Market News and Charts for April 03, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

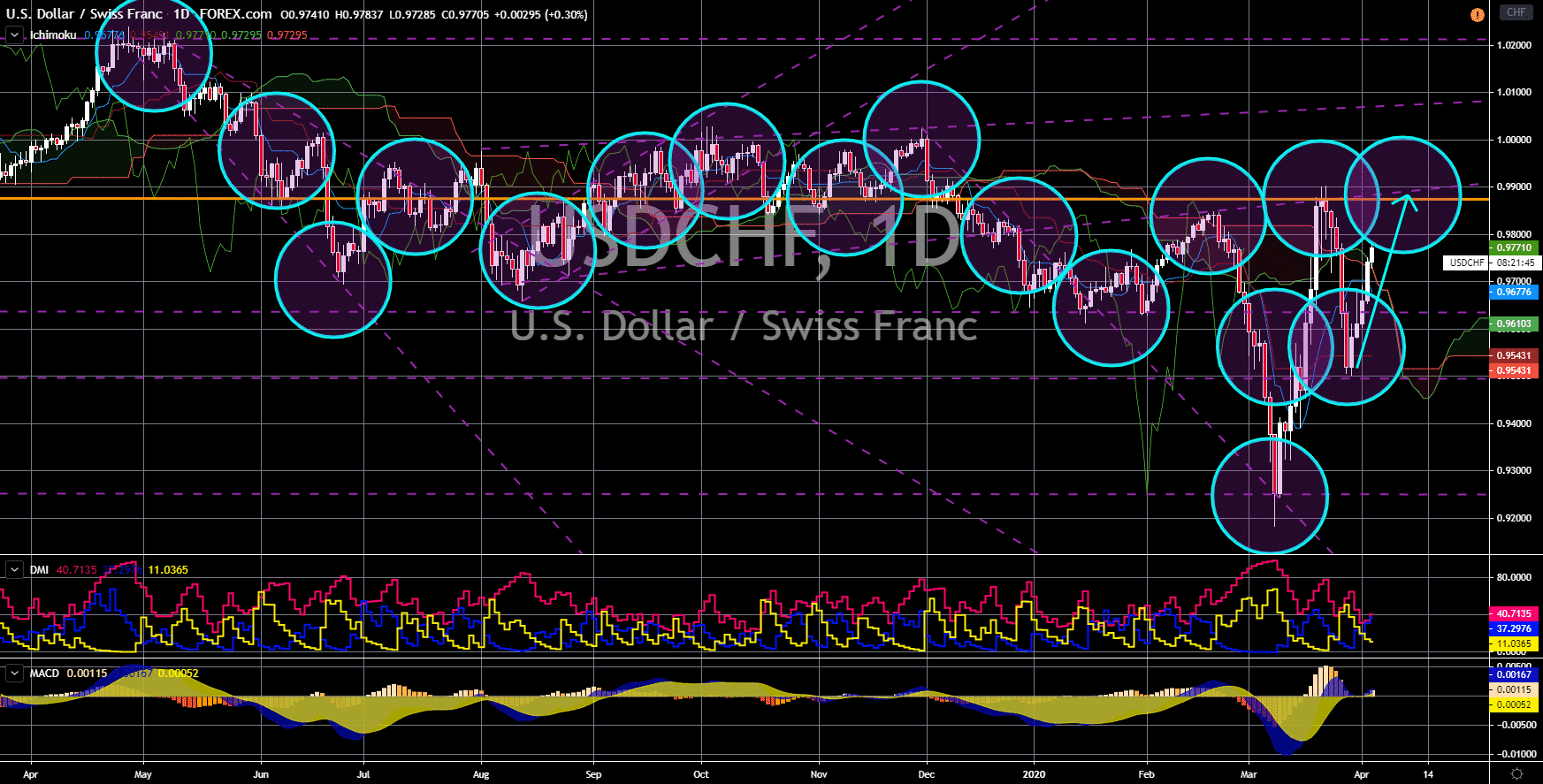

USD/SEK

The pair will bounce back from a major support line towards a key resistance line. The prospect of a cheap dollar is driving the greenback in sessions. Since the outbreak of the coronavirus, companies have warned that they will not be able to reach their earnings guidance. Aside from this, major US reports posted disappointing figures which made investors worry about the overall economic health of the country. In response to this, the Trump government introduced a $2.2 trillion stimulus package to aid companies hit by the virus. Moreover, the Federal Reserve slashed 150 basis points on its benchmark interest rate. Since the dollar is widely used for international transactions, the low value of the US dollar is attracting investors. Sweden, on the other hand, just recently ended its 5-year ultra-loose monetary policy. This means that free money is no longer available in the country and that they might pay an interest for a loan in the future.

