Market News and Charts for April 13, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

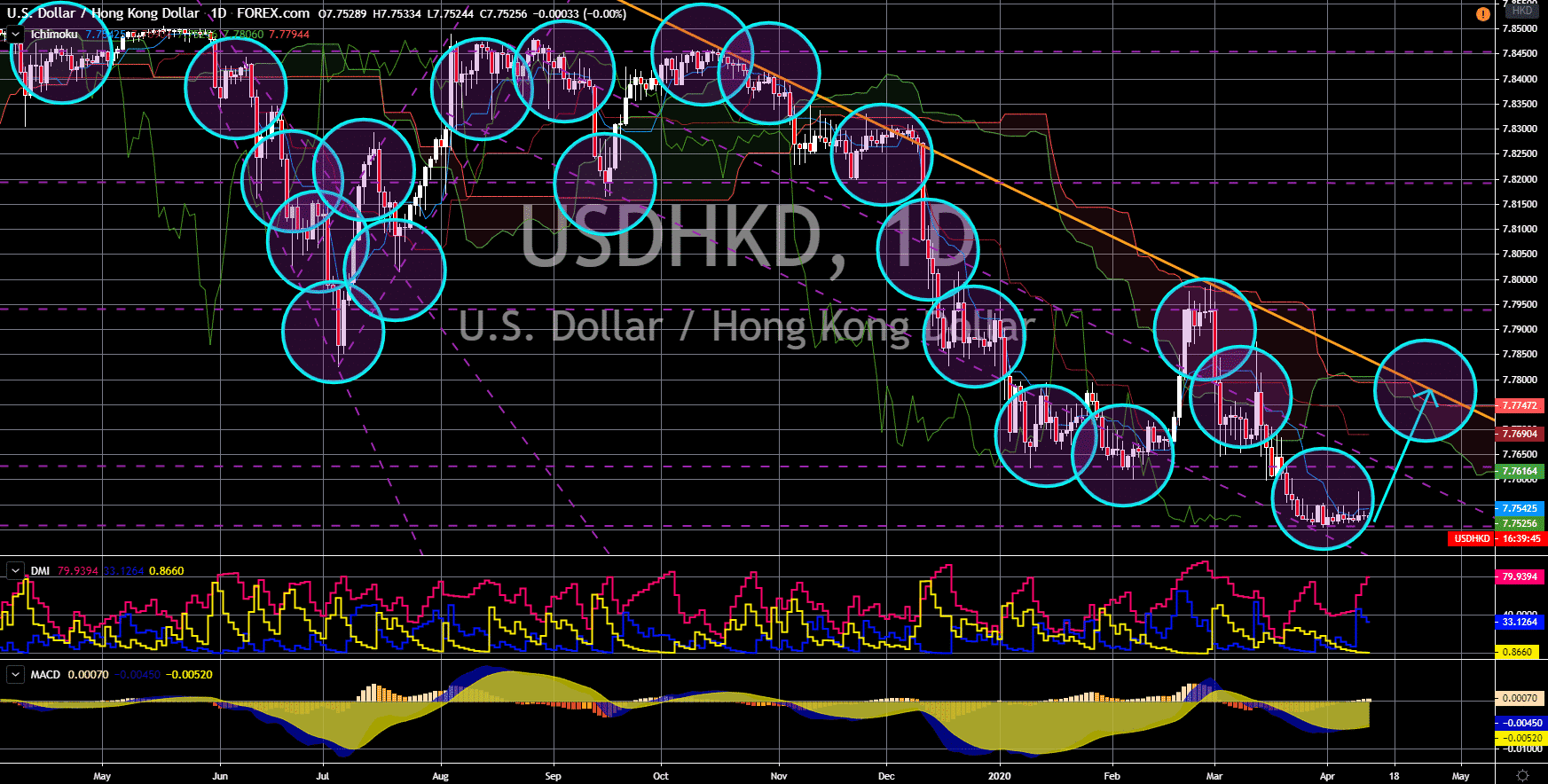

USD/HKD

The pair will bounce back from its recent low, sending the pair higher towards a downtrend channel resistance line. The coronavirus pandemic had forced the Hong Kong government to incur $35.68 billion deficit. Finance Minister Paul Chan said the country’s focus was on small and medium enterprises (SMEs). This was amid the possibility that Hong Kong might impose a strict lockdown. In line with this, the government is now considering using their reserves to aid businesses once the global pandemic hits the local economy. On Wednesday, Carrie Lam, Hong Kong’s Chief Executive, unveiled the country’s largest fiscal stimulus at $1.77 billion. On the other hand, the US also unveiled the largest fiscal stimulus in the country at $2 trillion. However, the country’s central bank quickly beat this record. Last week, the Federal Reserve introduced a $2.3 trillion package. Investors are expected to be bullish on the cheap dollar.

