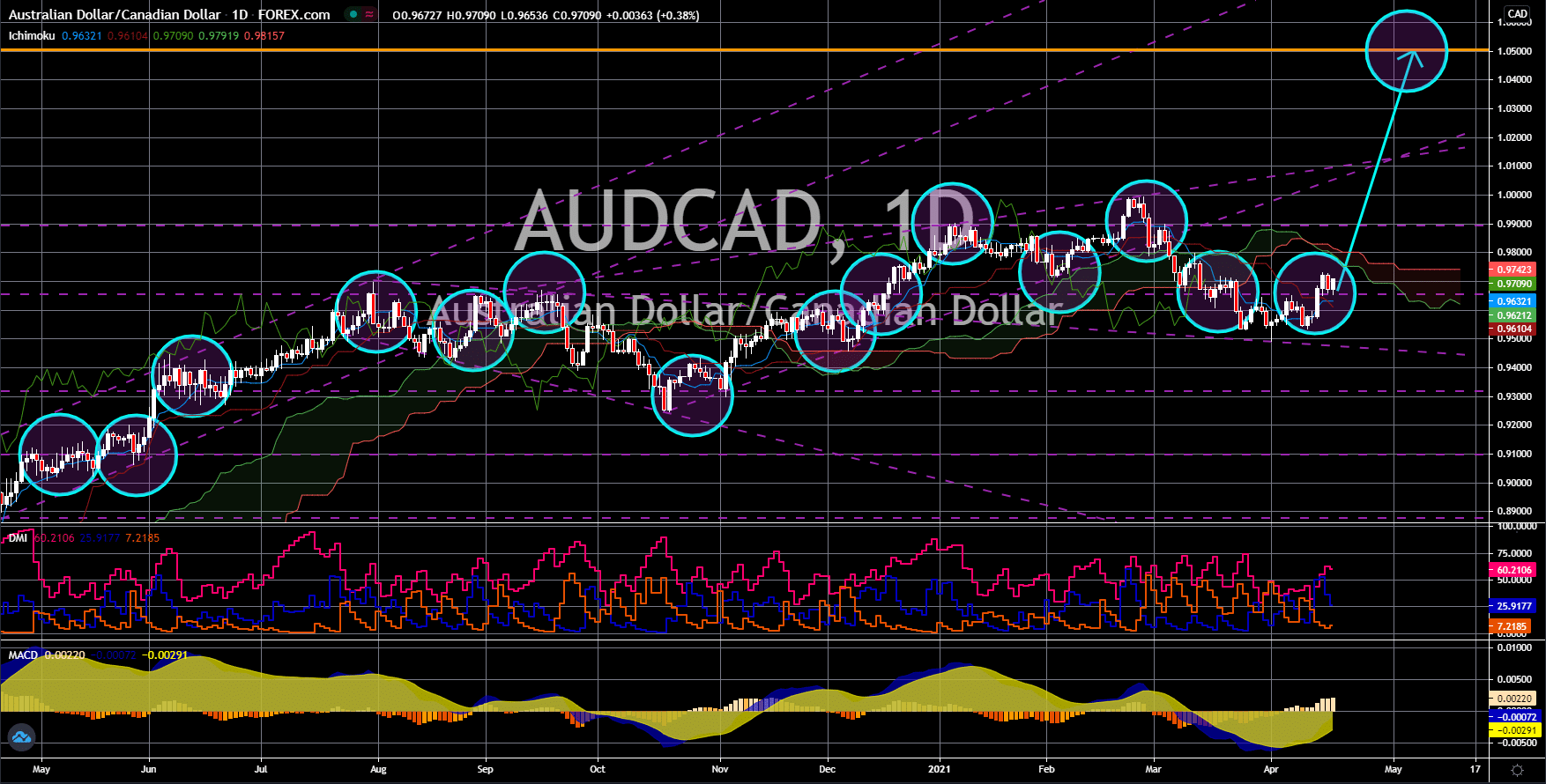

AUD/CHF

The pair will continue to soar towards the 0.77000 area to reach its 4-year high. A massive decline in franc should be expected following the comments from Swiss National Bank (SNB). The central bank said that it will continue to intervene in the foreign exchange in the market after the US Treasury Department removed Switzerland and Vietnam on the list of currency manipulators. Former President Donald Trump has led the trade war against countries during his term. Trump accused the Swiss officials of unfairly decreasing the value of its currency to gain advantage in the trading business. The SNB injected 110 billion francs of 120 billion USD in 2020 to the local economy as its surplus on trade with the US jumped to 28 billion. On the other hand, the continued recovery of Australia from the pandemic is strengthening the AUD. Unemployment fell to 5.6% in March against the 7.5% record in July 2020. This translates to 2,300 jobs created per day.