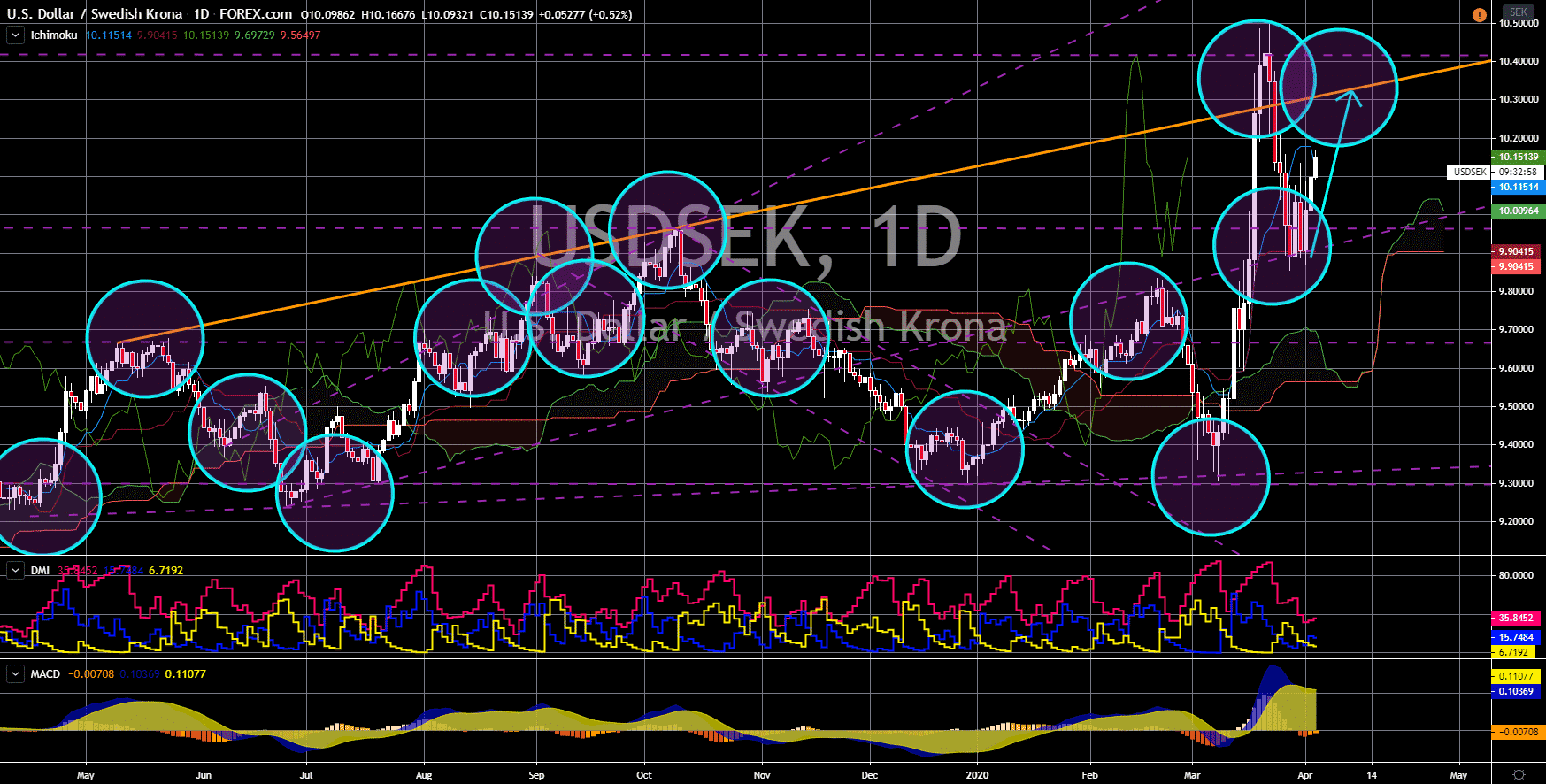

USD/ZAR

The pair will continue its rally in the following days. South Africa will experience a double recession once it posts its GDP growth rate result for the first quarter of 2020. The largest economy in Africa had a double whammy after the country entered recession this year and after credit rating agencies downgraded its bonds to “junk”. The 30 days lockdown in the country will further deteriorate the economic health of the country. Analysts expected the country to further contract in the second quarter by 23.5%. In addition to that, Q3 is not looking good either as analysts expect the country to still sit in the negative territory at -3.0% GDP growth rate. Meanwhile, the projection for South Africa’s 2020 GDP growth rate was at -4.0%. Back in 2019, the country was already experiencing trouble on its economy with its large fiscal deficit and ballooning debt with China. The slowdown in the Chinese economy could further drag the rand.