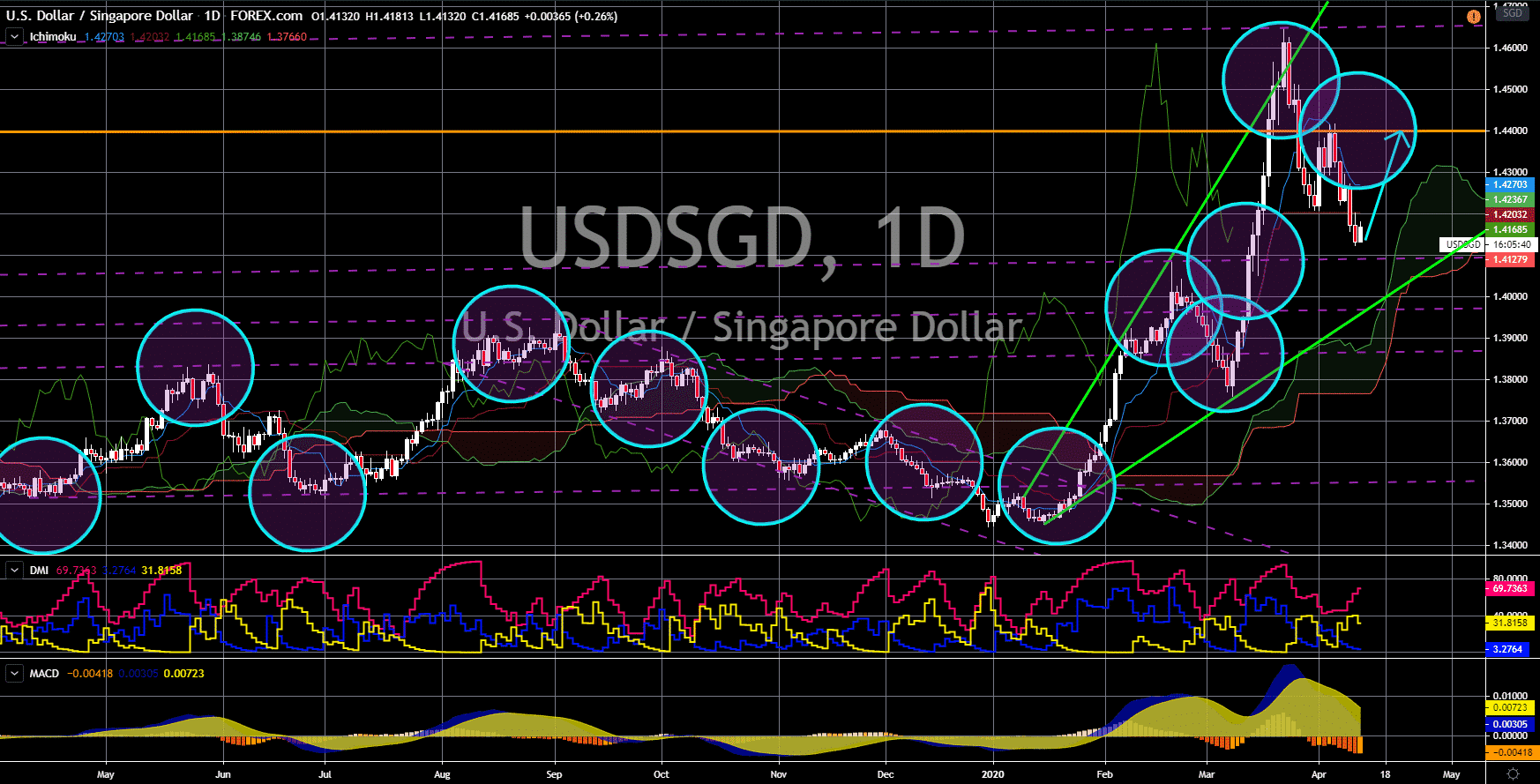

USD/SGD

The pair will move higher in the following days towards its previous high. Singapore is under pressure in today’s trading session as the country is set to report its GDP QoQ report. For February, the country’s GDP plummeted 10.6%. However, analysts warned that this figure could further drop once the country publishes its GDP QoQ report for March. This was amid the partial lockdown in the country. Analysts estimate the lockdown to cost the local economy around $7 billion, which is equivalent to 2% of the country’s gross domestic product.

In line with this, the government expects its economy to grow slower than previously forecasted. Expectations were now only at 1.0%, down from the 4.0% previously forecasted. The US, on the other hand, already prepared measures to counter the economic effect of the coronavirus. The US government introduces a $2 trillion stimulus while its central bank unveiled a $2.3 trillion package last week.