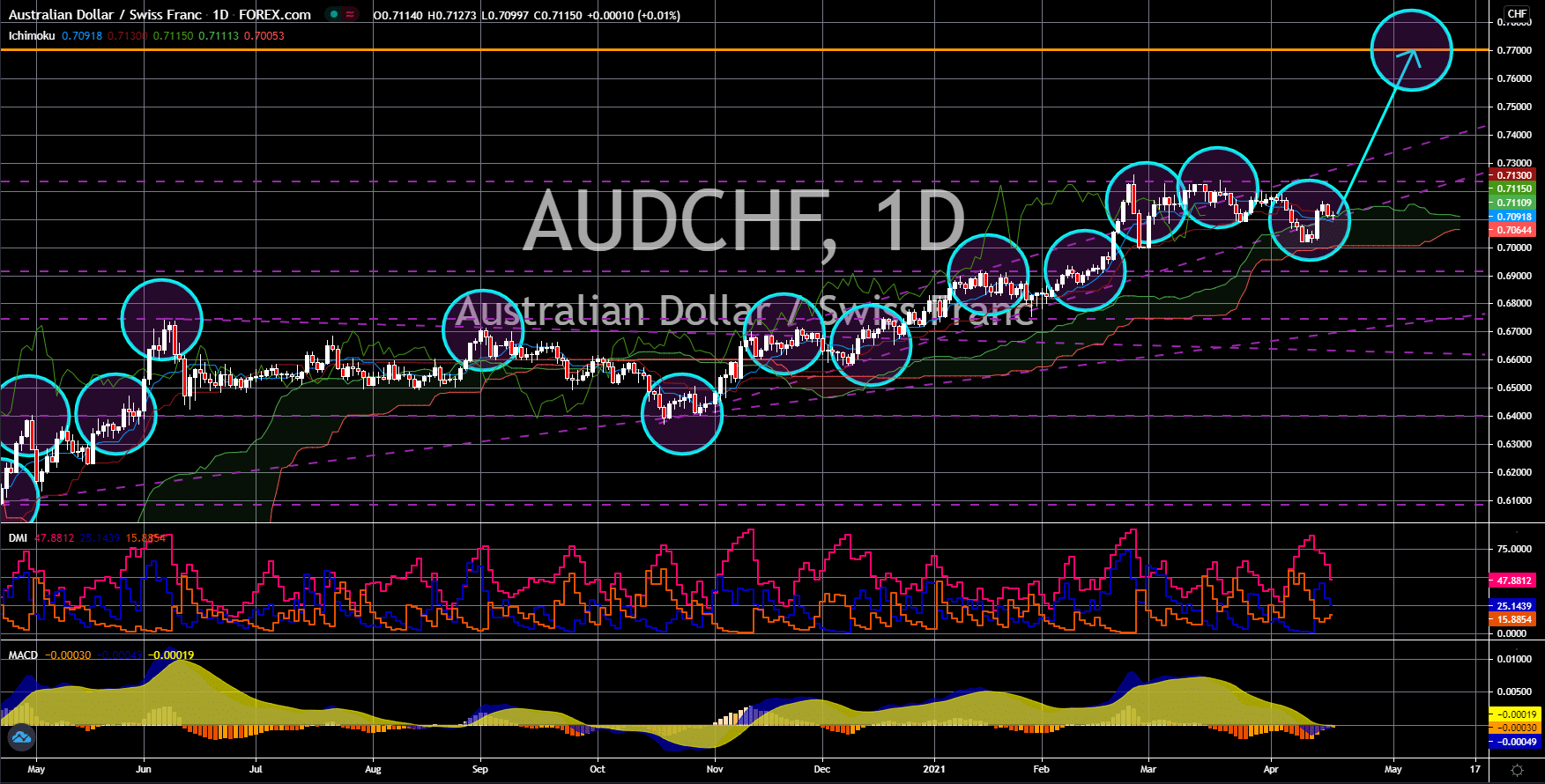

GBP/JPY

The pair will bounce back from its support line to reach the 160.00 psychological resistance area. The reopening of the British economy in mid-March is already showing a positive impact on several reports. Online job vacancies in the United Kingdom reached its pre-pandemic level as hiring by businesses soared. The catering and hospitality business category rose by 10 percentage points to 58% or 100% of February 2020 data. Meanwhile, Scotland saw the biggest increase in job advertising compared to other countries in the UK of 12%, which is past the February 2020 level by 2%. Also, NatWest’s UK Small Business Recovery PMI advanced to 55.8 points in March from the contraction in February of 46.5 points. In April 2020, the report hit its lowest level at 14.6 points. One of the key components of the improving business outlook was the rapid vaccination campaign by the UK government. 1/3 of the UK population have received COVID-19 vaccine.