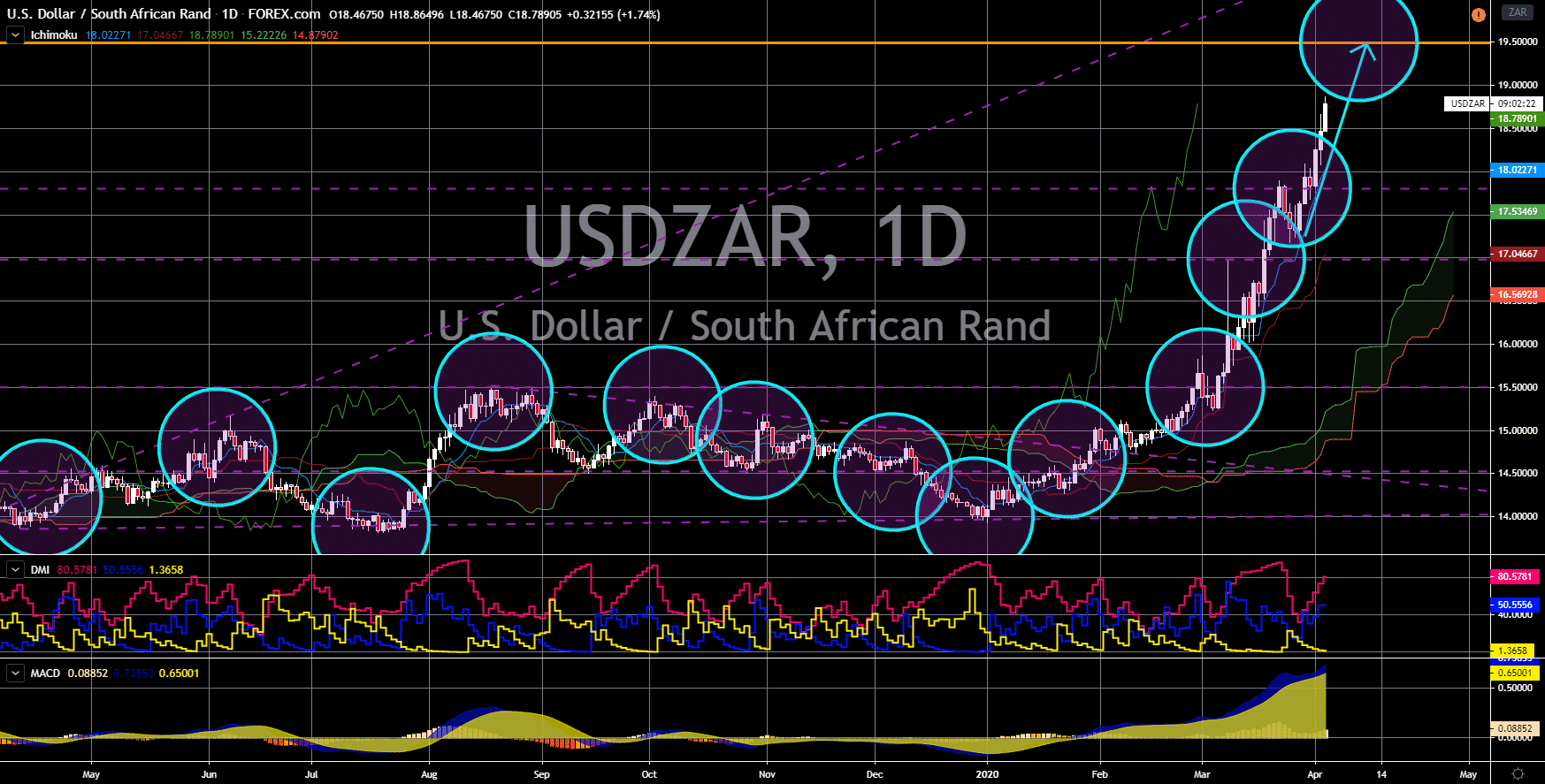

USD/RUB

The pair will reverse back towards a major support line after it failed to breakout from a major resistance line. The Russian ruble will strengthen against other currencies following the decision by the country to halt its foreign currency intervention. Russia has been lowering its currency intentionally after the oil price war between Russia and the Saudi Arabia led OPEC (Organization of the Petroleum Exporting Countries). However, this is about to change after reports that US President Donald Trump intervened between the two (2) oil producing giants. The efforts by Trump were concentrated on increasing crude oil prices. Oil companies in the US reported significant loss following the oil price war and the US president cannot afford to have two (2) problems altogether. The US is also experiencing problems with handling the economic impact of the deadly coronavirus. Airline companies have already asked assistance from the US government.