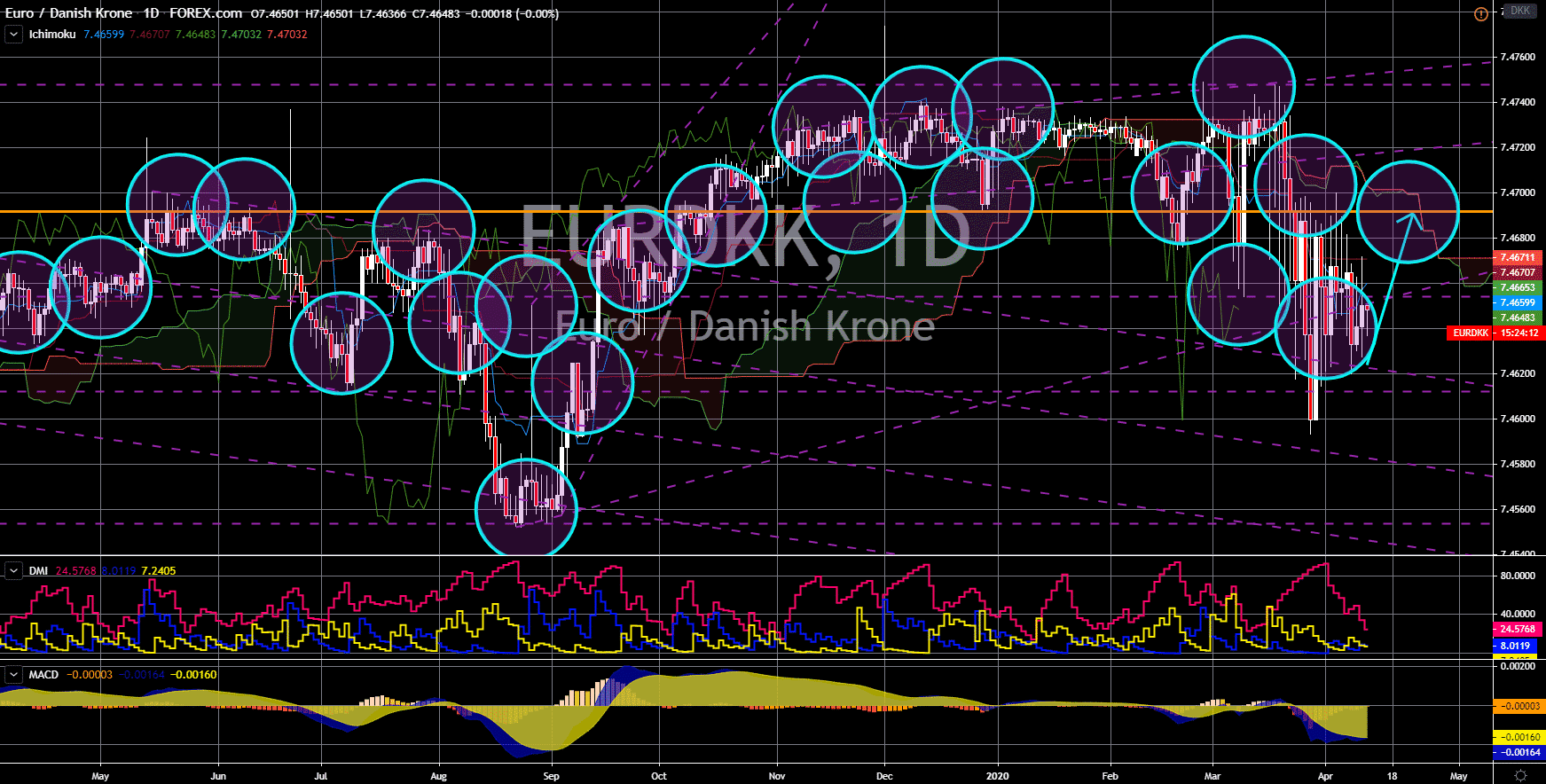

EUR/DKK

The pair will bounce back from a major support line, sending the pair higher towards a key resistance line. Denmark’s central bank warned investors that the country’s economy might shrink by as much as 10% as Europe braces for the economic impact of the coronavirus. The EU’s economic powerhouses, Germany and France, are also expected to contract by 4%.

Despite this, Germany and France had already taken steps to ease the economy. Germany introduced a $1 trillion stimulus to counter the economic threat of the coronavirus. Meanwhile, the Danish government is already planning to lift several restrictions to help the economy recover from the pandemic. However, the integrity of the European Union is being put into question following the failure by finance ministers of each member state to come up with an emergency fund. Bigger economies are asked to provide more assistance to the European Union but are unwilling to do so.

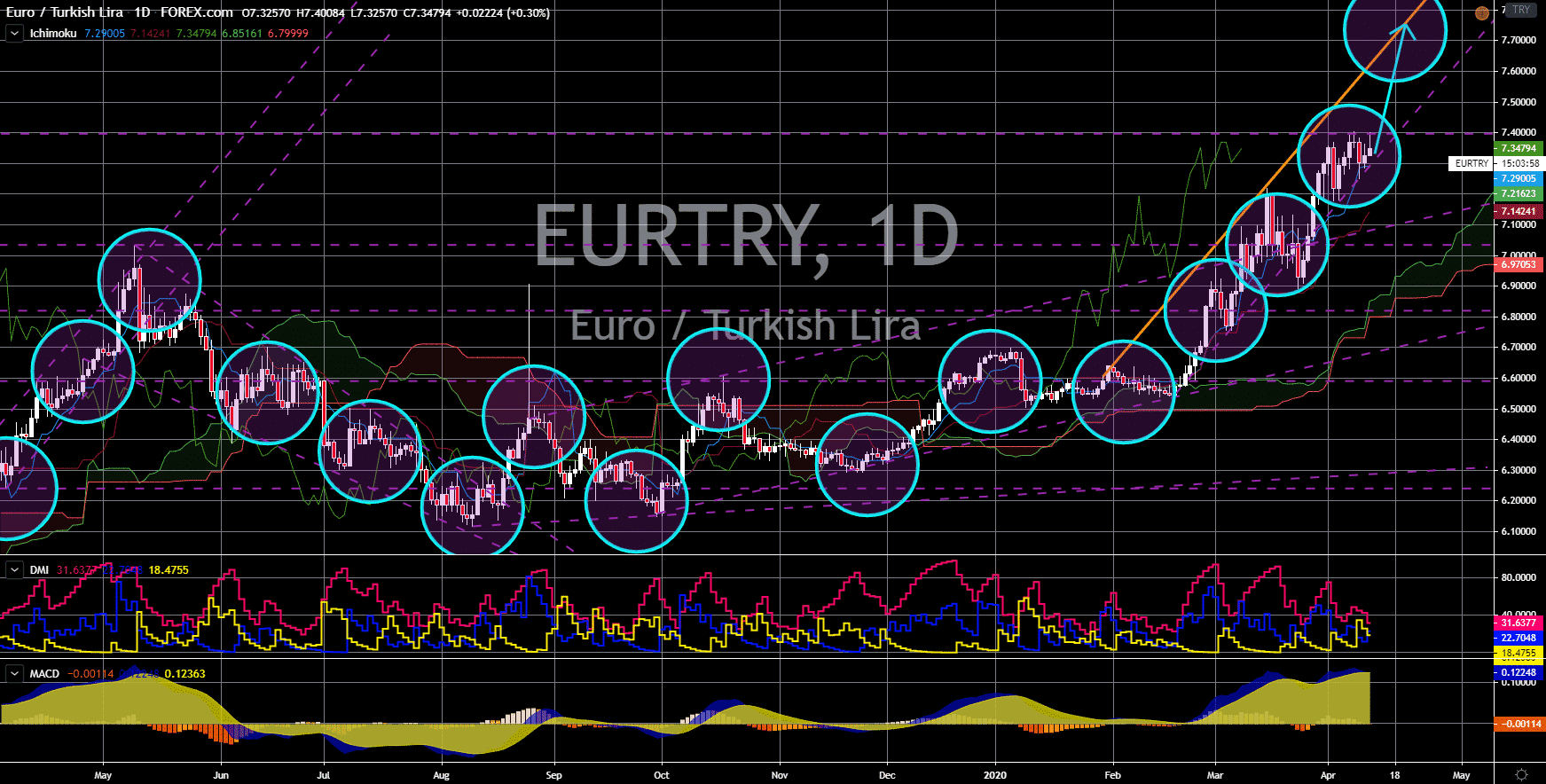

EUR/TRY

The pair will bounce back from an uptrend channel support line, sending it higher towards the channel’s resistance line. Major credit rating agencies are cutting their outlook on Turkey’s economy. This was amid the slowdown in the country coupled by the economic impact of the coronavirus. Fitch Ratings see Turkey’s economy growing at 0.8% from the previous forecast of 3.9%. Moody’s, on the other hand, predicted Turkey’s economy to suffer the most among the Group of 20 (G20) economies.

Meanwhile, the World Bank said the gap on Turkey’s budget could further widen as the country tries to counter the economic effect of COVID-19. Investors, however, are worried about the recent news about the country’s president. Recep Tayyip Erdogan said that an agreement between the country and the International Monetary Fund (IMF) was not his priority. This was despite the country having an economic turmoil due to the coronavirus.