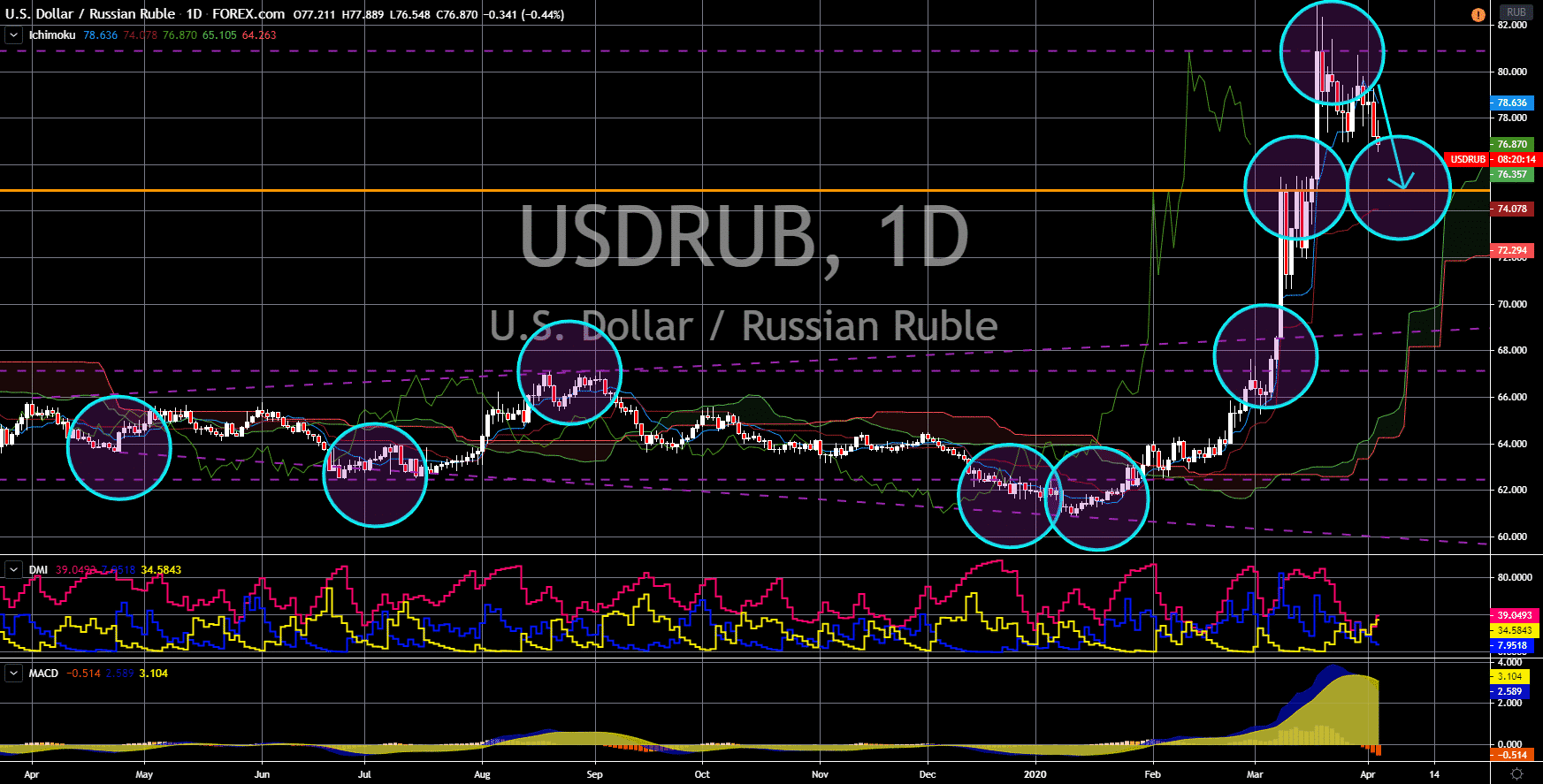

USD/CHF

The pair will bounce back from a key support line to retest a major resistance line. The US dollar, as a global currency, is beating the attractiveness of Swiss franc, a safe-haven currency. Currencies paired with the franc are plummeting as the coronavirus outbreak is pushing investors to seek shelter from safe-haven assets. Today, April 03, coronavirus cases around the world surpassed the 1 million mark. Cases in the US, on the other hand, was at 245,000 or about a quarter of the world tally. This prompted the US government to introduce a $2 trillion stimulus package to counter the economic effect of the virus. The US Congress and President Donald Trump are also in talks to create another stimulus package on top of the $2 trillion aid. The increased liquidity is pushing the value of the US dollar lower. However, investors and traders are buying the cheap dollars causing the greenback to stay at its current levels.